The Scoop on Bank Repo Mobile Homes: A Guide to Great Deals

Unlock savings with bank mobile home repos. Our guide helps you find, inspect, finance, and buy your affordable dream home.

What Exactly is a Repo Mobile Home?

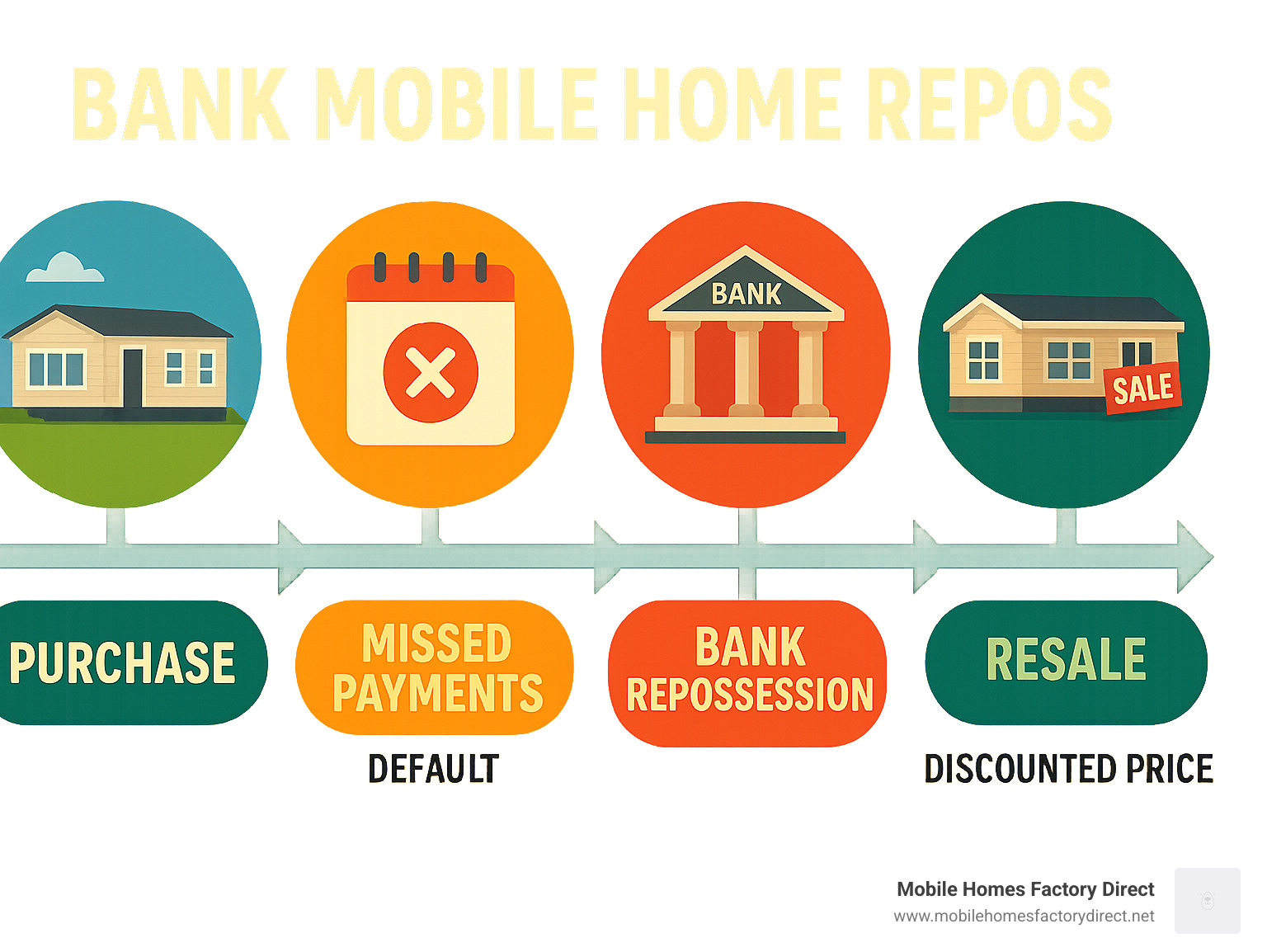

Bank mobile home repos are manufactured homes that lenders have taken back after the original owners defaulted on their loan payments. Financial institutions then sell these homes, often at prices well below their original cost, to recover their losses.

Quick Facts About Bank Mobile Home Repos:

- What they are: Foreclosed manufactured homes owned by banks

- Why they’re cheaper: Banks want to recover loan losses, not make profits

- Typical savings: 30-50% below retail prices

- Condition: Varies widely – some need work, others are move-in ready

- Legal status: Can be personal property or real estate depending on foundation type

The repossession process begins when a homeowner falls behind on payments, leading to the lender legally taking back the home. This process is often faster than traditional house foreclosures because many mobile homes are classified as personal property.

Banks are not in the housing business; their goal is to sell these homes quickly to recoup their losses. This urgency creates significant opportunities for savvy buyers.

The biggest draw is affordability. As one industry expert notes, “Repo mobile homes are usually sold for much less than their original price, which makes them a good deal for people who want a quality home at a lower cost.”

However, these homes are sold “as-is,” meaning you get what you see—including any potential problems.

The Pros and Cons of Buying a Repo Mobile Home

Buying a bank mobile home repo can be a game-changer for families ready to become homeowners. But like any major purchase, they come with both exciting opportunities and real challenges. Understanding the pros and cons is key to finding a great deal and avoiding unexpected repair bills.

The Upside: Major Advantages

Affordability is the biggest advantage, with genuine savings of 30-50% compared to retail prices. Banks aren’t trying to profit; they just want to recover their loan losses, and that urgency works in your favor. This means you can afford more home for your money—perhaps an extra bedroom or a bigger kitchen—and achieve faster homeownership.

The value potential is also significant. Buying below market price can give you instant equity in your home. Since banks want these homes sold quickly, there are often bargaining power and negotiation opportunities you wouldn’t get with a regular sale. Many repo homes are also surprisingly well-maintained, sometimes needing nothing more than a good cleaning.

Want to explore this option further? Check out our guide on Why Should You Get a Repo Mobile Home? for more detailed insights.

The Downside: Potential Risks to Consider

The biggest challenge is the “as-is” condition of most repo sales, meaning there’s no warranty. Required repairs might be obvious, but hidden costs can surprise you. You’ll have limited history on the home’s maintenance, so a thorough inspection is crucial.

Competition can be fierce for the best properties, sometimes leading to bidding wars and requiring quick decisions. You’ll also need to handle logistical considerations like delivery, setup, and utility connections, which are often not included in the sale price. These costs can add up, so it’s important to budget for them.

For a broader look at your options, our comparison of New vs Used Mobile Homes for Sale can help you weigh repo homes against other choices.

The bottom line? Bank mobile home repos can be fantastic opportunities for the right buyer – someone who’s prepared to do their homework, budget for potential surprises, and move quickly when they find the right home.

The Ultimate Guide to Finding and Buying Bank Mobile Home Repos

This guide will walk you through every step of the process for buying bank mobile home repos, from finding your perfect home to holding the keys.

Step 1: Where to Find Repo Mobile Homes for Sale

Finding the right bank mobile home repo requires knowing where to look and being ready to act fast. There are several reliable places to start your search.

Your first stop should be with us at Mobile Homes Factory Direct. We regularly have pre-owned and repo homes in our inventory for the San Antonio area, including Lytle and Devine. Check our dedicated Bank Repos page for our latest available properties.

Bank and lender websites are another goldmine, often listing repossessed properties under sections like “REO Properties” or “Foreclosed Homes.” This gives you access to fresh listings, sometimes before they hit the broader market.

Online marketplaces gather listings from multiple sources, making it easier to compare options and prices. You can filter by price, location, and condition to narrow down your choices.

Don’t overlook local real estate agents who specialize in manufactured housing. They often have insider knowledge about upcoming repos and can be invaluable partners in your search. The repo market moves fast, so checking multiple sources regularly gives you a real advantage.

Step 2: The All-Important Inspection

A thorough inspection is absolutely essential for bank mobile home repos. Since these homes are sold “as-is,” this step is your best protection against unexpected expenses. We strongly recommend hiring a professional inspector who specializes in manufactured homes, as they can spot issues an untrained eye might miss.

Focus on these key areas:

- Structural Integrity: Check floors, walls, and ceilings for sagging or cracks. Examine the chassis and frame underneath for rust or damage.

- Foundation and Leveling: Ensure piers, blocks, and tie-downs are secure for long-term stability.

- Roof and Exterior: Look for missing shingles, tears, or siding damage. Watch for signs of water damage, especially around windows and the roofline, as this can lead to costly mold and structural issues.

- Plumbing and Electrical: Test all faucets, toilets, and outlets. Check for leaks, corrosion, and any electrical panel issues.

- HVAC System: Test both heating and cooling functions and listen for any unusual noises.

- Interior Condition: Assess cosmetic needs like flooring and paint, as these costs can add up.

Also, locate the HUD certification label (red tag on the exterior) and data plate (usually inside a cabinet) to verify the home meets federal safety standards. Never put money down on a repo home without a complete inspection—what you don’t see can hurt your wallet.

Step 3: Navigating Financing and Legal Problems

Before buying a bank mobile home repo, it’s crucial to handle the legal and financial details. A title search and lien verification should be your top priority to ensure the title is clean and free from hidden liens or unpaid taxes. We recommend working with experts who can verify the VIN and check for outstanding tax obligations.

Zoning and permits are also essential. Verify that your chosen home can be legally placed in your desired location and that you can get all necessary permits for transport and setup. Local regulations can differ significantly, even within Texas.

If you plan to place the home in a manufactured home community, you must get park approval in writing before finalizing your purchase. Most parks have specific rules and require background checks.

Understanding the foreclosure process for mobile homes can also help, as it differs depending on whether the home is classified as personal or real property.

Step 4: What Are the Financing Options for Bank Mobile Home Repos?

Financing a bank mobile home repo is more straightforward than you might think. Several options exist, and many lenders work with buyers in various credit situations. At Mobile Homes Factory Direct, we specialize in making financing simple.

- Chattel loans are the most popular option for manufactured homes as personal property. They typically have 15-20 year terms and are available from specialized lenders who may work with credit scores as low as 550.

- FHA Title I loans may be available if the repo home is on a permanent foundation and meets FHA requirements. They offer competitive rates and lower down payments.

- Conventional mortgages are an option if the home is permanently attached to land you own and classified as real property, offering terms up to 30 years.

- Owner financing may be available directly from the selling bank.

- A cash purchase simplifies the process and eliminates interest.

Lenders evaluate your credit history, debt-to-income ratio, and income. We work with many lenders offering flexible financing for all credit types. If you have credit concerns, see our guide on How to Get a Mobile Home with Bad Credit.

For more details, explore our Mobile Home Financing section.

Step 5: Making an Offer and Closing the Deal

Once you’ve found your home, inspected it, and secured financing, it’s time to make an offer and close the deal. Budgeting for costs beyond the purchase price is crucial. Factor in:

- Delivery and Setup: Transportation can be $3-$7 per mile, while professional setup (blocking, leveling, skirting) typically runs $3,250-$10,000.

- Utility Hookups: Water, sewer, and electricity hookups usually cost $1,000-$3,000.

- Site Preparation: If placing the home on raw land, this may include land clearing ($500-$2,000) and foundation work ($2,000-$5,000).

- Repairs and Maintenance: Budget 5-10% of the purchase price for initial repairs and about $1,000 for first-year maintenance.

- Closing Costs: These include origination, title, and appraisal fees.

When making a smart offer, factor in the home’s “as-is” condition and any needed repairs. Research comparable sales to ensure your offer is competitive. Always put your offer in writing with contingencies for inspection and financing.

The closing process timeline is typically 4-6 weeks for home-only loans and 6-8 weeks for land-home packages. Our Mobile Home Pricing Guide can help you prepare a realistic budget.

Repo vs. New: Which Mobile Home is Right for You?

Choosing between a bank mobile home repo and a new manufactured home is a big decision. Both are paths to homeownership, but they offer very different journeys in terms of cost, condition, and customization.

Cost is often the deciding factor. Bank mobile home repos can save you 30-50% upfront compared to new homes. However, new homes offer a pristine, “never-lived-in” feel.

The condition is another key difference. Repo homes are sold “as-is,” potentially with issues like a leaky roof or old appliances. New homes arrive from the factory with no wear and tear.

Customization is a major advantage of new homes, allowing you to choose layouts, flooring, and features. With a repo, you’re limited to the existing design, though renovations are always an option.

New homes also come with manufacturer warranties for peace of mind, covering defects for the first year or more. Repo homes offer no such protection; you are responsible for all repairs.

| Feature | Repo Mobile Home | New Mobile Home |

|---|---|---|

| Cost | 30-50% savings upfront | Higher initial investment |

| Condition | “As-is” with potential issues | Brand new, pristine condition |

| Customization | Post-purchase renovations only | Full design control |

| Warranty | No warranty protection | Manufacturer and dealer warranties |

| Move-in Time | Varies widely | Predictable timeline |

When considering total cost, a repo might need significant repairs, potentially offsetting the initial savings. New homes have more predictable costs. Financing can also be easier for new homes, which often qualify for better loan terms. However, buying a repo at a steep discount can provide instant equity.

So, which is right for you? If you’re handy, on a tight budget, and comfortable with some uncertainty, a bank mobile home repo offers incredible value. If you prefer predictability, full customization, and the peace of mind of a warranty, a new home is likely the better choice.

Both options are smart alternatives when Buying a Mobile Home Instead of a Regular Home. The right choice depends on your budget, risk tolerance, and home improvement skills.

Frequently Asked Questions about Bank Mobile Home Repos

Buying a bank mobile home repo brings up many questions. Here are answers to the most common ones to help you move forward with confidence.

How are bank mobile home repos different from traditional foreclosures?

The main difference is how the home is legally classified: as personal property or real property.

Most mobile homes are titled as personal property (like a car), especially if they aren’t on land you own. These go through a “repossession,” which is a faster process with fewer legal protections for the homeowner than a traditional foreclosure.

A mobile home permanently attached to land you own is considered real property. It goes through the same legal foreclosure process as a traditional house, which is longer and offers more homeowner protections.

Essentially, the process for a repo is often much quicker than a standard home foreclosure.

If you or someone you know is dealing with these challenges, HUD-approved counselors offer free help and guidance.

Can I buy a repo mobile home with land?

Yes, it’s possible to find a bank mobile home repo with land, which can be a fantastic deal. You might find land-home packages where the home and land are sold together, simplifying the process. More often, repos are sold as “home-only” deals. This requires you to buy or lease land separately but offers more flexibility in choosing your location.

We keep an eye out for both types of deals, and you can check our current offerings at Repo Mobile Homes with Land for Sale to see what’s available.

Are there age restrictions for financing a repo mobile home?

The good news is that age restrictions are rarely a deal-breaker. Most lenders focus on condition over age. A well-maintained older home is often more financeable than a newer, neglected one. Appraisers look at structural integrity and overall livability, not just the year it was built.

While lender policies vary—some may offer better rates for newer homes—outright age restrictions are uncommon. The key is finding the right lender, which is why we suggest exploring various Loan Options for Mobile Homes to find the best fit.

Our team has relationships with lenders who regularly finance repo mobile homes of all ages and conditions. We can connect you with financing experts who understand that a quality home is a quality home, regardless of its age.

Your Path to an Affordable Home Starts Here

We hope this guide highlights the incredible opportunity bank mobile home repos represent. With 30-50% savings and the potential for instant equity, they make homeownership possible for many families.

While buying a repo requires due diligence—thorough inspections, legal understanding, and careful budgeting—the rewards can be life-changing. The most important takeaway is that you don’t have to do it alone.

At Mobile Homes Factory Direct, our mission is to make homeownership accessible and straightforward. Our experienced team can guide you through every step, from financing to setup. We offer flexible financing for all credit types, including bad or no credit, because we believe everyone deserves a chance to own a home.

Whether you’re a first-time buyer, a growing family, or looking to downsize, a repo mobile home could be your perfect match. The key is taking that first step.

Ready to start your journey toward affordable homeownership? Explore our available pre-owned homes to find your perfect match! Your new home might be just a click away.