Your Path to Ownership: Securing a Manufactured Home Loan

Unlock homeownership with a manufactured home loan. Discover options, requirements, and the step-by-step financing process today!

The Path to Affordable Homeownership Through Manufactured Home Financing

A manufactured home loan opens the door to affordable homeownership for millions of Americans who find traditional housing out of reach. With home prices ranging from $50,000 to $500,000, manufactured homes cost about 50% less than traditional houses and offer monthly housing costs roughly 40% lower than site-built homes.

Quick Answer: Manufactured Home Loan Options

- Conventional Loans: 3-5% down, 620+ credit score, owned land required

- FHA Loans: 3.5% down, 580+ credit score, up to 30-year terms

- Chattel Loans: 5-10% down, 575+ credit score, for leased land

- VA Loans: 0% down for eligible veterans, up to 30-year terms

The financing landscape for manufactured homes has evolved significantly. Unlike the past when buyers faced limited options and high-interest personal loans, today’s market offers multiple pathways to homeownership with competitive rates and flexible terms.

Three main factors determine your loan type:

- Whether you own the land or lease it

- If the home is classified as real property or personal property

- Your credit score and down payment capability

As one industry expert noted, “Mobile home financing in Canada is a great way for many to own a home… This makes mobile homes a more affordable choice than traditional houses.” The same principle applies across North America, where manufactured housing provides a practical solution to the housing affordability crisis.

Understanding your options is the first step toward homeownership. Whether you’re a first-time buyer with limited savings, someone rebuilding credit, or simply seeking an affordable housing solution, manufactured home loans offer flexibility and accessibility that traditional mortgages often can’t match.

Understanding Your Manufactured Home Loan Options

Finding the right financing for your manufactured home doesn’t have to be overwhelming. Think of it like shopping for the perfect home – there are several great options, and the best choice depends on your specific situation. The biggest factor? Whether you’ll own the land under your home or lease it.

Let me break down your main options in a way that actually makes sense:

| Loan Type | Minimum Down Payment | Typical Credit Score | Loan Term | Best For |

|---|---|---|---|---|

| Conventional | 3% | 620+ | 15-30 years | Homes on owned land, permanent foundation |

| FHA | 3.5% | 580+ (as low as 500) | Up to 30 years | First-time buyers, flexible credit, owned land |

| VA | 0% | Varies | Up to 30 years | Eligible veterans on owned land |

| Chattel | 5-10% | 575+ | 10-15 years | Homes on leased land, personal property |

Conventional Mortgages

Here’s something that surprises many people: you can get a regular mortgage for a manufactured home, just like you would for any other house. The key is that your home needs to be considered real property, which means it’s permanently attached to a foundation on land you own.

This is often your best deal financially. Conventional mortgages typically offer the lowest interest rates and longest terms – usually 15 to 30 years. That translates to smaller monthly payments, which is always nice for your budget.

The real game-changer is Fannie Mae’s MH Advantage program. With just 3% down and a 30-year fixed rate, it’s designed specifically for manufactured homes. And here’s the best part: research shows that manufactured homes can appreciate at the same rate as traditional site-built homes. Your home isn’t just a place to live – it’s an investment that can grow in value.

If you have a credit score of 680 or higher, you’ll get even better pricing. Want to explore this option? Check out our guide on Manufactured Home Mortgage to learn more.

Government-Backed Loans (FHA & VA)

The government wants to help you become a homeowner, and they’ve created some pretty amazing programs to make it happen. These loans are especially helpful if you’re buying your first home or if your credit isn’t perfect.

FHA loans are backed by the Federal Housing Administration, which means lenders feel more comfortable offering you better terms. You can put down as little as 3.5% if your credit score is 580 or higher. Even if your score is between 500-579, you might still qualify with a 10% down payment. These loans can stretch up to 30 years, keeping your monthly payments manageable.

HUD’s Title I Program has been helping people finance manufactured homes since 1969. They can finance your home, your lot, or both together. It’s a tried-and-true program that’s helped thousands of families. Our FHA Mobile Home Financing guide has all the details you need.

VA loans are one of the best benefits of military service. If you’re a veteran or active-duty service member, you might qualify for a manufactured home loan with zero down payment. That’s right – no down payment at all. You can also get up to 30 years to pay it back, making homeownership incredibly affordable.

Chattel Loans

Sometimes you want to live in a manufactured home community or on leased land, and that’s perfectly fine. Chattel loans are designed exactly for this situation. Instead of financing real estate, you’re financing personal property – think of it like a car loan, but for your home.

The good news is that chattel loans are often more flexible with credit requirements. You might qualify with a credit score as low as 575, though having 620 or higher will get you better terms. These loans are also faster to process since there’s less paperwork involved.

The trade-off is that interest rates are typically higher – usually between 5.5% and 8.5% – and loan terms are shorter, often 10 to 15 years. This means higher monthly payments, but you’ll pay less interest over the life of the loan.

Chattel loans fill an important gap in the market. They make homeownership possible even when traditional mortgages won’t work for your situation. If you’re considering this option, our Loan Options for Mobile Homes guide will help you understand all the details.

The bottom line? There’s likely a financing option that works for your situation. Whether you’re a first-time buyer, a veteran, or someone who prefers the community lifestyle, there’s a path to owning your manufactured home.

Key Requirements for Your Manufactured Home Loan

Getting approved for a manufactured home loan doesn’t have to be a mystery. Think of it like preparing for a job interview – when you know what lenders are looking for, you can put your best foot forward. The good news? The requirements are pretty straightforward, and there are options for almost every financial situation.

Credit Score and Debt-to-Income (DTI)

Your credit score is basically your financial report card – it tells lenders how well you’ve managed money in the past. Don’t worry if it’s not perfect; we’ve helped plenty of folks with less-than-stellar credit find their path to homeownership.

Here’s what you need to know about minimum credit scores for different loan types: FHA loans are incredibly forgiving, accepting scores as low as 500 (though you’ll need 10% down) or 580 with just 3.5% down. Conventional loans typically want to see at least 620, while chattel loans often work with scores starting at 575. The sweet spot? If you have a score of 680 or higher, you’ll likely qualify for the best rates and terms available.

Your Debt-to-Income ratio is equally important. This compares all your monthly debt payments (including your future home payment) to your gross monthly income. Most lenders want to see this ratio stay under 43%. Think of it this way – if you make $4,000 a month, your total debt payments shouldn’t exceed about $1,720.

If your credit needs some work, don’t give up! Many of our customers have successfully secured financing despite past challenges. Check out our guide on Financing for Mobile Homes with Bad Credit for helpful strategies and options.

Down Payment and Loan Terms

The down payment is your upfront investment in your new home, and it directly affects both your monthly payment and the total cost of your loan. The amount you’ll need varies quite a bit depending on which type of manufactured home loan you choose.

Conventional loans can require as little as 3% down, while FHA loans ask for 3.5%. If you’re a veteran, VA loans might not require any down payment at all – that’s one of the incredible benefits of your service. Chattel loans typically range from 5% to 10%, though used homes might require 10% to 20% down.

Loan terms determine how long you have to pay back your loan. Conventional, FHA, and VA loans often offer 15 to 30-year terms, giving you plenty of time to spread out payments. Chattel loans are usually shorter – typically 10 to 15 years – which means higher monthly payments but less interest paid over time.

Here’s the thing about longer vs. shorter terms: a 30-year loan means lower monthly payments, but you’ll pay more interest over the life of the loan. A 15-year loan means higher monthly payments but significant savings on total interest. It’s all about finding what fits your budget and goals.

Want to see how different down payments and terms affect your monthly payment? Our Manufactured Home Loan Calculator lets you play with different scenarios until you find the perfect fit.

The Role of Land Ownership

This might be the most important factor in determining your financing options. Whether you own the land or lease it completely changes how lenders view your home – and what loan programs you can use.

When you own the land and your home sits on a permanent foundation, it’s classified as real property – just like a traditional house. This opens up all the best financing options: conventional loans, FHA loans, and VA loans. Lenders love this setup because they have both the home and the land as collateral, which means lower risk for them and better rates for you.

If you’re leasing the land (like in a mobile home community), your home is considered personal property. This typically means you’ll need a chattel loan, which comes with higher interest rates and shorter terms. Think of it like financing a car – the lender can’t count on the land as security, so they’re taking on more risk.

The difference in financing costs can be significant. Mortgages for homes on owned land often have rates similar to traditional home loans, while chattel loans might run 2-3% higher. Over the life of a loan, that can mean tens of thousands of dollars in additional interest.

If you’re considering purchasing land along with your home, we have detailed information about Financing Mobile Home with Land that walks you through the process and benefits.

The bottom line? Understanding these requirements helps you prepare for success. Whether you’re working with excellent credit or rebuilding your financial foundation, there’s likely a path to homeownership that works for your situation.

The Step-by-Step Application Process

Getting your manufactured home loan approved doesn’t have to feel overwhelming. Think of it like following a recipe – when you have all the right ingredients and follow the steps in order, you’ll end up with exactly what you’re hoping for: the keys to your new home!

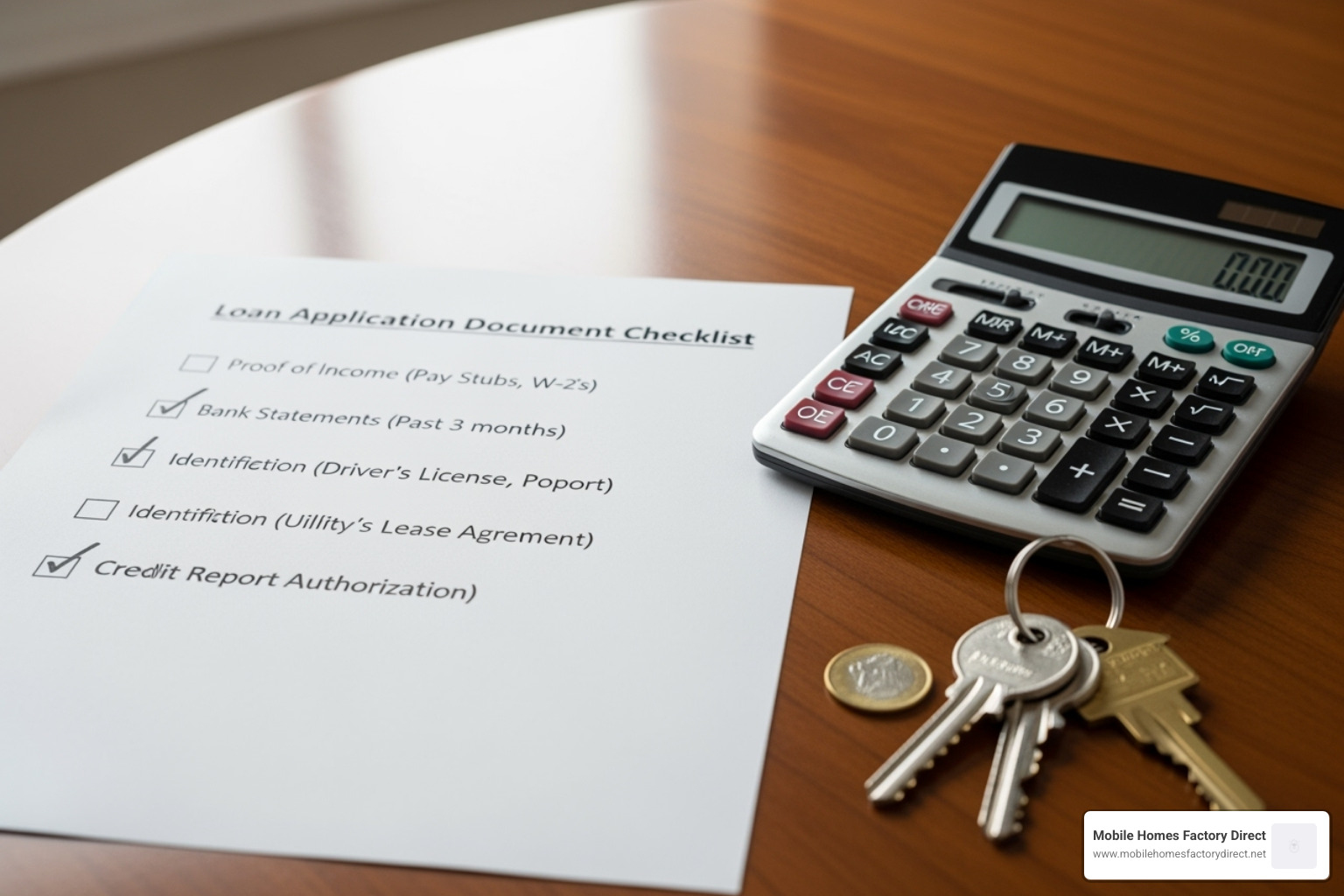

Before we dive into the process, let’s talk about the paperwork you’ll need. Gathering these documents early will save you time and stress later:

- Photo ID

- Recent Pay Stubs (last 30 days)

- W-2s or Tax Returns (past two years)

- Bank Statements (past two months)

Step 1: Budgeting and Pre-Approval

The first step might not be the most exciting, but it’s definitely the most important: figuring out what you can actually afford. This isn’t just about the monthly payment – you’ll also need to budget for property taxes, insurance, utilities, and possibly lot rent if you’re planning to lease land.

With manufactured homes ranging from $50,000 to $500,000, having a clear budget helps narrow down your options from the start. It’s like going grocery shopping with a list – you’re much less likely to get distracted by things you don’t actually need!

Once you know your budget, it’s time to check your credit score. Don’t worry if it’s not perfect – we work with people across the credit spectrum. Your score simply helps determine which loan options will work best for your situation.

The real game-changer is getting pre-approved. This is where a lender takes a preliminary look at your finances and tells you how much they’re willing to lend you. Pre-approval is incredibly powerful because it shows sellers you’re serious, gives you a firm budget to work with, and can make the final approval process lightning-fast – sometimes as quick as 24 hours!

Getting pre-approved also means you won’t fall in love with a home that’s outside your price range. Trust us, it’s much better to know your limits upfront than to have your heart broken later. For detailed guidance on this crucial step, check out our Pre-Approval Process resource.

Step 2: Choosing Your Home and Lender

Now comes the fun part – shopping for your new home! Whether you’re dreaming of a cozy single-wide or need the extra space of a double-wide, this is where your vision starts becoming reality.

At the same time, you’ll want to shop around for the best lender. Just like you wouldn’t buy the first car you test drive, don’t accept the first loan offer you receive. Different lenders specialize in different types of manufactured home loan products, and their rates can vary significantly.

Banks typically offer solid options, especially if you’re buying a home for land you already own. Credit unions often provide competitive rates – sometimes up to 0.5% lower than traditional banks – and they’re usually more willing to work with you if your credit isn’t perfect. Specialized lenders focus specifically on manufactured housing and understand the unique aspects of this market better than anyone.

The beauty of working with us at Mobile Homes Factory Direct is that we’ve already done the legwork of building relationships with reliable financing partners. We know which lenders offer the most flexible terms and understand manufactured housing inside and out. Our Manufactured Home Financing Companies guide can help you understand your options.

Step 3: Appraisal, Underwriting, and Closing

You’ve found your dream home and chosen your lender – congratulations! Now it’s time to cross the finish line with the final steps of your loan process.

First comes the appraisal. Just like with any home purchase, an appraiser will visit to determine the fair market value of your manufactured home. They’ll look at factors like the home’s size (it needs to be at least 400-600 square feet), whether it’s on a permanent foundation, and confirm it meets current safety standards like HUD Code compliance. This protects both you and the lender by ensuring the loan amount makes sense for the home’s actual value.

Next is underwriting, where your lender becomes a detective, carefully reviewing every piece of your financial puzzle. They’ll verify your income, double-check your credit history, and make sure everything about the home meets their lending requirements. It might feel a bit invasive, but remember – they want you to succeed just as much as you do!

Finally, you’ll reach closing day – the moment you’ve been working toward! This is when you’ll sign all the official loan documents and officially become a homeowner. Be prepared for closing costs, which typically run between 1.5% and 4% of your home’s purchase price. The lender will also conduct a title search to make sure there are no legal issues with the property.

Once all the paperwork is signed and the funds are transferred, you’ll get those magical keys to your new manufactured home. It’s a moment that makes all the paperwork and waiting completely worth it!

Frequently Asked Questions about Manufactured Home Loans

We understand that choosing the right financing can feel overwhelming, especially when you’re navigating terms and options you might not encounter elsewhere. That’s perfectly normal! Let’s tackle some of the most common questions we hear from families just like yours who are exploring manufactured home loan options.

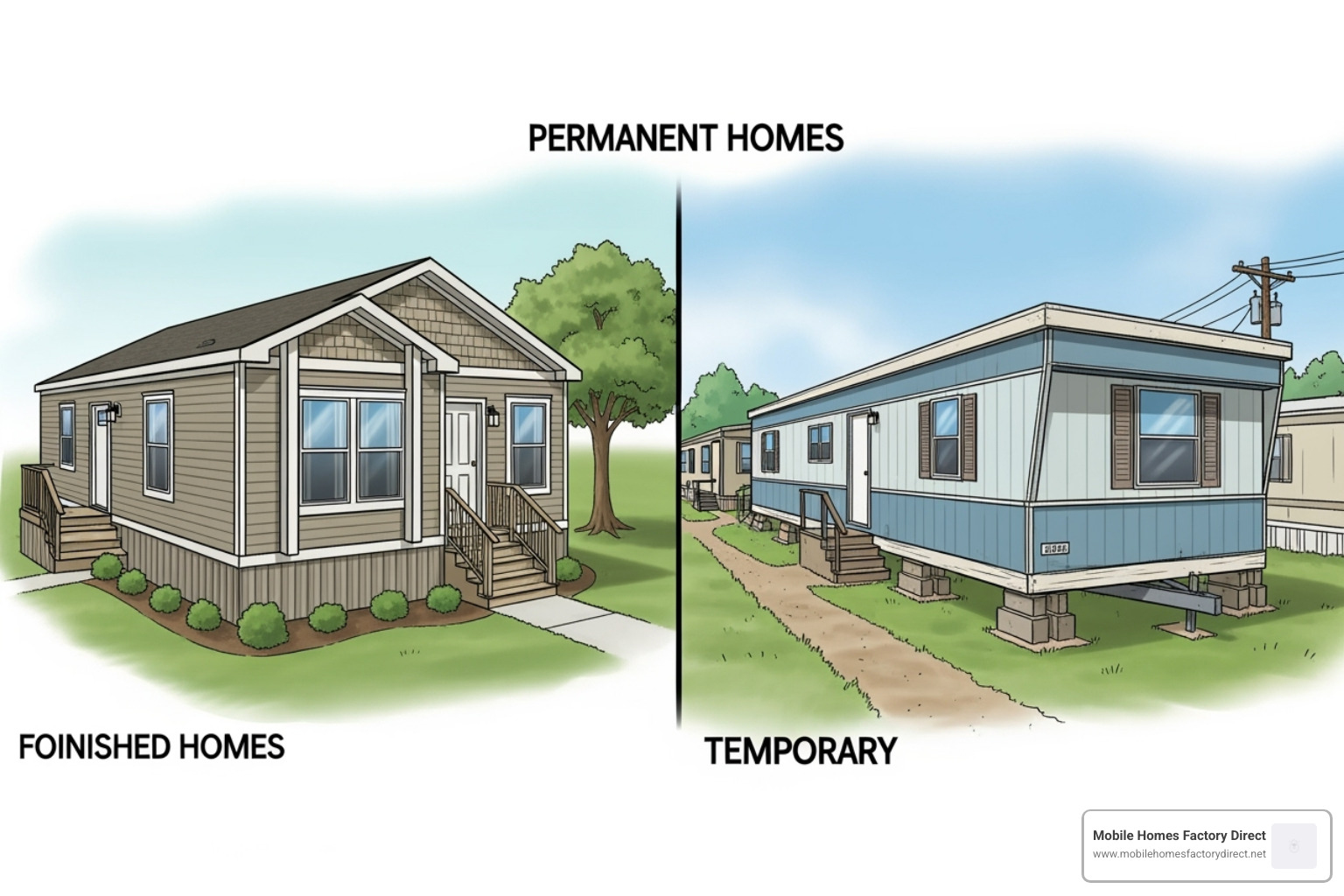

What is the difference between financing a modular vs. a mobile home?

Here’s where things get a bit technical, but it’s actually simpler than it sounds. The main difference comes down to how and where these homes are built, which then affects your financing options.

Modular homes are built in factory sections and then assembled on your property with a permanent foundation. Think of them like a puzzle that gets put together on-site. Because they’re built to the same local building codes as traditional houses, lenders treat them just like any other “stick-built” home. This means you’ll typically have access to conventional mortgages with competitive rates and terms.

Manufactured homes (which used to be called mobile homes) are also factory-built, but they’re constructed to federal HUD standards rather than local codes. They come with their own steel chassis and wheels, even though most never move once they’re placed. The key difference for financing is whether your manufactured home ends up classified as “real property” or “personal property.”

If your manufactured home sits on land you own with a permanent foundation, it can often qualify for the same conventional, FHA, or VA loans as modular homes. But if it’s in a mobile home park on leased land, you’ll likely need a chattel loan instead.

The good news? Both paths can lead to affordable homeownership. It’s just a matter of understanding which category your dream home falls into.

What are the typical interest rates for a manufactured home loan?

Interest rates are like the weather – they change based on many factors, and what you’ll pay depends on your specific situation. But we can give you some realistic expectations to help with your planning.

Conventional mortgages typically offer the best rates for manufactured homes classified as real property. You’re looking at rates around 6.17% on average, though borrowers with excellent credit scores of 680 or higher often secure even better terms.

FHA loans run slightly higher but remain very competitive, averaging around 6.45%. The government backing makes these attractive for first-time buyers or those with less-than-perfect credit.

Chattel loans come with higher rates because they’re secured only by the home itself, not land. These typically range from 5.5% to 8.5%, sometimes starting around 8% or higher depending on your credit profile.

Your credit score makes a huge difference here. Someone with a 750 credit score will get significantly better rates than someone with a 600 score, regardless of loan type. Market conditions also play a role – rates fluctuate based on broader economic factors.

The best approach? Get pre-approved with multiple lenders to see actual rates rather than estimates. This gives you real numbers to work with and helps you negotiate the best deal.

Can I get a loan for a used manufactured home?

Absolutely! In fact, financing a used manufactured home is quite common and can be a smart way to get more home for your money. Many of our clients choose pre-owned homes because they offer excellent value.

That said, lenders do have some additional requirements for used homes. Age matters – many lenders prefer homes that are less than 20 years old, though some programs have relaxed these restrictions recently. The home’s condition is crucial too. It needs to pass an appraisal and often an inspection to ensure it’s structurally sound and meets current safety standards.

You might need to put down a bit more money upfront. For chattel loans on used manufactured homes, a 10-20% down payment is typical, compared to 5-10% for new homes. Interest rates may also be slightly higher due to the perceived depreciation risk.

But here’s the thing – none of these requirements are deal-breakers. They’re just factors to plan for. A well-maintained used manufactured home can provide decades of comfortable living at a fraction of the cost of new construction.

The key is working with lenders who understand manufactured housing and can guide you through the process. That’s where our experience really helps – we know which lenders work well with used manufactured homes and can connect you with the right financing partners for your situation.

Conclusion: Your Dream Home is Within Reach

Finding the right manufactured home loan doesn’t have to feel like solving a complex puzzle. Throughout this guide, we’ve walked through the landscape of financing options together, and here’s the beautiful truth: there really is a path for almost everyone.

Whether you’re drawn to the competitive rates of conventional mortgages when you own your land, excited about the accessibility of FHA loans with their 3.5% down payments, grateful for VA benefits that require no down payment at all, or need the flexibility of chattel loans for leased land situations, each option serves real families with real dreams of homeownership.

The key ingredients for success are understanding where you stand financially, knowing your credit score and DTI ratio, and being clear about your land situation. Yes, the paperwork might seem overwhelming at first glance, but remember – it’s just a series of simple steps: budget, get pre-approved, choose your home and lender, then steer the final stretch to closing.

What makes us truly proud at Mobile Homes Factory Direct is seeing families find that homeownership isn’t just for people with perfect credit or hefty savings accounts. We’ve built our entire approach around offering the best homes at the best prices with a straightforward process that doesn’t leave anyone behind. Whether your credit needs some work or you’re starting fresh, we believe in flexible financing that meets you where you are.

Every day, we see the joy on families’ faces when they realize their manufactured home loan approval means they’re just weeks away from having their own front door, their own space, their own piece of the American dream. That moment when you get your keys? It’s absolutely worth every form you filled out and every phone call you made.

Your perfect home is waiting for you, and we’re here to help make it happen. Ready to take that first exciting step?

View our available homes and let’s start your homeownership journey today.