From FICO Fumbles to Front Door Keys: Securing Your Home with Bad Credit

Dream of homeownership? Discover flexible financing and strategies for a bad credit home purchase. Your new home awaits!

Introduction: Your Path to Homeownership Starts Here

A bad credit home purchase might seem impossible, but thousands of families prove otherwise every year. While traditional lenders often slam the door on borrowers with credit scores below 620, specialized financing options and government-backed programs can still open the path to homeownership.

Here’s your quick roadmap to securing a home with bad credit:

Main Options for Bad Credit Home Buyers:

- FHA loans – Accept scores as low as 500 with 10% down

- Chattel loans – For manufactured homes, flexible credit requirements

- In-house financing – Direct dealer financing with custom terms

- Private lenders – Asset-based lending focusing on property value

- Co-signer loans – Leverage someone else’s good credit

Key Requirements:

- Credit score of 500+ (varies by program)

- Down payment of 3.5-20% depending on loan type

- Debt-to-income ratio under 43%

- Stable employment history (2+ years preferred)

- Cash reserves for closing costs

Expected Costs:

- Interest rates 1-4% higher than prime borrowers

- Higher down payment requirements

- Additional fees and mortgage insurance

The truth is simple: bad credit makes buying harder and more expensive, but not impossible. With the right lender and financing program, you can still achieve homeownership while rebuilding your credit for the future.

The key is understanding which programs accept your credit situation and how to strengthen your application in other areas. Let’s explore exactly how to turn your credit challenges into homeownership success.

Understanding the Landscape: What is a “Bad Credit” Score for a Home Purchase?

When we talk about a bad credit home purchase, it all comes down to your credit score. Lenders see this 300-850 FICO score as a financial report card. A lower score signals you’re a higher risk borrower, making lenders more cautious.

Lenders may pull different FICO scores (like Score 2, 4, or 5) from Experian, TransUnion, or Equifax, so slight variations are normal.

Your score directly impacts your approval chances, interest rates, and lender options. But even with bad credit, homeownership is still achievable.

You can get a better sense of what rates might be available to you by checking out this helpful tool: Explore mortgage rates with this tool from the CFPB.

How a Low Score Affects Your Home Financing

A low score presents challenges, but understanding them is key. The biggest impact is higher interest rates. While a top-credit borrower might get a 6% rate, you could face 8-12% or more. On a $150,000 manufactured home loan, that could mean paying $200-400 more monthly. These increased monthly payments also limit your purchasing power, as a higher rate means a smaller approved loan amount.

You’ll also likely face higher insurance premiums. Many programs require mortgage insurance when you put down less than 20%, and bad credit can make these premiums more expensive.

You’ll also face limited lender options. Traditional banks often won’t work with borrowers below certain credit scores, pushing you toward alternative lenders with potentially stricter loan terms, like larger down payments.

The good news? Specialized lenders like Mobile Homes Factory Direct understand these challenges and offer flexible solutions designed specifically for buyers in your situation.

What Credit Score is Considered ‘Bad’ for a Home Purchase?

Scores below 620 are challenging for most traditional lenders, making many conventional loans unavailable or have less favorable terms.

A score between 580-669 is “fair credit,” which still means limited options and higher costs.

Scores below 580 are considered “poor credit,” and while most traditional programs are off the table, specialized programs still exist.

Different lender-specific standards mean what’s “bad” to one lender might be acceptable to another. Some manufactured home lenders work with scores as low as 500, especially when you’re buying the home as personal property rather than real estate.

When your credit puts you in the subprime category, you’ll pay more and have fewer choices, but you’re definitely not out of options. The key is finding the right lender who specializes in working with your credit situation – and that’s exactly what we do at Mobile Homes Factory Direct.

Your Home Financing Playbook: Top Options for a Bad Credit Home Purchase

A bad credit home purchase is possible. While your options differ from someone with perfect credit, real paths to homeownership exist. This playbook covers flexible financing, specialized programs for manufactured homes, and alternative routes for when traditional lenders say no.

Flexible Financing Solutions from Mobile Homes Factory Direct

At Mobile Homes Factory Direct, we believe your credit score is just one part of your financial story. We help families turned away by traditional lenders by taking the time to understand their whole situation.

Our programs work with buyers who have credit scores of 500 and above. That might sound impossible if you’ve been hearing “no” from other lenders, but it’s real. We offer low down payment options and work with in-house financing programs that let us look beyond just that three-digit number.

We focus on custom solutions for manufactured and mobile homes. We understand that life happens, so we can often work with situations like steady but non-traditional income or past financial rough patches.

Our team has helped families in Von Ormy, San Antonio, Laredo, Corpus Christi, New Braunfels, and Victoria turn their credit challenges into home keys. If you’re ready to explore what’s possible, check out our detailed guide on Financing for Mobile Homes with Bad Credit.

Specialized Financing for Manufactured Homes

Manufactured homes offer unique financing advantages for buyers with bad credit.

Chattel loans are a flexible option where the home serves as collateral, similar to a car loan. This leads to more relaxed credit requirements. While rates may be higher (5-10%) and terms shorter (15-20 years), these loans close faster with simpler applications.

FHA loans can be absolute game-changers for manufactured homes. These government-backed loans accept credit scores as low as 500 if you can put down 10%, or 580 with just 3.5% down. Yes, you’ll pay mortgage insurance, but the flexible credit requirements make homeownership possible for many families who thought they were out of options. Learn more about FHA Mobile Home Financing to see if this path fits your situation.

Conventional loans through Fannie Mae and Freddie Mac guidelines can work if your manufactured home is permanently attached to land you own. These typically need credit scores around 620 to 660, but they offer longer 30-year terms and often lower interest rates. If your credit is climbing back up, this might be worth waiting for.

Alternative Paths When Traditional Routes Are Blocked

Sometimes you need to get creative, and that’s perfectly okay. When traditional lenders say no, these alternative approaches have opened doors for many families pursuing a bad credit home purchase.

In-house financing allows us to look at your complete financial picture, not just a credit score. We consider factors like stable employment and your overall financial situation, an approach that often makes the difference for approval.

Asset-based lending focuses on the value of the home you’re buying rather than your credit history. If you can bring a substantial down payment – say 20% or more – some private lenders will work with you based on the property’s value and your equity. These are often shorter-term solutions, maybe 1 to 3 years, giving you time to improve your credit before refinancing into better terms.

Higher down payments consistently open doors that seemed closed. When you put down 20% or more, you’re showing serious commitment and reducing the lender’s risk significantly. This single factor can transform a “no” into a “yes” across many different types of lenders.

These alternative paths are often stepping stones. You might start with a higher rate, but making consistent payments allows you to rebuild credit and refinance into better terms later. For more guidance on building credit for a home purchase, explore our No Credit Mobile Homes Ultimate Guide.

Strengthening Your Application: What Lenders See Besides Your Score

Your credit score is only part of the story. For a bad credit home purchase, lenders examine other factors you can control to strengthen your application. While improving your credit score takes time, boosting these other areas can quickly improve your approval chances.

Building a Strong Financial Profile for a Bad Credit Home Purchase

Lenders want to feel confident you can handle your mortgage payments. Here’s how to show them you’re a safe bet, despite past credit challenges.

Your down payment is your secret weapon. While some programs allow as little as 3.5% down, putting down 20% or more can completely change your application’s appeal. It reduces the lender’s risk and often lets you avoid private mortgage insurance (PMI), saving you money monthly.

Keep your debt-to-income ratio in check. Lenders typically want to see your total monthly debt payments stay under 43% of your gross monthly income. If you’re currently over this threshold, focus on paying down high-interest debts like credit cards before applying for your mortgage.

For example, if you earn $5,000 per month, your total debt payments (including the new mortgage) should ideally stay under $2,150. This shows lenders you have breathing room in your budget.

Cash reserves provide peace of mind. Having 3-6 months of mortgage payments saved after your down payment and closing costs shows lenders you’re prepared for emergencies and financially mature.

Stable employment history matters enormously. Lenders love consistency. A two-year work history with the same employer or in the same field shows you have reliable income. If you’re self-employed, you’ll need tax returns and bank statements proving consistent earnings over time. Recent job changes aren’t necessarily deal-breakers, especially if you stayed in the same industry or received a promotion. Just be prepared to explain any employment gaps or career shifts.

Assembling Your Documentation for a Bad Credit Home Purchase

Getting your paperwork organized ahead of time makes the entire process smoother and shows lenders you’re serious.

Income documentation forms the foundation of your application. You’ll need recent pay stubs (usually the last 30 days), W-2 forms from the past two years, and federal tax returns for the same period. Self-employed buyers should also prepare profit and loss statements showing consistent income.

Bank statements from the past two months prove you have funds for your down payment and closing costs. Lenders want to see this money has been in your accounts for a while, not suddenly deposited from unknown sources.

Don’t forget your photo ID – something as simple as a driver’s license or passport.

Prepare a Letter of Explanation (LOX) for any negative items on your credit report. Be honest and concise, focusing on what you’ve learned and how things have improved. This humanizes your application and shows responsibility.

If family members are helping with your down payment, you’ll need gift letters stating these funds are gifts, not loans that need repayment. This prevents lenders from counting these amounts as additional debt obligations.

Finally, gather property information about your manufactured home, including details about its make, model, year, and where it will be located. This helps lenders assess the home’s value and determine appropriate loan terms.

The Comeback Plan: How to Improve Your Credit for a Home Purchase

You don’t have to stay stuck with poor credit. Improving your score creates a positive cycle: better credit leads to lower interest rates and more affordable payments. Your score is a snapshot that can change as you build better financial habits. Whether you buy now with flexible financing or wait to improve your options, every point you gain opens new doors.

Short-Term Fixes and Long-Term Strategies

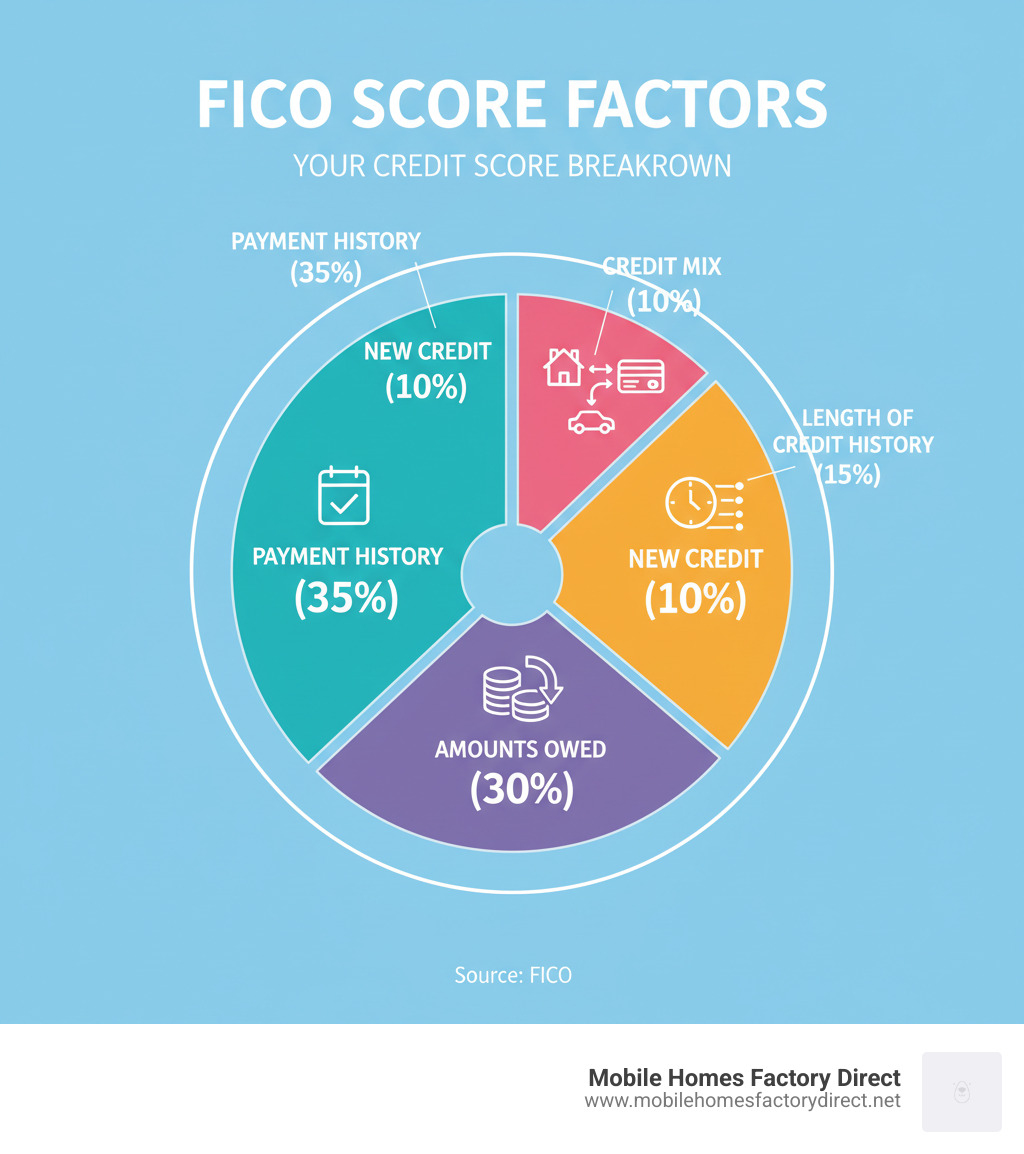

The foundation of credit improvement rests on understanding what actually moves your score. Payment history carries the most weight at 35% of your FICO score, so making every payment on time becomes your most powerful tool. Set up automatic payments if you need to – whatever it takes to avoid those costly late marks.

Your credit utilization comes in second at 30% of your score. This means keeping your credit card balances low compared to your limits. If you have a $1,000 credit limit, try to stay under $300. Paying down those high balances can boost your score faster than almost anything else you can do.

Avoiding new credit applications protects your score from unnecessary dings. Each application creates a hard inquiry that can lower your score temporarily. In the months before applying for your home loan, resist the temptation to open new accounts or chase those store credit card offers.

Keeping old accounts open helps your credit age, which makes up 15% of your score. That first credit card you got years ago? Keep it active with small purchases you pay off immediately. Closing old accounts can actually hurt your score by shortening your credit history.

Disputing credit report errors can provide quick wins if you find mistakes. Check your reports from all three bureaus and challenge anything that doesn’t look right. Sometimes a simple dispute can remove an error that’s been dragging down your score unfairly.

For those starting from scratch or rebuilding after major credit damage, secured credit cards or credit-builder loans create positive payment history. These tools require upfront money but give you a chance to prove you can handle credit responsibly.

How Long Does It Take to Rebuild?

The timeline for credit recovery depends on where you’re starting and how damaged your credit has become. Most people see noticeable improvements within 6 to 12 months of consistent effort. That might be enough to move you from “poor” to “fair” credit, opening up better financing options.

If you’ve been through major financial setbacks, the recovery takes longer but isn’t impossible. Bankruptcy typically requires a waiting period of at least two years before most conventional lenders will consider you, though some specialized programs may work with you sooner. Foreclosure stays on your credit report for up to seven years, but its impact lessens over time.

The key is remembering that negative items lose their punch as time passes. That missed payment from two years ago hurts less than one from last month. Meanwhile, every on-time payment you make today builds positive momentum for tomorrow.

Even if you decide to move forward with a bad credit home purchase right now, continuing to work on your credit sets you up for refinancing later. Imagine starting with a 9% interest rate today, then refinancing to 6% in two years after improving your score. On a $200,000 loan, that difference saves you over $400 per month.

Credit repair isn’t glamorous work, but it’s some of the most valuable work you can do for your financial future. Every point you gain is money back in your pocket when it’s time to buy or refinance your home.

Frequently Asked Questions about Bad Credit Home Purchases

We get calls every day from folks who think their credit score has slammed the door on homeownership. The good news? Most of their worries are based on outdated information or myths they’ve heard. Let’s clear up the confusion with straight answers to the questions we hear most often about bad credit home purchases.

Can I buy a manufactured home with a 500 credit score?

Yes, a 500 credit score doesn’t disqualify you from buying a manufactured home. While traditional banks might turn you away, we work with buyers in your exact situation every single day.

Here’s what makes manufactured homes different: we have specialized financing programs designed specifically for people with credit challenges. At Mobile Homes Factory Direct, our in-house financing looks at the whole picture – not just three digits on a credit report. We consider your income stability, your willingness to put money down, and your commitment to making payments.

What to expect with a 500 credit score:

- Higher down payment requirements (often 15-25%)

- Interest rates above prime lending rates

- Shorter loan terms in some cases

- Focus on your current ability to pay rather than past credit mistakes

The key is finding the right lender who understands manufactured home financing. We’ve helped hundreds of families with credit scores in the 500s become homeowners, and we’d love to explore your options too.

What is the minimum down payment with bad credit?

The down payment requirements vary quite a bit depending on which financing route you take, but there are options for different budget levels.

Government-backed programs offer some of the lowest down payment options. FHA loans allow just 3.5% down if your credit score is 580 or higher. If you’re in the 500-579 range, you’ll need 10% down, but that’s still very manageable for many families.

Chattel loans for manufactured homes typically require 10-20% down. These loans treat your home as personal property rather than real estate, which often means more flexible credit requirements but higher down payments.

In-house financing gives us the most flexibility to work with your specific situation. Depending on your credit score, income, and the home you’re purchasing, we might work with down payments ranging from 10-25%. The higher your down payment, the better terms we can often offer.

Here’s the reality: a larger down payment is your best friend when you have bad credit. It reduces the lender’s risk, shows your commitment, and often open ups better interest rates. Even an extra 5% down can make a significant difference in your loan approval and terms.

Are interest rates much higher for bad credit home financing?

We won’t sugarcoat this – yes, interest rates are typically higher when you have bad credit. Lenders charge more because they’re taking on additional risk. But “higher” doesn’t mean “impossible to afford.”

The rate difference can range from 1-4 percentage points higher than what someone with excellent credit would pay. While prime borrowers might see rates in the low-to-mid 4% range, you might be looking at rates in the 6-10% range, depending on your specific credit situation and the lender.

Here’s a real-world example: On a $400,000 mortgage, a borrower with a 570 credit score might pay around $2,324 monthly with a B lender at 4.99%. Someone with a 500 score using a private lender at 7.49% might pay $2,497 monthly. That’s about $173 more per month – significant, but not necessarily out of reach.

Why shopping around matters: Different lenders specialize in different credit ranges. One lender might quote you 9%, while another offers 6.5% for the exact same situation. We work with multiple lending partners specifically to find you the best rate available for your credit profile.

The silver lining: These higher rates don’t have to be permanent. Many of our clients improve their credit over 12-24 months, then refinance into better rates. Think of your first loan as a stepping stone to homeownership, not a life sentence.

The bottom line is this: bad credit makes financing more expensive, but it doesn’t make it impossible. With the right approach and realistic expectations, you can still achieve homeownership and work toward better rates in the future.

Conclusion: From Applicant to Homeowner

Your dream of homeownership is absolutely within reach, even if you’re facing a bad credit home purchase. We’ve walked alongside hundreds of families who thought their credit challenges had locked them out forever, only to see them proudly holding keys to their new manufactured home just months later.

The truth is, your credit score is just one chapter in your financial story – not the final page. Throughout this guide, we’ve shown you that lenders look at the complete picture of who you are as a borrower. Your stable job, your savings, your commitment to making payments – these all matter just as much as those three digits on your credit report.

Remember the key strategies that can transform your application from a rejection into an approval. A solid down payment shows lenders you’re serious about this investment. Keeping your debt-to-income ratio low proves you can handle monthly payments comfortably. Having cash reserves in the bank demonstrates you’re prepared for homeownership’s responsibilities.

The financing landscape for manufactured homes offers unique opportunities that traditional home buyers simply don’t have. Chattel loans, FHA programs, and in-house financing create multiple pathways to homeownership, each designed to work around different credit situations. These aren’t consolation prizes – they’re legitimate, effective ways to secure quality housing for your family.

At Mobile Homes Factory Direct, we’ve built our entire business around one simple belief: everyone deserves a shot at homeownership. We’ve helped people from all walks of life—from single parents with past bankruptcies to young couples with student loan debt—become proud homeowners.

Our expertise in flexible financing for manufactured and mobile homes throughout Von Ormy, San Antonio, Laredo, Corpus Christi, New Braunfels, and Victoria means we understand exactly which programs work best for different situations. More importantly, we know how to present your application in the strongest possible light.

Your credit challenges don’t define your future – they’re simply obstacles we can work around together. While you’re securing your home today, you can also be building toward better rates tomorrow. Every on-time payment you make on your new mortgage helps rebuild your credit score, setting you up for refinancing opportunities down the road.

The path from applicant to homeowner might look different than you originally imagined, but it’s absolutely achievable. Don’t let past financial mistakes steal your family’s future security and stability. Take that first step with us, and let’s turn your homeownership dreams into reality.

Ready to start building your credit for even better opportunities ahead? Take the next step with our FICO Score Improvement Program and create the financial foundation you deserve.