Don’t Let Bad Credit Stop You: Mobile Home Ownership is Possible

Unlock homeownership! Learn how to secure financing for bad credit mobile homes, even with a low score. Start your journey today!

Why Bad Credit Doesn’t Have to Stop Your Dream of Homeownership

Bad credit mobile homes are within your reach—even if you’ve been told “no” by traditional lenders. Thousands of families with credit challenges successfully buy manufactured homes every year through specialized financing programs designed for your situation.

Here’s what you need to know:

- Minimum credit scores for many mobile home loans start at 500-580.

- Down payments typically range from 3.5% to 20%.

- FHA, portfolio lenders, and in-house financing offer paths when banks say no.

- Your credit score is just one factor—income and down payment matter too.

A site-built starter home can cost $260K or more, but a quality manufactured home can be yours for under $100K. This makes them a smart, affordable path to homeownership for people rebuilding their credit. The key is knowing which lenders work with lower credit scores. While prime credit is 720+, scores as low as 500 can still qualify with the right approach.

You don’t need perfect credit. You need the right information. This guide will walk you through understanding your credit, exploring loan options, and preparing a strong application. We’ve helped hundreds of families overcome credit challenges, and we can help you too.

Key bad credit mobile homes vocabulary:

Understanding Your Credit Score and Why It Matters

Your credit score is a snapshot of how you’ve managed borrowed money. Most lenders use FICO scores (300-850). While prime credit (720-850) gets the best rates, many of our clients start in the sub-prime (620-674) or poor (300-619) ranges. A lower score means more risk to a lender, which can lead to a higher down payment or interest rate. However, at Mobile Homes Factory Direct, we partner with lenders who understand that life events like medical bills or divorce happen and that your score doesn’t tell the whole story.

For more guidance on rebuilding your financial foundation, check out our resources on Credit Counseling Bad Credit.

What Credit Score Do You Need?

While traditional lenders often want a 620-640 credit score, specialized programs are more flexible.

- FHA Title II loans (for home and land) consider scores as low as 580.

- FHA Title I loans (for the home itself) can go down to 500, but you’ll need a 10% down payment (vs. 3.5% with a 580+ score).

We’ve helped clients with scores in the mid-500s find flexible lenders. Yes, rates will be higher, but the door isn’t closed. Even a small 20-30 point improvement in your score can save you thousands over the life of your loan, so taking a few months to boost it can be a smart move.

How to Improve Your Credit Before Applying

Improving your credit is about consistent, smart habits. Here are the most effective steps to strengthen your application for financing bad credit mobile homes.

- Check Your Reports: Get free reports from Equifax, Experian, and TransUnion. Dispute any errors immediately, as fixing them can provide a quick score boost.

- Pay Bills On Time: Payment history is the biggest factor in your score. Set up auto-payments to never miss a due date.

- Lower Credit Card Balances: Keep your credit utilization below 30% (e.g., a balance under $300 on a $1,000 limit). This can rapidly improve your score.

- Manage Your DTI: Your debt-to-income ratio (monthly debt payments divided by monthly income) should be as low as possible. Focus on paying down existing debts.

- Avoid New Credit: Hard inquiries from new applications can temporarily lower your score. Avoid opening new accounts in the months before you apply for a home loan.

- Show Stability: Lenders love to see at least two years of stable employment history in the same field.

If you feel overwhelmed, a nonprofit credit counseling service can help create a plan. For more detailed strategies, visit our guide on Bad Credit Repair.

Loan Options for Bad Credit Mobile Homes

Finding the right financing when your credit isn’t perfect is our specialty. The type of loan depends on whether your home is real property (attached to land you own) or personal property (on leased land), which uses a “chattel” loan. We have solutions for both scenarios, connecting you with lenders who look beyond your score to your income stability and employment history. For a complete overview, check our guide on Loan Options for Mobile Homes.

Flexible Financing Programs

These programs make bad credit mobile homes accessible to real families.

- FHA Title I Loans: Finance the home itself (personal property), whether you own the land or lease a lot. Borrow up to $69,678 for the home or $92,904 for the home and lot. You can get approved with a score as low as 500 with 10% down, or 580 with just 3.5% down.

- FHA Title II Loans: Work like a traditional mortgage for manufactured homes on a permanent foundation (real property). This often means better rates. The minimum score is typically 580 with a 3.5% down payment. Learn more about FHA Mobile Home Financing.

- USDA Rural Housing Loans: For eligible rural areas, these government-backed loans offer 100% financing with zero down payment. While they prefer a 640+ credit score, exceptions are made for borrowers with stable income. Your home must be new and permanently installed in a USDA-eligible area.

Down Payment Assistance and Special Programs

Coming up with a down payment can be tough. Fortunately, Texas offers numerous state and local down payment assistance programs (DPAs) that provide grants or forgivable loans to cover these upfront costs. A larger down payment strengthens your application, often resulting in better loan terms and lower interest rates, which is a huge advantage when you have a lower credit score. We encourage you to explore local options on the HUD assistance programs page to find what’s available in your area.

In-House and Portfolio Loan Options

Beyond government programs, other powerful options exist.

- Portfolio Lenders: These institutions keep their loans instead of selling them, giving them the freedom to approve loans based on your whole story, not just a credit score. They might approve a 520 score if you have steady employment and a reasonable explanation for past issues.

- In-House Financing: At Mobile Homes Factory Direct, we offer this directly. You work with us, not a distant bank. Our flexible approach means we often find solutions when others say no, and we’ve helped hundreds of families with scores in the 500s become homeowners. Learn more in our Manufactured Home Mortgage guide.

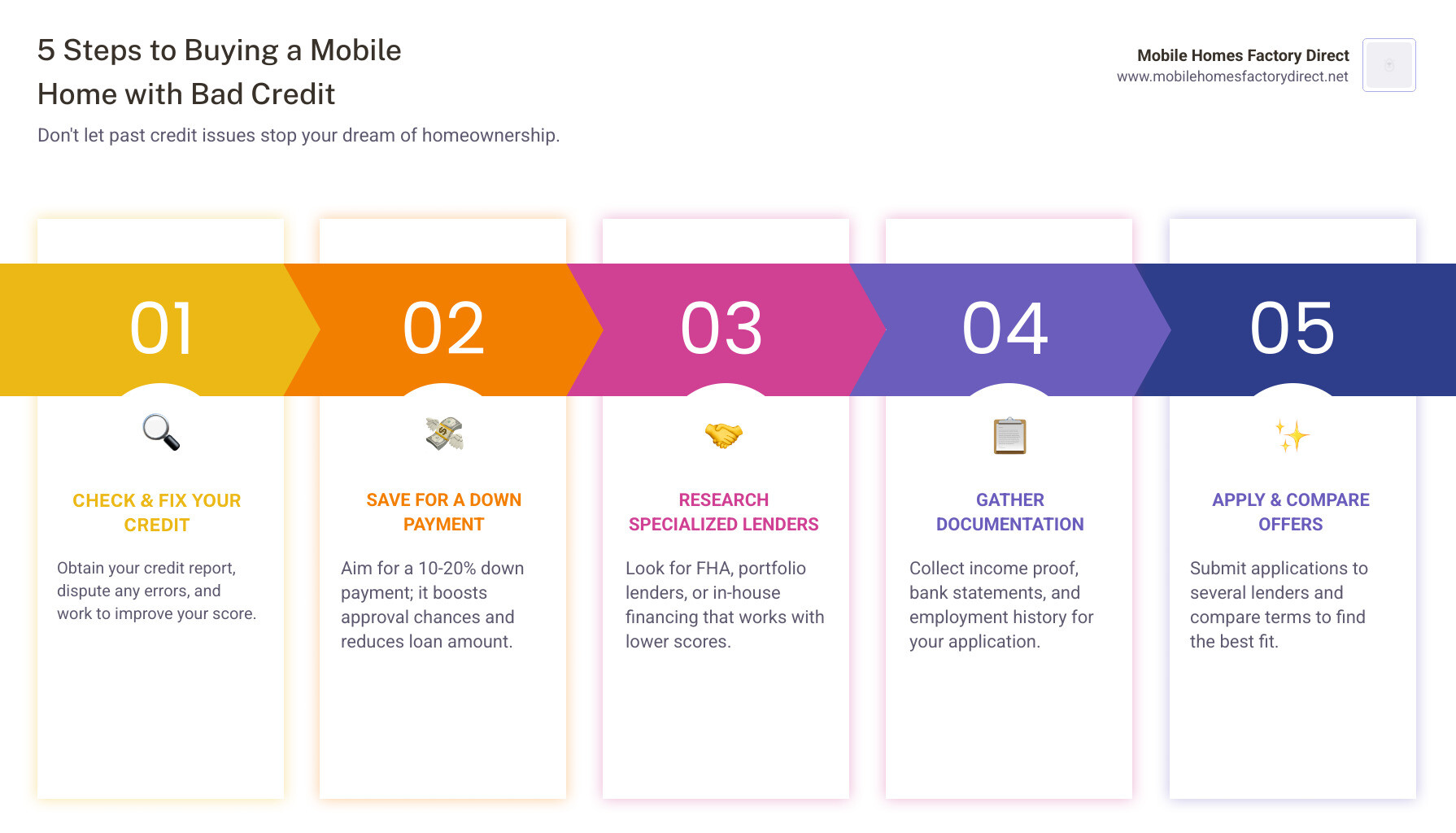

Your Step-by-Step Guide to Getting Approved

Getting approved for a mobile home loan with bad credit is about strategy, not luck. Think of it like preparing for a big interview: you want to show up organized and ready.

The pre-approval process is your secret weapon, giving you a realistic budget before you start shopping. When you work with lenders, be honest. A straightforward explanation for a past job loss or medical emergency can turn a red flag into an understanding moment. Learn more in our Mobile Home Financing 2/Pre-Approval Process guide.

The Power of a Down Payment and Co-Signers

When your credit is low, your down payment is your strongest advocate. While some loans require as little as 3.5-10% down, putting down 10% to 20% can be a game-changer for bad credit mobile homes. It lowers the lender’s risk and can lead to a lower interest rate. If you can’t reach that goal alone, a co-signer or co-borrower with stronger credit can dramatically improve your approval odds. Just ensure everyone understands this is a serious financial commitment that affects both credit histories.

Gathering Your Documentation

An organized application shows responsibility. Before you apply, gather these documents:

- Proof of Income: Recent pay stubs (30-60 days) and W-2s from the last two years. (Tax returns if self-employed).

- Financial Statements: 2-3 months of bank statements.

- Employment History: Proof of stable employment, ideally two years in the same field.

- Identification: A valid photo ID.

- Credit Explanation Letter: A brief, honest letter explaining any negative marks on your credit report.

Having this ready makes the process smoother and faster.

What to Do If Your Application is Denied

A denial isn’t the end. It’s a roadmap for what to fix.

- Ask Why: Lenders must legally tell you the specific reasons for denial (credit score, DTI, etc.). This is crucial information.

- Make a Plan: Focus on improving the problem areas. Pay down debt, save more for a down payment, or work on your credit score.

- Reapply: After a few months of consistent progress, you can reapply. A 30-50 point score increase can make all the difference.

Traditional financing isn’t the only route. If you face repeated denials, it may be time to explore alternative paths. Our No Credit Mobile Homes Ultimate Guide offers more strategies.

Alternative Paths to Homeownership

If traditional financing isn’t an option right now, don’t worry. Bad credit mobile homes are still within reach through alternative paths. These are legitimate solutions that let you move into your own home while you continue to improve your financial health, building equity and a positive payment history.

For more insights on the buying process, explore our Buying a Mobile Home resources.

Lease-to-Own Options for Bad Credit Mobile Homes

A lease-to-own arrangement can be a lifeline. You rent a manufactured home for a set period (usually 1-3 years) with the option to buy it later. A portion of your rent typically goes toward your future down payment. This gives you time to live in the home, repair your credit, and save more money before you need to qualify for a mortgage. Before signing any agreement, have an attorney review the contract to understand the purchase price, rent credits, and maintenance responsibilities.

Finding Affordable Mobile Homes

Manufactured homes are already more affordable than site-built houses, and you can stretch your budget even further.

- Factory-Direct: As a factory-direct dealer, we eliminate middleman markups, offering new homes for under $100,000.

- Used & Repossessed Homes: The used market offers tremendous value. Bank-owned (repo) homes are often sold at deep discounts because the lender wants to move them quickly. Our guides on Repossessed Mobile Homes and Bank Repo Mobile Homes can help you steer these opportunities.

- “As-Is” Homes: These homes are sold at a lower price, reflecting that you accept them in their current condition. If you’re handy, this is a great way to build instant equity.

Always get a thorough inspection before buying any used or “as-is” home to avoid costly surprises. Factor in all costs—purchase price, transport, setup, and repairs—when calculating your budget.

Frequently Asked Questions about Mobile Home Financing

We hear from families every day who have questions about financing, especially with imperfect credit. Let’s clear up some common concerns about bad credit mobile homes.

What’s the difference between mobile, manufactured, and modular homes for financing?

The terms matter for financing, as they are not interchangeable.

- Mobile Homes: Built before June 15, 1976, with no national building code. They are harder to finance and often require specialized chattel loans.

- Manufactured Homes: Built after June 15, 1976, to a national HUD code. This standardization makes them much easier to finance. If placed on a permanent foundation on land you own (real property), they can qualify for traditional mortgages. If on leased land (personal property), you’ll likely use a chattel loan.

- Modular Homes: Built in sections to the same local codes as site-built homes. They are financed with standard mortgages.

For bad credit buyers, the manufactured home category offers the most flexible options, like FHA programs and chattel loans.

How do interest rates and loan terms work for bad credit mobile homes?

It’s important to have realistic expectations. With bad credit, interest rates will be higher to offset the lender’s risk. For chattel loans, rates can be 2-5% above traditional mortgage rates. While this means paying more over time, you’re building equity instead of paying rent. Loan terms typically range from 15 to 25 years. A shorter term means a higher monthly payment but less interest paid overall. Be prepared for associated fees like closing costs (2-5% of loan), origination fees, appraisal fees, and title fees. Always look at the total cost of the loan, not just the interest rate. You can check Current Manufactured Home Mortgage Rates to get a general idea of the market.

Can I get a mobile home loan with a 500 credit score?

Yes, it’s possible, but it requires the right strategy and expectations.

- FHA Title I loans are a great option, accepting scores as low as 500 if you have a 10% down payment. (This drops to 3.5% down with a 580 score).

- Specialized portfolio lenders, like those we work with, may also approve scores in the low 500s if you have compensating factors like stable income and a low debt-to-income ratio.

With a 500 score, expect to provide a higher down payment (at least 10%) and pay a higher interest rate. A co-signer with strong credit can dramatically improve your approval odds and help you secure a better rate. It’s challenging but far from impossible, and we specialize in finding solutions for this exact situation.

Conclusion

The truth is, owning a bad credit mobile home is not just a dream—it’s an achievable goal for families across Texas. Your credit score is part of your past, but it doesn’t have to dictate your future.

You’ve learned that scores as low as 500 can qualify, that a solid down payment is a powerful tool, and that specialized lenders are ready to help. A quality manufactured home under $100K makes ownership affordable now, not someday.

At Mobile Homes Factory Direct, we specialize in flexible financing for all credit types. We’ve helped hundreds of families in Von Ormy, San Antonio, and beyond become homeowners, and we’re here to help you too.

Your path forward starts today. Let’s build your future together.