Find Your Dream Repo Mobile Home Nearby

Find your affordable repossessed mobile home near me! Save 20-40% on foreclosed properties. Learn pros, cons, and financing tips.

Introduction: The Smart Path to Affordable Homeownership

Finding a repossessed mobile home near me is one of the most practical routes to homeownership in today’s housing market. These bank-owned properties often sell for 20-40% below market value, creating immediate equity that’s hard to find with traditional home purchases.

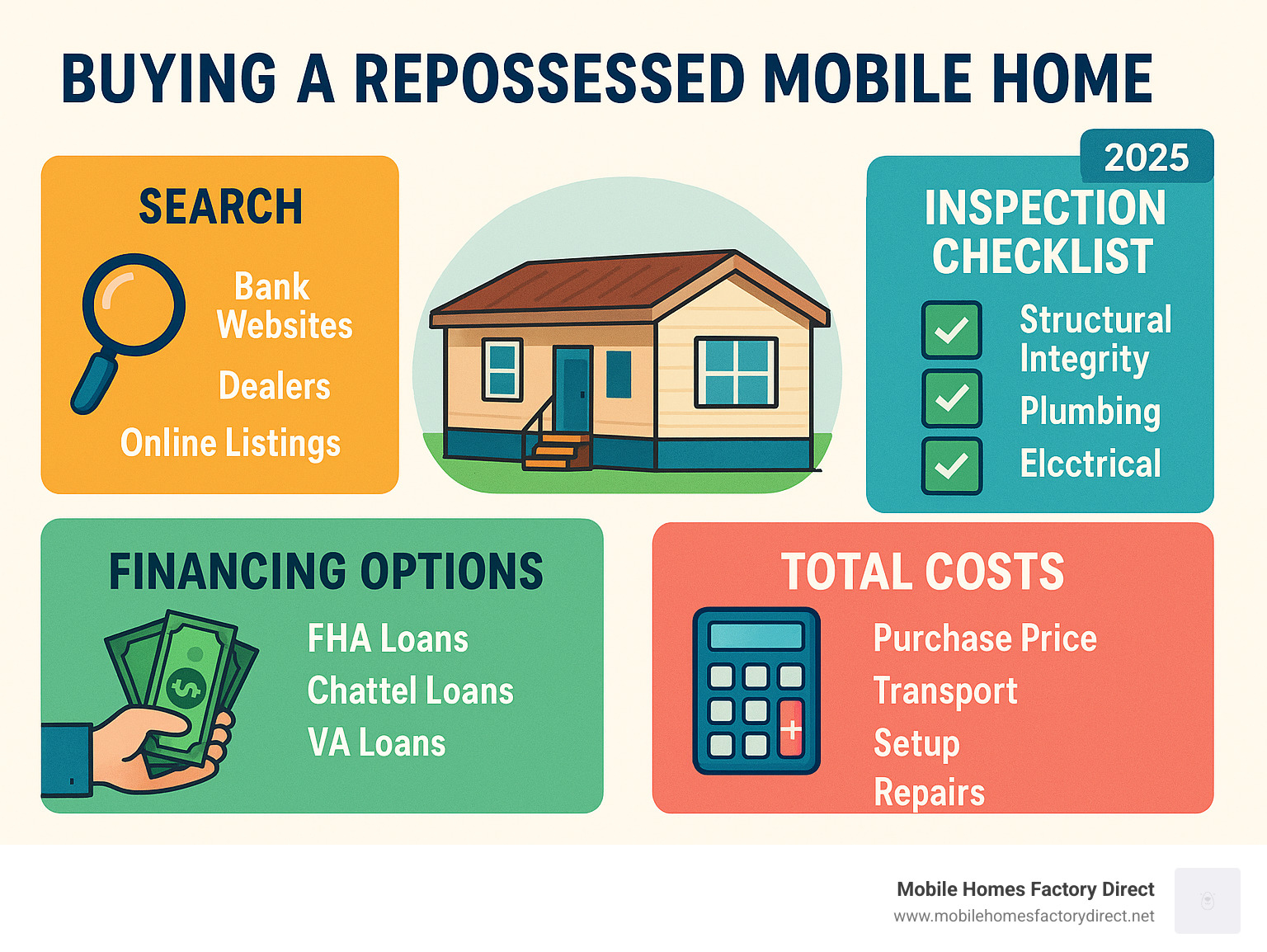

Quick Answer for Repo Mobile Home Buyers:

- Best Places to Search: Specialized dealers, bank websites (REO sections), online marketplaces, local foreclosure listings

- Average Savings: 20-40% below comparable market prices

- Typical Price Range: $25,000-$60,000 in Texas

- Financing Options: FHA Title I loans, chattel loans, land-home packages, VA loans

- Key Considerations: “As-is” condition, professional inspection required, title verification essential

Repossessed mobile homes are manufactured homes that lenders have reclaimed due to loan defaults. Banks are motivated to sell these properties quickly to clear their books, creating excellent opportunities for buyers. The immediate equity position buyers can achieve is a major advantage, as walking into a property with 20-40% built-in equity is practically unheard of in today’s housing market.

Whether you’re a first-time buyer with credit challenges or an investor, repo mobile homes provide flexibility. Many are move-in ready, while others offer the chance to customize at a fraction of new home costs.

The Pros and Cons of Buying a Repo Mobile Home

When considering a repossessed mobile home near me, it’s important to weigh the incredible opportunities against the potential challenges. It’s like buying from an auction—amazing deals exist, but you need to be informed.

The Unbeatable Advantages

The biggest draw is affordability. These homes are often priced 20-40% below market value, providing instant equity. This lower purchase price allows you to stop renting and start building wealth. Many repo homes are move-in ready, needing only minor cosmetic updates. For those who find a home with land, you can eliminate lot rent entirely, saving hundreds each month. Explore options at Repo Mobile Homes With Land For Sale. The investment potential is also significant, offering opportunities for rental income or appreciation. Learn more in our guide on Why Should You Get a Repo Mobile Home?.

Potential Risks and How to Mitigate Them

Every deal has its risks. Repo homes are sold “as-is,” meaning the bank makes no repairs. This can lead to unexpected costs for hidden damages related to the roof, plumbing, or electrical systems. Other potential problems include:

- Title and Lien Issues: Unresolved ownership claims or outstanding debts can complicate the purchase.

- Zoning Restrictions: Local ordinances may limit where you can place a manufactured home.

- Financing Challenges: Not all lenders are familiar with manufactured home loans, but we specialize in navigating this process.

The key to mitigating these risks is due diligence. A professional inspection, title verification, and working with experienced professionals are essential. Our Used Repo Mobile Homes section offers more insight. With the right preparation, the savings and opportunities can far outweigh the challenges.

How to Find a Repossessed Mobile Home Near Me

The market for repo mobile homes moves fast, so knowing where to look is key. The best properties can sell within days, making a proactive search essential.

Best Ways to Search for a Repossessed Mobile Home Near Me

To find a repossessed mobile home near me, explore multiple avenues to increase your chances of success. Here are the most effective methods:

- Specialized Dealers: This should be your first stop. Dealers like Mobile Homes Factory Direct have strong relationships with lenders and often get early access to repossessed inventory. We guide you through the entire process, making it as simple as possible.

- Bank Websites: Financial institutions list repossessed properties (REO – Real Estate Owned) directly on their sites. Our Bank Repos page is a great resource for these listings.

- Online Marketplaces: Use platforms that allow you to filter for repo or foreclosed properties in your specific area.

- Local Listings and Community Boards: Check traditional real estate listings and drive through mobile home communities. Park managers often have information on upcoming repossessions.

For a comprehensive search, visit our Find Repo Mobile Homes For Sale Near Me page.

Focusing Your Search in Texas

Texas is a strong market for manufactured housing, offering more inventory and better deals. We are deeply rooted in Texas, serving communities like Von Ormy, Somerset, Atascosa, Macdona, San Antonio, JBSA Lackland, Lytle, Poteet, La Coste, Leming, Natalia, Elmendorf, Castroville, JBSA Ft Sam Houston, Bigfoot, and Devine.

Our local presence gives us a pulse on the market, including dedicated resources for areas like New Braunfels. Explore our pages for Mobile Homes for Sale in New Braunfels and guidance on How to Find Mobile Homes for Sale New Braunfels.

Understanding state-specific rules is vital. The Texas manufactured housing regulations provide guidance on titling and installation. A major advantage in Texas is the opportunity to find a repo home with land, which eliminates lot rent. Our Repo Mobile Homes With Land For Sale listings showcase these valuable opportunities.

The Crucial Steps: Inspection and Due Diligence

After finding a potential repossessed mobile home near me, the inspection and due diligence phase begins. This is the most critical step, as these homes are sold “as-is,” and a thorough review can save you from costly surprises.

What to Expect When Inspecting a Repossessed Mobile Home Near Me

Never buy a repossessed mobile home without a professional inspection. An inspector specializing in manufactured homes will know what to look for. A small inspection fee can save you thousands in potential repairs. The inspection should be comprehensive:

- Structural Integrity: Check the foundation, walls, roof structure, and chassis frame for settling, damage, or rust.

- Exterior: Examine the roof, siding, windows, and doors for leaks, cracks, or other damage.

- Water Damage: Look for stains, mold, or warped flooring, especially around windows, under sinks, and in corners.

- Major Systems: Test all plumbing, electrical, and HVAC systems to ensure they are functional and up to code.

- HUD Data Plate & Label: Locate the interior data plate and exterior certification label. These are crucial for financing and permitting.

Verifying Legal Status and Paperwork

Navigating the paperwork is just as important as the physical inspection. The legal side of buying a repo mobile home has unique requirements.

- Title Search and Lien Verification: It is essential to ensure the title is clear of any outstanding liens. Mobile homes can be titled as personal property or real estate, so this must be clarified.

- Texas Statement of Ownership: In Texas, you will work with the Texas Department of Housing and Community Affairs to transfer the title using a Statement of Ownership.

- County Records and Permits: Contact the local planning department to understand zoning restrictions, foundation requirements, and necessary permits for moving or placing the home.

Understanding these legal processes can be complex, but our team has the expertise to guide you. For more details, explore our Tag: Repo Mobile Homes section. Proper due diligence is the key to a smart purchase.

Financing and Purchasing Your Repo Home

Understanding the financing and budgeting for a repossessed mobile home near me is crucial for a smooth journey to homeownership.

Navigating Your Financing Options

Financing a repo home is more straightforward than you might think, especially with a specialist. Key options include:

- Chattel Loans: These are common for home-only purchases, where the home itself is the collateral. Terms are typically 15-20 years.

- Land-Home Package Loans: If the home comes with land, this loan bundles them into a single mortgage, often with longer terms and lower rates.

- Government-Backed Loans: FHA, VA, and USDA loans offer favorable terms, low down payments, and even 100% financing for eligible buyers.

Lenders generally look for a credit score of 600+, but we work with partners who consider scores as low as 550. At Mobile Homes Factory Direct, we offer flexible financing for all credit types. We believe everyone deserves a chance at homeownership. Explore your options on our Financing a Mobile Home page or our Mobile Home Loan Bad Credit page if you have credit concerns.

| Loan Type | Best For | Typical Terms | Interest Rates | Down Payment |

|---|---|---|---|---|

| Chattel Loan | Home-only purchases (in parks or on leased land) | 15-20 years | 5-15% | 5-20% |

| Land-Home Loan | Home + Land package | Up to 30 years | 3-8% | 0-20% |

| FHA Title I | Home + Land, lower down payment | Up to 20 years (home), 30 years (land) | Competitive | As low as 3.5% |

| VA Loan | Veterans, 100% financing | Up to 30 years | Competitive | 0% |

| USDA Loan | Rural properties, 100% financing | Up to 30 years | Competitive | 0% |

Budgeting for the Total Cost

The purchase price is just the starting point. It’s important to budget for the total cost of ownership to avoid surprises. Beyond the purchase price ($25,000-$60,000 in Texas), plan for these additional expenses:

- Closing Costs: Typically 3-6% of the loan amount for fees like appraisal and title.

- Transportation & Setup: If the home needs to be moved, costs can include transport ($3-$7/mile), permits, site prep, foundation work, and utility hookups. Setup includes blocking, leveling, skirting, and steps.

- Repairs & Maintenance: Budget an additional 5-15% of the purchase price for immediate repairs on an “as-is” home, plus a reserve for first-year maintenance.

While these costs add up, the initial savings on a repo home make it a significantly more affordable path to homeownership. Use our Manufactured Home Loan Calculator to estimate payments and explore resources like How to Get a Mobile Home With Bad Credit to plan your budget.

Frequently Asked Questions about Repo Mobile Homes

Asking the right questions about buying a repossessed mobile home near me can save you time and money. Here are answers to the most common concerns.

What is the typical condition of a repossessed mobile home?

The condition of repo mobile homes varies widely. Some are pristine and move-in ready, while others are fixer-uppers that require significant work due to neglect. All repo homes are sold “as-is,” meaning the lender makes no repairs. This is why a professional inspection is non-negotiable; it protects you from unforeseen problems with major systems like plumbing, electrical, or the roof. You must determine if a home’s condition fits your budget and willingness to do repairs.

Can I get a loan for a repo mobile home if I have bad credit?

Yes, absolutely. At Mobile Homes Factory Direct, we specialize in flexible financing for all credit types, including bad or no credit. We work with lenders who focus on your current income and stability rather than just your credit score. While a lower score might result in a slightly higher interest rate, the significant savings on the home’s purchase price often offset this. Don’t let past credit issues stop you from pursuing homeownership. Visit our Mobile Home Financing page to learn more.

Does a repossessed mobile home come with land?

Sometimes. A repossessed mobile home near me can be sold in two ways:

- Home-Only: This is more common. The home was located in a park or on leased land, and only the structure was repossessed. You will need to move it to your own land or a new park lot.

- Home and Land Package: This is a fantastic deal where both the home and the land it sits on were financed together and repossessed as a single property. This eliminates lot rent and allows you to build equity in both the home and the land.

These land-home packages are highly sought after. You can browse current listings on our Repo Mobile Homes With Land For Sale page. Always verify the land title is clear before purchasing.

Your Journey to an Affordable Dream Home Starts Here

Finding a repossessed mobile home near me is a brilliant financial decision that opens the door to affordable homeownership. With savings of 20-40% below market value, you gain immediate equity and a head start on building wealth. We’ve covered the incredible advantages and the potential challenges, but with the right team, every challenge has a solution.

The path to owning a home doesn’t have to be overwhelming. Whether you have credit challenges or limited savings, a repo mobile home can be your ticket to a place you can call your own.

At Mobile Homes Factory Direct, we help Texas families achieve their homeownership dreams. We serve communities from San Antonio to Von Ormy and beyond, and our flexible financing works with all credit types because we believe everyone deserves that chance. Our simple process and genuine care set us apart.

The Texas market is full of opportunities, and we’re here to guide you through every step—from finding the perfect home to securing financing and handling the paperwork. Your dream is closer than you think.

Explore our available pre-owned homes today and let’s start this exciting journey together. Your new home is waiting for you.