Mobile Home Pricing: Your Ultimate Guide to Affordable Living

Discover true mobile home prices. Get a complete breakdown of costs, financing, and tips for affordable homeownership.

Why Mobile Home Prices Make Homeownership Accessible

Mobile home prices offer an affordable path to homeownership for millions of Americans facing budget constraints or credit challenges. With new manufactured homes ranging from $40,000 to $250,000 and used options starting as low as $10,000, these homes cost significantly less than traditional site-built houses that average $155,000 to $416,000.

Quick Mobile Home Price Overview:

- New Single-Wide: $40,000 – $90,000 (600-1,300 sq ft)

- New Double-Wide: $75,000 – $160,000 (1,500-2,500 sq ft)

- New Triple-Wide: $100,000 – $250,000 (2,000-3,600 sq ft)

- Used Mobile Homes: $10,000 – $100,000 (depending on age/condition)

The affordability of manufactured homes goes beyond just the sticker price. Unlike traditional homes, mobile homes are built in controlled factory environments, which reduces construction costs and time. However, understanding the total cost is crucial for budget planning.

Your final investment includes the home price plus delivery ($2,000-$14,000), site preparation ($4,000-$11,000), utility connections ($9,000-$34,500 for vacant land), and ongoing costs like lot rent ($300-$1,000 monthly) if you don’t own land.

Modern manufactured homes also offer surprising quality and customization options. Today’s homes feature energy-efficient appliances, vaulted ceilings, and spacious floor plans that rival traditional construction – all while maintaining their cost advantage.

Understanding Mobile Home Prices by Type and Condition

Shopping for a mobile home feels a lot like shopping for a car – you’ve got different sizes, ages, and features to choose from. The mobile home prices you’ll encounter depend heavily on whether you’re looking at a brand-new model fresh from the factory or a pre-owned home with some character. Let’s walk through what you can expect to pay for each type.

Average New Mobile Home Prices

When you buy new, you’re getting the latest in manufactured home design. Think energy-efficient appliances, modern layouts, and that wonderful “new home smell” (without the overwhelm of building from scratch).

Single-wide homes are your most budget-friendly option at $40,000 to $90,000. These homes stretch 42 to 90 feet long but stay narrow at 10 to 16 feet wide. You’ll get between 600 and 1,300 square feet – perfect for singles, couples, or small families who want efficiency without cramped quarters.

Double-wide homes step up the game significantly. At $75,000 to $160,000, they offer 1,500 to 2,500 square feet of living space. The extra width (20 to 42 feet) makes a huge difference in how spacious everything feels. You can actually have separate living and dining areas, multiple bedrooms, and more than one bathroom.

Triple-wide homes are where manufactured homes really show off. These beauties run $100,000 to $250,000 and can give you up to 3,600 square feet. We’re talking 3 to 5 bedrooms, multiple bathrooms, and floor plans that rival traditional site-built homes.

Here’s how the numbers break down:

| Home Type | Average Price Range | Average Square Footage | Average Price Per Square Foot |

|---|---|---|---|

| Single-Wide | $40,000 – $90,000 | 1,075 sq ft | $53.04 |

| Double-Wide | $75,000 – $160,000 | 1,746 sq ft | $58.73 |

| Triple-Wide | $100,000 – $250,000 | 2,000 – 3,600 sq ft | Varies widely |

Average Used Mobile Home Prices

Here’s where things get really interesting for budget-conscious buyers. Just like cars, manufactured homes depreciate – especially in those first few years. But unlike cars, a well-maintained mobile home can serve you beautifully for decades.

The depreciation factor works in your favor when buying used. Mobile homes classified as personal property (not permanently attached to land you own) lose value over time. This might sound scary, but it creates incredible opportunities for smart buyers.

Condition matters more than age when you’re shopping used homes. A 15-year-old home that’s been lovingly maintained can be a better buy than a 5-year-old home that’s been neglected. Look for signs of good care: updated flooring, fresh paint, and well-maintained exteriors.

Used mobile home prices typically fall between $10,000 and $100,000. Used single-wides often start around $10,000 and top out near $25,000. Used double-wides usually run $20,000 to $50,000, while used triple-wides begin around $50,000 and climb higher for luxury models in excellent condition.

At Mobile Homes Factory Direct, we offer fantastic options in Used Manufactured Housing for Sale and Repossessed Mobile Homes. These homes often come at significantly reduced prices, making homeownership possible even on tight budgets.

How Customization Options Affect Price

This is where new manufactured homes really shine – and where your budget can get creative. The ability to customize your home is exciting, but each upgrade adds to those base mobile home prices.

Upgraded materials and finishes make the biggest visual impact. Swapping vinyl flooring for hardwood or tile, choosing granite countertops over laminate, or selecting premium cabinetry can transform your home’s look and feel. The same goes for designer fixtures, custom paint colors, or upgraded exterior siding.

Floor plan modifications let you create the exact layout you need. Want an extra bathroom? Need a larger master bedroom? These changes require custom factory work, which adds to the cost but gives you exactly what your family needs.

Energy-efficient upgrades cost more upfront but save money long-term. ENERGY STAR® appliances, better insulation, Low-E windows, and efficient heating and cooling systems reduce your monthly utility bills. These upgrades often pay for themselves within a few years.

Customization can add anywhere from $10 to $150 per square foot to your home’s price. The key is prioritizing what matters most to your family. You can Compare Manufactured Homes Floor Plans to see how different options might fit your needs and budget.

Beyond the Sticker Price: Additional Costs to Budget For

When you’re shopping for a manufactured home, it’s easy to get excited about those attractive mobile home prices you see advertised. But here’s the thing – that sticker price is just the beginning of your investment, not the end. Think of it like buying a car: you wouldn’t expect the dealership price to include your insurance, gas, and maintenance for the next decade, right?

The same principle applies to mobile homes. The true cost includes everything needed to turn that factory-fresh home into your actual, livable dream space.

The total installed cost of a manufactured home typically ranges from $143,000 to $268,000. This more complete picture includes your home, land considerations, delivery, setup, and all those necessary steps that transform a house into your home. Understanding these costs upfront helps you budget realistically and avoid any unwelcome surprises down the road.

Land and Site Preparation

Every home needs somewhere to live, and that’s where things can get interesting budget-wise. You’ve got two main paths: buying your own land or renting a lot in a manufactured home community.

If you choose to buy land, you’re looking at costs that vary wildly depending on where you want to live. The national average runs around $3,020 per acre, but that number can swing dramatically. Rural areas might offer great deals, while desirable locations near cities can cost significantly more. When you own the land, you’ll also handle property taxes, which typically run $5,000 to $15,000 annually.

Renting a lot in a manufactured home community is often the more budget-friendly route. Lot rent usually falls between $300 and $1,000 per month, depending on your area and what amenities the community offers. Many communities include perks like clubhouses, pools, and organized activities – it’s like living in a resort where you actually know your neighbors!

Once you’ve sorted out where your home will live, you need to prepare that space. Site preparation averages $4,000 to $11,000 and includes clearing the land, grading it properly, and ensuring good drainage. This isn’t optional – it’s the foundation (literally) of your home’s long-term stability.

Your home will need a proper foundation, and this is where costs can really add up. A permanent foundation runs $3,000 to $36,000, with most homeowners paying $10,000 to $15,000 for a solid concrete slab or pier and beam setup. This investment is worth it though – it can help your home qualify as real estate rather than personal property, which opens up better financing options. You can learn more about your options at Mobile Home Foundation Types, and the official permanent foundation standards provide detailed requirements.

If you’re setting up on vacant land, bringing utilities to your property is another major expense. Connecting water, sewer, electricity, and gas can cost $9,000 to $34,500, depending on how far you are from existing utility lines and how complex the hookup process is.

Transport and Setup Costs

Now comes the exciting part – getting your new home from the factory to your prepared site! This process involves more logistics than you might expect, and the costs reflect that complexity.

Delivery fees are often included in your home’s price for nearby locations, typically up to 100 miles. Beyond that distance, you’ll pay additional mileage charges of about $6 to $15 per mile. For longer moves, expect costs between $1 and $5 per mile, which means short-distance hauls might run $1,000 to $5,000, while cross-state moves can reach $10,000 to $25,000.

You’ll have a choice between full-service delivery and transport-only options. Full-service delivery and setup, which includes professional installation and connection, costs $2,000 to $14,000. While transport-only might seem cheaper at $1,000 to $5,000, setting up a manufactured home requires specialized knowledge and equipment. Most homeowners find the peace of mind of professional installation worth the extra cost.

Don’t forget about permits – you’ll need these before any setup begins. Building permits for manufactured homes typically cost $500 to $2,000, varying by local requirements.

Utility hookups are the final step in making your house a home. Connecting your home to water, sewer, electric, and gas services usually involves additional costs beyond bringing utilities to the property, often running several hundred to a few thousand dollars depending on complexity.

Taxes, Insurance, and Ongoing Fees

Once your home is beautifully set up and you’re ready to move in, you’ll have ongoing costs to consider. These aren’t surprises – they’re just part of responsible homeownership.

Taxes can be tricky because they depend on how your home is classified. If your manufactured home sits on a permanent foundation and is titled as real estate, you’ll pay property taxes just like any traditional homeowner – typically $5,000 to $15,000 annually if you own the land. If it’s titled as personal property, you might pay annual taxes to your state’s DMV instead, similar to a vehicle registration.

Many areas charge impact fees of $1,500 to $10,000 for new development on vacant land. These fees help cover the cost of public services like roads, schools, and emergency services.

Homeowner’s insurance is essential for protecting your investment, and it’s surprisingly affordable. Most manufactured home insurance policies cost $500 to $1,500 per year, depending on your home’s value, location, and the coverage level you choose.

Maintenance costs are part of keeping any home in great shape. Modern manufactured homes can last 30 to 55 years with proper care. Skirting installation costs $900 to $3,000 but improves both appearance and protection from weather and pests. Occasional releveling runs $500 to $1,000 and helps ensure your home stays structurally sound as the ground naturally settles over time.

Regular upkeep like HVAC servicing, roof inspections, and basic plumbing or electrical maintenance typically runs a few hundred dollars per year – a small price to pay for a comfortable, well-maintained home.

Financing Your Mobile Home Purchase

Let’s be honest – financing a mobile home isn’t quite the same as getting a traditional mortgage. The process has its own quirks, but here’s the good news: there are plenty of options available, even if your credit score isn’t perfect. At Mobile Homes Factory Direct, we’ve helped countless families find financing solutions that work for their unique situations, offering flexible financing for all credit types.

The key difference you’ll notice is that mobile home prices and financing often depend on whether your home will be considered real property (permanently attached to land you own) or personal property (like a vehicle). This classification affects everything from interest rates to loan terms.

Your credit score definitely impacts your options, but don’t let that discourage you. We’ve seen people with all kinds of credit histories achieve their homeownership dreams. The important thing is understanding what’s available and finding the right fit for your budget. You can explore more details on our Mobile Home Financing page.

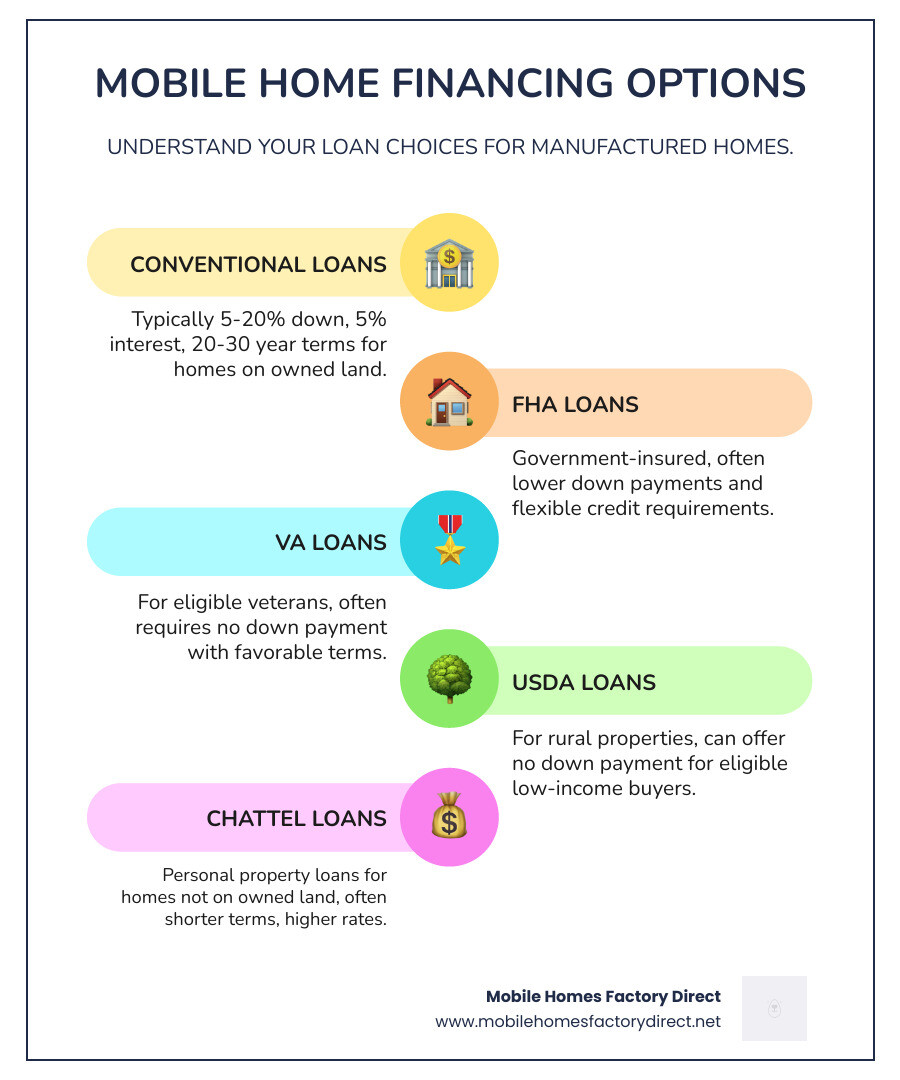

Common Loan Options

Think of mobile home financing like a toolbox – different tools work better for different jobs. Here are the main financing options available:

Conventional loans work much like traditional mortgages, but they’re typically reserved for manufactured homes that are permanently attached to land you own. You’ll need a down payment of 5-20% and decent credit, but you’ll get favorable interest rates around 5% with terms of 20-30 years.

FHA loans are a popular choice because they’re more forgiving. Backed by the Federal Housing Administration, these loans accept lower credit scores and require as little as 3.5% down. However, there are loan limits: up to $69,678 for just the home, $23,226 for land only, or $92,904 for home and land together. Terms usually run 15-25 years with competitive rates.

VA loans are an incredible benefit for eligible veterans, active service members, and their spouses. These loans often require no down payment, have no mortgage insurance, and offer below-market interest rates (often around 3.5%). If you qualify, this is usually your best option with terms from 15-30 years.

USDA loans serve families in eligible rural areas who meet income requirements. Like VA loans, they often require no down payment and offer competitive rates, making homeownership more accessible in rural communities.

Chattel loans treat your mobile home like personal property rather than real estate – similar to a car loan. These are common when you’re renting land or your home isn’t permanently attached. While they offer more flexibility, they typically come with higher interest rates (around 13%, though good credit can get you below 10%) and shorter terms (up to 20 years). You’ll need at least 5% down.

How Financing Affects Overall Cost

Here’s where the math really matters for your wallet. The financing you choose can dramatically change how much you actually pay for your home over time.

Interest rates make the biggest difference in your total cost. Imagine borrowing $80,000 for a double-wide home. With a 3.5% VA loan over 30 years, you’ll pay about $360 monthly and roughly $49,000 in interest. With a 13% chattel loan over 20 years, you’ll pay about $967 monthly and approximately $152,000 in interest. That’s a difference of over $100,000!

Loan terms create a balancing act between monthly affordability and total cost. Shorter terms mean higher monthly payments but less interest overall. Longer terms reduce your monthly burden but increase what you pay in the long run. The key is finding the sweet spot that fits your monthly budget while keeping total costs reasonable.

Down payments work in your favor by reducing both your monthly payment and total interest. Even FHA’s modest 3.5% down payment can save you thousands compared to financing the full amount. If you can manage a larger down payment, you’ll see even more savings.

Our team at Mobile Homes Factory Direct understands these nuances and can help you steer the options to find what works best for your situation. We recommend using our Manufactured Home Loan Calculator to see how different scenarios affect your payments. It’s a great way to understand the real impact of your financing choices before you commit.

Frequently Asked Questions about Mobile Home Costs

We get lots of thoughtful questions about mobile home prices and what ownership really looks like. Let’s explore the most common ones – chances are, you’re wondering about these too!

Are mobile homes a good investment?

This question comes up all the time, and honestly, the answer depends on how you define “investment.” Let’s be real here – traditionally, manufactured homes haven’t been the get-rich-quick scheme that some real estate markets offered. Most mobile homes are considered personal property and do depreciate over time, similar to how your car loses value.

But here’s where things get interesting. The real value often lies in the land ownership. If you own the property your home sits on, that land typically appreciates over time. Plus, the manufactured housing industry has come a long way since the 1970s.

Modern manufactured homes built to today’s HUD standards are far more durable and well-constructed than their predecessors. When your home is permanently attached to a foundation on land you own, it can hold its value much better. While it might not appreciate as quickly as a traditional site-built home in a hot market, it offers something incredibly valuable: affordable homeownership.

Think about it this way – instead of throwing away $1,200+ monthly on rent, you’re building equity and stability. For many families, that’s the best investment they could make. You can explore more about this topic in our guide on the Pros and Cons of Owning a Mobile Home in New Braunfels.

How long do mobile homes last?

Modern manufactured homes are built to go the distance. You can expect your home to last 30 to 55 years on average, and many well-maintained homes exceed that timeframe.

The game-changer was the HUD code implementation in 1976. This federal standard transformed the industry, requiring strict safety and quality guidelines for all manufactured homes. If you’re buying a home built after 1976, you’re getting a product that meets rigorous construction standards.

The secret to longevity? Regular maintenance. Just like any home, a little TLC goes a long way. This means staying on top of routine inspections, addressing small issues before they become big problems, and handling periodic maintenance like releveling ($500-$1,000 every few years) or skirting repairs ($900-$3,000 when needed).

We’ve seen manufactured homes from the 1980s and 1990s that still provide comfortable, safe living because their owners took good care of them. Your home’s lifespan is really in your hands!

What are the typical ongoing costs of owning a mobile home?

Let’s talk about the monthly reality of mobile home ownership. Understanding these costs upfront helps you budget properly and avoid surprises down the road.

Lot rent is often the biggest ongoing expense if you don’t own your land. Monthly lot rent in manufactured home communities typically runs $300 to $1,000, depending on your location and the amenities offered. Some communities include certain utilities or offer clubhouses, pools, and organized activities that add value to this cost.

Insurance is non-negotiable for protecting your investment. Manufactured home insurance averages $500 to $1,500 annually. The exact amount depends on your home’s value, your location, and the coverage level you choose.

Maintenance costs are generally lower than traditional homes, but they’re still part of the picture. Budget a few hundred dollars yearly for routine upkeep – things like HVAC servicing, minor repairs, and general maintenance. Occasionally, you might need larger maintenance items like releveling or skirting work.

Don’t forget about utilities – electricity, water, sewer, and possibly gas. The good news is that many modern manufactured homes feature energy-efficient designs that help keep these costs manageable.

If your home is permanently affixed to land you own, property taxes become part of your annual expenses, typically ranging from $5,000 to $15,000 depending on your location and home value.

While these ongoing costs might seem like a lot, they’re often still significantly less than traditional homeownership expenses, making manufactured homes an attractive long-term housing solution.

Your Path to Affordable Homeownership

We hope this comprehensive guide has given you a clear understanding of mobile home prices and what goes into the total cost of ownership. From the base sticker price to delivery costs, site preparation, and those ongoing expenses that keep your home running smoothly, having the complete picture helps you make the best decision for your family.

The beauty of manufactured homes lies in their genuine affordability and accessibility. While a traditional site-built home might feel financially out of reach, mobile homes offer a realistic path to homeownership that doesn’t require decades of saving or perfect credit. With base prices starting as low as $40,000 for new homes and $10,000 for quality used options, you can achieve the dream of owning your own space much sooner than you might think.

Modern manufactured homes aren’t just affordable – they’re genuinely impressive. Today’s designs feature spacious floor plans, energy-efficient appliances, and customization options that let you create a home that truly reflects your style and needs. Whether you’re drawn to the cozy efficiency of a single-wide or the expansive luxury of a triple-wide, there’s a manufactured home that fits both your lifestyle and your budget.

The key to success is comprehensive budgeting. Your total investment includes more than just the home price. Factor in delivery costs ($2,000-$14,000), site preparation ($4,000-$11,000), and ongoing expenses like lot rent ($300-$1,000 monthly) or property taxes if you own land. Having a realistic budget that covers all these elements ensures you’ll enjoy your new home without financial stress.

At Mobile Homes Factory Direct, we understand that every family’s situation is unique. That’s why we’ve built our entire business around making homeownership accessible to everyone. Our simple process eliminates the confusion often associated with home buying, while our transparent pricing means no surprises along the way. Most importantly, we offer flexible financing solutions designed to work with all credit types – because we believe everyone deserves a chance at homeownership, regardless of their credit history.

Our team genuinely cares about finding you the perfect home that fits both your dreams and your budget. We’re here to guide you through every step, from selecting the right floor plan to understanding your financing options and coordinating delivery and setup.

Ready to turn your homeownership dreams into reality? Explore our available homes today! and find just how achievable your perfect home can be.