Unlock Your Future: Approval Strategies for Bad Credit

Unlock approval! Learn strategies for mobile home financing, even with Bad credit approved. Get your dream home now.

Why Bad Credit Doesn’t Have to Stop Your Homeownership Dreams

Getting bad credit approved for a mobile home loan is possible with the right strategies. While a credit score below 650 presents challenges, many families with less-than-perfect credit successfully secure financing for their dream homes every year.

Quick Answer for Bad Credit Approval:

- FHA loans: Available with credit scores as low as 580 (3.5% down payment)

- Chattel loans: Use the mobile home as collateral, often easier approval

- In-house financing: Many dealers offer flexible terms for bad credit buyers

- Down payment boost: 10-20% down payment significantly improves approval odds

- Income requirement: Most lenders want $1,800+ monthly gross income

The truth is that bad credit is often a temporary setback, not a permanent barrier. Specialized lenders and programs exist to help people who have faced bankruptcy, missed payments, or are new to credit.

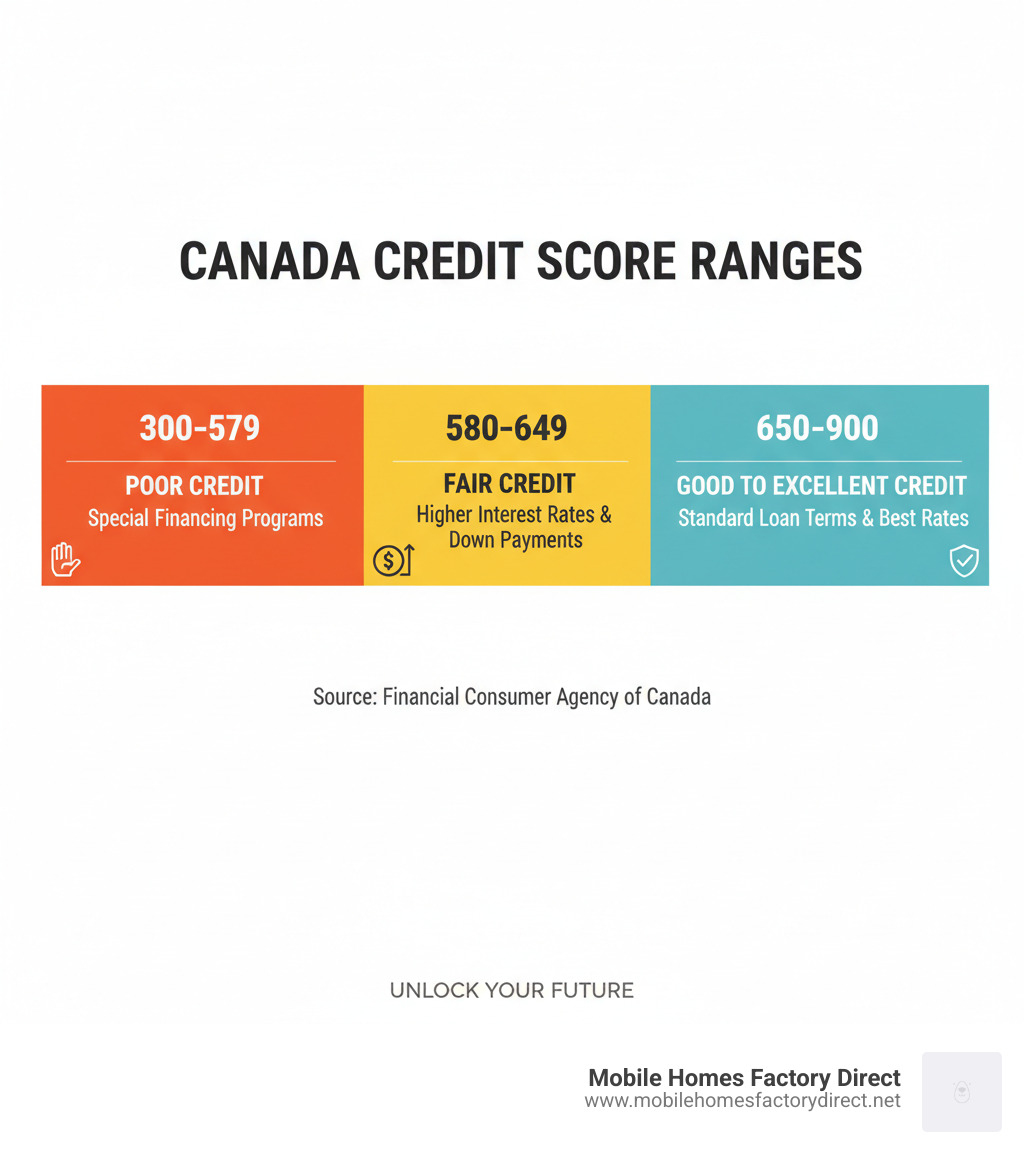

In Canada, credit scores range from 300 to 900, with the average sitting around 650. If your score falls below this mark, you’re not alone and still have options. Many lenders offer programs designed for buyers who need bad credit approved financing solutions.

This guide will walk you through proven strategies to maximize your approval chances, understand your financing options, and secure the keys to your new mobile home, even with credit challenges.

Understanding Your Credit and Its Impact

Dealing with credit challenges while buying a mobile home can be overwhelming. At Mobile Homes Factory Direct, we’ve seen how a lower credit score can create obstacles, but we’re here to help. A credit score below 650 often leads to loan denials, higher interest rates, and stricter terms because lenders view it as a sign of increased risk.

Your credit score is the key to affordable financing. In Canada, scores range from 300-900, with an average around 650. A score below this significantly impacts your options. Before proceeding, check your credit score for free through an online service to know where you stand.

How a Low Credit Score Creates Problems

Lenders view a low credit score as a sign of past financial struggles, which can make getting bad credit approved feel impossible. This perception leads to several problems:

- Limited financing options: Many traditional lenders won’t work with borrowers below certain credit thresholds.

- Unfavorable terms: Lenders who do work with you may offer shorter repayment periods or higher fees, turning the purchase into a financial strain.

- Higher monthly payments: Higher interest rates directly increase your monthly payment, making an affordable home seem out of reach.

- More interest paid over time: A higher interest rate means paying dramatically more over the life of the loan—potentially tens of thousands of extra dollars.

The Direct Link Between Your Score and Loan Terms

Your credit score and Annual Percentage Rate (APR) are directly connected. Lenders use formulas to set your interest rate: a higher score means lower risk and a lower APR.

A 20-point difference in your score can change your interest rate by 0.25% to 0.5%, adding up to thousands over the loan’s life. Personal loan APRs can range from 4.99% to 34.99%, with your credit information being a key factor. Your score also influences your required down payment and loan-to-value ratio.

Understanding this connection is powerful. Every point added to your score saves you money and increases flexibility. At Mobile Homes Factory Direct, we help buyers understand how even slight score improvements can lead to better loan terms.

Proactive Steps to Boost Your Approval Chances

Getting bad credit approved financing isn’t just about finding a lender who will say yes; it’s about positioning yourself as an attractive borrower. Taking charge of your finances and demonstrating responsible money management can dramatically improve your approval chances and build good long-term habits.

Budgeting is your secret weapon. A clear budget proves to lenders you understand your finances. Managing existing debt, especially high-interest credit cards, shows you can handle financial commitments.

Build a Stronger Financial Profile

To become a more attractive borrower, focus on these key strategies:

- Save for a down payment: Aiming for 10-20% of the home’s price is the most powerful move you can make. It takes discipline, but it significantly lowers your monthly payments.

- Reduce credit card balances: Keep your credit utilization below 30% of your available limit (e.g., under $300 on a $1,000 limit). This can quickly boost your credit score.

- Pay bills on time: Your payment history is the biggest part of your credit score. Consistent, on-time payments work wonders over a few months.

- Create a savings plan: A realistic plan for your down payment and an emergency fund demonstrates financial stability to lenders.

Gather Your Essential Documentation

Being prepared with your paperwork shows lenders you’re serious. You’ll need:

- Proof of income: Recent pay stubs or tax returns showing a gross monthly income of at least $1,800.

- Bank statements: The last 2-3 months to show savings habits and asset verification.

- Employment history: Details to prove stable work.

- Government-issued ID: For identity verification.

- Mobile home details: Model, make, year, and price if you’ve chosen a home.

The Power of a Down Payment for Bad Credit Approved

Your down payment is the key to better terms and higher approval odds with bad credit. A larger down payment reduces the lender’s risk, as they are lending less money. This makes them more comfortable working with borrowers who have credit challenges.

A bigger down payment means a smaller loan, which translates to lower monthly payments. It also dramatically improves your approval odds by acting as a counterbalance to a low credit score. Most importantly, it shows you’re financially serious. Saving a large down payment despite past credit issues signals to lenders that you are committed to successful homeownership.

Finding the Right Financing Options for Bad Credit Approved

Finding the right financing with credit challenges can be overwhelming, but bad credit approved options are available, especially in the mobile home industry. At Mobile Homes Factory Direct, we help families in Von Ormy, TX, and surrounding areas like Somerset, Atascosa, Macdona, San Antonio, and JBSA Lackland achieve homeownership regardless of their credit history.

We know credit scores don’t tell the whole story. Whether you’ve faced divorce, medical bills, or past financial mistakes, we’re committed to finding a solution that fits your budget. Our flexible financing approach looks beyond your credit score to consider your income, stability, and commitment. As specialists in bad credit approved financing, we understand the mobile home market.

Flexible Solutions for When You Need Bad Credit Approved

Mobile home financing offers several paths that are more forgiving than traditional mortgages:

- FHA loans: These government-backed loans are popular for buyers with credit challenges. With scores as low as 580, you may qualify for a 3.5% down payment. Even scores between 500-579 could be approved with a 10% down payment.

- Chattel loans: These loans use the mobile home as collateral, making them accessible for buyers with credit issues. While terms may be shorter, they are often the key to homeownership.

- In-house financing: This is a key service at Mobile Homes Factory Direct. We work directly with you and our network of specialized lenders to find creative solutions traditional banks won’t consider, helping families who were previously denied.

When researching lenders, read customer reviews and look for companies committed to transparency and responsible lending.

Programs and Initiatives for Mobile Home Buyers

Beyond standard loans, several programs exist to make homeownership more accessible:

- Flexible down payment options: Some programs offer down payment assistance or allow gift funds. We explore every option to make your down payment manageable.

- Local financing programs: Texas sometimes offers special incentives for manufactured home buyers, such as reduced interest rates or assistance.

- First-time buyer initiatives: These programs often provide extra support, education, and financial incentives for new home buyers.

At Mobile Homes Factory Direct, we’ve made it our mission to turn homeownership dreams into reality. Your credit challenges are just one part of your story, and we’re here to help you write the next chapter.

Navigating the Risks and Rebuilding Your Future

Getting bad credit approved for a mobile home loan is exciting, but it’s important to be realistic. These loans often have higher interest rates, meaning you’ll pay more over time. Personal loan interest rates can range from under 5% to over 30%, depending on your credit. This difference adds up significantly, so it’s crucial to have realistic expectations for budgeting.

Beware of predatory lenders. Red flags include excessive fees, high-pressure tactics, or terms that seem too good to be true. A legitimate lender will give you time to review your commitment, so walk away if you feel rushed. Ensure the monthly payment fits comfortably in your budget, accounting for other costs like insurance and maintenance.

Here’s what the numbers might look like in real terms:

| Loan Type | Credit Score | APR (Estimate) | Monthly Payment (approx.) | Total Interest Paid (approx. over 30 years) |

|---|---|---|---|---|

| Good Credit Loan | 720+ | 6.00% | $120.00 | $23,200 |

| Bad Credit Loan | 580 | 9.00% | $161.00 | $37,800 |

Table based on a $20,000 mobile home loan for 30 years. Actual numbers will vary.

This example shows why rebuilding your credit is so important.

How Repaying a Loan Responsibly Rebuilds Your Credit

Your mobile home loan can be a credit repair tool. Every on-time payment proves your reliability to credit agencies.

- Payment history is the most important factor in your credit score. Consistent, on-time payments on a major loan can quickly improve your score.

- A mobile home loan also improves your credit mix, as scoring models like to see you can handle different types of credit.

- This loan is a stepping stone to better rates. As your score improves, you can qualify for better terms on future credit and potentially refinance your mobile home loan at a lower rate.

Consistency is key; set up automatic payments to ensure you never miss one.

The Role of a Financial Advisor

A credit counselor or financial advisor can help anyone build a stronger financial future. They can help you spot errors on your credit report, create a personalized plan, or set up a debt management plan to simplify payments and reduce interest rates.

Seek help if you’re overwhelmed by debt, unsure how to improve your credit, or falling behind on payments. An advisor provides an objective viewpoint and helps you create a long-term plan for sustainable financial habits. Asking for help shows you’re serious about improving your situation.

Frequently Asked Questions about Getting Approved with Bad Credit

Navigating mobile home financing with bad credit brings up many questions. We’ve helped countless families in the Von Ormy area secure bad credit approved financing, and we’re here to answer your most common concerns.

What is the minimum income required for a bad credit mobile home loan?

Most lenders look for a minimum gross monthly income of around $1,800, though this varies. This ensures you can manage repayments alongside basic living expenses. Lenders want your total monthly debt obligations to stay under 41-45% of your gross monthly income. This debt-to-income ratio includes your potential home payment and other recurring debts, leaving enough for living expenses.

If you earn less, some lenders may still work with you if you have a co-signer or can make a larger down payment.

Can I get approved for a mobile home loan if I have a past bankruptcy?

Yes. Many buyers with a past bankruptcy can qualify for mobile home financing, especially after some time has passed and you’ve shown responsible financial behavior. While a bankruptcy stays on your credit report for 7-10 years, lenders focus more on your current financial situation and the steps you’ve taken to rebuild. They want to see that you’re committed to a fresh start. We regularly help individuals who have faced bankruptcy secure financing.

Will checking my own credit score lower it?

No. Checking your own credit score through services like Credit Karma or from credit bureaus results in a “soft inquiry,” which does not affect your score. This is a common misconception.

What can temporarily lower your score are “hard inquiries,” which occur when you formally apply for credit. A single hard inquiry has a minimal impact, but multiple inquiries in a short period are a greater concern for lenders. Many lenders, including those we work with, use soft inquiries for pre-approval, allowing you to explore bad credit approved options without impacting your score.

Conclusion

This guide has covered the essentials for securing bad credit approved financing for your mobile home. We’ve discussed how your credit score impacts loan terms and how to take charge of your finances through budgeting and saving for a down payment.

Key strategies include building a stronger financial profile with on-time payments and low credit card balances, and gathering your documentation. We also explored financing paths like FHA loans (for scores as low as 580), chattel loans, and flexible in-house financing.

Bad credit is a temporary chapter, not the end. Every on-time loan payment helps rewrite your credit history, proving your reliability to future lenders and opening doors to better financial opportunities.

At Mobile Homes Factory Direct, we believe everyone deserves a place to call home. We’ve helped families in Von Ormy, TX, and surrounding areas like Somerset, Atascosa, Macdona, San Antonio, and JBSA Lackland achieve homeownership when they thought it was impossible.

We offer flexible financing for all credit types—including bad credit and no credit. Our streamlined process takes the stress out of home buying, and our team is dedicated to finding you the right home at the right price.

Don’t let past credit mistakes steal your future dreams. Your perfect home is waiting.

Explore our mobile homes and financing options today, and let’s start writing the next chapter of your story together.