Zero to Hero: Financing Your Mobile Home Journey

Unlock homeownership! Learn to finance no credit mobile homes, overcome lender hurdles, and boost your approval odds today.

Your Path to Homeownership Starts Here

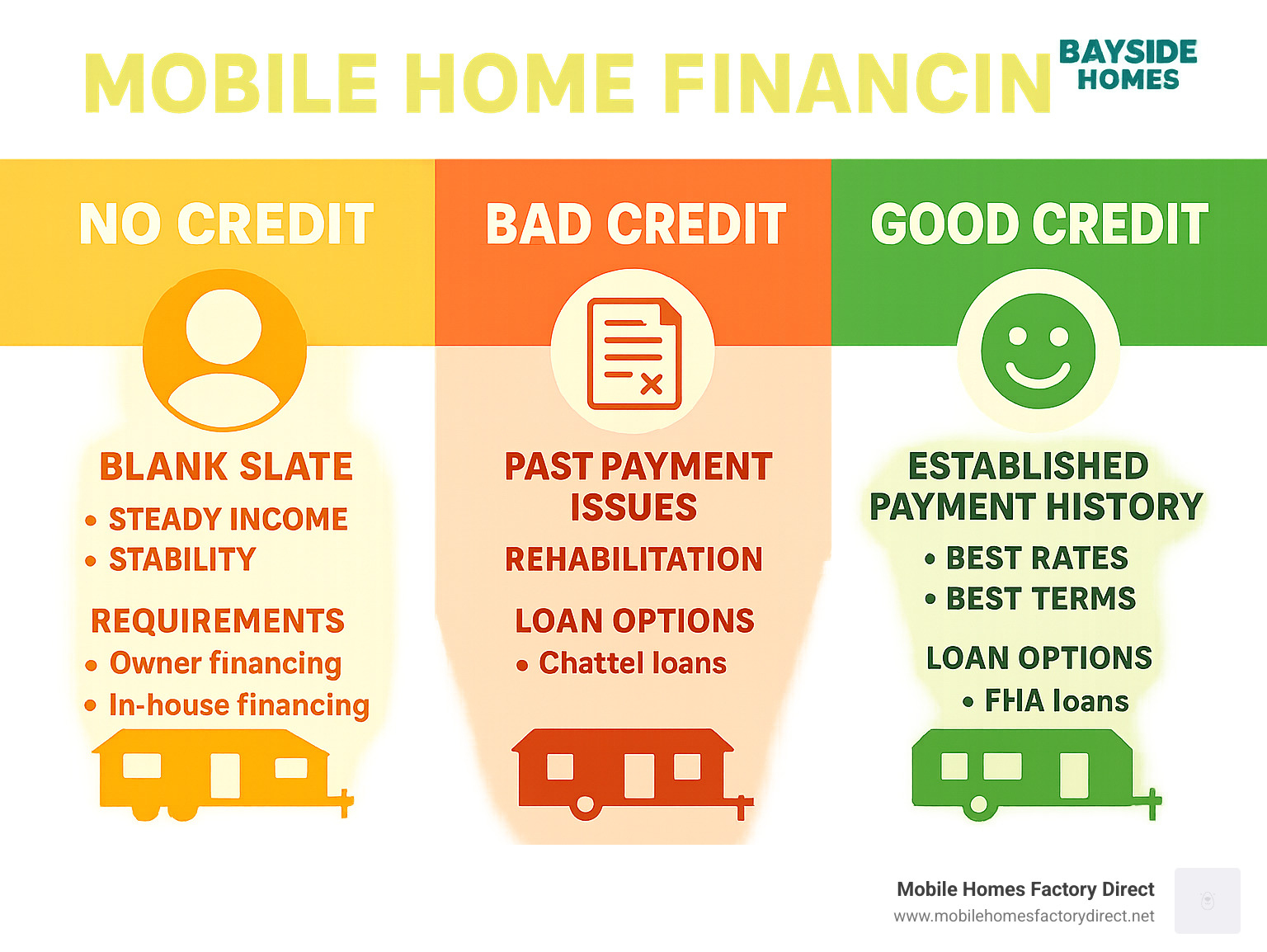

No credit mobile homes are available through specialized financing programs that focus on income stability and down payment rather than credit history. Here are your main options:

Key Financing Solutions:

- Owner Financing – Direct payment plans with home sellers

- Chattel Loans – Personal property loans using the home as collateral

- In-House Financing – Dealer-provided payment programs

- FHA Title I Loans – Government-backed loans for manufactured homes

- Alternative Income Programs – For self-employed or non-traditional income

What You’ll Need:

- Proof of steady income (pay stubs, bank statements)

- Down payment of 10-20% typically

- Low debt-to-income ratio

- Stable employment history

Many people think homeownership is impossible without established credit. That’s simply not true. The mobile home industry has developed creative solutions specifically for first-time buyers and those starting their credit journey.

Banks might hesitate because they can’t predict your payment behavior. But specialized lenders understand that steady income and savings habits often matter more than a three-digit credit score.

The key is knowing where to look and how to present yourself as a reliable borrower. With the right approach, you can move from having no credit history to holding keys to your own home.

Understanding the Challenge: Why Lenders Hesitate with No Credit

Let’s be honest – getting financing for no credit mobile homes can feel like trying to get a job that requires experience when you need the job to get experience. It’s frustrating, but understanding why lenders hesitate can help you steer this challenge more effectively.

The whole thing comes down to one simple concept: risk. Lenders aren’t being mean when they turn down applications from people with no credit history. They’re just trying to protect their business by figuring out who’s likely to pay them back.

The Lender’s Perspective on Risk

Think of your credit score as your financial report card. When lenders look at it, they’re trying to predict your future payment behavior based on how you’ve handled money in the past. Did you pay your credit cards on time? How about that car loan? Student loans?

But when you have no credit history, it’s like showing up to take a test with a completely blank answer sheet. The lender has no payment history to review, no data points to analyze, and no way to gauge your reliability as a borrower.

This creates what lenders call “financial unknowns.” You might be incredibly responsible with money – maybe you’ve been paying rent on time for years or always cover your bills in full. But without that documented credit history, lenders can’t see this proof of reliability.

From their perspective, you represent a higher perceived risk simply because they can’t predict how you’ll behave as a borrower. It’s not personal; it’s just business math.

How Property Type Affects Financing

Here’s where things get even trickier for mobile home buyers. The type of property you want to finance makes a huge difference in how lenders view your application.

Traditional homes are almost always considered real property – they’re permanently attached to land and generally increase in value over time. Mobile homes, however, fall into two different categories depending on your situation.

If you own the land and your mobile home has a permanent foundation, it’s typically classified as real property. Lenders love this setup because the home and land together provide solid collateral value and loan security.

But many mobile homes sit on leased land in mobile home parks. In these cases, the home is considered personal property – more like a car than a house. This is where lenders get nervous about mobile homes without permanent foundations.

The concern is simple: mobile home depreciation. Personal property typically loses value over time, and because it can be moved, it’s harder for lenders to recover their investment if something goes wrong. They worry about the collateral differences between a mobile home that could theoretically be relocated and a traditional house that’s not going anywhere.

This mobile home classification issue, combined with having no credit history, creates a double challenge. But don’t worry – specialized lenders understand these unique situations and have developed solutions specifically for buyers like you.

Navigating Financing for No Credit Mobile Homes

Here’s the good news: while traditional banks might slam their doors shut when they see your blank credit report, the mobile home world operates differently. The manufactured housing industry has spent decades creating financing solutions specifically for people like you – folks who are financially responsible but just haven’t built up that credit history yet.

Think of it this way: every homeowner started somewhere. The mobile home industry gets that, and they’ve built an entire ecosystem of alternative lending options around helping first-time buyers succeed.

Specific Loan Options for No Credit Mobile Homes

When you’re looking at no credit mobile homes, you’ve got several paths forward. Each one works a little differently, but they all focus on what you can do rather than what’s missing from your credit report.

Chattel loans are probably going to be your best friend in this journey. These work just like a car loan – the mobile home itself secures the loan. Specialized lenders offer these specifically for manufactured homes, and they care more about your steady paycheck than your credit score. Yes, you’ll face higher interest rates than someone with perfect credit, but you’ll also get your keys.

Owner financing is where things get really interesting. Sometimes the person selling the mobile home becomes your lender. Instead of dealing with a bank, you work out payment terms directly with the seller. Many sellers love this arrangement because they get steady monthly income, and you love it because they’re often willing to be flexible with someone who has no payment history but shows financial stability.

In-house financing through dealers like us at Mobile Homes Factory Direct opens another door. We work with lenders who understand the manufactured housing market inside and out. They know that a person with no credit isn’t the same as someone with bad credit, and they’ve designed programs specifically for your situation.

FHA Title I loans bring the government into your corner. These loans are backed by the Federal Housing Administration, which means lenders feel more comfortable working with buyers who have limited credit history. The government backing reduces their risk, which increases your chances of approval.

For our veterans, VA loans offer an incredible opportunity. If you’ve served our country, you might qualify for financing with no down payment required. It’s one of the best ways to say “thank you” for your service.

The key is understanding that each option comes with its own requirements and trade-offs. Higher interest rates are common across all these programs – that’s just the reality of no credit mobile homes financing. But remember, you’re not stuck with these rates forever. As you build your credit through homeownership, you can often refinance to better terms down the road.

You can explore more details about Financing a Mobile Home to see which option might work best for your specific situation.

Chattel Loans vs. Traditional Mortgages

Understanding the difference between these two loan types is crucial for your success. It’s like knowing the difference between renting and buying – they serve similar purposes but work completely differently.

Traditional mortgages treat your home and land as one package deal. The bank sees this as solid collateral because land typically holds its value over time. These loans usually offer longer terms (up to 30 years) and lower interest rates.

Chattel loans focus solely on the mobile home itself, treating it more like personal property. Since many mobile homes sit on leased land in parks or communities, the lender can only use the home as collateral. This creates more risk from their perspective, which translates to shorter loan terms and higher rates for you.

Here’s how they stack up:

| Feature | Chattel Loans | Traditional Mortgages |

|---|---|---|

| Property Type | Personal property (home only) | Real property (home and land) |

| Land Ownership | Often on leased land | Land owned by borrower |

| Interest Rates | Higher due to risk | Lower rates available |

| Loan Terms | 10-25 years typically | 15-30 years available |

| Down Payment | 5-20% common | 3.5% (FHA) to 20% |

The land ownership impact is huge here. If you’re buying a mobile home that will sit on land you own, you might qualify for a traditional mortgage with better terms. But if you’re placing your home in a mobile home community on leased land, chattel loans become your primary option.

Don’t let the higher rates discourage you. Chattel loans exist specifically for situations like yours, and they’re designed to work with no credit mobile homes buyers. The lenders who offer these loans understand the manufactured housing market and have realistic expectations about your financial profile.

The most important thing is getting started. Once you’re a homeowner making regular payments, you’re building the credit history that opens doors to better financing options in the future.

For more detailed comparisons, check out our guide on Mobile Home Financing to see which approach makes the most sense for your situation.

Boosting Your Approval Odds: A Step-by-Step Guide

Getting approved for no credit mobile homes financing might feel intimidating at first, but here’s the encouraging truth: lenders want to say yes. They’re in business to make loans, not turn people away. The key is showing them you’re a safe bet, even without a traditional credit score.

Think of it this way – you’ve been paying bills your whole adult life. Rent, utilities, car payments, groceries. That’s proof you can manage money responsibly. Now we just need to package that story in a way lenders understand and appreciate.

Key Eligibility Requirements for No Credit Mobile Homes

When lenders can’t rely on a credit score, they dig deeper into your financial life. This actually works in your favor because it gives you multiple ways to prove you’re responsible with money.

Steady income documentation becomes your best friend in this process. Lenders want to see those recent pay stubs – usually the last two to three months worth. Your bank statements tell an even richer story, showing consistent deposits and responsible spending patterns over three to six months. If you’re self-employed or have variable income, tax returns from the past one to two years paint the bigger picture of your earning power.

Employment stability matters tremendously to lenders evaluating no credit mobile homes applications. They’re looking for at least one to two years in the same line of work. This doesn’t mean you need to stay at the exact same company, but jumping from retail to construction to food service might raise questions. Consistency shows you’re not a flight risk when it comes to income.

Your down payment savings speak volumes about your commitment. While some programs offer zero down options for veterans or qualified landowners, having 5-20% saved up demonstrates serious intent. Plus, the more you put down, the less you need to borrow – which makes lenders much more comfortable.

The debt-to-income ratio is where many people get tripped up, but it’s simpler than it sounds. Lenders just want to see that after paying your current bills, you’ll have enough left over for your mobile home payment without stretching too thin. Think of it as proving you won’t be eating ramen noodles every night just to afford your mortgage.

For those with alternative income sources – freelancers, gig workers, small business owners – don’t worry. We understand not everyone fits the traditional W-2 mold. Business bank statements, contracts, invoices, and client letters all help build your case. The key is showing consistent income, even if it doesn’t arrive in neat bi-weekly paychecks.

Understanding what lenders need helps you gather everything upfront, making your application process smoother. Our Loan Options for Mobile Homes page walks through exactly how these requirements apply to different financing programs.

Proactive Steps to Build Your Financial Profile

Here’s something most people don’t realize: you can start building a positive financial profile right now, even while pursuing your mobile home purchase. These steps help with your current application and set you up for even better opportunities down the road.

Secured credit cards are like training wheels for credit building. You put down a deposit (say $300), and that becomes your credit limit. Use it for small purchases like gas or groceries, then pay it off completely every month. It shows lenders you can handle credit responsibly without any risk to you.

Credit-builder loans work backwards from regular loans in an interesting way. The bank holds your loan amount in a savings account while you make monthly payments. Once you’ve paid it off, you get the money back – plus you’ve built a payment history. It’s like forced savings with a credit-building bonus.

Don’t underestimate the power of on-time rent and utility payments. While these aren’t automatically reported to credit bureaus, they demonstrate reliability. Some services now let you report these payments to help build credit history. Even if not reported, consistent on-time payments show lenders you’re responsible with monthly obligations.

Credit counseling from a non-profit agency can be incredibly valuable. They’ll help you assess your finances, create a realistic budget, and guide you on building credit responsibly. The Consumer Financial Protection Bureau offers excellent guidance on building credit history from scratch.

Before diving into any application, review your finances honestly. Know your monthly income, understand your expenses, and figure out what you can realistically afford for a house payment. This preparation makes you a confident applicant and ensures you’re making a smart financial decision for your family’s future.

Our Manufactured Home Loan Calculator helps you estimate potential payments so there are no surprises. Building a strong financial profile takes time, but every positive step moves you closer to holding those house keys.

Frequently Asked Questions about No Credit Home Loans

These are the questions we hear most often from folks just starting their journey toward no credit mobile homes ownership. Let’s tackle them honestly – because you deserve straight answers.

Can I get a mobile home with zero down payment and no credit?

This is probably our most asked question, and I get why. When you’re already worried about having no credit history, the thought of needing thousands for a down payment can feel overwhelming.

Here’s the reality: it’s tough, but not impossible. Zero down options do exist, though they come with some specific requirements.

Veterans have the best shot at zero down financing. VA loans are designed specifically to help those who’ve served our country, and they often require no down payment at all. If you’re a veteran, this could be your golden ticket to homeownership.

Land ownership changes everything. If you already own a piece of land where you plan to place your mobile home, some lenders will consider that land equity as your down payment. It’s like having money in the bank – just in dirt form.

Some specialized lenders and dealer financing programs occasionally offer zero down promotions for buyers with rock-solid income and employment history. These are rare, but they happen.

The honest truth? Having both no credit and no down payment makes you a high-risk borrower in lenders’ eyes. Even saving up $2,000-3,000 for a small down payment can dramatically improve your chances and get you better terms.

Are interest rates always higher for no-credit mobile home loans?

I wish I could tell you otherwise, but yes, you’ll likely pay higher interest rates when you have no credit history. It’s not personal – it’s just how lending works.

Think of it from the lender’s perspective. They’re essentially betting money on someone they know nothing about financially. Higher rates are their insurance policy against that unknown risk.

Several factors influence exactly how much higher your rate will be:

Your down payment size matters tremendously. Put down 15-20% instead of 5%, and you might shave a point or two off your rate. The loan type also plays a role – chattel loans typically carry higher rates than traditional mortgages, regardless of credit.

Geographic location can affect rates slightly, and shorter loan terms often mean lower interest rates than longer ones.

Here’s the encouraging part: this isn’t forever. Once you start making on-time payments and building credit history, you can explore refinancing in a couple of years. Many of our customers do exactly that – they get started with higher rates, then refinance to better terms once they’ve proven themselves.

Always shop around. Different lenders have different risk appetites, and you might be surprised at the variation in rates you’ll find.

How long does the approval process take?

The timeline really depends on how prepared you are and which financing route you choose. Most of our customers close within 4-8 weeks from application to keys in hand.

Getting your documents together is usually the biggest time factor on your end. When you have all your pay stubs, bank statements, and employment verification ready to go, everything moves much faster. We always tell folks to gather these before they even start shopping.

Lender processing varies widely. Some specialized mobile home lenders can give you an answer in just a few days, while others might take 2-3 weeks to review everything thoroughly.

If your home needs an appraisal or inspection – which is more common when you’re putting it on owned land – add another week or two to the timeline.

Chattel loans (where you’re financing just the home) typically close faster than land-home packages. Think 4-6 weeks versus 6-8 weeks.

The good news? We’ve been through this process thousands of times. We know exactly what each lender needs and can help you avoid the common delays that trip up first-time buyers. Our goal is to make this as smooth and stress-free as possible for you.

Your Dream Home is Within Reach

Your journey to owning no credit mobile homes doesn’t have to end in frustration. Throughout this guide, we’ve shown you that homeownership is absolutely possible, even without a traditional credit history. The manufactured housing industry has evolved to serve people exactly like you – hardworking individuals who deserve a place to call their own.

The path forward is clearer than you might think. With specialized financing options like chattel loans, owner financing, and in-house programs, you have real alternatives to traditional bank mortgages. Your steady income and savings discipline matter more than a credit score that doesn’t exist yet.

At Mobile Homes Factory Direct, we’ve seen countless families transform their lives through homeownership. Whether you’re looking for a cozy single-wide for your first home or a spacious double-wide for your growing family, we understand the unique challenges you face. That’s why we’ve built relationships with lenders who specialize in helping people with all credit situations – including no credit at all.

We’re proud to serve communities throughout the San Antonio area, from Von Ormy and Somerset to Atascosa, Macdona, and Lytle. Our neighbors in Poteet, La Coste, Leming, Natalia, and Elmendorf know they can count on us for honest guidance and flexible solutions. We also work with families near Castroville, JBSA Fort Sam Houston, JBSA Lackland, Bigfoot, and Devine.

The key to your success lies in preparation and patience. Gather your income documentation, save for a down payment if possible, and be ready to show lenders that you’re financially responsible. Every homeowner started somewhere – and many started exactly where you are now.

Your dream home isn’t just wishful thinking. It’s a real possibility that’s waiting for you to take the first step. The keys to your own place are closer than you think, and we’re here to help you reach them.

Ready to explore your options? Take a look at Our Homes and find the perfect place to start your homeownership journey. Your future home is out there, and we can’t wait to help you find it.