Navigating Government Loans: A Comprehensive Look at Manufactured Home Financing

Unlock affordable homeownership! Learn about government loans for manufactured homes, FHA, USDA, VA programs, and eligibility.

Why Government Loans Make Manufactured Home Ownership Possible

Government loans for manufactured homes offer a path to affordable homeownership, helping families with limited budgets or credit challenges through reduced down payments, flexible credit requirements, and competitive rates.

Quick Answer – Government Loan Options for Manufactured Homes:

- FHA Loans – Down payments as low as 3.5%, credit scores starting at 580

- USDA Loans – Zero down payment for rural properties, income limits apply

- VA Loans – No down payment for eligible veterans and service members

- Loan Types – Title I (personal property) or Title II (real estate with land)

- Requirements – Home must be HUD-certified, built after 1976, minimum 400 sq ft

Manufactured homes are a practical solution to the widening homeownership gap. Built to federal HUD standards since 1976, they cost 20-30% less than comparable site-built homes and offer modern amenities.

The key difference? Government agencies like HUD, FHA, USDA, and VA don’t lend directly. They insure loans from private lenders, reducing risk and encouraging affordable financing.

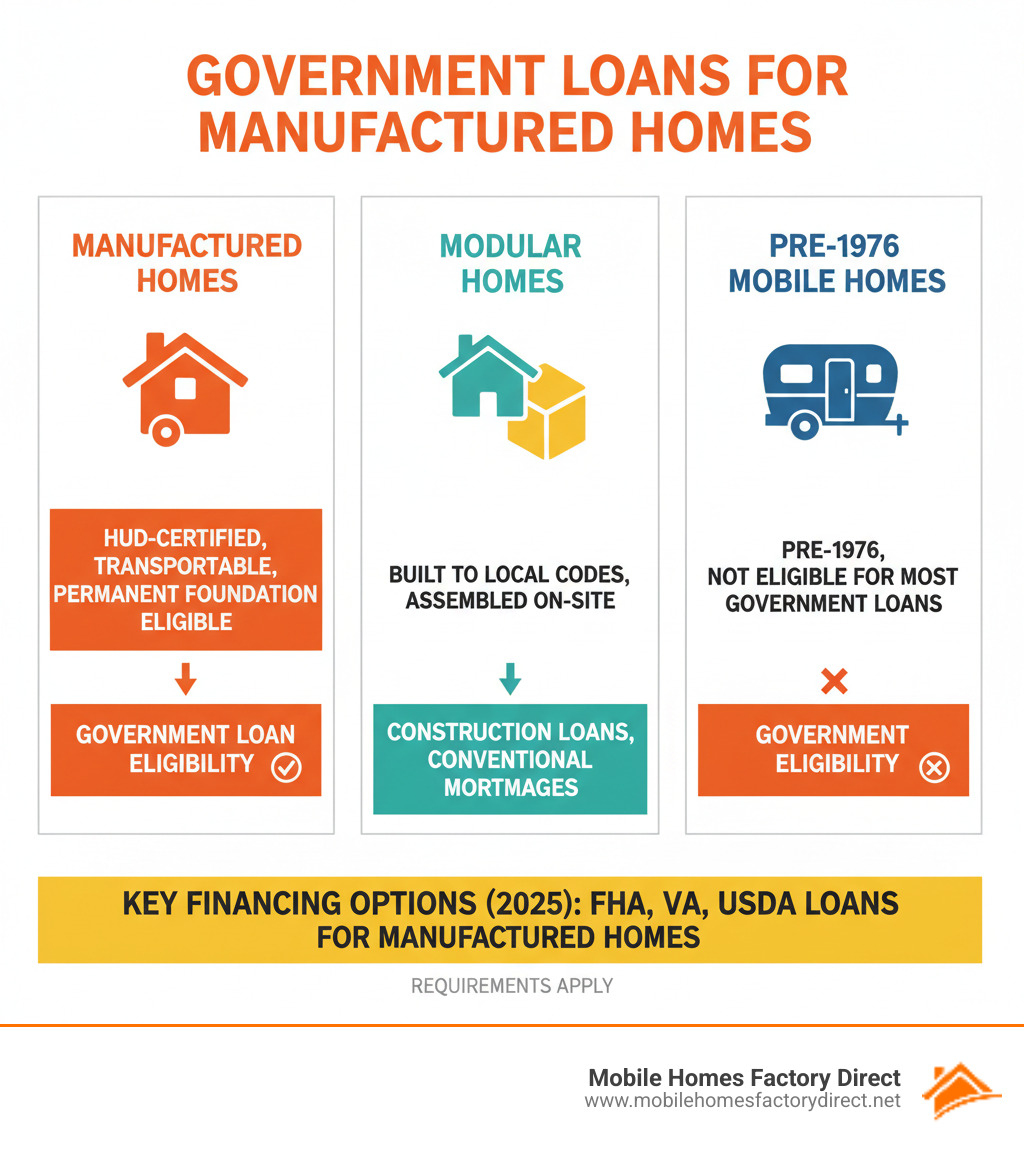

It’s crucial to know the difference: only manufactured homes (HUD-certified, built after 1976) qualify for most government loans, unlike older mobile homes or modular homes (built to local codes).

For first-time buyers, veterans, or rural relocators, government-backed financing makes homeownership affordable and achievable.

Understanding the Landscape of Government Loans for Manufactured Homes

When discussing government loans for manufactured homes, it’s important to know the government doesn’t lend money directly. Instead, agencies like HUD, FHA, USDA, and VA insure loans from private lenders. This insurance acts as a safety net, encouraging lenders to offer better terms, lower interest rates, and more flexible requirements.

Without this backing, most manufactured homes would only qualify for chattel financing—personal property loans with higher rates and shorter terms. The advantages of government loans are compelling: lower down payments, forgiving credit requirements, and longer loan terms. While there’s more paperwork and stricter property rules, the benefits are usually worth it.

The Key Agencies: HUD, FHA, USDA, and VA

Each agency plays a role in making homeownership possible:

U.S. Department of Housing and Urban Development (HUD) sets the national safety and construction standards (the “HUD Code”) for all manufactured homes built since June 15, 1976. It also oversees the FHA.

Federal Housing Administration (FHA), part of HUD, insures loans and is known for low down payments and flexible credit, making it popular with first-time buyers.

U.S. Department of Agriculture (USDA) focuses on rural America. Its Single Family Housing Guaranteed Loan Program offers zero-down-payment loans for eligible buyers in designated rural areas.

Department of Veterans Affairs (VA) serves those who’ve served our country. VA loans offer powerful benefits like no down payment and no private mortgage insurance for eligible veterans, active-duty service members, and surviving spouses.

These agencies ensure that homeownership isn’t just for those buying traditional houses. You can find more info about financing options in our comprehensive guide.

Real Estate vs. Personal Property: A Critical Distinction

Understanding how your home is classified—as real estate or personal property—is critical, as it dictates your financing options, rates, and terms.

Real Property classification occurs when your manufactured home is on a permanent foundation on land you own, and its title is converted to a real estate deed. Classified as real property, a manufactured home can be financed with traditional mortgages (FHA Title II, USDA, VA), offering lower rates, 30-year terms, and the ability to build equity.

Personal Property (or chattel) classification applies when the home is on leased land or has a vehicle-type title. As personal property, the home is financed with a chattel loan, which has higher rates (often 8%+) and shorter terms (15-25 years). FHA Title I loans are available for this classification.

Classifying your home as real property by placing it on a permanent foundation open ups superior financing and long-term financial benefits. We can help you understand Will FHA Finance a Manufactured Home based on its classification.

Key Government Loan Programs Explored

Finding the right government loan for a manufactured home is manageable. The three main programs—FHA, USDA, and VA—each offer unique strengths to make homeownership affordable.

FHA Government Loans for Manufactured Homes: Title I vs. Title II

The FHA offers two distinct loan programs for manufactured homes, providing different paths to homeownership.

FHA Title I loans are the primary option when a manufactured home is treated as personal property, such as in a community where you lease the land. These loans cover new and used homes, financing just the home (up to ~$70,000), a lot (~$23,000), or both (~$93,000), with higher limits in some areas. Terms are shorter, typically 15-25 years. A down payment can be as low as 3.5% (580+ credit score) or 10% (500-579 score), with a fixed interest rate. You can get more information on Financing Manufactured Homes (Title I) – HUD.

FHA Title II loans are traditional mortgages for manufactured homes classified as real property—permanently attached to a foundation on land you own. Benefits include a 30-year mortgage term, higher loan limits (e.g., up to $498,257 in most Texas counties), and the same 3.5% down payment. However, you’ll pay both upfront (1.75%) and annual (0.15%-0.75%) mortgage insurance. This path is ideal for building long-term equity. Our guide on FHA Mobile Home Financing has more details.

USDA Loans: Boosting Rural Homeownership

For those drawn to rural living, USDA loans through the Single Family Housing Guaranteed Loan Program are an excellent option for government loans for manufactured homes. The main feature is the zero down payment requirement. To qualify, your income must be within local limits, and the home must be in a USDA-eligible rural area.

The manufactured home must be new (built in the last 12 months, never installed), have at least 400 square feet, sit on a permanent foundation, display the red HUD certification label, and be classified as real estate. The USDA also offers a Combination Construction-to-Permanent Loan, which bundles the financing for the land, home, and site preparation into a single loan guaranteed at 100% of the appraised value.

You can check USDA eligibility requirements and learn about the Single Family Housing Guaranteed Loan Program.

VA Loans: A Benefit for Service Members

For veterans, active-duty service members, and eligible surviving spouses, VA loans are an outstanding benefit. Key advantages include no down payment, no private mortgage insurance, and competitive interest rates. The primary cost is a one-time VA funding fee, which varies by service history and can often be rolled into the loan.

The manufactured home must be on a permanent foundation, classified as real estate, and meet the VA’s minimum property requirements for safety and quality. A special Native American Direct Loan (NADL) program is also available for qualifying veterans purchasing homes on Federal Trust Land.

It’s a benefit earned through service. You can learn about home loan programs for veterans directly from the VA.

Eligibility Unpacked: Borrower and Property Requirements

Getting approved for a government loan for a manufactured home involves two parts: borrower and property eligibility. These requirements are in place to protect both you and the lender, ensuring you’re buying a safe, quality home.

Borrower Eligibility Criteria

Government-backed loans are designed to be more accessible than conventional loans.

Credit scores don’t need to be perfect. FHA loans accept scores as low as 580 (3.5% down) or 500 (10% down). USDA loans generally look for a 640 score, while VA loans have no official minimum, but lenders often prefer 620+. Don’t be discouraged by a challenging credit history; explore our Financing for Mobile Homes with Bad Credit options.

Down payments are a major advantage. FHA requires as little as 3.5% down, while USDA and VA loans offer zero down payment to eligible borrowers, significantly reducing upfront costs.

Your debt-to-income ratio is also reviewed. FHA generally allows up to 43% (sometimes higher), USDA looks for under 41%, and the VA uses a ‘residual income’ calculation.

Lenders usually require a two-year history of stable employment and income to show you’re a reliable earner.

Property Eligibility for Government Loans for Manufactured Homes

Your manufactured home must meet federal standards to ensure it’s a quality investment.

The most important rule is HUD Code compliance. The home must be built after June 15, 1976, to comply with federal construction and safety standards. Older mobile homes do not qualify.

Regarding size, the home must have at least 400 square feet of living space.

A permanent foundation is required for most government loans. This classifies the home as real estate, open uping better loan terms and appreciation potential.

The home must have its HUD data plate (usually inside) and the red certification labels (outside) to prove it meets federal standards.

The site and installation must meet federal and local standards, including proper utilities and zoning. For leased-land communities, the community may need to be approved and offer a lease of at least three years.

The Application Process and Finding a Lender

The application process for a government loan for a manufactured home is straightforward. We’ll walk you through the steps so you can focus on getting the keys to your new home.

Step 1: Gather Your Documents and Get Pre-Approved

Before you start shopping, get pre-approved. This shows sellers you’re a serious buyer and gives you a clear budget.

Gather your financial documents: ID, Social Security card, recent pay stubs, two years of tax returns/W-2s, and recent bank statements. Include info on existing debts. Veterans will need their Certificate of Eligibility for a VA loan.

A lender specializing in manufactured homes will review your documents to determine your budget and provide a pre-approval letter. Pre-approval often reveals you can afford more than you thought, thanks to the low down payment options with government loans for manufactured homes.

Step 2: Find an Approved Lender and a HUD Counselor

Find a lender who specializes in manufactured homes and understands the nuances of FHA, USDA, and VA programs.

Finding the right lender can be done with the HUD-approved lender search tool, but always ask about their specific experience. A simpler route is to work with a dealer like Mobile Homes Factory Direct. We have a network of experienced lenders who offer competitive rates.

A HUD-approved housing counselor can also be a valuable resource. These counselors offer free, unbiased advice on the home buying process. You can find a HUD-approved housing counselor in your area online.

Step 3: The Appraisal, Underwriting, and Closing Process

Once you’ve found a home and a lender, the final steps ensure the deal is sound.

The appraisal process involves an independent professional who determines the home’s market value and verifies it meets all requirements, including the HUD Code, a permanent foundation, and proper certification labels.

Underwriting is when the lender’s underwriter reviews all documents, the appraisal, and your finances to ensure everything aligns with program guidelines before final approval.

The closing process is the finish line. At closing, you’ll sign the final loan documents. Review your Closing Disclosure carefully, as it details all costs and terms. Once signed, the home is yours. The entire process typically takes 30-45 days.

Frequently Asked Questions about Manufactured Home Loans

We know you have questions about government loans for manufactured homes. Here are answers to the most common ones.

Can I get a government loan for a manufactured home on leased land?

Yes, you can. FHA Title I loans are specifically designed to finance a manufactured home on leased land, a common scenario for homes in communities. These loans treat the home as personal property, allowing you to finance the home without owning the land.

HUD provides protections for these arrangements, requiring communities to offer an initial lease of at least three years and provide 180 days’ written notice for termination.

USDA and VA loans, however, generally require you to own the land and have the home classified as real estate.

What are the typical interest rates and loan terms?

Interest rates and terms depend on the loan program and how the home is classified (real vs. personal property).

FHA Title I loans (personal property) have terms of 20-25 years. Rates are slightly higher than real estate loans but much better than private chattel financing.

For homes on a permanent foundation (real property), FHA Title II, USDA, or VA loans offer 30-year terms and competitive interest rates, similar to traditional mortgages. Your credit score will influence your exact rate.

In contrast, private chattel loans from non-government lenders often have higher rates (starting around 8%) and shorter terms, which is why government-backed loans can save you thousands. We can help you explore more on loan options to find what works for you.

How are new construction and installation costs handled?

When buying a new manufactured home, costs include site prep, transport, and setup. Some government loans for manufactured homes can roll all these expenses into one loan.

USDA’s Combination Construction-to-Permanent Loan Program is a great option for rural buyers. It can cover the home, land, site prep, and installation in a single loan, guaranteed at 100% of the appraised value.

FHA One-Time Close loans also combine the financing for the lot, home, and installation into a single loan with one closing, saving you time and money. These comprehensive options make managing the costs of a new home much simpler.

Conclusion

Your path to homeownership is more accessible than you might think. Government loans for manufactured homes, backed by the FHA, USDA, and VA, have made this dream a reality for countless families by offering affordable and accessible financing.

The variety of these programs is their strength. Whether you need an FHA Title I loan for a home on leased land, want zero down payment with a USDA loan for rural living, or plan to use your VA benefits, there’s a program for you.

We’ve covered the key requirements, from the HUD certification label to the need for a permanent foundation. While there is paperwork, these standards exist to protect your investment and ensure you get a quality home.

At Mobile Homes Factory Direct, we help families in Von Ormy, Somerset, Atascosa, Macdona, San Antonio, and around JBSA Lackland achieve homeownership daily. We know the local market and these financing programs inside and out. Our team works with specialized lenders to help you steer everything from credit challenges to finding the perfect home.

The benefits are clear: down payments as low as 3.5% (FHA), zero down (USDA/VA), and 30-year terms for real estate. These are real opportunities to stop renting and start building equity.

Don’t let another month of rent go by. The financing options are available, and we’re here to help.

Explore your financing options with us and find out just how achievable your homeownership dreams really are. Let’s turn those rent payments into mortgage payments that build your future.