Your Path to Homeownership: Mobile Home Loans Simplified

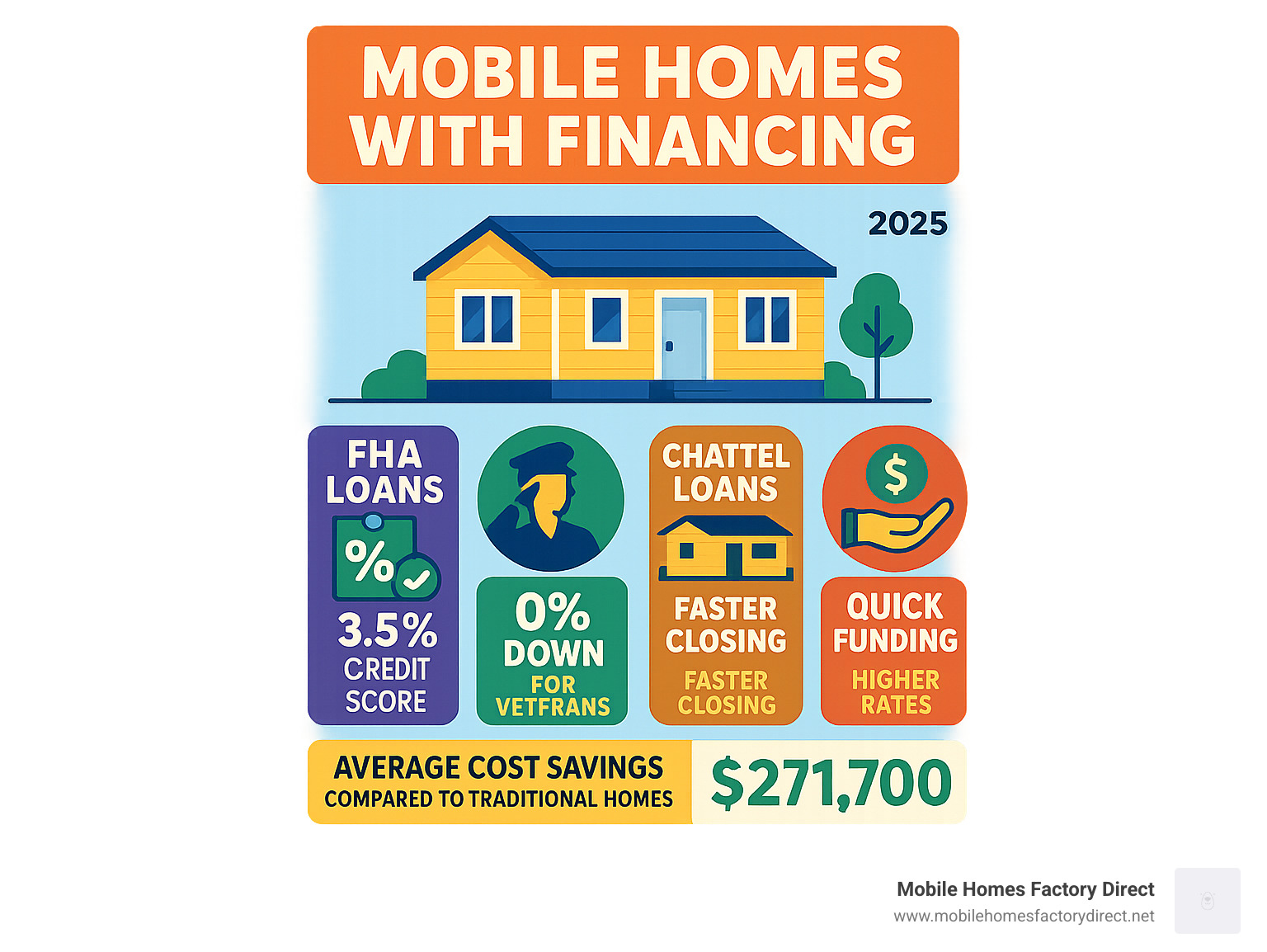

Unlock affordable homeownership! Explore options for mobile homes with financing. Learn about FHA, VA, & chattel loans. Your path to a new home.

Why Mobile Home Financing Opens the Door to Affordable Homeownership

Mobile homes with financing offer a practical path to homeownership when traditional housing is out of reach. With the median price of traditional homes over $416,900, manufactured homes provide a cost-effective alternative, averaging $145,200 for a double-wide.

Quick financing options for mobile homes:

- FHA Loans: Down payments as low as 3.5% with credit scores from 580.

- VA Loans: Zero down payment for eligible veterans.

- Chattel Loans: Finance the home without owning land, with a faster closing.

- Personal Loans: Quick funding for older homes.

- Land-in-Lieu: Use property equity for your down payment.

The financing landscape for mobile homes has evolved. Today’s buyers can access government-backed loans, specialized lenders, and flexible terms that make homeownership achievable, even with credit challenges.

“Finding a lender for a mobile home may take more legwork than for a traditional home,” but the variety of programs means there’s likely a solution for you. Mobile home financing can bridge the gap between renting and owning for first-time buyers, veterans, or those rebuilding credit.

The key is matching your financing options to your specific needs, including home type, credit profile, and land ownership.

Explore more about Mobile homes with financing:

Understanding Your Home: Mobile, Manufactured, and Modular

Before seeking mobile homes with financing, it’s crucial to understand your home type. The terms “mobile,” “manufactured,” and “modular” are not interchangeable, and their differences in construction standards significantly impact your financing options and long-term investment.

All three are types of factory-built housing, constructed in a controlled environment and then transported to your site, but the similarities largely end there.

Mobile vs. Manufactured Homes

Most people use “mobile home” and “manufactured home” interchangeably, but a key distinction impacts your financing.

Mobile homes were built before June 15, 1976. They were constructed on a steel chassis and lacked uniform federal building standards, leading to variable quality.

Manufactured homes are built after June 15, 1976, under the federal HUD Code. This code establishes safety and quality standards for everything from structural integrity to electrical systems. Every post-1976 manufactured home has a HUD data plate and a certification label (a red tag), which are essential for securing better financing. The HUD Code’s safety standards give lenders more confidence, improving financing availability.

You can learn more about official HUD financing at Financing Manufactured (Mobile) Homes (Title I) | HUD.gov , or explore broader options at More info about mobile home loans.

Manufactured vs. Modular Homes

The difference between manufactured and modular homes can save you thousands in financing costs. Both are factory-built in sections, but they follow different building codes.

Manufactured homes follow the federal HUD Code. They can be placed on a permanent foundation but are often classified as personal property unless the title is retired.

Modular homes are built to the same state and local codes as traditional site-built homes. They are placed on permanent foundations, often with crawlspaces or basements. Because they meet local codes and have permanent foundations, modular homes are appraised like site-built homes. This provides greater financing flexibility, allowing access to conventional, FHA, VA, and USDA loans with terms similar to traditional homes. Modular homes also tend to hold their resale value better as they are treated as real estate.

If you’re thinking about a modular home, check out Financing for Modular Homes for more details. Understanding these distinctions helps you choose the right home and financing path for your budget.

Exploring Your Options for Mobile homes with financing

Finding the right financing for your manufactured home is manageable. Several options exist for different situations, whether you’re a first-time buyer, a veteran, or financing a home on leased land. Here are your main financing choices:

| Loan Type | Down Payment | Credit Score (Min.) | Land Requirement | Pros | Cons |

|---|---|---|---|---|---|

| FHA Loans | 3.5% (580+ FICO) | 500 | Title I: Leased/Owned; Title II: Owned, Permanent Foundation | Low down payment, flexible credit, government-insured | Property requirements strict, mortgage insurance required, engineer report often needed |

| VA Loans | 0% | Typically 620 | Owned, Permanent Foundation (for best terms) | 100% financing, no PMI, competitive rates, for veterans & eligible service members | Eligibility limited to veterans, funding fee applies, specific property standards |

| Chattel Loans | Varies (5-20%+) | 575 | Not required (home-only finance) | Faster closing, finance home on leased land, less paperwork | Higher interest rates, shorter terms, home depreciates as personal property |

| Personal Loans | Varies (often 0%) | 600 | Not required | Quick funding, unsecured, fewer restrictions, good for older homes not qualifying elsewhere | Higher interest rates, lower maximums, shorter repayment terms |

| Conventional Loans | 5-20% | 620 | Owned, Permanent Foundation | Competitive rates, no PMI with 20% down, flexible terms, for well-qualified buyers | Higher credit requirements, larger down payments often needed, stricter property standards |

If you’re ready to explore lenders, check out our guide to Manufactured Home Financing Companies.

Government-Backed Mortgages

Government-backed mortgages are often the most accessible path to homeownership. FHA loans are popular, allowing down payments as low as 3.5% for credit scores of 580+. Buyers with scores between 500-579 may qualify with a 10% down payment. FHA offers two programs: Title I loans can finance the home alone, even on leased land, while Title II loans finance the home and land together as real estate, requiring a permanent foundation. Learn more at FHA Mobile Home Financing.

VA loans are an excellent option for eligible veterans, offering up to 100% financing (zero down payment), competitive rates, and no monthly mortgage insurance. USDA loans offer a zero-down option for qualified buyers in rural areas. Conventional loans from Fannie Mae and Freddie Mac have programs like MH Advantage, with down payments as low as 3% for those with credit scores of 620+.

Chattel Loans

Chattel loans are specialized financing for manufactured homes treated as personal property, common for homes in parks or on leased land. They offer simplicity and faster closing times. The trade-off is typically higher interest rates and shorter terms (around 20 years). Chattel lenders can be more flexible with credit, sometimes accepting scores as low as 575, making them a viable option if traditional mortgages are out of reach.

Personal Loans

Personal loans can be useful for older homes that don’t qualify for other financing or when you need quick funding. Most are unsecured, and funding can be available within a day. The downsides include higher interest rates, lower loan amounts, and shorter repayment terms (often up to 7 years). For those with credit challenges, exploring Bad Credit Home Loans might reveal personal loan options.

Key Differences: Traditional Mortgages vs. Mobile homes with financing

The difference between financing types boils down to how lenders view the asset. Traditional homes usually appreciate, while manufactured homes (especially those not on permanent foundations) can depreciate. This perceived risk often means slightly higher interest rates and shorter loan terms for manufactured home loans. The home’s classification as personal or real property is a key factor. The good news is this gap has narrowed, and many manufactured homes now qualify for traditional mortgages. For a deeper understanding, visit Manufactured Home Mortgage.

Qualifying for Your Loan: Requirements and Eligibility

Getting approved for mobile homes with financing is achievable with proper planning. Lenders look for financial readiness and ensure the home meets safety and quality standards.

The Role of Credit and Down Payments

Your credit score and down payment are key to your loan approval and terms. FHA loans accept scores as low as 580 (3.5% down) or 500 (10% down). Conventional loans usually require 620+, while chattel loans may start at 575. A higher score can save you thousands in interest over the life of the loan. If you’re dealing with credit challenges, check out Mobile Home Loan Bad Credit.

Down payments are often manageable. VA loans offer up to 100% financing (zero down) for veterans. FHA loans require as little as 3.5%. A game-changer is the land-in-lieu down payment: if you own your land, you can often use its equity as your down payment. Lenders also check your debt-to-income ratio (DTI), preferring 43% or less, though some government loans are more flexible.

Property and Land Requirements

The home itself must also meet standards. HUD Code compliance is essential for most financing. The home must be built after June 15, 1976, and have its original HUD data plate and certification label. If missing, you can request verification from the Institute for Building Technology and Safety.

Permanent foundations are required for most conventional, FHA Title II, and VA loans, classifying the home as real estate and leading to better loan terms. Proper tie-downs and anchoring are also crucial, and an engineering report is often required to verify compliance.

Owning vs. leasing land significantly impacts financing. Owning the land allows you to finance the home and land together as real property, which requires you to retire the title of the home. For details, visit Financing a Mobile Home with Land. If you’re leasing land, you’ll typically use chattel loans or FHA Title I loans.

Size requirements also apply (usually a minimum of 400 square feet). Financing is easiest for homes that have not been moved, though VA loans offer some flexibility.

Factoring in Long-Term Costs

Beyond loan approval, budget for ongoing homeownership costs. These include property taxes (in Texas, typically 1.5%-2.5% of assessed value), homeowners insurance ($600-$1,200 annually), and maintenance. Be aware that homes with polybutylene pipes can be difficult to insure. If on leased land, factor in monthly lot rent (around $400-$700 in the San Antonio area) plus utilities. Use a payment calculator to get a realistic picture of your total monthly expenses.

The Application Process: From Preparation to Closing

Applying for mobile homes with financing is a manageable process with clear steps. Knowing what to expect makes it easier.

Preparing for Mobile homes with financing: A Checklist

Preparation is key to a smooth application process. Lenders appreciate well-prepared applicants.

- Check your credit reports from all three bureaus for errors. Knowing your score helps identify realistic loan options.

- Save for a down payment. A larger down payment strengthens your application and can lead to better rates. Land equity can also be used.

- Reduce your debt-to-income ratio by paying down debts. This shows lenders you can comfortably afford your new home payment.

- Gather your financial documents early, including recent tax returns, pay stubs, bank statements, and a valid ID.

- Get pre-approved. A lender reviews your finances and commits to a loan amount. This sets your budget and shows sellers you’re a serious buyer. Start this step at our Mobile Home Financing 2: Pre-Approval Process page.

Step-by-Step Application Guide

The application process follows a logical sequence, moving you closer to homeownership.

- Submit your application. You can often do this online for convenience. Fill it out completely and accurately to avoid delays. Our Mobile Home Financing 2: On-Line Application makes this step straightforward.

- Provide supporting documentation promptly. Quick responses speed up the process.

- Appraisal and inspection. The lender orders a professional evaluation of the home (using form 1004C for manufactured homes) and land to verify structural and safety standards.

- Underwriting. The lender’s team reviews your entire file to assess risk and ensure it meets guidelines. Requests for more information are normal.

- Final approval is given once underwriting is complete and all conditions are met.

- Closing day. You’ll sign legal documents, pay closing costs (typically 2-5% of the loan amount), and receive the keys to your new home.

Frequently Asked Questions about Mobile Home Financing

Navigating mobile homes with financing can bring up questions. Here are answers to the most common concerns to help you move forward with confidence.

How hard is it to get financing for a mobile home?

While it can be more challenging than traditional home financing, getting a loan for a mobile home is more accessible today than in the past. The main hurdle is that lenders may view manufactured homes as riskier due to potential depreciation. However, this is changing, especially for newer homes on permanent foundations. Government-backed programs like FHA and VA loans have made financing much easier. Approval is easiest for a post-1976 manufactured home with HUD certification, placed on a permanent foundation on land you own.

What credit score is needed for a mobile home loan?

Credit score requirements vary by loan type, with options available for most credit situations. FHA loans are very flexible, allowing scores as low as 580 with 3.5% down, or 500 with 10% down. Conventional loans usually require a score of 620 or higher. Chattel loans, for homes on leased land, may be available for credit scores starting around 575. A higher credit score will save you significant money in interest over the life of the loan. We work with lenders who understand past credit challenges and can help find a path forward.

Can I finance a mobile home if I don’t own the land?

Yes, you can. Chattel loans are the primary option for financing a home on leased land. They treat the home as personal property, with the home itself as collateral. FHA Title I loans are another option, provided the lease meets certain requirements, such as a three-year minimum term. While these loans usually have higher interest rates and shorter terms than traditional mortgages, they provide a flexible path to homeownership. However, financing the home and land together typically results in better loan terms and lower rates.

Your Next Step to Affordable Homeownership

Mobile homes with financing can be straightforward. As this guide shows, many paths lead to homeownership. Manufactured homes offer incredible value, and the right financing can make your dream a reality sooner than you think.

At Mobile Homes Factory Direct, we help families achieve homeownership. We understand every situation is unique, which is why we work with all credit types, from excellent to those rebuilding. Located in Von Ormy, TX, we are your neighbors, dedicated to helping you find the perfect home at the best price. Our simple process makes buying a home easy.

We finance single-wide, double-wide, and triple-wide homes. Our lending partners understand manufactured housing and offer flexible solutions that traditional banks might not. Your journey starts here, and we’ll guide you every step of the way, from understanding financing to finding your perfect home.

Ready to see what’s possible? Your new home might be just a click away.