Repo Double Wides: Your Path to Affordable Spacious Living

Find affordable repossessed double wide mobile homes for sale. Learn pros, cons, financing & more for your spacious new home!

Finding Your Dream Home: The Reality of Repo Double Wide Opportunities

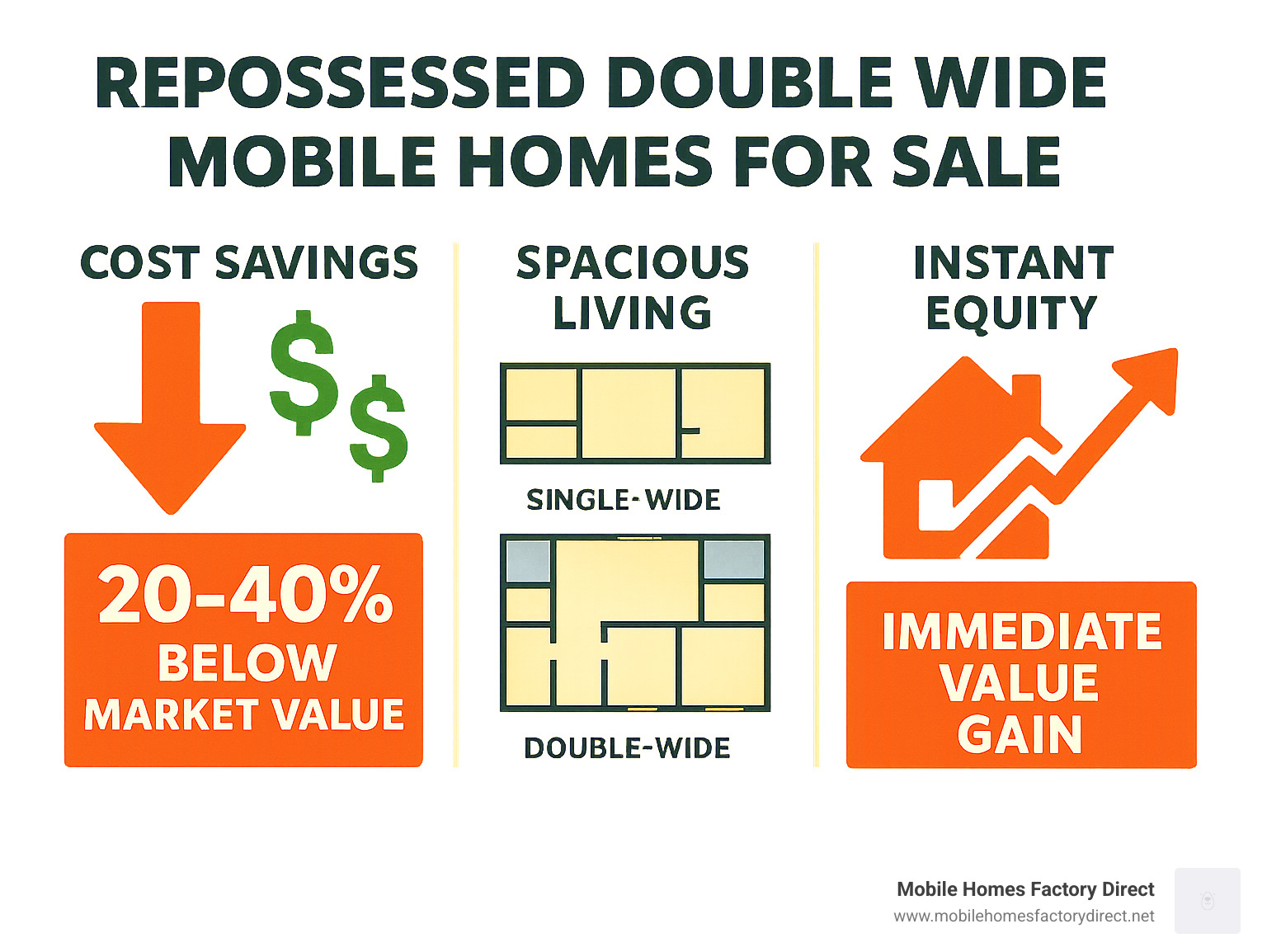

Repossessed double wide mobile homes for sale offer families a direct path to affordable homeownership with spacious living at prices typically 20-40% below market value. These homes become available when lenders reclaim properties due to loan defaults, creating opportunities for buyers to gain immediate equity and more space for their money.

Quick Facts About Repo Double Wides:

- Cost Savings: 20-40% below market value

- Immediate Equity: Built-in from day one

- Space: Double the width of single-wide homes

- Financing: Multiple options including FHA loans

- Timeline: 6-8 weeks from offer to closing

- Condition: Sold “as-is” – inspection recommended

As one Texas family shared after purchasing their repo double-wide: “We got a home we never thought we could afford, and the space has transformed our lives.”

These homes represent more than just a discount – they’re a realistic solution for families facing rising housing costs. Lenders are motivated sellers, which means better negotiation power for buyers. Whether you’re a first-time homebuyer or looking to downsize, repo double wides provide the space and affordability that traditional housing often can’t match.

The key is understanding both the opportunities and the responsibilities that come with buying a repossessed home.

The Pros and Cons of Buying a Repo Double Wide

When you find repossessed double wide mobile homes for sale, it can feel like finding a hidden treasure in today’s expensive housing market. The savings alone are enough to make anyone take notice – these homes typically sell for 20-40% below market value. That’s not just a discount; it’s instant equity from the moment you sign the papers.

Think about it this way: if a similar home would cost $80,000 on the regular market, you might find a repo for $50,000. That $30,000 difference doesn’t just disappear – it becomes your equity right from day one. It’s like getting a head start on building wealth through homeownership.

The space factor is another huge win. Double wide mobile homes give you significantly more room than single-wide models, and often more space per dollar than traditional site-built homes. We’re talking about homes that can easily accommodate growing families, home offices, or that craft room you’ve always wanted. The two-section design creates floor plans that feel open and spacious, not cramped or confined.

Here’s where it gets really exciting, especially for our Texas families: the opportunity to own your land. When you buy a repo double wide with land, you’re eliminating monthly lot rent that can run anywhere from $300 to $800 or more. That money stays in your pocket every month, and the land itself can appreciate over time, adding another layer to your investment.

Even if repairs are needed, these homes offer incredible potential for customization. You can make updates and improvements exactly to your taste, often for less than the total cost of a traditional home. We’ve seen families transform repo double wides into stunning, personalized homes that perfectly fit their lifestyle.

For more insights on maximizing your investment, explore our guide on Used Double Wide Mobile Homes for Sale.

Key Risks and How to Mitigate Them

Now, let’s be honest about the challenges. Repossessed double wide mobile homes for sale come with the reality that they’re sold “as-is.” This means what you see is what you get – no warranties, no guarantees that everything works perfectly.

The previous owners might have deferred maintenance, and lenders aren’t in the business of making repairs before selling. You could encounter anything from minor cosmetic issues to more serious problems with the foundation, roof, or major systems like plumbing, electrical, or HVAC. We’ve seen buyers find everything from leaky roofs to outdated electrical panels that need immediate attention.

Title and lien issues can also surface. Sometimes previous owners leave behind unpaid debts tied to the property, or there might be complications with the ownership history. These legal tangles can delay your purchase or create unexpected costs.

The good news? These risks are manageable with the right approach.

Professional inspections are your best defense. Never – and we mean never – skip this step. A qualified inspector who specializes in manufactured homes will examine the structural integrity, foundation, roof, siding, and all major systems. Yes, it costs $300-$500, but that’s pocket change compared to finding a $6,000 HVAC problem after you’ve already bought the home.

Title searches are equally important. Work with a reputable title company to verify that both the home and land (if included) have clear titles with no outstanding liens or legal issues. This step protects you from inheriting someone else’s financial problems.

Budget for repairs by setting aside 5-15% of the purchase price for immediate needs and updates. This gives you a financial cushion to address inspection findings and make the home truly yours without stress.

The key is going in with your eyes wide open and the right professional team supporting you. When you do your homework upfront, you can move forward confidently and avoid costly surprises down the road.

Learn more about the advantages of this investment at Why You Should Get a Repo Mobile Home.

[TABLE] Comparing Repo Homes: With Land vs. Without Land

One of the biggest decisions when buying repossessed double wide mobile homes for sale is whether to purchase with or without land. Each path has different financial implications and lifestyle considerations:

| Feature | Repo Home WITH Land | Repo Home WITHOUT Land (in a community) |

|---|---|---|

| Upfront Cost | Higher | Lower |

| Monthly Costs | Property taxes, mortgage | Community fee ($300-$800+), mortgage |

| Equity/Appreciation | Builds equity in home & land | Builds equity in home only |

| Financing | Land-home mortgage loans | Chattel loans |

| Stability | High (you own the property) | Lower (subject to community rules/fee increases) |

| Freedom | More freedom for improvements | Restricted by community rules |

Buying with land means higher upfront costs, but you’re making a complete real estate investment. You’ll typically qualify for traditional mortgage loans with better interest rates and longer terms (up to 30 years). No monthly lot rent means more money in your pocket each month, and land appreciation can boost your overall investment value significantly.

Buying without land offers lower entry costs, making homeownership more accessible. However, you’ll face ongoing community fees that can increase over time, and financing usually involves chattel loans with higher interest rates and shorter terms. You build equity in the home but miss out on land appreciation.

The choice depends on your budget and long-term goals. Many of our Texas families find that owning both the home and land provides the stability and financial benefits they’re looking for in homeownership.

The Ultimate Guide to Finding Repossessed Double Wide Mobile Homes for Sale

Finding repossessed double wide mobile homes for sale doesn’t have to feel overwhelming. Think of it as a treasure hunt where the prize is your dream home at an incredible price. The secret is knowing where to look and being ready to act quickly when you find the right one.

The best deals move fast in the repo market. We’ve seen beautiful homes sell within days of being listed. That’s why having a solid search strategy and the right connections makes all the difference.

At Mobile Homes Factory Direct, we’ve helped hundreds of families in Von Ormy, Somerset, and across Texas find their perfect home. We often get early access to repo inventory before it hits the general market, which means our clients get first dibs on the best deals. Don’t wait to Check out our current Repo Mobile Homes for Sale – you might just find your future home today.

Where to Find Listings for Repossessed Double Wide Mobile Homes for Sale

Your search for repossessed double wide mobile homes for sale should start with specialized dealers like us. We work directly with lenders and banks, often receiving repo inventory before it’s advertised elsewhere. This inside track can save you weeks of searching and help you snag the best deals before other buyers even know they exist.

Bank and lender websites are your next stop. Look for their REO (Real Estate Owned) sections where they list foreclosed properties. These banks are motivated sellers who want to move inventory quickly, which works in your favor. The key is checking these sites regularly since new listings appear frequently.

Online marketplaces have revolutionized how people find repo homes. These platforms let you search by location, price range, and specific features. You can filter results to show only repossessed properties, making your search much more efficient. The beauty of online searching is that you can do it from your couch at any time of day.

Don’t overlook local searches in your target areas. Sometimes the best finds come from driving through manufactured home communities and keeping your eyes open for “For Sale” signs. We’ve had clients find amazing deals this way, especially in smaller Texas towns where homes might not be listed online immediately.

Social media groups dedicated to mobile homes can be surprisingly helpful. People often share listings and tips about upcoming repo sales. It’s like having a network of scouts helping you find deals.

The repo market rewards those who are prepared and persistent. Having your financing pre-approved and knowing exactly what you’re looking for gives you a huge advantage when that perfect home appears. For more targeted searching in your area, visit our page on Find Repo Mobile Homes for Sale Near Me.

The Importance of a Professional Inspection

Here’s the truth about buying repossessed double wide mobile homes for sale: skipping the professional inspection to save a few hundred dollars is the biggest mistake you can make. We’ve seen too many excited buyers turn into stressed homeowners when they find expensive problems after closing.

These homes are sold “as-is,” which means what you see is what you get – including what you don’t see. A specialized manufactured home inspector becomes your detective, uncovering potential issues before they become your expensive headaches.

Structural integrity is the foundation of everything else. Your inspector will check for soft spots in floors, cracks in walls, and signs of water damage that could indicate serious problems. They’ll examine the foundation to ensure the home is properly leveled and supported – crucial for preventing future settling issues.

The roof and siding get thorough attention since they’re your first line of defense against weather. Any leaks or damage here can lead to costly interior problems down the road. Plumbing and electrical systems need to function safely and efficiently, while your HVAC system should keep you comfortable year-round without breaking the bank on utility bills.

One critical step that many buyers don’t know about is HUD data plate verification. Every manufactured home has specific certification labels that prove it meets federal safety standards. Your inspector will verify these are present and legitimate – protecting you from potential legal and resale issues.

A specialized inspector typically costs between $300-$500, but this investment can save you thousands. One of our recent clients finded foundation issues during inspection and negotiated a $3,000 price reduction. Another avoided a home that looked perfect but had major electrical problems that would have cost $5,000 to fix.

Think of the inspection as buying peace of mind. It either confirms you’re getting a great deal or gives you the information you need to negotiate a better one. Either way, you win.

The Buying Process: From Financing to Closing

Once you’ve found that perfect repossessed double wide mobile home for sale, you’re ready for the exciting part – actually making it yours! While the buying process might feel overwhelming at first, we’ve walked hundreds of families through these exact steps. With a little preparation and the right guidance, it’s surprisingly straightforward.

The journey typically takes about 6-8 weeks from offer to keys in hand when you’re buying a repo mobile home with land. If you’re purchasing just the home (without land), the timeline often shortens to 4-6 weeks. Throughout this process, you’ll want to budget for closing costs, which usually run between 3-6% of your loan amount.

The first step is securing pre-approval for financing. This isn’t just a formality – it’s your ticket to being taken seriously by sellers. When you walk in with pre-approval in hand, sellers know you’re ready to move forward, not just window shopping.

Next comes making your offer. Here’s where strategy matters. Since these are repo properties, lenders are motivated to sell, but you still want to be competitive. Include smart contingencies for a professional inspection, financing approval, and clear title verification. These protect you without making your offer weak.

The appraisal process follows, where your lender ensures the home’s value supports your loan amount. For repossessed double wide mobile homes for sale with land, this step is particularly important since you’re financing real estate.

Your final walk-through happens just before closing. This is your chance to verify everything is exactly as expected – all systems working, no new damage, and any agreed-upon repairs completed.

Financing Your Repossessed Double Wide Mobile Homes for Sale

Here’s the good news about financing repossessed double wide mobile homes for sale – lenders want to move these properties quickly, which often works in your favor. We’ve helped families with all types of credit situations find financing solutions, including those with bad credit or no credit history at all.

FHA loans are often the golden ticket for manufactured home buyers. These government-backed loans accept credit scores as low as 580 and require down payments of just 3.5%. Even better, they can finance both the home and land together when you’re buying a complete package. For many first-time buyers, this is the most accessible path to homeownership. You can learn more about FHA loans for manufactured homes.

Chattel loans come into play when you’re buying just the home without land. Think of these as personal property loans, similar to financing a car. While they typically have higher interest rates and shorter terms (usually 15-20 years), they can be easier to qualify for and perfect for homes going into mobile home communities.

Land-home combo loans are your best bet when purchasing both the home and property together. These work like traditional mortgages, offering lower interest rates and longer terms up to 30 years. Veterans and rural buyers often qualify for special programs with even better terms – sometimes even 100% financing!

Seller financing occasionally appears with repo properties, where the bank holding the property finances your purchase directly. This can be incredibly flexible, especially if your financial situation doesn’t fit traditional lending boxes.

Don’t let credit score worries hold you back. While higher scores always help, we regularly work with buyers whose scores are in the 550-600 range. Lenders look at the complete picture – your income stability, debt-to-income ratio, and down payment all matter.

We encourage you to explore your Mobile Home Finance options and see what works best for your situation.

Understanding the Closing Process

Closing day is when all your hard work pays off – literally! This is where ownership officially transfers from the lender to you, and you finally get those keys.

Title search and insurance form the foundation of your closing. A title company digs deep into the property’s history, making sure there are no surprise liens, ownership disputes, or other legal complications lurking in the background. For repossessed double wide mobile homes for sale with land, this includes both the home’s title and the land’s title. Title insurance, typically costing $500-$1,500, protects you if any issues surface later.

Verifying a clear title is absolutely critical. We’ve seen deals fall apart at the last minute because of unfinded liens or ownership complications. This step ensures you’re getting exactly what you’re paying for, with no legal strings attached.

Signing legal documents might feel like the most intimidating part, but it doesn’t have to be. You’ll encounter the loan agreement, deed, insurance documents, and various disclosure forms. Our team makes sure you understand every single document before you sign. No rushing, no pressure – just clear explanations so you feel confident about every signature.

Transfer of ownership happens the moment all documents are signed and funds change hands. It’s official – you’re now a homeowner!

Receiving the keys is the moment you’ve been waiting for. There’s nothing quite like holding those keys and knowing this beautiful repossessed double wide mobile home for sale is truly yours.

What to expect on closing day is pretty straightforward. Plan for about 1-2 hours of paperwork signing, bring a certified check for your closing costs and down payment, and don’t forget a valid photo ID. Most closings happen at a title company office, though some can be handled at our location for your convenience.

For a deeper dive into the mortgage process for manufactured homes, visit Learn more about getting a Manufactured Home Mortgage.

Frequently Asked Questions about Repo Double Wides

We love chatting with families about repossessed double wide mobile homes for sale because we know this can feel like uncharted territory. Let’s tackle the questions that come up most often in our conversations at Mobile Homes Factory Direct.

Are repo mobile homes significantly cheaper?

Absolutely, and this is what makes them such an exciting opportunity! Repossessed double wide mobile homes for sale typically sell for 20-40% below market value. Think about it – when a lender repossesses a home, they’re not trying to make a profit. They just want to recover what’s owed on the loan and move on.

This creates a win-win situation. The lender gets their money back quickly, and you get immediate equity built into your purchase. It’s like buying a home with a built-in discount that you can’t find anywhere else in the housing market. One family we worked with last year saved $28,000 on their double wide compared to similar homes in their area. That’s money they could put toward improvements, emergency savings, or just enjoy having in their pocket.

What credit score is needed to buy a repossessed double wide?

Here’s some good news – financing for repossessed double wide mobile homes for sale is often more flexible than you might expect. While a higher credit score always helps with better interest rates, we specialize in finding solutions for all credit situations.

FHA loans can work with credit scores as low as 580, and we’ve helped families with scores in the 500s find financing through specialized lenders. These lenders understand that your credit score is just one piece of your financial picture. They also look at your income stability, how long you’ve been at your job, and your debt-to-income ratio.

At Mobile Homes Factory Direct, we pride ourselves on working with people who have bad credit or even no credit history. We’ve seen too many families give up on homeownership because they think their credit disqualifies them. That’s simply not true in the manufactured housing world. Our network of lenders specializes in looking beyond just the numbers to see the whole person.

What are the biggest hidden costs to watch out for?

The word “hidden” makes it sound sneaky, but we prefer to think of these as costs you need to plan for upfront. The biggest surprise expense is usually repairs for issues that weren’t caught during inspection. This is exactly why we hammer home the importance of that professional inspection so much.

Problems with the foundation, roof, or major systems like HVAC, plumbing, or electrical can run into thousands of dollars. We’ve seen buyers skip the $400 inspection to save money, only to face $6,000 in HVAC repairs later. That’s a costly lesson no one wants to learn.

Transportation and setup costs are another area to budget for if the home needs to be moved. You’re looking at $3-$7 per mile for transport, plus setup fees that can range from $3,250 to $9,000 depending on what’s needed for blocking, leveling, and anchoring.

Don’t forget about closing costs (typically 3-6% of your loan amount), insurance (which can run $600-$1,200 annually for manufactured homes), and basic site preparation if you’re putting the home on raw land.

The secret to avoiding surprises is building these costs into your budget from day one. We always recommend having a thorough inspection and setting aside 5-15% of the purchase price for initial repairs and improvements. This way, you’re prepared for anything and can focus on enjoying your new home instead of worrying about unexpected expenses.

Your Next Step to an Affordable Home

Purchasing a repossessed double wide mobile home for sale represents more than just a smart financial decision – it’s your gateway to the American dream of homeownership, often at prices that seemed impossible just years ago. We’ve had the privilege of watching countless families across Texas transform their lives through these incredible opportunities, from young couples in San Antonio getting their first taste of homeownership to retirees in Corpus Christi finding the perfect downsizing solution.

The math is simple, but the impact is life-changing. When you can buy a home for 20-40% below market value, you’re not just saving money – you’re building immediate equity from day one. That spacious double wide that might cost $180,000 new could be yours for $120,000 as a repo, giving you $60,000 in instant equity. It’s like getting a head start on building wealth while enjoying the space and comfort your family deserves.

Due diligence isn’t just recommended – it’s your best friend. That $400 professional inspection we keep talking about? It’s the difference between a dream purchase and a financial nightmare. The clear title search, the thorough walk-through, the repair budget – these aren’t just steps in a process, they’re your insurance policy for peace of mind.

Financing flexibility means opportunity for everyone. Whether you’re a first-time buyer with limited credit history, a veteran looking to use your VA benefits, or someone rebuilding after financial challenges, there’s likely a path forward. FHA loans, chattel financing, land-home packages – we’ve seen families succeed with all types of credit situations because lenders understand that repossessed double wide mobile homes for sale represent solid value.

Land ownership changes everything. When you own both the home and the land beneath it, you’re not just buying shelter – you’re investing in your family’s future. No more monthly lot rent, no more community rules limiting your improvements, and the potential for your property to appreciate over time.

At Mobile Homes Factory Direct, we’ve built our reputation on making homeownership accessible and affordable. We believe everyone deserves a place to call their own, and we’re committed to helping you find it. Our simple process, flexible financing options for all credit types (including bad or no credit), and genuine care for our customers set us apart.

Ready to take the next step? For expert guidance and to find the perfect home in the Von Ormy area and beyond, explore our inventory of pre-owned homes. Your affordable, spacious new home is waiting – let’s make it happen together!