Bad Credit Blues? Find Your Way Back with Credit Counseling

Overcome financial stress with credit counseling bad credit. Learn how to get financial control and improve your credit score.

Why Bad Credit Doesn’t Have to Define Your Future

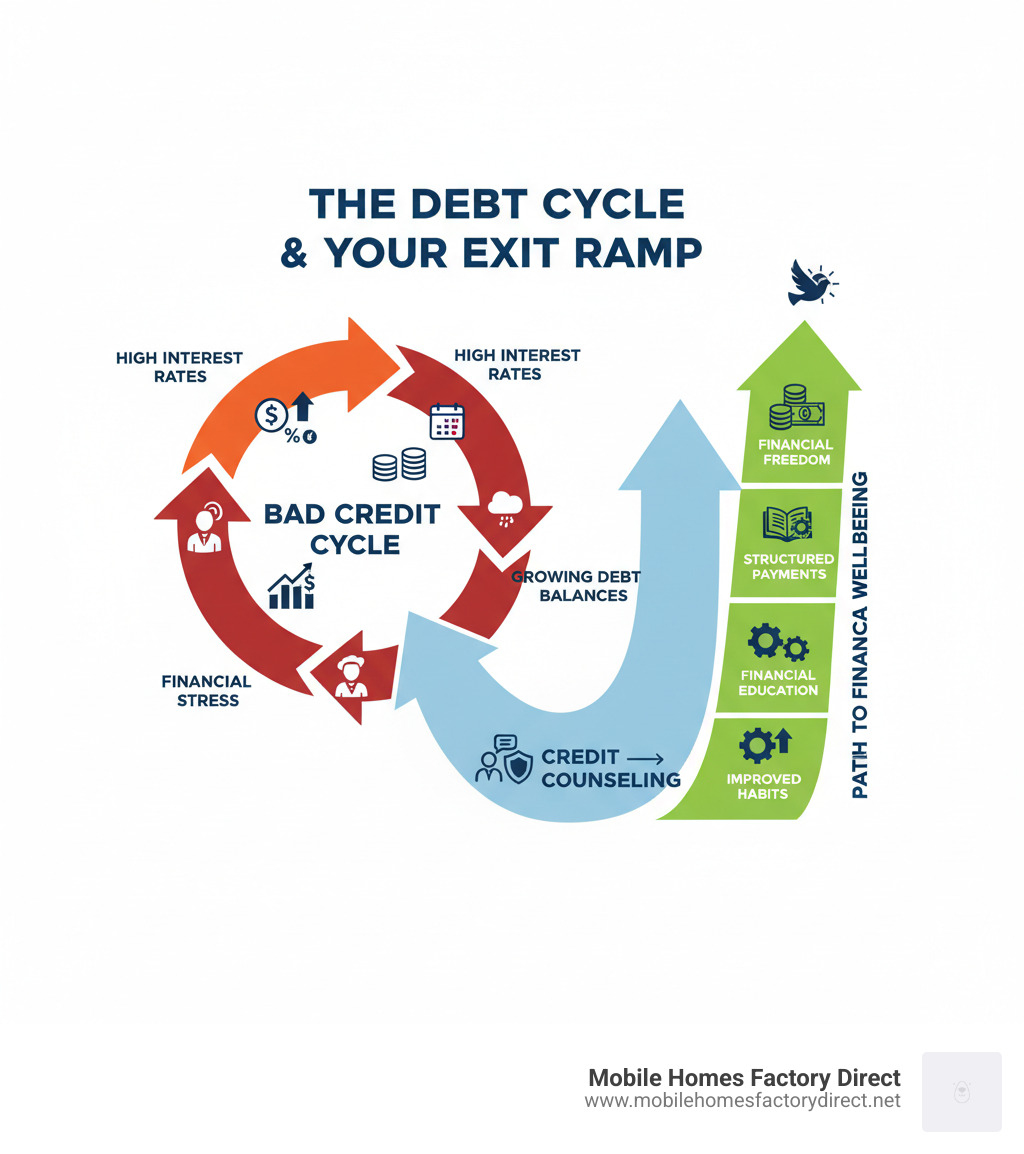

Credit counseling bad credit situations can feel overwhelming, but there’s hope. If you’re struggling with debt and poor credit scores, credit counseling offers a structured path back to financial stability through education, budgeting help, and debt management strategies.

Key Benefits of Credit Counseling for Bad Credit:

- Free initial consultation with certified counselors

- Debt Management Plans that can lower interest rates and monthly payments

- Budgeting education to prevent future financial problems

- Credit report review to identify and dispute errors

- No direct negative impact on your credit score from counseling sessions

- Potential savings of thousands compared to minimum payments

According to research from the National Foundation for Credit Counseling, nearly 70% of people enrolled in debt management plans successfully paid off their debt within 4-5 years. One study found participants improved their credit scores by an average of 50 points while reducing revolving debt by $8,000 over just 18 months.

The path isn’t always easy – it requires commitment and discipline. But for millions of Americans carrying credit card debt month after month (43% according to a 2020 NFCC survey), credit counseling provides the education and structure needed to break free from the paycheck-to-paycheck cycle.

“The ultimate payoff isn’t really monetary. It’s peace of mind,” notes one industry expert. Whether you’re dreaming of homeownership or simply want to regain control of your finances, credit counseling can be the first step toward a more secure financial future.

What is Credit Counseling and How Does It Work?

If you’re drowning in debt and wondering how you got here, you’re not alone. Credit counseling bad credit situations affect millions of Americans, but here’s the good news: there’s a lifeline available that doesn’t involve complicated financial jargon or intimidating bank meetings.

Credit counseling is essentially having a knowledgeable friend in your corner – someone who understands money management and debt advice without the judgment. Think of it as an educational service designed to help you take control of your finances, one step at a time.

The magic happens during your initial consultation, which is typically free. You’ll sit down with a certified counselor (in person, by phone, or virtually) who will conduct a thorough financial review of your situation. They’ll want to understand your income, monthly expenses, existing debts, and what you’re hoping to achieve financially.

This isn’t a interrogation – it’s more like mapping out where you are and where you want to go. Your counselor will then create a personalized action plan custom specifically to your circumstances. This might include budgeting strategies, debt repayment options, or guidance on improving your financial habits.

To get the most from your session, gather some key information to share with your counselor: recent pay stubs or tax returns, statements for all your debts (credit cards, loans, medical bills), and a breakdown of your monthly expenses. Having these ready means your counselor can give you the most accurate and helpful advice possible.

How Credit Counseling Helps with Bad Credit

When you have bad credit, it can feel like every financial door is slammed shut. But credit counseling offers several powerful tools to help you turn things around.

The most impactful solution is often a structured repayment plan called a Debt Management Plan. Through this process, your counselor can work magic behind the scenes – negotiating with your creditors for lower interest rates and getting those annoying late fees waived. Suddenly, your monthly payments become more manageable, and more of your money goes toward actually paying down debt instead of feeding the interest monster.

But credit counseling goes much deeper than just rearranging your payments. It focuses on building improved financial habits that will serve you for life. Your counselor will help you develop solid budgeting skills – learning to track where your money goes and making sure it goes where you want it to.

The real game-changer is the financial literacy education you’ll receive. You’ll finally understand how credit actually works, why certain financial decisions hurt your score, and most importantly, how to avoid the traps that got you here in the first place.

This comprehensive approach helps you break the paycheck-to-paycheck cycle that keeps so many people stuck. And once you’re on solid ground financially, opportunities that seemed impossible before – like getting financing for a new home – become realistic goals. If homeownership is on your horizon, you might find our guide helpful: How to Get a Mobile Home with Bad Credit.

Types of Services Offered

Credit counseling agencies are like financial Swiss Army knives – they offer multiple tools to help you succeed. While every situation is unique, most agencies provide a comprehensive menu of services to meet your specific needs.

General budgeting advice forms the foundation of most counseling relationships. Your counselor will help you create a realistic budget that actually works with your lifestyle, identify sneaky expenses that drain your wallet, and develop strategies to make your money stretch further.

Many agencies offer financial workshops on topics like understanding your credit report, managing credit cards wisely, and planning for retirement. These workshops are often free and provide valuable education that can prevent future financial headaches.

The star of the show is often Debt Management Plans (DMPs) – these consolidate your unsecured debts into one manageable monthly payment, typically with better terms than you could negotiate on your own.

For those dreaming of homeownership, housing counseling can be invaluable. This includes first-time homebuyer education that walks you through the entire process, from understanding mortgages to navigating the closing process. For more comprehensive homebuyer education resources, check out More info about homebuyer education.

If student loans are weighing you down, student loan counseling helps you explore repayment options, deferment possibilities, and consolidation strategies that can make those payments more manageable.

Finally, agencies provide pre-bankruptcy counseling – a mandatory step if you’re considering bankruptcy. This session helps you understand all your alternatives and the real implications of filing, ensuring you make the best decision for your situation.

The Debt Management Plan (DMP): A Closer Look

When you’re dealing with credit counseling bad credit situations, your counselor might suggest something called a Debt Management Plan, or DMP for short. Think of it as your personal roadmap out of debt – one that’s been carefully designed to make your journey as smooth as possible.

A DMP is essentially a structured way to tackle your unsecured debts like credit cards, personal loans, and medical bills. Instead of juggling multiple payments with different due dates (we’ve all been there!), you get to consolidate everything into one single monthly payment. It’s like having all your scattered puzzle pieces finally come together into one clear picture.

Here’s the beautiful part: your credit counseling agency becomes your financial advocate. They roll up their sleeves and negotiate directly with your creditors on your behalf. These conversations often lead to lower interest rates and waived fees that you might never have been able to secure on your own. Creditors actually prefer working with reputable agencies because they know you’re serious about paying back what you owe.

Once everything’s set up, you make that single monthly payment to the credit counseling agency. They then distribute the money to all your creditors according to the plan you’ve agreed on. No more worrying about missing a payment or sending money to the wrong place – it’s all handled for you.

Most DMPs are designed to get you completely debt-free within three to five years. That might sound like a long time, but having a clear finish line can be incredibly motivating. You’ll actually be able to see the light at the end of the tunnel, and it gets brighter every month.

Does Credit Counseling Affect Your Credit Score?

This question keeps a lot of people up at night, especially when they’re already worried about bad credit. The honest answer? It’s complicated, but usually works out in your favor over time.

Let’s start with the good news: simply talking to a credit counselor or attending their workshops won’t hurt your credit score at all. These are educational services, and the credit bureaus don’t even know about them. So you can get all the advice you need without any worry.

When it comes to actually starting a Debt Management Plan, things get a bit more nuanced. You might see a temporary dip in your score initially, but this usually happens for practical reasons. If your counselor recommends closing some credit card accounts (which is often smart to prevent more debt), your credit utilization rate might jump up temporarily. Since this makes up about 30% of your credit score, you could see some movement.

Your creditors might also add a note to your credit report showing that you’re repaying through a debt management plan. Future lenders will see this, but it won’t directly lower your score. Think of it as context rather than a penalty – it actually shows you’re taking responsibility for your debts.

Here’s where the magic happens: as you stick with your DMP, your credit score typically starts climbing. Consistent on-time payments make up 35% of your credit score, and a DMP ensures you never miss a payment. As your debt balances shrink month after month, your credit utilization improves too.

The financial habits you develop during credit counseling – budgeting, understanding credit, avoiding new debt – these skills keep working for you long after your DMP is finished. It’s like learning to ride a bike: once you’ve got it, you’ve got it for life.

If you want to dive deeper into exactly how a DMP might affect your specific situation, this resource from myFICO offers some great insights into the relationship between debt management plans and credit scores.

How to Choose the Right Credit Counseling for Bad Credit

Finding the right credit counselor when you’re dealing with credit counseling bad credit situations is honestly one of the most important decisions you’ll make on your financial journey. Think of it like choosing a doctor – you want someone who truly understands your situation, has the right credentials, and genuinely cares about helping you get better.

The good news? With a little research and the right questions, you can find an agency that will be your trusted partner in turning your finances around. The not-so-good news? There are some less-than-reputable companies out there that might try to take advantage of your situation. But don’t worry – we’ll help you spot the difference.

Take your time with this decision. When you’re already stressed about money, it’s tempting to jump at the first solution that comes along. But spending a few extra hours researching could save you hundreds of dollars and months of frustration down the road.

Finding a Reputable Agency for Bad Credit

Here’s something that might surprise you: not all credit counseling agencies are created equal. The biggest difference you need to understand is between nonprofit and for-profit agencies, and this distinction could make or break your experience.

We strongly recommend going with a nonprofit credit counseling agency. Why? Because they’re legally required to put your interests first, not their profit margins. Their counselors are there to help you succeed, not to sell you expensive services you don’t need. Plus, their fees are typically much lower – often just enough to keep their doors open and their counselors trained.

For-profit agencies, on the other hand, have shareholders to please and revenue targets to hit. That doesn’t automatically make them bad, but it does create different motivations that might not always align with what’s best for your wallet.

When you’re looking for a reputable agency, keep an eye out for certain accreditations that signal quality and trustworthiness. The National Foundation for Credit Counseling (NFCC) is like the gold standard in this industry. Their member agencies follow strict guidelines and their counselors must be certified. You can search for NFCC members near you at National Foundation for Credit Counseling (NFCC).

Another solid option is looking for agencies affiliated with the Financial Counseling Association of America (FCAA). They also maintain high standards for their member organizations.

If you’re considering bankruptcy as an option, there’s actually a government resource that can help. The U.S. Trustee Program maintains a list of agencies approved to provide the mandatory pre-bankruptcy counseling. You can find this list at U.S. Trustee Program list. Many of these agencies also offer general credit counseling services beyond bankruptcy preparation.

Don’t forget to check with your state’s attorney general’s office or the Better Business Bureau. A quick search can reveal if an agency has a pattern of complaints or unresolved issues. A few isolated complaints aren’t necessarily deal-breakers, but a pattern of problems definitely is.

Costs and Red Flags to Watch For

Let’s talk money – specifically, what you should expect to pay and what should make you run in the opposite direction.

Legitimate costs are actually pretty reasonable. Most reputable nonprofit agencies offer that initial consultation completely free. Think of it as a financial check-up where you can learn about your options without spending a dime. If you decide to move forward with a Debt Management Plan, you’ll typically see a setup fee capped at $79 by federal regulations, plus monthly fees ranging from $20 to $40. These modest fees are usually more than offset by the money you’ll save through lower interest rates and waived penalties.

Now, here’s where your radar should go up. Some warning signs should send you looking elsewhere immediately. Unrealistic promises are the biggest red flag. If someone guarantees they can eliminate your debt overnight or promises to completely erase accurate negative information from your credit report, they’re either lying or don’t understand how credit actually works. Real financial recovery takes time and effort – there are no magic wands.

High-pressure sales tactics are another major warning sign. A legitimate counselor will give you time to think, provide written information, and never make you feel rushed into a decision. Your financial situation didn’t develop overnight, and the solution shouldn’t be rushed either.

Be wary of any agency that lacks transparency about their fees or services. Everything should be clearly explained in writing before you commit to anything. If they’re vague about costs or how their programs work, that’s not a good sign.

Here are some specific questions that can help you separate the good agencies from the questionable ones: Are you a nonprofit organization and can you prove it? What certifications do your counselors have? Can you provide a detailed breakdown of all fees in writing? What happens if I can’t make a payment? Do you offer educational resources beyond debt management? How do you protect my personal information?

The right agency will welcome these questions and answer them thoroughly. If anyone seems annoyed or evasive, keep looking. You’re interviewing them as much as they’re evaluating your situation. Trust your instincts – if something feels off, it probably is.

Weighing Alternatives and Common Questions

When you’re dealing with credit counseling bad credit challenges, it’s natural to wonder if there are other paths forward. While credit counseling and Debt Management Plans can be incredibly helpful, they’re not your only option. Let’s explore what else is out there and how these alternatives stack up.

Alternatives to Credit Counseling

Do-it-yourself approaches can work well if you’re disciplined and organized. The debt snowball method focuses on paying off your smallest debt first while making minimum payments on everything else. Once that smallest debt is gone, you roll that payment into the next smallest debt. It builds momentum and gives you psychological wins along the way.

The debt avalanche method takes a different approach – you tackle the debt with the highest interest rate first. This saves you the most money over time, though it might take longer to see that first victory.

Debt consolidation loans let you combine multiple debts into one new loan, ideally with a lower interest rate. This can simplify your life by giving you just one monthly payment instead of juggling several. The catch? You typically need decent credit to qualify for a good interest rate. If you’re dealing with bad credit, this might not be your best bet right now. However, improving your credit could open doors to better financing options later, including opportunities like Bad Credit Home Loans.

Debt settlement involves negotiating with creditors to accept less than what you owe. While this might sound appealing, it comes with serious risks. Your credit score will take a major hit, you’ll likely face collection calls and potential lawsuits, and the forgiven debt might count as taxable income. This is generally considered a last resort before bankruptcy.

Here’s how these options compare:

| Approach | Credit Counseling (DMP) | Debt Consolidation | Debt Settlement |

|---|---|---|---|

| Goal | Pay full debt with better terms plus education | Simplify payments, lower interest | Pay less than full amount |

| Credit Impact | Temporary dip, then improvement | New inquiry, potential boost | Severe negative impact |

| Timeline | 3-5 years | Varies by loan | 2-4 years but risky |

| Education | Extensive budgeting and financial literacy | Minimal | Minimal |

| Fees | Low (non-profit agencies) | Loan fees and interest | High percentage-based fees |

Potential Risks and Alternatives to Credit Counseling for Bad Credit

Let’s be honest about credit counseling – it’s not perfect for everyone. It’s definitely not a quick fix. Most Debt Management Plans take three to five years to complete. If you’re hoping for instant relief, you’ll need to adjust your expectations.

Commitment is absolutely essential. You’ll need to stick to your monthly payments religiously. Miss payments, and you could jeopardize the entire plan and lose the benefits you’ve negotiated with creditors.

There might be a temporary dip in your credit score when you start a DMP, especially if you close credit card accounts. This happens because your available credit decreases while your debt stays the same, increasing your credit utilization ratio. The good news? This is usually temporary and gets better as you pay down your debts.

Not all debts qualify for a DMP either. These plans typically cover unsecured debts like credit cards, personal loans, and medical bills. Your mortgage, car loan, or student loans usually won’t be included.

For people with truly overwhelming debt, other options might be necessary. Bankruptcy can provide a fresh start, though it severely impacts your credit for years. Working directly with creditors is another possibility – sometimes they’ll agree to hardship plans or lower interest rates if you ask. This requires good negotiation skills and patience, but it can work.

The key is finding the approach that fits your specific situation and gives you the best chance of long-term success.

Frequently Asked Questions

Can I get a home loan while in credit counseling?

Yes, you absolutely can! In fact, being in credit counseling often shows lenders that you’re serious about managing your finances responsibly. Many FHA lenders view a Debt Management Plan positively because it demonstrates you’re actively addressing your debt rather than ignoring it.

Most lenders will want to see that you’ve been making consistent payments through your DMP for at least 12 months. Some might require written permission from your credit counselor before approving your loan. While conventional loans might be a bit stricter, being in credit counseling isn’t an automatic disqualifier.

We understand that homeownership is often a major goal, and we’re here to help you explore your options for Financing a Mobile Home when you’re ready.

What is pre-bankruptcy credit counseling?

If you’re considering bankruptcy, you’ll need to complete credit counseling first – it’s actually required by law. This mandatory session must be done with an agency approved by the U.S. Trustee Program within 180 days before you file.

The counselor will walk you through different types of bankruptcy, help you explore alternatives, and make sure you understand what bankruptcy really means for your future. It’s designed to ensure you’ve considered all your options before taking this significant step. You can find more detailed information about this process at Bankruptcy Counseling information.

What’s the difference between credit counseling and credit repair?

This is a great question because these two services are often confused, but they’re quite different.

Credit counseling takes a big-picture approach to your finances. Counselors help you understand budgeting, create sustainable money habits, and often set up payment plans to tackle your debts. It’s about teaching you skills that will serve you for life and addressing why you got into debt in the first place.

Credit repair focuses specifically on your credit report, disputing negative items that might be inaccurate, outdated, or unverifiable. While you can dispute errors yourself for free, many credit repair companies charge fees and sometimes make unrealistic promises about what they can accomplish.

Here’s the thing – no one can legally remove accurate negative information from your credit report, despite what some companies claim. Credit counseling offers a more comprehensive and honest approach to improving your overall financial health, which naturally leads to better credit over time.

Conclusion: Your Path to a Brighter Financial Future

The journey through credit counseling bad credit challenges doesn’t have to be one you walk alone. Throughout this guide, we’ve explored how credit counseling serves as much more than a quick fix – it’s truly an empowering tool that combines education, practical planning, and ongoing support to help you reclaim your financial independence.

Think about where you started reading this article. Maybe you felt overwhelmed by mounting debts, frustrated by high interest rates, or discouraged by a credit score that seemed to close more doors than it opened. Now you understand that credit counseling offers real, tangible solutions. Debt Management Plans can transform multiple overwhelming payments into one manageable monthly amount, often with significantly lower interest rates. The budgeting education and financial literacy you gain become lifelong skills that prevent you from falling back into old patterns.

Yes, there might be a temporary dip in your credit score when you start a DMP, but remember – this is like taking a step back to leap forward. Those consistent, on-time payments you’ll be making through your plan are building something much more valuable: a solid foundation of financial responsibility that lenders respect and reward.

At Mobile Homes Factory Direct, we’ve worked with countless families who thought their credit challenges meant homeownership was out of reach. We’ve seen how taking control of your finances through credit counseling can be the turning point that transforms dreams into reality. Bad credit doesn’t define your future – your commitment to changing your financial habits does.

The most important step is often the hardest one: deciding to begin. That free initial consultation with a certified credit counselor costs you nothing except a little time, but it could save you thousands of dollars and years of financial stress. You deserve peace of mind. You deserve to sleep well at night knowing your finances are under control.

Your brighter financial future is waiting, and it might be closer than you think. Ready to improve your credit for a new home? Explore our FICO Score Improvement Program and take the next step towards securing your dream home.