Home Sweet Home: How Credit Counseling Makes Buying Easy

Unlock your dream home! Learn how credit counseling for home buying helps improve credit, manage debt, and secure your mortgage.

Why Credit Counseling is Your Key to Affordable Homeownership

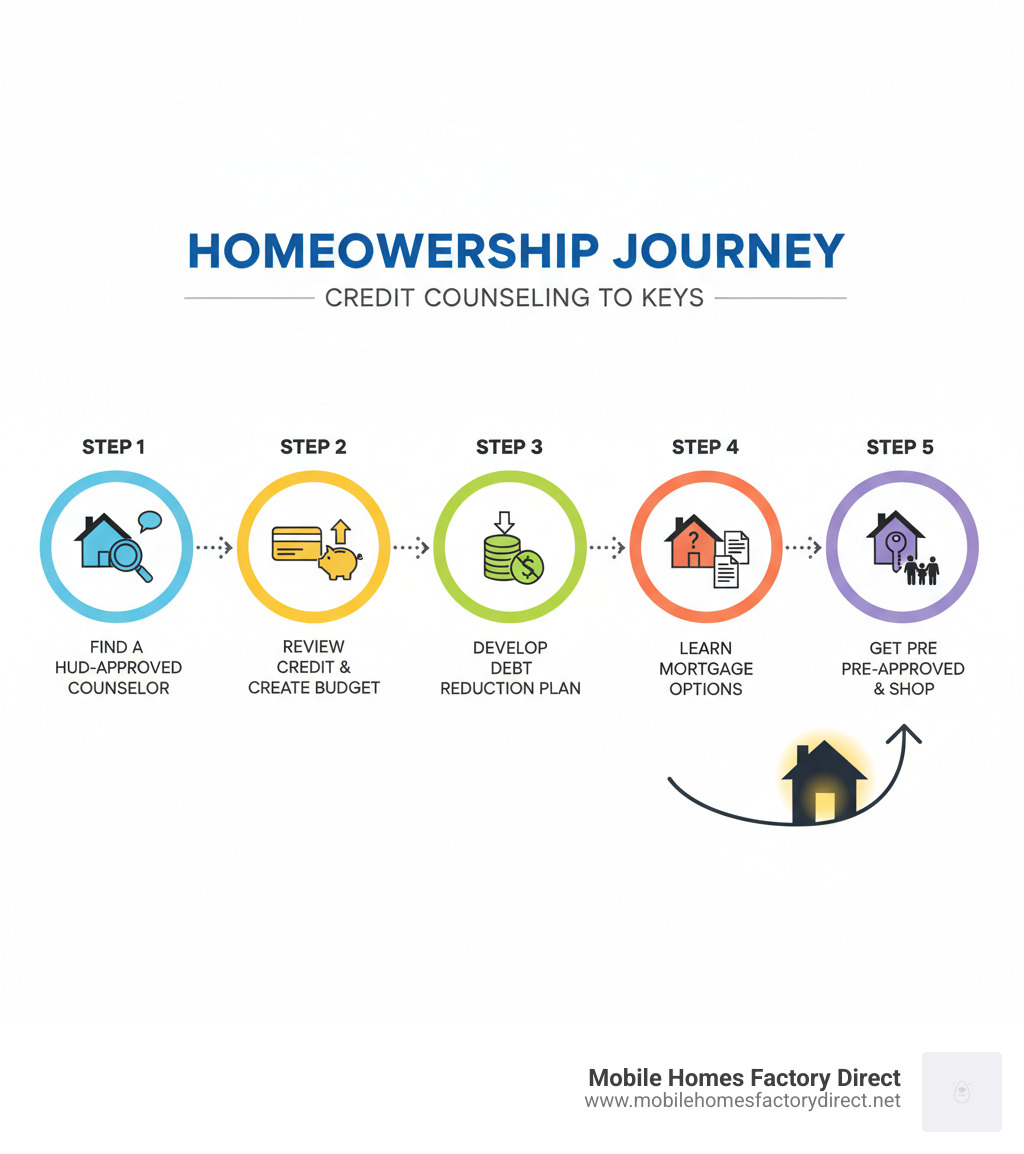

Credit counseling for home buying connects you with certified professionals who help you improve your credit score, create a budget, manage debt, and steer the mortgage process. These services are often free or low-cost through HUD-approved agencies and can help you qualify for better loan terms, even with past financial challenges.

Quick Answer: What You’ll Get from Credit Counseling

- Credit Report Review – Identify errors and learn strategies to boost your score.

- Budget Creation – Plan for a down payment, closing costs, and monthly payments.

- Debt Management – Reduce existing debt to improve mortgage eligibility.

- Mortgage Education – Understand loan options and avoid predatory lending.

- Access to Programs – Connect with first-time homebuyer assistance.

Owning a home is a major life goal, but the path isn’t always easy. Many people face obstacles like bad credit, debt, or a lack of savings. In fact, 53% of recent homebuyers said debt caused them to delay buying a home for four years or more, and in 2024, lack of savings was the biggest barrier.

Credit counseling exists to help you overcome these challenges. A certified credit counselor provides one-on-one guidance to improve your financial health, boost your credit score, and prepare you for a mortgage. They help you create a realistic budget and connect you with programs for buyers with less-than-perfect credit, turning your dream of homeownership into a reality.

Credit counseling for home buying terms simplified:

What is Credit Counseling and How Does It Help Home Buyers?

Think of credit counseling for home buying as getting a personalized financial assessment from a certified professional. This service, usually offered by non-profits, gives you a clear, honest look at your finances. Your counselor provides one-on-one assistance to help you understand your credit reports, budget effectively, and tackle debt strategically.

Together, you’ll create a realistic budget and action plan custom to your life. Your counselor becomes your partner in getting mortgage-ready, helping you see obstacles before they become problems.

The specifics of credit counseling for home buying

When counseling focuses on home buying, it becomes more targeted. Your counselor will conduct a mortgage readiness assessment to see if you’re prepared for what lenders require. They’ll examine your debt-to-income ratio (DTI), a key metric for lenders, and help you improve it if needed. Since lack of savings is a major barrier, your counselor will also work with you on savings strategies for a down payment that fit your budget. The goal is to spot and resolve financial obstacles, like an old collection account, before they derail your plans.

Ready to get started? You can Find a HUD-approved housing counselor in your area.

Why a HUD-Approved Housing Counselor is Your Best Bet

While general credit counselors are helpful, HUD-approved housing counselors offer specialized housing expertise. Approved by the U.S. Department of Housing and Urban Development, they provide unbiased advice, often at little or no cost.

Here’s what makes them special:

- Access to Programs: They know about state and local homebuyer programs in Texas for down payments and closing costs and can connect you with ones you qualify for.

- Financial Expertise: They understand foreclosure prevention and can help you choose a mortgage you can afford long-term.

- Protection: They are trained to spot predatory lending and can help you avoid unfair or abusive loan terms.

Many non-profit agencies employ HUD-approved counselors, so their goal is your success, not selling a product. They offer educational resources to help you make smart decisions. Learn more about the Advantages of nonprofit agencies for aspiring buyers.

Building Your Financial Foundation for a Mortgage

Before buying a home in Von Ormy, San Antonio, or anywhere in Texas, you need a solid financial foundation. Credit counseling for home buying is your most valuable tool for this. Many people face obstacles like debt and lack of savings, but with the right guidance, you can become mortgage-ready by improving your credit, mastering your budget, and reducing debt.

How to Improve Your Credit Score for a Better Mortgage

Your credit score is your financial reputation, and lenders use it to determine your loan approval and interest rate. Reducing your mortgage rate by just one percentage point could save you tens of thousands of dollars in interest over a 30-year loan.

A credit counselor will help you review your credit reports from Equifax, Experian, and TransUnion. Studies have found that one in four credit reports contain errors that can lower your score. Your counselor will show you how to spot and dispute these mistakes. Correcting errors alone can sometimes provide an immediate score boost.

Beyond fixing errors, your counselor will create a personalized strategy for building positive credit. This includes making on-time payments, managing credit utilization, and diversifying your credit mix. For those in the San Antonio area, a FICO Score Improvement Program can provide a clear, actionable plan to improve your scores over time.

Budgeting and Saving for a Down Payment and Beyond

Smart budgeting is about making your money work for you. In credit counseling for home buying, your counselor helps you analyze your income and expenses to create a realistic household budget. This roadmap helps you cover current bills while carving out room for savings.

Your counselor will help you identify practical strategies to save for a down payment. But that’s not the only upfront cost. Closing costs can add up to thousands, so your counselor will help you build them into your savings plan. They will also help you budget for post-purchase expenses like property taxes, insurance, and maintenance, ensuring you’re ready for the full financial commitment of homeownership.

How a Debt Management Plan (DMP) Can Prepare You for a Mortgage

If you’re struggling with credit card bills or personal loans, a Debt Management Plan (DMP) can help. Offered by non-profit credit counseling agencies, a DMP consolidates your unsecured debts into a single monthly payment. The agency works with your creditors to negotiate lower interest rates (often reducing credit card rates to around 8%) and waive fees.

A DMP prepares you for a mortgage in several ways. It lowers your debt-to-income ratio, establishes a consistent positive payment history, and typically helps you become debt-free in three to five years. This demonstrates financial discipline and makes you a stronger mortgage applicant who can qualify for better rates.

Navigating the Home Buying Process with an Expert

Think of a credit counselor as your personal guide through the maze of mortgage options, loan terms, and special programs. They help you understand what’s available and what makes sense for your situation, helping you avoid costly mistakes.

Explaining Different Mortgage and Loan Options

Mortgages can be confusing, with options like conventional loans, FHA loans, and VA loans. Each has different requirements for down payments, interest rates, and qualification.

Your counselor acts as a translator, explaining each loan type in plain English. They can guide you to the best fit, whether it’s a VA loan for a veteran or an FHA loan for a first-time buyer with limited savings. If you’re interested in a manufactured home in Von Ormy, they can explain specific financing like FHA Title I loans. They also help you compare loan offers, understand the difference between interest rate and APR, and spot red-flag fees. A HUD-approved counselor offers independent advice, ensuring you make the smartest decision for your future.

Special Programs and Education for First-Time Homebuyers

If you’re a first-time homebuyer in Texas, you may have more help available than you realize. Your credit counselor is the key to open uping these resources.

Down payment assistance programs at the state and local level can provide grants or low-interest loans to help with upfront costs. Your counselor knows which programs you qualify for and how to apply. Many lenders also require a homebuyer education course, which teaches you everything from understanding mortgage documents to budgeting for maintenance. Your counselor can connect you to approved courses like Homebuyer education courses like Fannie Mae HomeView®. Completing a course can often qualify you for special loan terms or additional assistance.

Counseling is available both before you buy (pre-purchase) and after (post-purchase) to ensure you’re ready not just to buy a home, but to keep it for the long haul.

Finding and Affording Credit Counseling

Accessing credit counseling for home buying is more straightforward and affordable than most people realize. Here’s how to find a reputable agency and what to expect in terms of cost.

How to Find a Reputable Counseling Agency

Finding a trustworthy counselor is crucial. Your best starting point is the U.S. Department of Housing and Urban Development (HUD), which maintains a nationwide HUD-approved agency list. You can search for counselors near Von Ormy, San Antonio, or your target area.

Other ways to find a quality agency include:

- Look for certification by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

- Ask potential lenders for recommendations, as they often work with specific HUD-approved agencies.

- Use the Consumer Financial Protection Bureau (CFPB) tool to find housing counselors.

When you contact an agency, ask about their services for homebuyers, their fees, and their process.

Understanding the Costs of credit counseling for home buying

Many credit counseling services are free or very low-cost. Here’s a general breakdown:

- Pre-purchase counseling, a comprehensive assessment before you buy, typically costs between $50 to $130.

- Post-purchase counseling, which helps you manage finances after buying, is often free or may cost $25 to $75.

- Mortgage delinquency counseling (foreclosure prevention) is typically free through HUD-approved agencies.

Many non-profit agencies offer their initial consultation completely free. They also often have fee waiver programs or reduced rates based on your income. Don’t let cost concerns stop you from reaching out. The small investment in counseling could save you thousands on your mortgage through better interest rates and loan terms.

Frequently Asked Questions about Home Buyer Counseling

We hear the same questions from aspiring homeowners in Texas all the time. Here are answers to some of the most common ones about credit counseling for home buying.

Can counseling help me buy a home after a foreclosure or bankruptcy?

Yes, absolutely. A foreclosure or bankruptcy doesn’t mean homeownership is permanently out of reach. Credit counseling specializes in helping people re-enter the housing market after financial setbacks.

Your counselor will help you address past issues and create a plan to rebuild your credit responsibly. While a foreclosure or bankruptcy stays on your credit report for several years, you don’t have to wait that long to buy a home. By establishing a new history of on-time payments and responsible financial behavior, you can demonstrate to lenders that you are now a reliable borrower. Your counselor can also connect you with loan programs for people rebuilding their credit.

How long does it take for credit counseling to improve my chances of buying a home?

The timeline depends on your starting point. However, you’ll see some benefits immediately. After your first session, you’ll have a clear budget and an action plan, which is empowering.

Credit score improvements take longer, typically several months of consistent effort. Disputing errors can bring quick results (sometimes within 30 days), but building a positive payment history takes time. If you enter a Debt Management Plan (DMP), you’re looking at a three to five year commitment to become debt-free. The process is about building sustainable financial health, not finding quick fixes.

What should I bring to my first counseling session?

Being prepared will help you get the most out of your first session. Your counselor needs a full picture of your finances to provide the best advice. Plan to bring the following:

- Proof of income: Recent pay stubs, tax returns, or other documentation.

- Bank statements: From the last few months for all checking and savings accounts.

- Debt statements: For all credit cards, personal loans, student loans, medical bills, etc.

- Monthly expenses: A list of all your regular spending (rent, utilities, groceries, insurance, etc.).

- Your goals: Be ready to share what you hope to achieve, whether it’s saving for a down payment or buying a home in a specific area like San Antonio.

Don’t worry if it’s not perfectly organized. The most important thing is to be honest about your situation and willing to make changes.

Conclusion: Your Path to Homeownership Starts Here

You’re serious about making homeownership happen, and now you know that credit counseling for home buying offers a clear, proven path forward.

You’ve learned how a counselor can help you improve your credit, create a realistic budget, and manage debt to become mortgage-ready. Best of all, these expert services are often free or highly affordable through HUD-approved agencies.

Financial education is about empowerment. Understanding your finances makes you a confident homebuyer, not just a hopeful one.

At Mobile Homes Factory Direct, we believe homeownership is an achievable goal for everyone, regardless of your starting point. We’ve helped buyers with past bankruptcies, foreclosures, and bad credit find their dream homes in Von Ormy, San Antonio, and throughout Texas.

Your path to homeownership starts now. Take the first step and learn about our FICO score improvement program. Let us show you how our flexible financing and expert guidance can turn your dream into your address. The keys to your new home are closer than you think.