Smart Buys: How to Purchase Bank Repo Trailers

Discover how to find and buy bank repo trailers for sale. Save big on affordable housing with our expert guide. Learn pros, cons, and tips.

Why Bank Repo Trailers Offer Smart Savings for Budget-Conscious Buyers

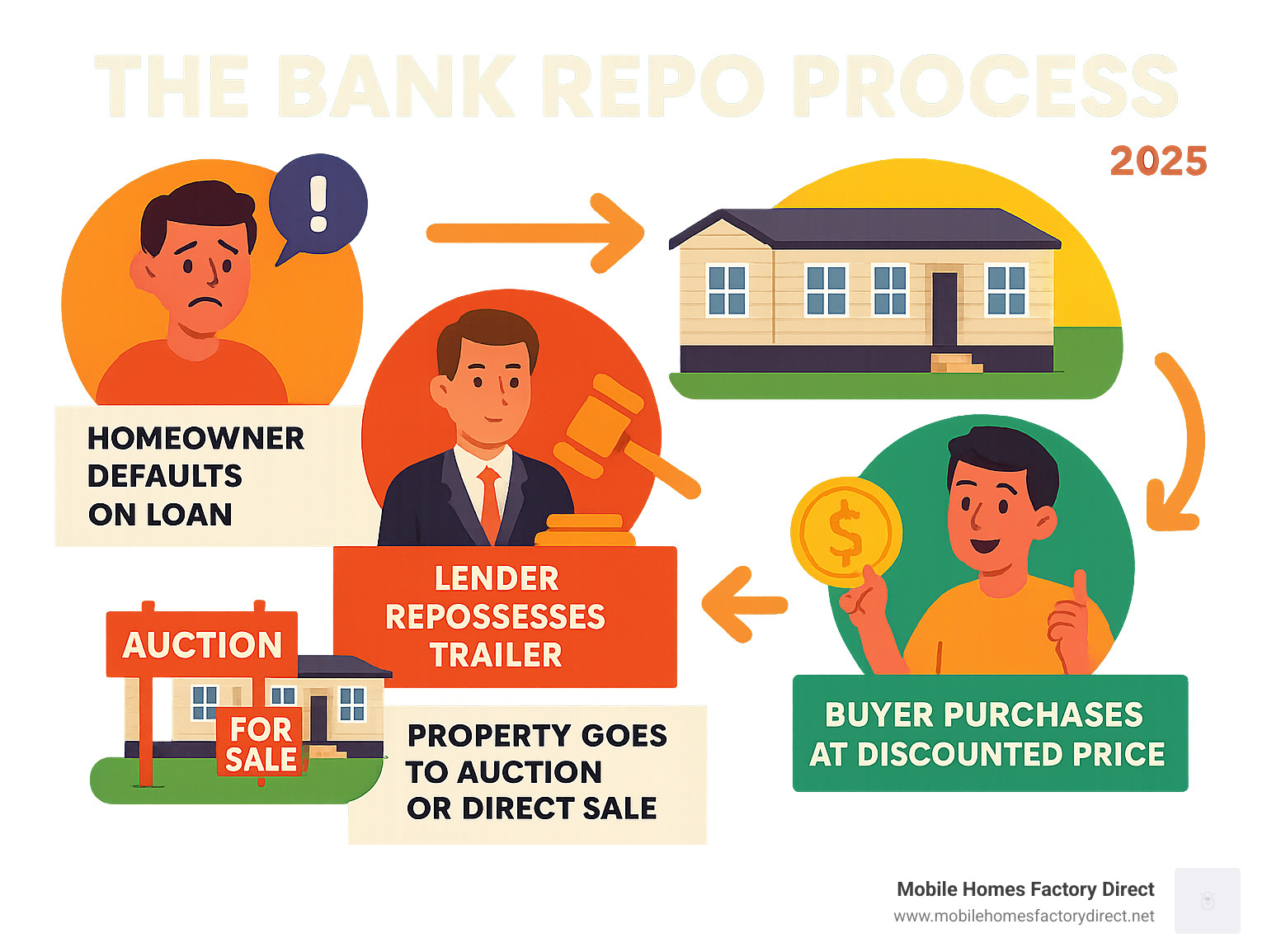

Bank repo trailers for sale represent an affordable path to homeownership, offering significant savings for buyers willing to do their homework. These repossessed manufactured homes become available when owners default on their loans, forcing lenders to recoup losses through quick sales.

Quick Answer for Buyers:

- Where to Find Them: Direct from lenders, specialized dealers, and auction sites

- Typical Savings: 20% or more below market value

- Best Candidates: Cash buyers or those with specialized financing

- Key Requirements: Professional inspection, clear title verification, “as-is” purchase acceptance

Industry data shows repossessed mobile homes can be discounted 20% or more compared to similar non-repossessed properties. This creates opportunities for first-time buyers, investors, and anyone seeking affordable housing solutions.

However, buying a repo trailer has its challenges. These homes are sold “as-is,” so you’ll need to factor in potential repair costs. Financing can also be restrictive, as many traditional lenders hesitate to finance repossessed properties due to their condition.

Success lies in thorough research and professional inspections. As one industry expert noted, “Buyers should always work with legal professionals to ensure they are protected and that all title and ownership paperwork is in order.”

Understanding Bank Repo Trailers: The Pros and Cons

Considering bank repo trailers for sale means stepping into a unique part of the housing market. It can be exciting, but you need to do your homework. Understanding how these homes become available and what they offer helps you make a smart decision.

What Are Bank Repo Trailers and Why Are They Available?

A bank repo trailer is a manufactured home a lender has taken back after the owner couldn’t keep up with loan payments. When payments stop, the lender steps in to protect their investment.

Banks aren’t in the business of being landlords. As financial institutions, a repossessed home is a non-performing asset—dead weight that isn’t making them money.

This creates your opportunity. Lenders want to recover their losses quickly and get these properties off their books. They are motivated sellers who often price these homes below market value to move them fast, creating attractive deals.

These sales happen through direct sales from lenders, specialized dealers like us, or auctions. Lenders focus on asset recovery, not maximizing profit on each property.

The Key Advantages of Buying bank repo trailers for sale

Let’s discuss why bank repo trailers for sale can be a smart move.

The biggest draw is the cost savings, often 20% or more compared to similar homes on the market. For example, a home that normally costs $80,000 might be found for $64,000 or less as a repo. These savings can make homeownership possible.

These properties also offer serious investment potential. Buyers can renovate repos and flip them for profit or turn them into rental properties. The lower purchase price leaves more room in the budget for improvements.

Another advantage is negotiation flexibility. You’re dealing with lenders who view these homes as business assets, not homeowners with emotional attachments. They want them gone and are often more willing to negotiate.

The process can also move quickly. Lenders want reliable buyers who can close the deal efficiently.

For more detailed information about the benefits, check out our guide on Repossessed Mobile Homes.

Buyer Beware: Potential Risks and Downsides

However, buying bank repo trailers for sale has challenges you need to understand.

The biggest issue is that these homes are sold “as-is.” This means you get what you see, problems and all. The lender won’t make repairs; the home’s condition is your responsibility.

Potential damage and lack of maintenance are real concerns. When families face financial hardship, home maintenance is often neglected. You might find anything from minor cosmetic issues to serious problems with plumbing, electrical systems, or structure. Vacant properties can also have pest or weather damage.

Limited financing options can be a hurdle. Many traditional lenders are hesitant to finance repossessed properties due to their condition or title issues. You may need specialized lenders, personal loans, or to pay in cash.

There’s also a risk of legal complications, like issues with the title, liens, or unpaid taxes. This is why due diligence with professionals is so important.

Don’t let these risks scare you away; just go in with your eyes open. The key is a thorough inspection and understanding what you’re buying. Knowledge is power in repo purchases. Understanding the opportunities and challenges will help you find a great deal. For more insights, read our article on Why Should You Get a Repo Mobile Home.

The Ultimate Guide to Finding and Inspecting Bank Repo Trailers for Sale

Finding the perfect bank repo trailer for sale requires patience and the right approach. You can uncover incredible deals that make homeownership affordable.

The key is knowing where to look and what to inspect. First, you find the listings, then you thoroughly inspect the property.

Where to Find Legitimate Listings

You can find legitimate repossessed manufactured homes in several places. Direct from lenders and banks is a good starting point. Many financial institutions have departments for repossessed inventory, but they may not advertise them widely. Call major lenders to ask about their repo inventory.

Specialized dealers like Mobile Homes Factory Direct offer another excellent avenue. We work directly with banks to acquire repossessed units, making them available to you with simplified processes and flexible financing. Since we have locations throughout Texas, including Von Ormy, Somerset, and San Antonio, you can easily visit us.

Dealers specializing in repossessed homes are common and often have relationships with multiple lenders. They can guide you through the unique aspects of repo sales.

Online platforms specializing in repossessed assets are another option. These sites may require registration or involve bidding, but they offer access to a wider range of properties.

The benefit of working with us is that we’ve done the legwork. We have relationships with lenders and acquire quality repossessed homes at competitive prices. To explore your options, see how you can Find Repo Mobile Homes for Sale Near Me.

The Inspection Checklist: What to Look For Before You Buy

Since bank repo trailers for sale are sold “as-is,” a thorough inspection is essential. It’s your insurance against expensive surprises.

We strongly recommend hiring a professional inspector specializing in manufactured homes. They can spot problems an amateur might miss. However, you should also know what to look for.

- Structural integrity and the foundation are your first concern. Check the steel frame for rust or damage. Ensure the foundation blocking properly supports the home and keeps it level. Cracked blocks or shifting piers are red flags for costly repairs.

- Water damage can be a major issue. Examine the roof for leaks. Inside, look for water stains, soft floors, and musty smells that indicate mold or mildew.

- The home’s systems need careful attention. Test the electrical panel, outlets, and switches. Look for exposed wires or burn marks. Check plumbing for leaks under sinks, around toilets, and at the water heater. Test water pressure and drainage.

- HVAC systems should be tested for heating and cooling. Listen for unusual noises and ask about its last service date. Test any included appliances.

- Pest infestations are another concern. Look for signs of rodents, insects, or termites, especially around the foundation and in crawl spaces. These can be expensive to fix.

A professional inspection provides information on necessary repairs and costs. This is invaluable for budgeting and negotiating. Whether it’s a single-wide or a Used Double Wide Mobile Homes for Sale, a thorough inspection prevents future headaches.

Navigating the Purchase: Financing, Legal Steps, and Negotiation

You’ve found a bank repo trailer for sale and completed your inspection. Now it’s time to make it yours. This stage is where preparation pays off, helping you score a great deal and avoid expensive lessons.

Securing Financing for a Repossessed Trailer

Financing a repo home isn’t as straightforward as a traditional mortgage, but it’s achievable with the right approach and partners.

Traditional lenders can be skittish about repo homes due to the “as-is” condition and potential repairs. You might face restrictive terms, higher interest rates, or rejection.

The good news is that specialized lenders understand the repo market. They know a well-chosen repo is a good investment. We have relationships with these partners and offer in-house financing for all credit types, including bad or no credit.

Cash purchases are a golden ticket. Cash eliminates financing headaches and makes you an attractive buyer. Banks prefer cash for a quick, clean transaction.

For smaller or older units, personal loans are an option, but they usually have higher interest rates and shorter terms. Weigh your options to find what works for you.

We’re here to guide you through the Mobile Home Financing process. Always verify your lender’s credentials through NMLS Consumer Access to protect yourself.

Legal and Title Considerations You Can’t Ignore

The legal details are crucial. Cutting corners here can cause major problems later. Getting them right upfront will save you future headaches.

- A title search is non-negotiable. Confirm the title is clear and the lender has the legal right to sell. This helps you avoid inheriting surprise liens or claims.

- Unpaid taxes and fees can be an issue. Previous owners may have left unpaid property taxes, utility bills, or lot rent. Clarify who is responsible for these costs and get it in writing.

- The home’s classification matters. In Texas, manufactured homes can be personal property (with a title) or real property (with a deed). This affects paperwork and taxes. Familiarize yourself with Texas manufactured housing regulations.

- Working with experienced professionals is essential. A reputable dealer, attorney, and title company ensure a smooth transaction and prevent legal issues, even for Repo Mobile Homes with Land for Sale.

Strategies for Negotiating the Best Deal on a bank repo trailers for sale

Negotiating for a bank repo trailer for sale is where you can maximize savings. Banks aren’t emotionally attached; they just want the property off their books.

- Research market values. To negotiate effectively, know what similar homes sell for. Look at comparable sales in your area. Our Mobile Home Pricing Guide is a great starting point.

- Your inspection report is negotiation gold. Use every issue and needed repair to ask for a lower price. If the home’s condition doesn’t match the bank’s assumed condition, the price should reflect that.

- Understand the bank’s motivation. They want a quick, clean sale to a serious buyer who can close without drama. Having financing or cash makes you an ideal candidate.

- Make reasonable, fact-based offers. Present a well-researched offer that accounts for the home’s condition, repairs, and market value. Banks respond better to buyers who have done their homework.

- Be willing to walk away. If the numbers or terms aren’t right, say no. This can motivate sellers to reconsider and prevents you from making emotional decisions you might regret.

Frequently Asked Questions about Bank Repo Trailers

When considering bank repo trailers for sale, it’s natural to have questions. This isn’t a typical home-buying experience. Here are the most common questions we hear from buyers.

What is the typical condition of a repossessed mobile home?

There is no “typical” condition for a repossessed mobile home. Like a used car, it depends on the previous owner and the circumstances of the repossession.

- Pleasant surprises happen. Some homes are only a few years old and in excellent condition, perhaps due to a previous owner’s sudden job loss or medical issue. These homes offer incredible value.

- The reality check: most repos are sold “as-is.” You buy the home in its current condition, and the bank makes no repairs.

- Fixer-uppers are more common. When families struggle financially, maintenance is often neglected. Issues can range from minor cosmetic problems to serious roof, plumbing, or electrical issues. Sometimes, there’s even intentional damage.

This wide range of conditions is why a professional inspection is crucial. It’s the only way to know what you’re buying and to budget for repairs, acting as an insurance policy against surprises.

Are financing options different for repo trailers compared to new ones?

Yes, financing is different and can be the biggest hurdle for buyers of bank repo trailers for sale. It’s more challenging than financing a new home.

- Traditional lenders often get nervous about “as-is” repossessed units. They worry hidden problems could affect the home’s value, making the loan seem riskier.

- Fewer lenders work with repo homes, especially those needing significant repairs. You’ll need to shop around beyond typical banks.

- Interest rates may be higher than for a new home. Lenders might charge more to offset perceived risk, and you may need a larger down payment.

The good news: We have relationships with lenders who understand repossessed manufactured homes. We offer flexible financing for all credit types, including bad or no credit, because we believe everyone deserves a chance at homeownership.

If you’re worried about credit issues, our guide on How to Get a Mobile Home with Bad Credit can help you understand your options.

How much cheaper are bank repo trailers?

This is where repos shine. The savings can be substantial, often 20% or more below the market value of a comparable non-repossessed home.

Why the big discounts? Banks aren’t in the housing business. A repossessed home is a non-performing asset they want to sell quickly. This urgency benefits the buyer.

Let’s talk numbers. While new homes might range from $60,000 to $120,000, comparable repo units could be $40,000 to $96,000 or less. These deals can save families tens of thousands of dollars.

Several factors affect your savings: The home’s condition is the biggest one. Age, location, and how motivated the bank is to sell also play a role. The best deals happen when banks are eager to move inventory.

To get a better sense of how repo prices stack up, check out our comparison of New vs Used Mobile Homes for Sale.

Your Path to an Affordable Home

You now understand bank repo trailers for sale, and it’s time to turn that knowledge into action. You’re armed with the facts, know what to look for, and understand the opportunities and challenges.

Buying a repossessed manufactured home is about smart purchasing that makes homeownership affordable. We’ve seen families transform their lives by turning a repo into their dream home.

Due diligence is your best friend. A professional inspection is your insurance against surprises. Successful buyers do their homework, ask the right questions, and work with experienced professionals.

In Texas, we’ve seen many success stories. From young couples in San Antonio to retirees in Somerset, affordable homeownership through repossessed homes has opened doors.

At Mobile Homes Factory Direct, our mission is to guide you with honesty and expertise. We’re not just selling a home; we’re helping you build a foundation for your future. Our locations across Von Ormy, Somerset, Atascosa, Macdona, San Antonio, Jbsa Lackland, Lytle, Poteet, La Coste, Leming, Natalia, Elmendorf, Castroville, Jbsa Ft Sam Houston, Bigfoot, and Devine mean we’re always nearby to help.

Working with us means we handle the complex details so you can focus on the exciting part. Our flexible financing options mean we might say yes even if traditional lenders have said no.

Ready to take action? Your affordable home could be a repossessed gem waiting for you to see its potential.