Second Chances, First-Rate Homes: Your Guide to Pre-Owned Mobile Homes

Your guide to affordable homeownership! Explore pre-owned mobile homes, including repo deals. Learn smart tips & financing options.

Your Path to Affordable Homeownership Starts Here

Pre-owned mobile homes offer a practical solution for individuals seeking quality housing without the hefty price tag of new construction. These manufactured homes provide an accessible entry point into homeownership, especially for those facing budget constraints or credit challenges.

Quick Answer: Where to Find Pre-owned Mobile Homes

- Specialized dealers – Often carry inspected, certified units

- Bank repossession listings – Up to 30-50% savings compared to new homes

- Online marketplaces – MHVillage, Facebook Marketplace, Craigslist

- Mobile home communities – Direct sales from current residents

- Estate sales – Quality homes from family transitions

Price Range: $25,000-$60,000 for most pre-owned units

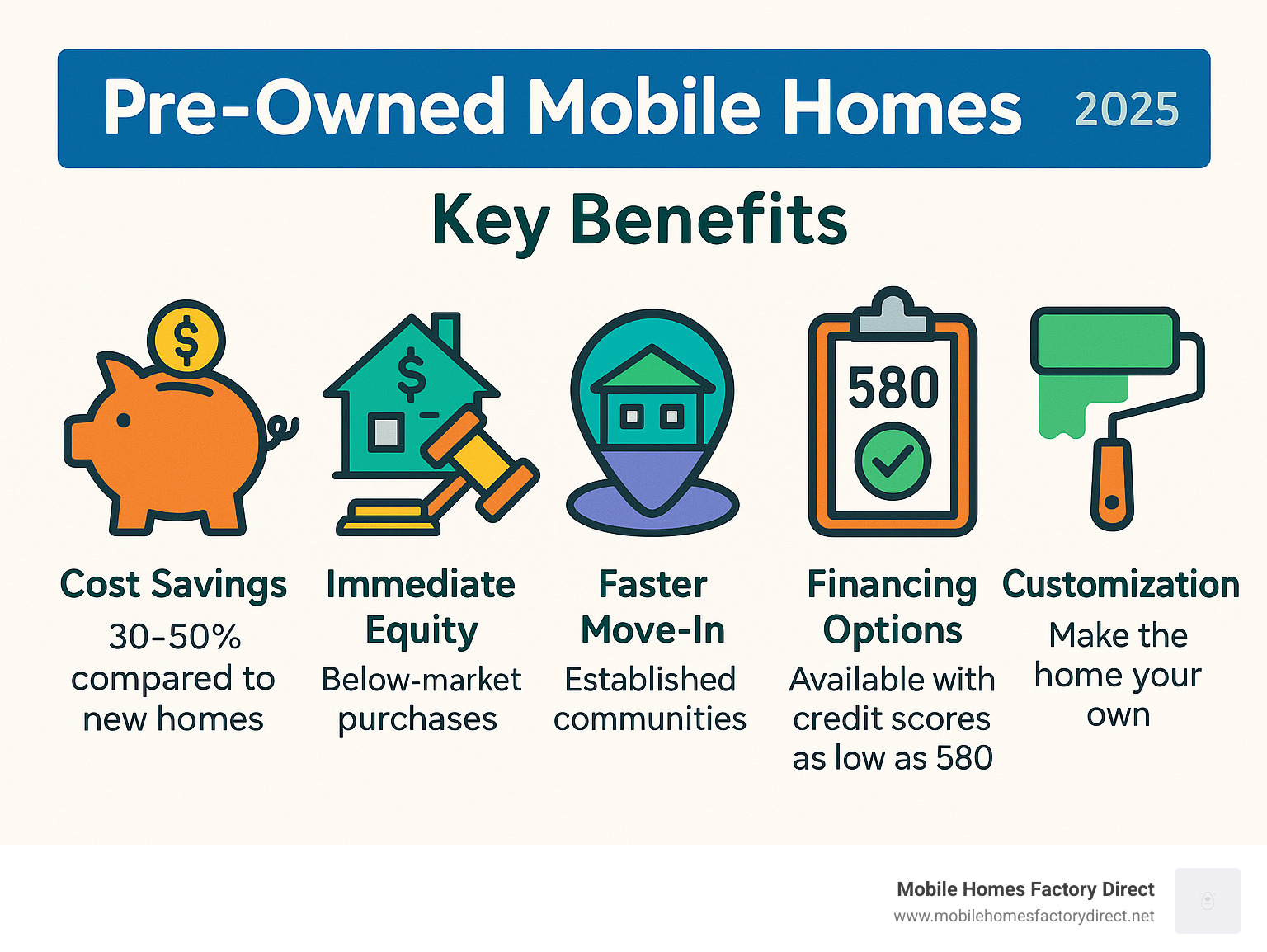

Financing: Available with credit scores as low as 580 through FHA loans

Savings: Immediate equity potential from below-market purchases

The appeal goes beyond just affordability. As one industry expert noted, “Sometimes a ‘new to you’ but pre-loved home can be the answer to budget constraints.” Pre-owned mobile homes can save you thousands compared to new construction while offering the same comfortable living space, often with established landscaping and immediate occupancy. With a few improvements, your pre-owned home can become a stepping stone to building wealth and achieving the American dream.

The key is understanding what to look for, where to find the best deals, and how to steer the buying process successfully.

Pre-owned mobile homes terms to learn:

The Value Proposition: Why Choose a Used Mobile Home?

Pre-owned mobile homes are manufactured homes with previous owners, distinguishing them from new units straight from the factory. While new homes offer the latest designs and full warranties, they come with a higher price and immediate depreciation. In contrast, pre-owned homes have already depreciated, allowing you to acquire them for significantly less. They offer immense value and a faster path to homeownership.

Here’s a quick comparison to help you weigh your options:

| Factor | New Mobile Homes | Pre-Owned Mobile Homes |

|---|---|---|

| Price | Higher initial cost | Significantly lower, often 30-50% less |

| Depreciation | Steepest depreciation occurs initially | Initial depreciation has already occurred |

| Customization | Full customization from factory | Limited, often involves renovations/updates |

| Move-in Time | Can be longer due to manufacturing/delivery | Potentially faster, especially if already sited |

| Repairs | Minimal, covered by warranty | Potential for immediate repairs, sold “as-is” |

| Warranty | Full manufacturer warranty | Limited or no warranty, some dealer-certified homes offer limited warranties |

The Advantages of Buying Pre-Owned

The allure of a pre-owned mobile home is strong, and for good reason! We’ve seen countless families find their perfect fit in these cost-effective dwellings.

- Cost Savings: This is the biggest draw, with savings of 30% to 50% compared to a new manufactured home. These savings can be used for upgrades, furniture, or to build your savings.

- Immediate Equity: Buying below market value means the home is worth more than you paid, giving you a head start on building wealth.

- Faster Availability: Unlike new homes that need to be built, many pre-owned mobile homes are ready for quick possession, allowing you to move in much sooner.

- Proven Communities: Buying a home in an existing park lets you assess the neighborhood, amenities, and community vibe before you commit.

- Customization Potential: A lower purchase price leaves more budget for renovations and upgrades. You can put your own “sweat equity” into the home to reflect your personal style.

For a deeper dive into the cost benefits, check out our guide on New vs Used Mobile Homes For Sale.

Potential Risks and Considerations

While the advantages are compelling, we believe in being upfront about potential challenges. Buying a pre-owned mobile home isn’t without its considerations, and being aware of these can help you make a smart, informed decision.

- ‘As-Is’ Condition: Many pre-owned mobile homes are sold “as-is,” meaning the seller isn’t responsible for repairs after the sale. This makes a thorough inspection critical.

- Potential for Repairs: An older home may need immediate attention, from cosmetic updates to major system repairs (plumbing, electrical, HVAC). It’s crucial to budget for these potential costs.

- Older Standards: Older homes may be built to outdated codes, resulting in lower energy efficiency and higher utility bills unless upgraded.

- Financing Challenges: Securing loans for older mobile homes, especially on leased land, can be more difficult. Lenders may have stricter requirements for these models.

- Limited Warranty: Pre-owned mobile homes typically have limited or no warranties, unlike new homes. Some reputable dealers may offer limited warranties on certified units, but this isn’t standard.

Understanding these points is part of being a savvy buyer. Our Best Mobile Home Buyers Guide offers even more insights to prepare you.

The Smart Buyer’s Roadmap: Finding and Purchasing Pre-owned Mobile Homes

With a clear roadmap, navigating the market for pre-owned mobile homes is an exciting journey. We’re here to guide you!

Where to Find Pre-owned Mobile Homes for Sale

The first step in any treasure hunt is knowing where to look! For pre-owned mobile homes, you have several excellent avenues:

- Specialized Dealers: Companies like us specialize in manufactured homes and often have a rotating inventory of pre-owned mobile homes. We can provide quality-checked units, and sometimes even offer limited warranties or handle delivery and setup. Dealers are also a great resource for understanding financing options specific to pre-owned mobile homes.

- Online Marketplaces: Websites like MHVillage, Facebook Marketplace, and Craigslist are popular spots for both private sellers and smaller dealers to list homes. You can find everything from single-wide gems to spacious double-wides. Remember to use caution and verify listings when dealing with private parties.

- Find a great selection of Used Single Wide Mobile Homes For Sale.

- Explore more spacious options with Used Double Wide Mobile Homes For Sale.

- Bank Listings: Lenders often repossess homes due to loan defaults. These “repo” homes can be fantastic deals, often sold at significant discounts to recoup losses quickly. We’ll dig deeper into these later.

- Community Bulletin Boards: Believe it or not, some of the best deals can be found right within existing mobile home communities. Residents looking to sell, or park management, might post notices on bulletin boards or community websites. This is especially true if a park is undergoing ownership changes or closure.

- Private Sellers: Sometimes, homeowners simply want to sell their current mobile home directly. You might find these listings through word-of-mouth, local classifieds, or online platforms. While private sales can offer flexibility, they also require more due diligence on your part, as there’s no dealer oversight.

- Estate Sales: When families settle an estate, they sometimes sell a mobile home. These can be hidden gems, often well-maintained, but they might require quick action.

The Non-Negotiable Step: Inspection and Condition Assessment

Never put money down on a pre-owned mobile home without a thorough inspection. This is the most important step to protect your investment and avoid costly surprises. Even if a home looks great, a professional inspection is essential. While we at Mobile Homes Factory Direct inspect and refurbish our pre-owned homes, this isn’t a universal practice. An inspector specializing in manufactured homes will examine the property inside and out.

Here’s a checklist of what to focus on during your inspection:

- Structural Integrity:

- Floors: Check for soft spots, squeaks, or bouncy areas, which can indicate water damage or subfloor issues.

- Walls and Ceilings: Look for cracks, bowing, or discoloration. Stains on the ceiling often point to roof leaks.

- Window and Door Frames: Check for water intrusion, rot, and poor seals.

- Chassis and Frame: Inspect the home’s frame for rust, bends, or cracks. If the home will be moved, check the axles and wheels.

- Roof and Leaks: Check the roof for missing shingles or damage. Inside, look for ceiling stains that indicate leaks.

- Plumbing and Electrical: Test all faucets and fixtures for leaks and pressure. A professional should check the outlets, lights, and electrical panel.

- HUD Data Plate: Find this metal plate (usually near the electrical panel or in a closet) to confirm the home meets federal HUD standards (post-1976). It provides the build date and Wind Zone rating, which are essential for permits and insurance.

- Systems Check: Test the heating, cooling, and any included major appliances.

Flaws are expected and can be powerful negotiation tools for a better price or pre-closing repairs. For more detailed advice, read our Repossessed Mobile Home Buying Tips.

Financing Your Pre-owned Mobile Home

Securing financing is a key step, and there are viable options even with less-than-perfect credit.

- Chattel Loans: These are the most common loans for homes on leased land. As personal property loans, they typically have 15-20 year terms and require a 5-20% down payment.

- Land-Home Packages: If you’re buying the home and land together, you may qualify for a land-home package. These real estate loans offer longer terms (up to 30 years) and better rates, similar to traditional mortgages.

- Credit Score Requirements: While lenders often prefer scores of 600+, we work with a network that can accommodate scores as low as 550. We aim to find flexible financing for all credit types.

- Debt-to-Income Ratio: Lenders assess your debt-to-income (DTI) ratio (monthly debt payments vs. gross income), preferring it to be below 43%.

- Down Payment: A down payment is usually required, but government-backed programs like FHA loans offer low down payment options (e.g., 3.5% with a 580 credit score).

- Other Options: For less expensive homes, personal loans or seller financing can be viable, though personal loans often have higher rates and shorter terms.

Financing is more accessible than many believe, as loans often have no age restrictions on the home. We can help you steer the options. Learn more in our Mobile Home Prices Ultimate Guide.

Legal, Title, and Permit Essentials

Proper paperwork and a clean ownership transfer are essential to protect your investment in a pre-owned mobile home.

- Title Verification: A mobile home has a title that proves ownership. Ensure it’s clear (not salvaged) and the VIN on the title matches the home’s VIN.

- Lien Search: Check for outstanding liens (legal claims) against the home. A UCC filing search at the county tax office can reveal these. Insist on seeing a lien release form from any previous lenders.

- Zoning Regulations: Before moving a home, verify that local zoning regulations permit manufactured homes on your property. Check setback requirements (distance from property lines) to avoid costly issues.

- Moving Permits: Moving a home requires transport permits from the state DOT (like TxDOT in Texas). These ensure legal transport and specify requirements like escort vehicles.

- Installation Permits: At the new site, you’ll need local permits for installation, utility hookups, and foundation work.

- Community Rules: If moving into a community, review and adhere to its rules, which may include restrictions on home age, appearance, or size.

The Texas Department of Housing and Community Affairs (TDHCA) is an excellent resource for state-specific regulations. For more general guidance, see our Tag: Buying A Mobile Home.

Open uping Deep Savings: A Closer Look at Repo Mobile Homes

Among pre-owned mobile homes, repossessed (“repo”) units are an attractive option for budget-conscious buyers, offering a path to homeownership at a significantly reduced cost.

The Appeal of Repossessed Homes: More Than Just Savings

A repossessed mobile home is one a lender has reclaimed after a loan default. The lender wants to sell it quickly to recover losses, creating a great opportunity for buyers.

- Significant Discounts (30-50%): Lenders prioritize a quick sale over maximum profit, often selling repo homes for 30-50% less than new manufactured homes.

- Below Market Value: Motivated lenders often price these homes below market value, allowing you to purchase a home for less than it’s worth.

- Immediate Equity: Purchasing below market value provides immediate equity, a powerful advantage for building wealth.

- Quick Sales Process: The sales process for repo homes is often much faster than traditional home sales, which is ideal if you need to move quickly.

Repo homes are an economical and practical path to homeownership. For more reasons to consider this option, explore Why Should You Get a Repo Mobile Home.

Finding and Financing Repossessed Mobile Homes

The repo market moves quickly, so being proactive is key!

Finding Repo Homes:

- Specialized Dealers: Many manufactured home dealers, including us, specialize in or carry an inventory of repossessed homes. We often have “first dibs” on newly available units from banks and can provide thoroughly inspected and sometimes refurbished units.

- Bank Websites: Many banks and financial institutions list their repossessed properties directly on their websites. This can be a great place to find upcoming auctions or direct sales.

- Online Marketplaces: While not exclusively for repos, sites like MHVillage and even eBay (for certain types of units) can have listings. Be sure to filter for “bank-owned” or “foreclosure.”

- Public Auctions: These can offer the lowest prices, but they come with the highest risk. Homes are typically sold “as-is, where-is,” with little opportunity for inspection before bidding.

- Local Credit Unions: Sometimes, local credit unions will have a small inventory of repossessed homes.

- State Inventory Listings: In some states, there are centralized listings for bank-owned properties.

To effectively search for these affordable options, check out our guide on how to Find Repo Mobile Homes For Sale Near Me.

Financing Repossessed Homes:

Financing for repo homes is very accessible, often with surprisingly favorable terms.

- FHA Loans: The Federal Housing Administration (FHA) offers popular loans for manufactured homes, accessible with credit scores as low as 580 and a 3.5% down payment. This makes homeownership a reality for many. You can read more about FHA loans for manufactured homes.

- Credit Scores as Low as 580: FHA loans help buyers with less-than-perfect credit. For scores below 580, other programs like owner financing may offer more flexibility.

- Zero Down Payment Options: Some programs, like VA loans for veterans, may offer zero down payment options, making homeownership even more accessible.

- Other Programs: Specialized financing programs are available through dealers and lenders, including owner financing and options for self-employed individuals.

For those interested in larger units, our Repossessed Double Wide Homes Complete Guide provides extensive detail.

Frequently Asked Questions about Pre-owned Homes

We understand you likely have more questions swirling around. Let’s tackle some of the most common ones we hear from our prospective homeowners.

What credit score do I need to buy a used mobile home?

The credit score needed to buy a pre-owned mobile home can vary depending on the lender and the type of loan.

- FHA Loans: These government-backed loans are a fantastic option and are often accessible with credit scores as low as 580. This makes them a popular choice for many buyers.

- Chattel Loans: For home-only loans (chattel loans), lenders typically look for scores in the 600s. However, some specialized lenders, particularly those working with dealers, might go as low as 550.

- Flexible Lenders: We pride ourselves on working with a wide network of lenders who understand the manufactured home market. This allows us to find flexible financing solutions for almost all credit types, including those with bad or no credit history.

- Debt-to-Income Ratio: Beyond your credit score, lenders will also evaluate your debt-to-income (DTI) ratio. They generally prefer this to be below 43%. A stable income history is also a crucial factor.

- Improving Your Score: If your score is low, paying down debt and making on-time payments can significantly improve your credit before you apply.

Are repo mobile homes a risky investment?

Repo mobile homes offer huge savings, but they aren’t inherently risky if you approach the purchase wisely.

- ‘As-Is’ Condition: Most repo homes are sold “as-is” and may need repairs. A thorough inspection is absolutely essential.

- Importance of Inspection: A professional inspection uncovers potential issues, allowing you to negotiate the price or budget for repairs. Do not skip this step.

- Potential for Repairs: Smart buyers budget 5-10% of the purchase price for initial repairs and cosmetic updates.

- High Reward: Despite the risks, the potential for huge savings and immediate equity makes repo homes a high-reward investment.

- Title Verification: Always verify the title is clear of liens to ensure a clean ownership transfer and protect your investment.

For a deeper dive into understanding these unique opportunities, explore our Bank Repos section.

How much does it cost to move a used mobile home?

Moving a pre-owned mobile home involves several costs beyond the purchase price.

- Transport Fees: Typically $3-$7 per mile for single-wides; more for double-wides.

- Escort Vehicles: Adds $1.50-$3 per mile. Single-wides usually need one, while double-wides need two.

- Permits: State transport permits from the state Department of Transportation (e.g., TxDOT in Texas) can cost $150-$500.

- Disconnection/Reassembly (Double-Wides): Disconnecting costs $1,000-$2,500; reassembly costs $2,000-$4,000.

- Site Preparation: This includes land clearing ($500-$2,000) and creating a foundation or pad ($2,000-$5,000).

- Setup Costs: Includes blocking and leveling ($1,000-$3,000), anchoring ($750-$1,500), skirting ($1,000-$3,000), steps ($500-$2,000), and utility hookups ($1,000-$3,000).

For a more comprehensive understanding of these homes, explore our Tag: Manufactured Homes.

Your New Beginning Awaits

Pre-owned mobile homes truly offer a remarkable path to homeownership, blending affordability with the comfort and space you desire. We’ve explored how they differ from new homes, their significant advantages, and the practical considerations every smart buyer should keep in mind. From the thrill of finding a great deal to the satisfaction of customizing your space, these homes represent a tangible step towards achieving your housing dreams.

We’ve emphasized the critical role of due diligence, especially thorough inspections and understanding the legal and financial landscape. And for those seeking even deeper savings, repossessed mobile homes present an exciting opportunity, often available with flexible financing options, even for those with lower credit scores.

At Mobile Homes Factory Direct, we are dedicated to making homeownership accessible and simple. With locations across Texas, including Von Ormy, San Antonio, and Laredo, we’re here to guide you through every step, offering the best homes at the best prices with flexible financing for all credit types. Your journey to an affordable, comfortable home is within reach.