Home Sweet Home: Navigating Bad Credit for Mortgage Approval

Buy homes with bad credit! Explore options for manufactured home financing, boost your approval odds, and get your dream home now.

Why Bad Credit Doesn’t Have to Block Your Path to Homeownership

Homes with bad credit might seem impossible to secure, but the reality is far more hopeful than you might think. According to research, 15.5% of Americans have a FICO score below 600, which is considered bad credit – yet many of these individuals still achieve homeownership through flexible financing options.

Quick Answer: Can You Buy a Home with Bad Credit?

Yes, you can buy a home with bad credit through:

- FHA loans (minimum 500 credit score with 10% down, or 580 with 3.5% down)

- VA loans for veterans (often no down payment required)

- USDA loans for rural areas (typically 580+ credit score)

- In-house financing from manufactured home dealers

- Specialized bad credit lenders with flexible requirements

The dream of owning your own home doesn’t disappear because of past financial struggles. Whether you’ve faced divorce, job loss, medical bills, or other challenges that hurt your credit, there are real paths to homeownership available right now.

Traditional banks might say “no,” but manufactured home dealers and specialized lenders often say “yes” to buyers with credit scores as low as 500. The key is understanding your options and knowing where to look.

This guide will show you exactly how to steer the process, from understanding which financing options work best for your situation to strategies that improve your approval odds. We’ll cover everything from down payment requirements to finding reputable lenders who specialize in helping credit-challenged buyers.

Understanding Your Credit and Its Impact on Manufactured Home Financing

Think of your credit score as your financial reputation rolled into a three-digit number. It tells lenders the story of how you’ve handled money in the past, and it carries a lot of weight when you’re shopping for homes with bad credit.

FICO scores range from 300 to 850, and here’s how lenders typically view them:

- Excellent: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

Most lenders consider anything below 670 as subprime credit, while scores under 580 fall into the “poor” category. The difference matters, as subprime borrowers (580-669) often have more financing options than those with poor credit (below 580).

How Bad Credit Affects Your Manufactured Home Purchase

Bad credit makes getting approved harder and more expensive. Here’s how it impacts your wallet:

-

Higher interest rates: Lenders see lower scores as higher risk and charge more. For example, on a $100,000 mortgage, a rate of 10% (due to bad credit) versus 4% could cost you over $144,000 more in total interest over 30 years. You can explore potential interest rates with this tool to see how your score affects your rate.

-

Increased fees: Loan origination and underwriting fees are often higher for bad credit loans, adding to your closing costs.

-

Private Mortgage Insurance (PMI): With a low down payment, you’ll likely pay PMI. FHA loans require mortgage insurance premiums regardless of your down payment size, which protects the lender.

-

Higher down payment requirements: While FHA loans accept 3.5% down with a 580+ score, conventional lenders might want 10-20% upfront if your credit is poor.

The good news? Understanding these impacts helps you prepare and find lenders, like manufactured home dealers, who offer flexible financing options that traditional banks don’t provide.

Your Guide to Finding Manufactured Homes with Bad Credit: Financing Options

When traditional banks say no, manufactured home financing offers several paths forward, even when you’re dealing with homes with bad credit challenges. The manufactured home industry understands that credit scores don’t tell the whole story, which is why flexible financing options exist.

| Feature | In-House Financing | Specialized Bad Credit Lenders |

|---|---|---|

| Minimum Credit Score | Often flexible, sometimes no credit check | Varies, typically 500-620 |

| Down Payment | Flexible, sometimes equity-based | Usually 10-20% |

| Ideal Candidate | Very low/no credit, quick approval needed | Some credit history but below conventional limits |

Let’s explore these options, because understanding your choices is the first step toward holding those house keys.

In-House Financing: Flexible Options for Challenging Credit

Many manufactured home dealers, including us at Mobile Homes Factory Direct, offer in-house financing, a “buy-here-pay-here” approach designed to help buyers succeed. This option offers significant flexibility for buyers with challenging credit, collections, charge-offs, or even a past foreclosure.

Benefits often include:

- Lower Credit Requirements: We look beyond the three-digit score. Some of our programs don’t even require a credit check, and we also work with people who have no credit history.

- Flexible Down Payments: The focus is on your ability to make payments rather than a rigid percentage upfront.

- Quick Approval: Handling financing directly or with specialized partners streamlines the process for a faster answer.

- Alternative Income Programs: We can work with self-employed individuals using bank statements or contracts, and even have options for buyers without a Social Security number.

Getting started is simple. Complete a free customer profile assessment, and our consultants can quickly match you with qualifying homes and loan programs.

Specialized Bad Credit Lenders

Beyond in-house options, a network of “subprime lenders” specializes in helping people with credit scores below conventional requirements. They have built their businesses around saying yes when others say no.

These lenders understand risk differently and are willing to work with scores that make traditional banks uncomfortable. The trade-off is typically higher interest rates and fees. Think of it as paying a premium for access—you can always refinance later for better terms once your credit improves.

To find reputable lenders, start with your manufactured home dealer, as we maintain relationships with trusted partners. When speaking with any lender, ask about their minimum credit score, down payment needs, rates, fees, and any prepayment penalties. A good lender will treat you with respect and explain everything clearly.

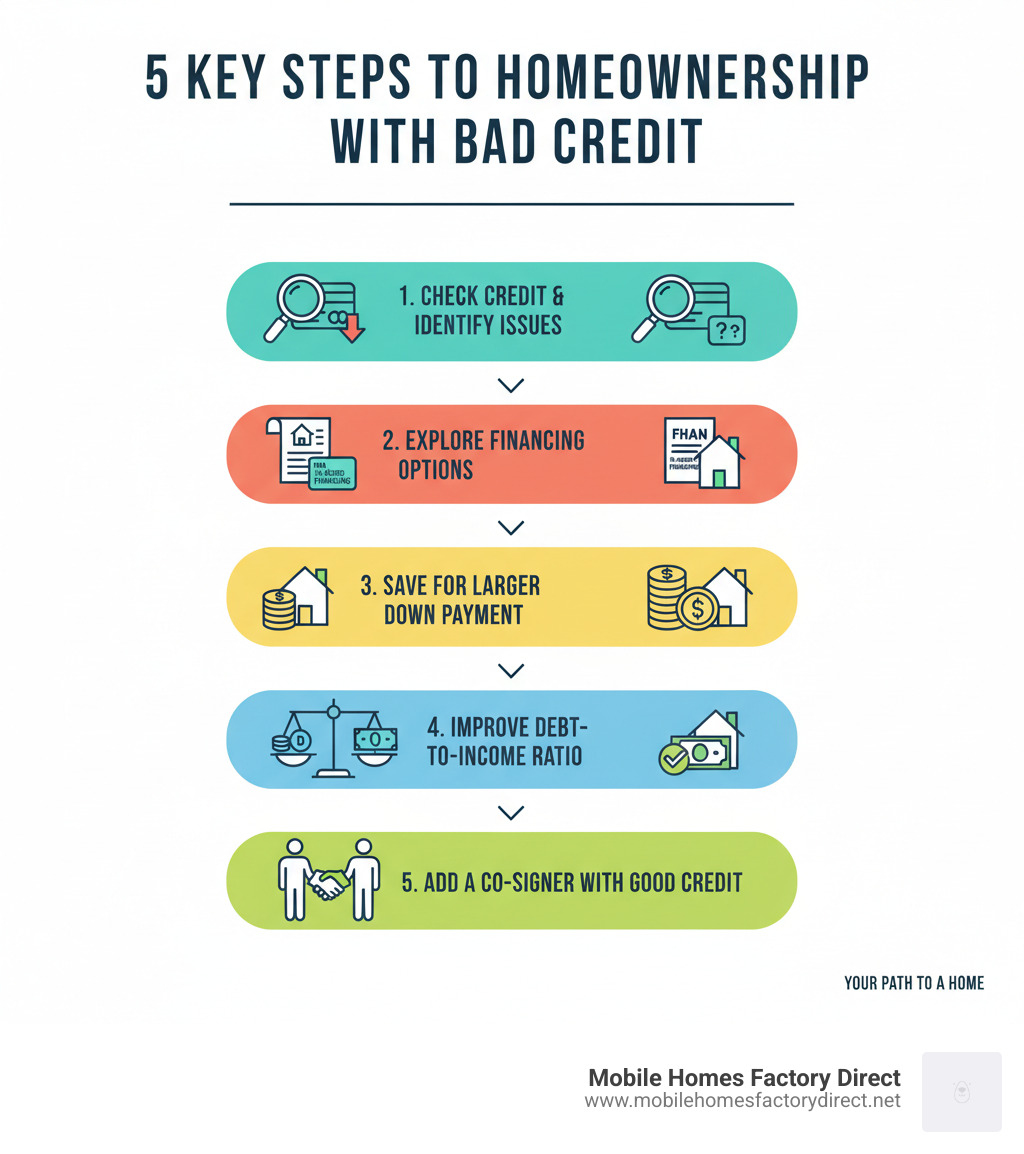

Strategies to Boost Your Mortgage Approval Odds

When you’re looking for homes with bad credit, lenders examine your entire financial picture, not just your score. You want the rest of your application to tell a story of stability and responsibility.

Lenders want to reduce their risk. You can use several strategies to show them you’re a reliable borrower, even with imperfect credit. Common reasons for loan denial—beyond a low score—include overextended credit, loan defaults, bankruptcy, or overdue taxes. Addressing these issues head-on is key.

The Power of a Larger Down Payment

A larger down payment is a powerful tool for your mortgage application. It shows the lender you are serious and financially invested.

When you put more money down, you reduce the lender’s risk. If they have to foreclose, they have a better chance of recouping their money. This also lowers your monthly payments because you’re borrowing less.

Lenders favor a good loan-to-value (LTV) ratio, which compares your loan amount to the home’s worth. A lower LTV, achieved with a larger down payment, makes you a more attractive borrower and can help you secure better terms, including a lower interest rate.

Understanding Your Debt-to-Income (DTI) Ratio

Your debt-to-income (DTI) ratio shows lenders how much of your monthly income is already committed to debt payments.

To calculate your DTI, add up all your monthly debt payments (credit cards, car loans, etc.), divide that by your gross monthly income, and multiply by 100. If you make $4,000 a month and have $1,200 in debt payments, your DTI is 30%.

Lenders look at two types of DTI: front-end (housing costs only) and back-end (all debts, including the new mortgage). Most lenders prefer a back-end DTI of 43% or less, though government-backed loans like FHA can be more flexible, sometimes allowing up to 56.9%.

You can improve your DTI by paying down existing debts (especially credit cards), increasing your income, and avoiding any new debt while applying for a mortgage.

Can You Secure Manufactured Homes with Bad Credit and a Co-signer?

Yes, adding a co-signer can be a game-changer. A co-signer with good credit lends their creditworthiness to your application, which can make all the difference when you’re trying to secure homes with bad credit.

Your co-signer needs a strong credit score (usually 670+), stable income, and a low DTI. With a co-signer, you are more likely to get approved and may qualify for better interest rates. Some lenders even average the credit scores of co-borrowers, which can be a significant help.

However, there are risks for the co-signer. If you miss payments, they are legally responsible for the full amount, and their credit will be damaged. This is a major commitment, so ensure everyone involved fully understands the responsibilities.

Improving Your Financial Profile for Homeownership

Taking time to improve your financial health before buying homes with bad credit is like giving yourself a financial makeover. A better score can save you thousands and open up more options.

Every point you add to your credit score can lead to lower lifetime costs. On a $100,000 mortgage, the difference between a 10% and 6% interest rate is over $80,000 over 30 years. Improving your credit also gives you access to more loan options with competitive terms, lower down payment requirements, and greater negotiating power. This creates overall financial stability that benefits every part of your life.

Actionable Steps to Improve Your Credit Score

Improving your credit takes focus and patience. Here are steps that can make a big difference:

- Check your credit report for errors. Get free reports from AnnualCreditReport.com and dispute any inaccuracies. This can sometimes provide a quick score boost.

- Pay every bill on time. Payment history is 35% of your score. Set up automatic payments or reminders to never miss a due date.

- Lower your credit card balances. Aim to use less than 30% of your available credit, and ideally under 10%. This impacts 30% of your score.

- Avoid applying for new credit. Each application can cause a small, temporary dip in your score.

- Consider using Experian Boost. This free service can give you credit for on-time utility and streaming service payments, potentially raising your score quickly.

- Negotiate with creditors. If you have accounts in collections, you may be able to negotiate a “pay-for-delete” agreement. Get any such agreement in writing. For complex situations, using a professional service like Credit Saint can help.

Pros and Cons of Buying Manufactured Homes with Bad Credit

Deciding whether to buy now or wait involves weighing the pros and cons for your specific situation.

Pros of Buying Sooner:

- Build Equity: Start investing in your own future instead of paying rent.

- Stability: Gain control over your living situation without worrying about landlords.

- Tax Benefits: You may be able to deduct mortgage interest and property taxes.

- Credit Improvement: Consistent mortgage payments will steadily improve your credit score.

Cons of Buying with Bad Credit:

- Higher Costs: Expect higher interest rates and fees, costing you significantly more over the loan’s life.

- Limited Choices: You’ll have fewer lenders to choose from, reducing your negotiating power.

- Stricter Requirements: You may need a larger down payment, and you must be wary of predatory lenders.

- Financial Strain: Higher monthly payments can be a burden if unexpected expenses arise.

Frequently Asked Questions about Buying a Manufactured Home with Bad Credit

We understand that buying homes with bad credit can feel overwhelming. Here are answers to the most common concerns we hear.

Can I really buy a manufactured home with a 500 credit score?

Yes, it is possible to buy a manufactured home with a 500 credit score. The most common path is an FHA loan, which requires a 10% down payment for scores between 500-579. If you can reach 580, the down payment drops to 3.5%.

With a 500-level score, lenders will use manual underwriting to review your entire financial profile. They look for “compensating factors” like steady employment, low debt, savings, or a strong rental history. At Mobile Homes Factory Direct, we specialize in connecting buyers with lenders who handle these exact situations.

How long does it take to improve my credit score for a mortgage?

The timeline varies. You could see quick improvements in 30-90 days by paying down credit card balances or using a tool like Experian Boost. For more significant changes (50-100 points), plan on 3-6 months of consistent good habits, like paying all bills on time and not opening new credit.

Major issues like bankruptcy or foreclosure will take longer to recover from, typically 1-2 years or more. However, you don’t need perfect credit to buy a home; you can start the process now while continuing to improve your score.

Are there special programs for first-time buyers with bad credit?

Yes, several programs are designed to help first-time buyers, even those with credit challenges.

-

Government-backed loans: FHA loans (as low as 500 score), VA loans for veterans (often no down payment, flexible on credit), and USDA loans for rural areas (zero down payment, typically 640+ score) are excellent options.

-

State and local assistance: Many governments offer down payment assistance programs in the form of grants or second mortgages. Research what’s available in your area.

-

Housing counseling agencies: These HUD-approved non-profits offer free advice and can connect you with lenders and programs you might not know about.

At Mobile Homes Factory Direct, we stay current on these programs and work with participating lenders to help you find the best fit for your situation.

Conclusion: Your Path to Homeownership Starts Now

The journey to owning homes with bad credit is achievable. As we’ve covered, your credit score is not a permanent barrier. Real solutions exist, from FHA loans that accept scores as low as 500 to the flexible in-house financing offered by manufactured home dealers.

By making smart financial preparations—like saving for a larger down payment, improving your debt-to-income ratio, or adding a co-signer—you can significantly boost your approval odds and secure better terms. These steps show lenders you are a responsible borrower, paving the way for a successful home purchase.

At Mobile Homes Factory Direct, we’ve built our reputation on helping credit-challenged buyers achieve their homeownership dreams. Located in Von Ormy, TX, we specialize in manufactured, mobile, and modular homes with flexible financing for all credit types, including bad or no credit. We understand that life happens, and we’re here to help you move forward.

Your dream home is closer than you think. The key is taking that first step. Don’t let yesterday’s financial challenges steal tomorrow’s possibilities. Your path to homeownership starts now.

Explore our flexible financing options to start your journey today!