Finding Your Steal: Repossessed Mobile Homes for Sale Near You

Find affordable repossessed house trailers for sale. Learn how to secure massive savings on your next home with our expert guide.

What Are Repossessed House Trailers and Why They’re Your Best Path to Affordable Homeownership

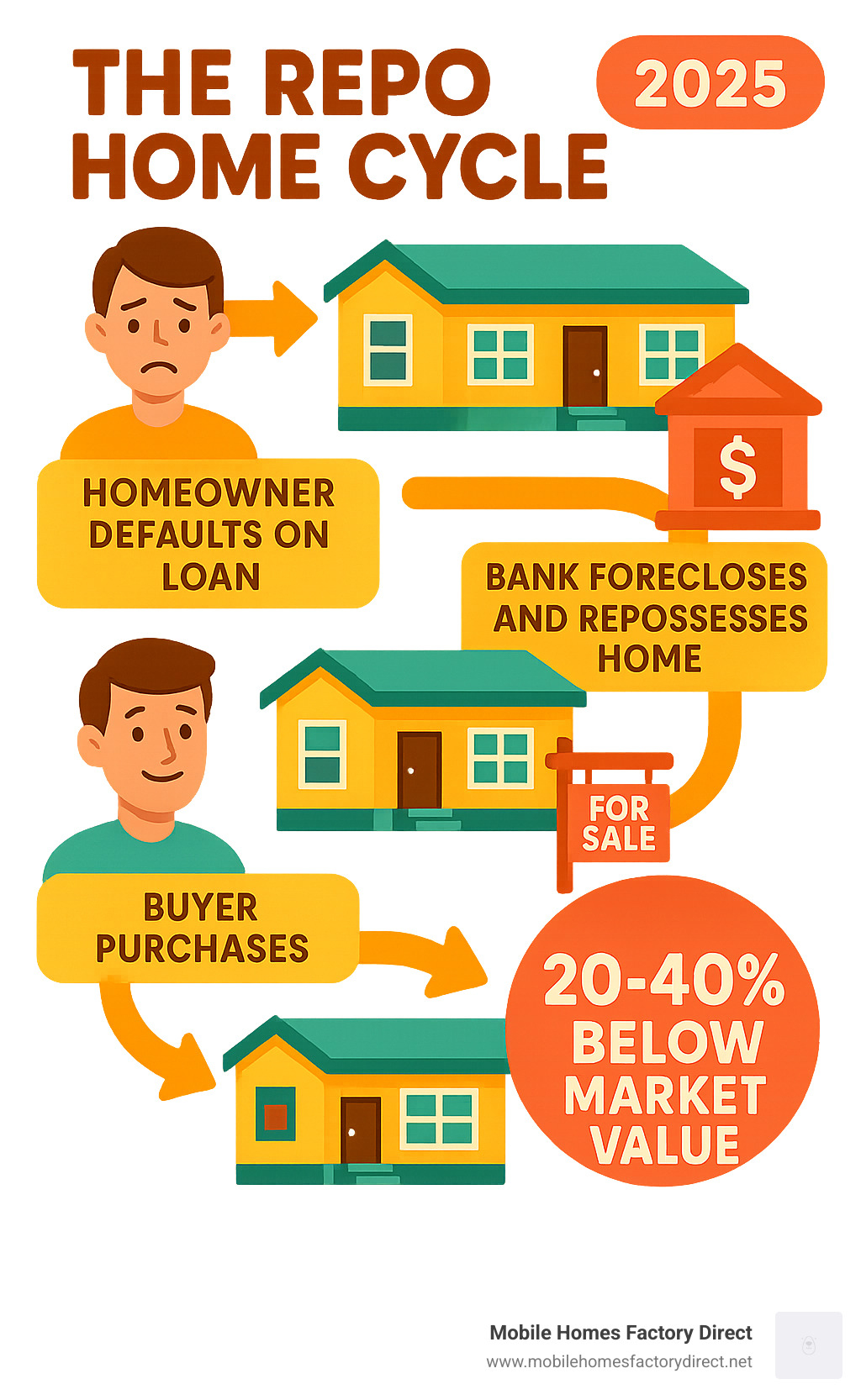

Repossessed house trailers for sale are one of the most overlooked opportunities in today’s housing market. These are manufactured homes that banks or lenders have reclaimed after previous owners defaulted on their mortgage payments.

Quick Answer: Where to Find Repossessed House Trailers for Sale

- Bank REO (Real Estate Owned) websites – Check major lenders’ foreclosure sections

- Specialized manufactured housing dealers – Often have exclusive repo inventory

- Government auction sites – GSA Auctions, HUD homes, county websites

- Online marketplaces – Facebook Marketplace, Craigslist (filter for “repo” or “bank-owned”)

- Geographic hotspots – Texas and Arizona have 500+ listings with average prices around $328,215

Repo homes are a compelling opportunity because they typically sell for 20-40% below market value. Banks want to recover their losses quickly, meaning a home that might retail for $80,000 could be yours for $50,000 or less.

When a homeowner defaults on their loan, the lender repossesses the property. After legal procedures, these homes are listed for sale at steep discounts. Banks aren’t in the business of holding real estate, so they’re motivated sellers.

“Times are tough, we understand that. Because of this, we want to offer you a chance at a home at a great price!” This sentiment from dealers reflects that repo homes serve families who need quality housing at affordable prices.

Used repo mobile homes can save you 30-50% compared to new manufactured homes, with prices from $25,000-$60,000. Some include land, eliminating the $300-$800 monthly lot rent.

Basic repossessed house trailers for sale vocab:

The Pros and Cons: Is a Repo Home Right for You?

Repossessed house trailers for sale aren’t for everyone, but they might be perfect for you. Understanding the possibilities and potential challenges is key.

The Major Advantages of Buying a Repo

The biggest advantage of repossessed house trailers for sale is the substantial savings. A double-wide that would normally cost $80,000 might be available as a repo for $50,000 or less. That’s 20-40% below market value—a life-changing amount of money.

You also build immediate equity from day one, giving you a financial safety net or a stepping stone for the future. The investment potential is even greater with land appreciation. While the home may depreciate, the land it sits on often increases in value.

By owning the land, you avoid lot rent, saving $300-$800 monthly. Over five years, that’s up to $48,000 you can save or invest. For families looking at this option, our guide on Repo Mobile Homes with Land for Sale shows you how to find these opportunities.

The bottom line is you could save 30-50% compared to buying new. That’s why so many smart buyers are asking Why Should You Get a Repo Mobile Home?—the financial benefits are too good to ignore.

Potential Risks and How to Mitigate Them

Repo homes come with an “as-is” label. The bank won’t fix a leaky faucet or a broken air conditioner; what you see is what you get. Common surprises include costly HVAC issues, hidden plumbing problems, and roof leaks. A new air conditioner alone can cost $5,000.

Paperwork can also be a headache. Title and lien issues can create legal nightmares, and zoning restrictions might prevent you from placing the home where you want.

But these risks are manageable. A professional inspection is the secret weapon. It costs a few hundred dollars but can save you thousands by uncovering potential problems. Smart buyers also get a thorough title search and lien check to avoid financial surprises from the home’s past.

For step-by-step guidance on avoiding these pitfalls, our Repossessed Mobile Home Buying Tips walks you through everything you need to know. Being informed is being smart about one of the biggest purchases you’ll ever make.

The Buyer’s Playbook: Finding and Securing Your Repo Home

Ready to start your hunt for repossessed house trailers for sale? With the right strategy, you’ll uncover some incredible deals.

Where to Find Repossessed House Trailers for Sale

Knowing where to look for repossessed house trailers for sale can make all the difference.

Specialized dealers like us at Mobile Homes Factory Direct are a great starting point. We often have inside access to repossessed inventory before it hits the general market. We proudly serve Von Ormy, Somerset, Atascosa, Macdona, San Antonio, Jbsa Lackland, and communities across Texas.

Bank REO listings are another goldmine. Banks want to sell repossessed homes quickly, so check the “REO” or “foreclosure” sections on their websites for good prices from motivated sellers.

Also check online marketplaces like MHVillage, Facebook Marketplace, and Craigslist. You can find deals from smaller dealers and individuals by filtering for “repo” or “foreclosure.”

Public auctions from agencies like GSA, HUD, or county tax offices can offer deep discounts. Be aware they often require cash and have strict “as-is” terms.

Geography matters. Texas is a hub with flexible financing, while Arizona has over 500 mobile homes with land listings and an average price around $328,215. Working with specialists like us gives you insider access to the best deals. Our team can help you Find Repo Mobile Homes for Sale Near Me in these prime markets.

The Inspection Process: What to Look For

Once you find a home, the inspection is your best protection to understand what “as-is” really means. Never skip a professional inspection by someone who specializes in manufactured homes. It costs a little upfront but can save you thousands.

Here’s what to check:

- Structural Integrity: The steel frame is the home’s backbone. Check for rust, cracks, or damage. A compromised frame can make moving the home impossible and repairs costly.

- Floor and Roof Integrity: Look for soft spots on the floor or water stains on ceilings. A bad roof can cause widespread water damage, mold, and structural problems.

- Systems Check: Test plumbing, electrical, and HVAC systems thoroughly. An unexpected HVAC replacement can cost thousands.

- Exterior: Check windows, doors, siding, and skirting. Skirting is vital for insulation and protecting the undercarriage.

- HUD Labels: Locate the data plate (inside) and certification label (exterior). These are essential for financing, permits, and moving the home.

Legal Due Diligence: Titles, Liens, and Permits

Legal due diligence is crucial to avoid inheriting the previous owner’s problems.

- Title Search: This is non-negotiable. It ensures the seller has the legal right to sell and that the title is clean, with matching VINs.

- Lien Checks: Check with the county tax office for unpaid property taxes and look for UCC filings for other creditor claims. Ensure you get a lien release form from the previous lender.

- Title Insurance: This is your safety net, protecting you financially from unknown title defects or liens that appear after the sale.

- Permits: If moving the home, you’ll need moving permits (from state agencies like the Texas Department of Housing and Community Affairs) and setup permits from the local county. Setup permits cost around $50-$200.

- Zoning: Always verify local zoning regulations to ensure a manufactured home is allowed on the land before you buy.

Our Repossessed Single Wide Mobile Homes Guide digs into specifics for those models. We’re here to help you steer these legal intricacies.

The Financials of Buying Repossessed House Trailers for Sale

Understanding the true cost of repossessed house trailers for sale helps you make smart decisions and avoid surprises.

Understanding the Price and Overall Costs

The savings on repossessed house trailers for sale are substantial. In Texas, prices typically range from $25,000 to $60,000. A 3-bed, 2-bath single-wide might be $25,000-$35,000, while a double-wide is often $35,000-$55,000. This is a 30-50% savings compared to new manufactured homes, meaning tens of thousands of dollars in immediate equity.

However, the sticker price is just the start. If the home needs to be moved, budget for additional costs.

- Moving Costs: Transporting a home can be a big expense, running $3-$7 per mile, plus pilot cars ($1.50-$3 per mile) and permits ($150-$500). Disconnecting utilities and splitting a double-wide can add another $2,000-$4,500.

- Setup Costs: Once on-site, expect costs for site prep ($500-$2,000), foundation ($2,000-$5,000), utility hookups ($1,000-$3,000), and installation like blocking, leveling, and skirting ($2,750-$7,500).

Budget an extra 5-10% of the purchase price for unexpected repairs that can arise after a move. For example, one customer’s total investment for a double-wide, including moving and setup, was $45,200—an incredible deal compared to new construction!

Financing Your Repo Mobile Home

Financing a repossessed house trailer for sale is achievable, even with imperfect credit. At Mobile Homes Factory Direct, we specialize in flexible financing for all credit types, including bad or no credit.

- Chattel loans are the most common option for the home only. They work like a car loan, with 15-20 year terms, 5-15% interest rates, and down payments as low as 5-20%.

- Land-home package loans are for homes sold with land. They function like traditional mortgages with longer terms (up to 30 years) and lower interest rates.

- Government-backed loans are also great options. FHA Mobile Home Financing accepts credit scores as low as 550 with a 3.5% down payment. VA loans may require no down payment for veterans, and USDA loans offer no-money-down options in eligible rural areas.

Most lenders prefer credit scores of 600+ and a debt-to-income ratio below 43%, but we work with partners who consider scores as low as 550. Lenders are often flexible with repo homes. Check out our guide on Financing for Mobile Homes with Bad Credit.

The Closing Process Explained

Once you’ve found a home and secured financing, the closing process begins. Our team keeps it simple and transparent.

- Making an Offer: Submit a written offer with $500-$2,000 in earnest money. Include contingencies for inspection, financing, and appraisal to protect yourself.

- Appraisal and Underwriting: The lender will appraise the home’s value while verifying your finances. You’ll do a final walk-through before closing.

- Closing Day: You’ll sign the final paperwork, and the keys become yours. Expect closing costs of 3-6% of the loan amount.

- Closing Timeline: Home-only loans usually close in 4-6 weeks, while land-home packages take 6-8 weeks. Banks are motivated to close quickly on Bank Repos, which can speed up the process.

Frequently Asked Questions about Repo Mobile Homes

We’ve helped hundreds of families find their perfect repossessed house trailers for sale. Here are answers to the most common questions.

How much cheaper are repossessed mobile homes?

The savings are significant. Banks want to recover their losses quickly, not maximize profit, so repo homes typically sell for 20-40% below market value. Compared to new manufactured homes, the savings are even greater at 30-50%. This can be the difference between renting and owning. Families can save tens of thousands of dollars, freeing up money for improvements, savings, or just monthly breathing room.

Can I get financing for a repo home with bad credit?

Yes, you can get financing even with bad credit. We specialize in helping families in all credit situations because we believe everyone deserves a shot at homeownership. Many lenders are flexible with repo homes, and we’ve helped clients with credit scores as low as 550 secure financing through our specialized lending partners.

FHA loans are a great option, accepting lower credit scores with down payments as low as 3.5%. VA loans are even better for veterans, sometimes requiring no down payment. The key is working with an expert who knows the market and has the right lending relationships. We guide you through the entire financing process, as detailed in our Financing for Mobile Homes with Bad Credit guide.

What are the biggest hidden costs to watch out for?

Being prepared for all costs is crucial. The biggest hidden costs include:

- Moving and Setup: Transport, site prep, foundation, and utility hookups can add up to several thousand dollars.

- Repairs and Renovations: Since homes are sold “as-is,” budget 5-15% of the purchase price for potential repairs to major systems like HVAC, plumbing, or roofing.

- Professional Services: A home inspection and title search are essential investments that protect you from larger problems.

- Insurance: Factor in insurance for transport and homeownership. The good news is that it’s typically more affordable than traditional homeowner’s insurance.

Even with these costs, you’ll likely save significantly. We help our clients create realistic budgets to ensure a stress-free, informed decision.

Conclusion: Your Path to Affordable Homeownership

You now know that repossessed house trailers for sale are one of the smartest paths to affordable homeownership. They are genuine opportunities to build equity and create stability for your family.

With savings of 20-40% below market value and 30-50% less than new homes, owning your own place is closer than you think. This journey is empowering because you are in control, making informed decisions based on inspections, financing choices, and due diligence.

We’ve seen countless families find the joy of homeownership this way. That feeling of possibility is what drives us every day.

At Mobile Homes Factory Direct, we’ve built our reputation on making homeownership accessible and straightforward. Located in Von Ormy, TX, we serve families throughout Von Ormy, Somerset, Atascosa, Macdona, San Antonio, Jbsa Lackland, and across Texas with the same commitment: the best homes at the best prices, backed by flexible financing for all credit types, including bad or no credit.

Our simple process takes the mystery out of buying a repo home. We are here to guide you through every detail—from finding the right home to securing financing to handling all the paperwork.

The path to affordable homeownership is waiting for you. Why not take the first step today? Explore our current pre-owned homes and see what’s possible. Let us help you open up the door to your new home—and your new future.