FHA and Your Single-Wide Dream: What You Need to Know

Wondering, does fha finance single wide mobile homes? Get the answers, requirements & steps for your affordable homeownership dream.

Why Understanding FHA Financing for Single-Wide Homes Matters

If you’re wondering does fha finance single wide mobile homes, the answer is yes, but only if specific requirements are met. Understanding these rules is key to a smooth home-buying process.

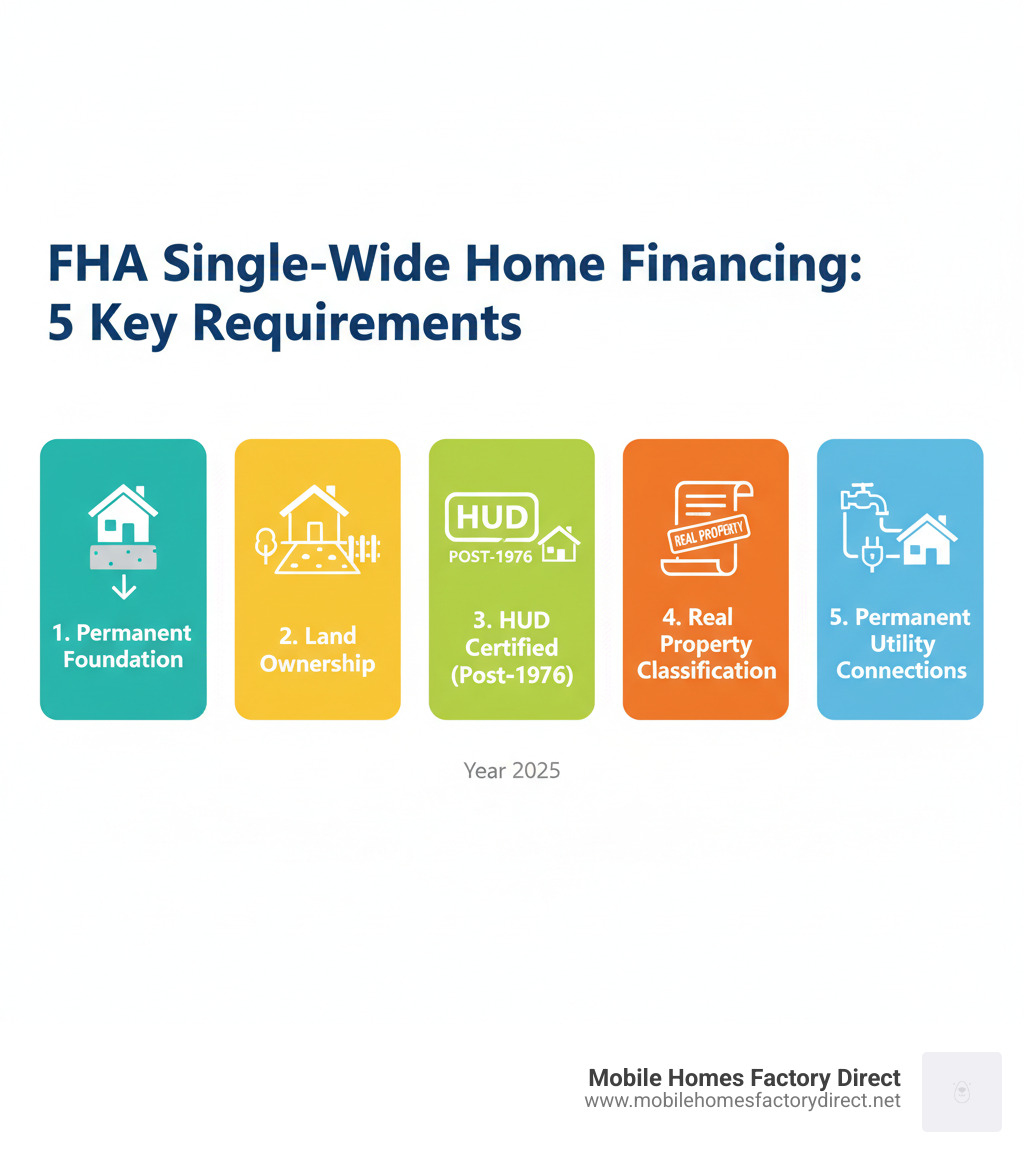

Quick Answer: FHA Single-Wide Home Financing Requirements

- Real Property Status: The home must be classified as real property.

- Permanent Foundation: It must be attached to a permanent foundation with wheels and axles removed.

- Land Ownership: You must own the land where the home sits.

- HUD Compliance: The home must be built after June 15, 1976, with a valid HUD certification label.

- Minimum Standards: It must be at least 400 square feet and have permanent utilities.

Single-wide manufactured homes are an affordable path to homeownership. The Federal Housing Administration (FHA) backs loans for them, making them accessible with down payments as low as 3.5%. However, these loans have strict property requirements that many single-wides don’t initially meet. Knowing these rules upfront saves time and frustration, as the key difference between a qualifying and non-qualifying home is often its foundation and legal classification.

The Big Question: Does FHA Finance Single Wide Mobile Homes?

Yes, FHA loans can be used to purchase single-wide manufactured homes, but with an important catch: the home must meet specific requirements to ensure it functions as permanent housing.

The biggest hurdle is whether the property is classified as real property or personal property. Most single-wides start as personal property, like a car, with a vehicle title. FHA loans, however, are for real estate—property permanently attached to land.

To qualify, the single-wide must be transformed into real estate through a process called de-titling. This involves permanently installing the home on land you own, securing it to a permanent foundation, and surrendering its vehicle title to have it legally recorded as part of your real estate.

This conversion makes the home eligible for attractive FHA financing, including down payments as low as 3.5% and more forgiving credit requirements than conventional loans. For more details, see our guide on FHA Mobile Home Financing.

Understanding FHA’s Role in Manufactured Housing

The Federal Housing Administration (FHA) doesn’t issue loans directly. Instead, it provides mortgage insurance that protects lenders against loss if a borrower defaults. This insurance reduces lender risk, encouraging them to offer favorable terms on manufactured homes, especially for buyers without large down payments or perfect credit. The Department of Housing and Urban Development (HUD) oversees the FHA and has comprehensive guidelines for these homes. You can find official resources at Financing Manufactured Homes – HUD.

The Critical “Real Property” Distinction

Achieving real property status is non-negotiable for an FHA loan. This means:

- You must own the land where the home sits. FHA will not finance a home on a rented lot.

- The home must be permanently attached to a foundation that meets FHA and local code standards. The wheels, axles, and towing hitch must be removed.

- The home’s vehicle title must be surrendered (de-titled), and the property recorded with the county as a single piece of real estate.

- You will pay property taxes on the combined value of the land and home, not personal property taxes.

This conversion gives the lender security, as the property is a fixed asset. Without it, the answer to does FHA finance single wide mobile homes is a firm no. At Mobile Homes Factory Direct, we help buyers steer these requirements from the start.

Unpacking FHA’s Strict Requirements for Single-Wide Homes

While the answer to does fha finance single wide mobile homes is yes, it comes with a rigorous set of requirements designed to ensure the home is safe, sound, and holds its value. These rules fall into three main categories: property standards, construction rules, and borrower qualifications.

Property and Foundation Standards

This is the most critical factor. The FHA requires the home to be a permanent structure, not a movable asset.

- Permanent Foundation: The home must be secured to a permanent foundation engineered to local standards and anchored below the frost line. The chassis must be permanently attached to this system. The HUD Permanent Foundations Guide for Manufactured Housing provides technical specifications.

- Wheels, Axles, and Hitch Removed: All components used for transport must be completely removed.

- Permanent Utilities: Water, sewer/septic, and electricity must be permanently connected according to local codes.

- Land Ownership: You must own the land. FHA financing is not available for homes on rented lots in mobile home parks. Our guide on Will FHA Finance a Manufactured Home? offers more detail.

Home Construction and Age Rules

The home itself must meet specific standards.

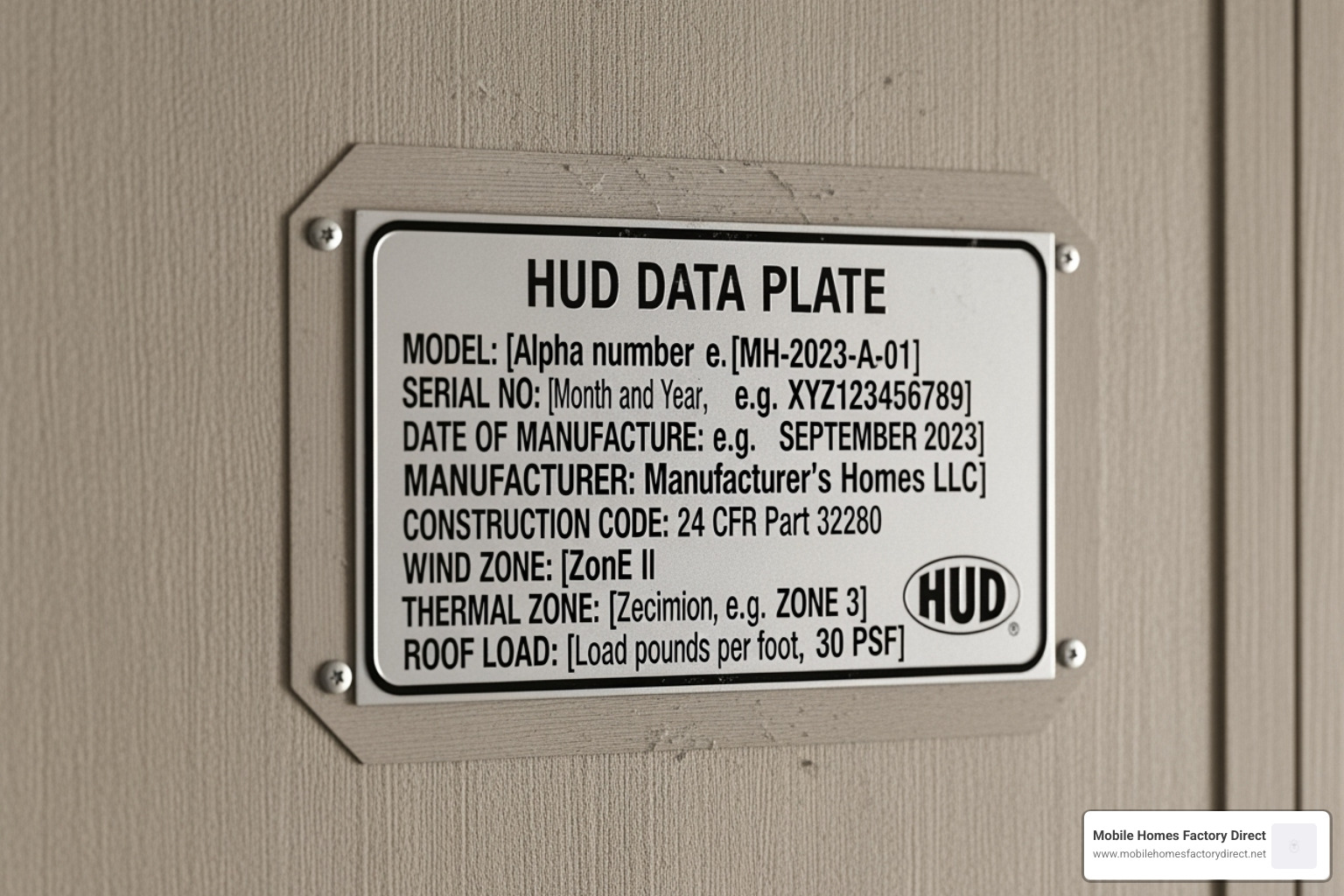

- Built After June 15, 1976: This is the date the HUD Manufactured Home Construction and Safety Standards (the HUD Code) went into effect, mandating federal rules for construction, safety, and energy efficiency.

- HUD Tag: A metal certification label must be affixed to the exterior of the home, proving it was built to HUD standards. No tag means no FHA loan.

- Minimum Floor Area: The home must have at least 400 square feet of living space, which most single-wides easily exceed.

- Relocation: A home can be moved from its original site, but it must be properly installed on a new permanent foundation and may require re-certification to confirm it still meets all FHA standards.

Borrower and Loan Eligibility

Finally, you as the borrower must qualify. FHA requirements are generally more flexible than conventional loans.

- Credit Score: FHA guidelines allow a 3.5% down payment for borrowers with a score of 580 or higher. Scores between 500-579 may qualify with a 10% down payment. We can help you understand your options, even with credit challenges, as explained in our resource on mobile home loans for bad credit.

- Debt-to-Income (DTI) Ratio: Generally, your housing costs should be no more than 31% of your income, and your total monthly debt no more than 43%.

- Mortgage Insurance Premiums (MIP): FHA loans require an Upfront Mortgage Insurance Premium (UFMIP) of 1.75% of the loan amount (can be financed) and an annual premium paid monthly. This insurance is what allows lenders to offer flexible terms.

- Loan Limits: FHA sets maximum loan amounts that vary by county, but single-wide homes typically fall well within these limits.

The FHA Loan Process for Your Single-Wide: A Step-by-Step Guide

Securing an FHA loan for a single-wide involves several steps. Breaking the process down makes it manageable. The flow is similar to buying a traditional house but with special attention to manufactured home requirements.

Step 1: Find an FHA-Approved Lender

Not all FHA-approved lenders handle manufactured home loans, as they require specialized knowledge. Seek out lenders who specifically advertise this service. The HUD website has a list of approved lenders on their Loans page.

Once you find a lender, apply for pre-approval. This involves submitting your financial documents for review. A pre-approval letter shows sellers you are a serious buyer and tells you how much you can afford. For more guidance, see our list of manufactured home financing companies.

Step 2: Locate a Compliant Single-Wide Home

With pre-approval in hand, you can search for a home that meets FHA’s strict standards. Work with a real estate agent experienced in FHA-financed manufactured homes.

During your search, verify these critical requirements upfront:

- The home was built after June 15, 1976.

- The HUD certification label (HUD tag) is present.

- The home is on a permanent foundation (or can be upgraded).

- The land is included in the sale.

At Mobile Homes Factory Direct, we specialize in helping buyers find homes that meet these financing requirements. You can browse our single wide homes for sale to see qualifying options.

Step 3: The FHA Appraisal and Underwriting

After your offer is accepted, the loan enters the appraisal and underwriting phase. Your lender will order an appraisal from an FHA-approved appraiser who will verify the home’s value and confirm it meets all FHA minimum property standards. This includes inspecting the foundation, HUD tag, structural integrity, and utility connections. Any issues must be corrected before the loan can close.

Simultaneously, an underwriter will review your financial profile to confirm you meet FHA’s borrower criteria. Once both the property and your finances are approved, you’ll receive a “clear to close.” This meticulous process protects you by ensuring you’re buying a sound investment. You can learn more about this phase in this guide on How to Get an FHA Loan for a Mobile or Manufactured Home.

Weighing the Pros, Cons, and Costs of FHA Financing

Deciding on an FHA loan requires weighing the pros and cons. While they make homeownership accessible, especially for those with budget or credit challenges, they come with specific trade-offs. At Mobile Homes Factory Direct, we want you to make a confident and informed choice.

Advantages of Using an FHA Loan

FHA loans were designed to help buyers who might struggle with conventional financing.

- Low Down Payment: You may only need 3.5% of the purchase price if your credit score is 580 or higher.

- Flexible Credit Requirements: FHA guidelines are more forgiving of past credit issues than conventional loans.

- Competitive Interest Rates: Because the loans are government-insured, lenders can offer attractive rates.

- 30-Year Loan Terms: A long repayment period keeps monthly payments manageable.

- Assumable Loans: A qualified buyer can take over your loan in the future, which can be a great selling point if interest rates rise.

These benefits make FHA a popular route to owning affordable mobile homes.

Challenges and Associated Costs

It’s also important to understand the costs and potential problems.

- Mortgage Insurance Premiums (MIP): FHA loans require an Upfront MIP (UFMIP) of 1.75% of the loan amount, which can be rolled into the mortgage. You’ll also pay an annual MIP for the life of the loan in most cases, which increases your monthly payment.

- Stricter Property Standards: The rigid requirements for the foundation, HUD tag, and land ownership narrow your home options. Upgrading a non-compliant home can be costly.

- Limited Lender Options: Not all FHA-approved lenders work with manufactured homes, so your choices may be limited.

- Other Costs: Budget for appraisal fees, which can be higher for manufactured homes, as well as standard closing costs.

For many families, the benefits of an FHA loan outweigh these drawbacks. The key is to plan for these costs and challenges from the beginning.

How FHA for Single-Wides Compares to Other Options

While FHA loans are a popular answer to does fha finance single wide mobile homes, they aren’t the only path. Depending on your situation, another option might be a better fit. At Mobile Homes Factory Direct, we offer flexible financing solutions and work with a network of lenders to find the right match for you.

How does FHA financing for single wide mobile homes compare to double-wides?

The core FHA requirements are the same for both single-wide and double-wide homes: a permanent foundation, land ownership, a HUD tag, and real property classification.

However, there are practical differences. Double-wides often appraise for higher values and may have a broader resale market, which can make some lenders more comfortable. But if a single-wide meets all FHA criteria, it is just as eligible for financing. The challenge is finding a compliant home.

What are the alternatives if FHA isn’t an option?

If an FHA loan isn’t right for you, consider these alternatives:

- VA Loans: An excellent option for eligible veterans and service members, offering 100% financing (zero down payment) and no monthly mortgage insurance. The property requirements are similar to FHA.

- USDA Loans: For homes in eligible rural areas, these loans also offer 100% financing. Income limits apply, and the home must be real property.

- Conventional Loans: These loans typically require higher credit scores and down payments (5-20%). However, you may avoid long-term mortgage insurance. The property must still be real property on a permanent foundation.

- Chattel Loans: These are personal property loans for homes not permanently affixed to land, such as those in a park. They function more like a car loan, with shorter terms and higher interest rates.

At Mobile Homes Factory Direct, we understand that traditional financing isn’t for everyone. We offer in-house financing and work with lenders specializing in all credit types. Explore all your options in our guide on financing a mobile home.

Conclusion

So, does fha finance single wide mobile homes? The answer is a definitive yes, but with important conditions. FHA loans provide a vital pathway to homeownership, but success depends on ensuring the home is legally and structurally a permanent residence.

The most critical requirements are:

- The home must be classified as real property.

- It must be on an FHA-approved permanent foundation on land you own.

- It must be built after June 15, 1976, and have a valid HUD certification label.

The trade-off for FHA’s benefits—like a low 3.5% down payment and flexible credit standards—is the cost of mortgage insurance and the strict property standards that can limit your home search.

Understanding these requirements is the key to a successful purchase. At Mobile Homes Factory Direct, we specialize in helping buyers steer this process. We connect customers with homes that meet financing standards and offer flexible financing for all credit types, including bad or no credit. An FHA-financed single-wide can make your dream of homeownership a reality.

Ready to take the next step? Find your perfect used single-wide mobile home today and let us help you explore your financing options.