Unlocking the Door: Government-Backed Home Loans for Bad Credit

Unlock homeownership with bad credit home loans for manufactured homes. Discover government-backed and flexible financing options.

Why Bad Credit Doesn’t Have to Block Your Path to Homeownership

Bad credit home loans are specialized financing options for borrowers with credit scores below 670, offering alternative pathways to homeownership when traditional mortgages aren’t available.

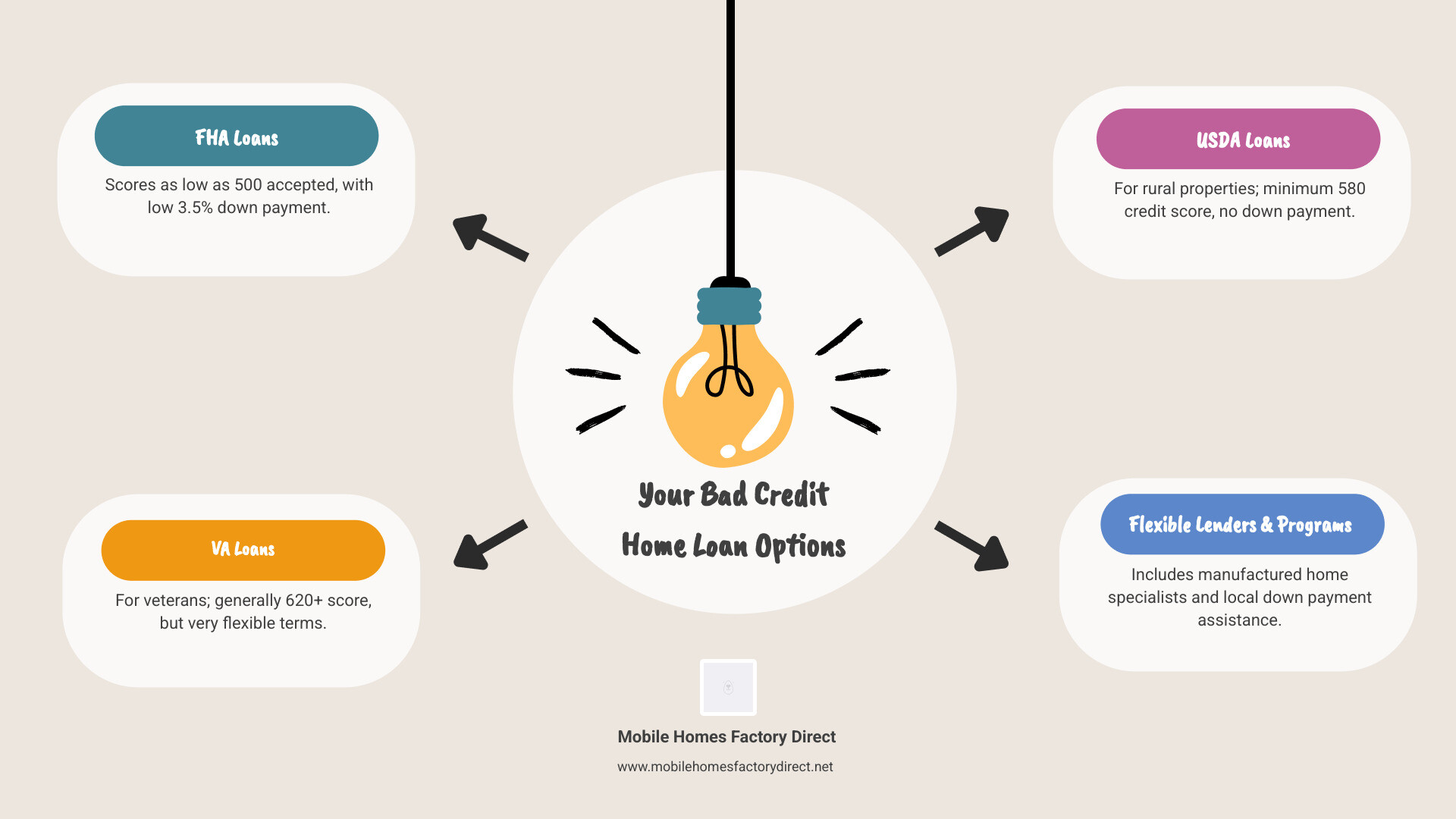

Quick Answer: Your Bad Credit Home Loan Options

- FHA Loans – Credit scores as low as 500 accepted (580 for 3.5% down payment)

- VA Loans – For veterans, typically require 620+ credit score but more flexible

- USDA Loans – Rural areas, minimum 580 credit score, no down payment

- Alternative Lenders – Manufactured home specialists, flexible credit requirements

- Government Programs – State and local down payment assistance programs

If you’re facing credit challenges, you’re not alone. People with bad credit can still get mortgages—you just need to know where to look.

Life events like job loss, medical bills, or divorce can damage your credit. The good news is that government-backed loans and specialized lenders exist to help people in your situation.

While traditional banks might say no, homeownership isn’t impossible. Government programs like FHA loans accept scores as low as 500, and manufactured home lenders often work with borrowers who have scores of 500 or higher.

The key is understanding your options and choosing the right path. Whether you’re looking at a manufactured home or exploring government-backed financing, real solutions are available today.

Understanding What “Bad Credit” Means for a Mortgage

The term “bad credit” can feel scary, but it isn’t as black and white as you might think and doesn’t have to crush your homeownership dreams.

For mortgages, “bad credit” usually refers to a FICO score below 670. Your credit score ranges from 300 to 850. While prime lenders prefer scores above 670, many alternative lenders work with borrowers who have scores of 500 or higher.

The ranges typically break down as follows: scores above 740 are excellent, 670-739 are good, 580-669 are fair, and below 580 is challenging—but not impossible.

Your credit score reflects several key factors. Payment history is the biggest (35% of your score), so late payments hurt. Credit utilization—how much available credit you’re using—accounts for about 30%. Your credit history length, credit types, and new credit applications round out the picture.

When your score is low, lenders see you as a higher-risk borrower. It’s not personal; smart lenders know that people with credit challenges can still be excellent borrowers with the right loan.

If you’re working to improve your credit, check out our FICO Score Improvement Program for practical steps.

What Do Lenders Consider Besides Your Score?

Your credit score isn’t the whole story. Lenders look at your complete financial picture, and there are ways to strengthen your application even with a lower score.

Income stability is huge. Lenders want to see a reliable way to make monthly payments. A steady job history shows you’re dependable. If you’re self-employed, you’ll need extra documentation like bank statements or tax returns to prove your income.

Cash reserves beyond your down payment are a game-changer. Money in the bank shows lenders you can handle unexpected expenses, acting as a safety net.

A larger down payment reduces the lender’s risk because you have more skin in the game. It also lowers your loan-to-value ratio, which helps offset credit concerns.

Employment history tells a story about your reliability. Lenders prefer consistent work, but they understand life happens. Be ready to explain any job changes honestly.

The property type matters. Modern manufactured homes are built to strict standards and can be excellent collateral, often appreciating in value just like traditional homes when placed on owned land.

Your debt-to-income ratio shows how much of your monthly income goes to debt. Lower is better, but many lenders work with ratios up to 43% or higher in special cases.

How a Low Score Impacts Your Loan

A lower credit score will change your loan terms, but it’s not the end of the world.

Higher interest rates are the biggest impact. Lenders charge more interest to balance the risk, meaning higher monthly payments. You can always refinance later when your credit improves.

You might also see increased fees like higher origination or processing costs. This is often worth it to get into your own home now rather than waiting years.

Stricter terms are common with bad credit home loans. You might have fewer loan options or need to meet additional requirements, like shorter loan terms.

Having limited lender options can work in your favor. You’ll work with specialized lenders who understand your situation, rather than trying to fit a big bank’s rigid requirements.

The key is finding lenders who specialize in your situation. You can compare mortgage rates with this tool to get a sense of what’s available.

Getting approved with less-than-perfect credit is often the first step toward rebuilding your financial future. Every on-time payment helps improve your credit score.

Your Guide to Government-Backed Bad Credit Home Loans for Manufactured Homes

The government has your back when it comes to homeownership. Even with credit challenges, programs exist to help you own your own home.

These programs exist because lawmakers know that bad credit doesn’t define your ability to be a responsible homeowner. Life events can damage a credit score, but that shouldn’t lock you out of homeownership.

Government agencies like the FHA have created loans with easier qualification standards, lower down payments, and more flexible terms than traditional loans. These are valuable for manufactured home buyers, recognizing them as a smart, affordable path to homeownership.

FHA Home Loans for Manufactured Homes

The FHA designs its loan programs for those without perfect credit. For bad credit home loans, FHA Title I loans for manufactured homes might be what you need.

FHA loans are accessible: you can qualify with a credit score as low as 580 and put down just 3.5%. If your score is between 500-579, you’ll just need a 10% down payment.

Government insurance makes this flexibility possible. When the FHA insures your loan, lenders are more comfortable working with borrowers who have credit challenges. You’ll pay mortgage insurance premiums (MIP), but this cost opens the door to homeownership.

FHA loans work well for manufactured homes because they recognize that modern manufactured homes are built to strict HUD standards. These are quality homes that can appreciate in value, especially on land you own.

We know the ins and outs of FHA financing for manufactured homes. You can learn More about FHA financing on our website to see if this option fits your situation.

State and Local Programs

Don’t overlook local help. Many states and communities offer programs that make homeownership more affordable, especially when combined with federal aid.

Down payment assistance programs provide grants or low-interest loans to cover upfront costs. Some programs offer credit counseling services to help improve your credit health.

First-time buyer grants provide financial aid for a first home purchase, and some areas have programs that specifically support manufactured home buyers. These local programs recognize the important role of manufactured homes in providing affordable housing.

As your local dealer in Von Ormy, TX, we stay up-to-date on all available state and local programs. We’ll help you identify and apply for any assistance to make your path to homeownership smoother.

Flexible Financing Options from Mobile Homes Factory Direct

Your credit score is just one chapter of your story. At Mobile Homes Factory Direct, we’ve seen hardworking families turned away by traditional banks. That’s why we’ve built our financing around real people, not just numbers on a credit report.

We believe everyone deserves a chance at homeownership. We’re here to help you find a path forward with bad credit home loans that make sense for your situation.

Manufactured Home Loans with Flexible Credit Requirements

The manufactured home industry has come a long way. Today’s homes are built to strict HUD Code standards, creating high-quality, durable homes that can appreciate in value, especially when you own the land.

This shift has opened doors for flexible financing. We work with personal property loans (chattel loans), which treat your home as personal property. These are perfect for homes on leased land and often have faster closing times and simpler requirements than traditional mortgages.

Your home serves as collateral, giving lenders the confidence to work with borrowers who might not qualify elsewhere. While the terms might be different from conventional mortgages (often shorter), they provide a real pathway to owning your home.

Check out our detailed guide on Loan Options for Mobile Homes to see what might work best for you.

What Are My Options for Bad Credit Home Loans?

When traditional lenders say no, we’re just getting started. We have several approaches to help people with credit challenges find financing:

- Our flexible in-house financing options let us work directly with you, focusing on your unique situation instead of rigid bank requirements.

- Our alternative income programs look at your actual earning potential, which is ideal for self-employed individuals or those with non-traditional income.

- Our guaranteed equity approval programs can leverage equity in a property or a substantial down payment to secure your loan, even when credit is a concern.

We partner with alternative and private lenders who specialize in working with credit scores of 500 or higher. The rates are competitive within the bad credit home loans market and give you a real chance at homeownership. Learn more in our guide to Financing for Mobile Homes with Bad Credit.

The Role of a Larger Down Payment

A larger down payment is a powerful tool when dealing with credit challenges. It shows lenders you’re serious and have skin in the game.

Putting more money down reduces the lender’s risk. They finance a smaller portion of your home’s value, creating a lower loan-to-value ratio, a key metric for assessing risk.

A substantial down payment can also help you secure better interest rates within the bad credit lending market and dramatically improves your approval chances. It signals financial discipline and commitment.

For borrowers with credit challenges, we typically recommend a down payment of at least 20%, though less may be possible depending on your overall financial picture. This down payment is an investment in your future, giving you more equity from the start.

How to Boost Your Approval Odds

Getting approved for bad credit home loans can feel like an uphill battle, but you can take concrete steps to improve your chances. Each positive change adds strength to your application. The key is being proactive and taking control of your financial picture to show lenders you’re serious about homeownership.

Improve Your Credit Score

Even small improvements to your credit score can make a meaningful difference.

- Pay bills on time. This is your most powerful tool, accounting for about 35% of your score. Set up automatic payments or reminders to ensure you never miss a due date.

- Reduce credit card balances. A quick score boost can come from keeping your credit utilization below 30% of your available limit.

- Dispute errors. Mistakes on your credit report are common. Check your reports from all three bureaus and challenge anything that looks wrong.

- Avoid new credit. Each hard inquiry for new credit can temporarily lower your score, so avoid new applications while preparing for a mortgage.

For detailed strategies, our guide on Financing for Mobile Homes with Bad Credit offers practical steps.

Lower Your Debt-to-Income (DTI) Ratio

Your DTI ratio shows lenders how much of your monthly income goes to debt. A lower number inspires more confidence.

- Pay down existing debt. Focus on high-interest debt first, like credit card balances.

- Increase your income. Even a small boost from a side gig or overtime helps your DTI calculation.

- Avoid large purchases. A new car or furniture can wait. Taking on new debt right before applying for a home loan can hurt your approval chances.

Most lenders prefer a DTI of 36% or lower, but some accept up to 43%.

Common Mistakes When Applying for Bad Credit Home Loans

Learning from others’ mistakes can save you time and heartache. Avoid these common pitfalls:

- Applying to too many lenders. Each application creates a hard inquiry. Research lenders first and talk to a few before formally applying.

- Not checking your credit report. Know what lenders will see. Get your free reports and review them carefully before you apply.

- Hiding financial issues. Lenders will find out about past credit problems. Be upfront and explain the circumstances to show honesty.

- Not having documents ready. Gather pay stubs, tax returns, and bank statements beforehand. Being organized shows you’re a serious and prepared borrower.

Every step you take to strengthen your financial profile brings you closer to holding the keys to your new home.

Frequently Asked Questions about Bad Credit Mortgages

We get many questions from people exploring bad credit home loans. When dealing with credit challenges, it’s natural to have concerns about what’s possible. Let’s walk through the most common ones.

Can I get a home loan after bankruptcy?

Yes, you can get a home loan after bankruptcy. It’s not the end of your homeownership dreams, but there are some hoops to jump through.

Most traditional lenders want to see at least two years pass after your bankruptcy discharge. A bankruptcy can stay on your credit report for up to seven years, but you don’t have to wait that long to explore your options.

The key is re-establishing your credit during that waiting period. Start with a secured credit card or a small personal loan that you pay off reliably. This shows lenders you are now managing your finances responsibly.

Alternative lenders are often more flexible and may work with you sooner. While you’ll likely face higher interest rates initially, these loans can be a stepping stone to conventional financing later.

Are there special programs for self-employed individuals?

Absolutely! Being self-employed shouldn’t keep you from owning a home, even with credit challenges. We know self-employed individuals often have unique income situations, like fluctuating income or business deductions.

That’s where alternative income programs come in. Instead of only looking at W-2s, these programs review your bank statements to see your real cash flow or business financial statements to understand your true earning potential.

The documentation requirements are more extensive, but the extra paperwork is worth it when it opens the door to homeownership.

What are the risks of a bad credit mortgage?

It’s important to be honest: bad credit home loans come with real risks.

- Higher interest rates are the biggest impact. Lenders charge more to offset their risk, meaning higher monthly payments and more interest paid over the life of the loan.

- Higher monthly payments can strain your budget. Be sure you can comfortably afford them before committing.

- Shorter loan terms are common, sometimes just 1-3 years with private lenders. This means you’ll need to refinance or pay off the loan relatively quickly.

- Predatory lending is a reality. Some lenders target people with credit challenges, offering loans with excessive fees or hidden costs. Always read everything carefully and ask questions.

- The risk of foreclosure increases if you struggle to make payments.

We share these risks not to scare you, but to help you make an informed decision. With proper planning, bad credit home loans can be a valuable tool for achieving homeownership while you improve your financial health.

Conclusion

Your credit challenges don’t have to end your homeownership story. This guide has shown that bad credit home loans are accessible through multiple pathways. While traditional banks might say no, government-backed programs like FHA loans open windows of opportunity for scores as low as 500.

The road to homeownership with bad credit requires strategy. We’ve covered what “bad credit” means to lenders, explored government programs, shared our flexible financing options, and provided concrete steps to boost your approval odds. Improving your credit, lowering your DTI, and saving for a larger down payment are powerful tools. Even after financial setbacks, the right approach can put homeownership back in reach.

At Mobile Homes Factory Direct, we believe everyone deserves a quality, affordable home. We offer the best manufactured homes at the best prices with a straightforward process and flexible financing for all credit types, including bad or no credit. For those in Von Ormy, TX, and the surrounding areas, we’re here to make your homeownership dream a reality.

You don’t have to steer this journey alone. Our experienced team understands the challenges of securing financing with credit issues and is committed to finding the right solutions for you. We’ll guide you through every step, from exploring government programs to finding alternative lenders.

Your new home is waiting. Let’s work together to make it happen.