Unlocking Value: The Smart Buyer’s Guide to Foreclosed Mobile Homes

Unlock affordable homeownership! Learn to find, inspect, finance, and buy foreclosed manufactured homes. Discover pros, cons & smart steps.

What is a Foreclosed Manufactured Home?

Foreclosed manufactured homes are properties that banks or lenders have taken back when the previous owner couldn’t make their mortgage payments. These homes offer a path to affordable homeownership, often at prices 20-50% below market value.

Quick Answer: What You Need to Know

- Definition: Homes repossessed by lenders due to payment default

- Types: Bank-owned (REO), auction properties, or government repos

- Savings: Typically discounted 20-50% from original price

- Classification: Personal property (repossessed faster) vs. real property (foreclosure process)

- Condition: Usually sold “as-is” requiring inspection and potential repairs

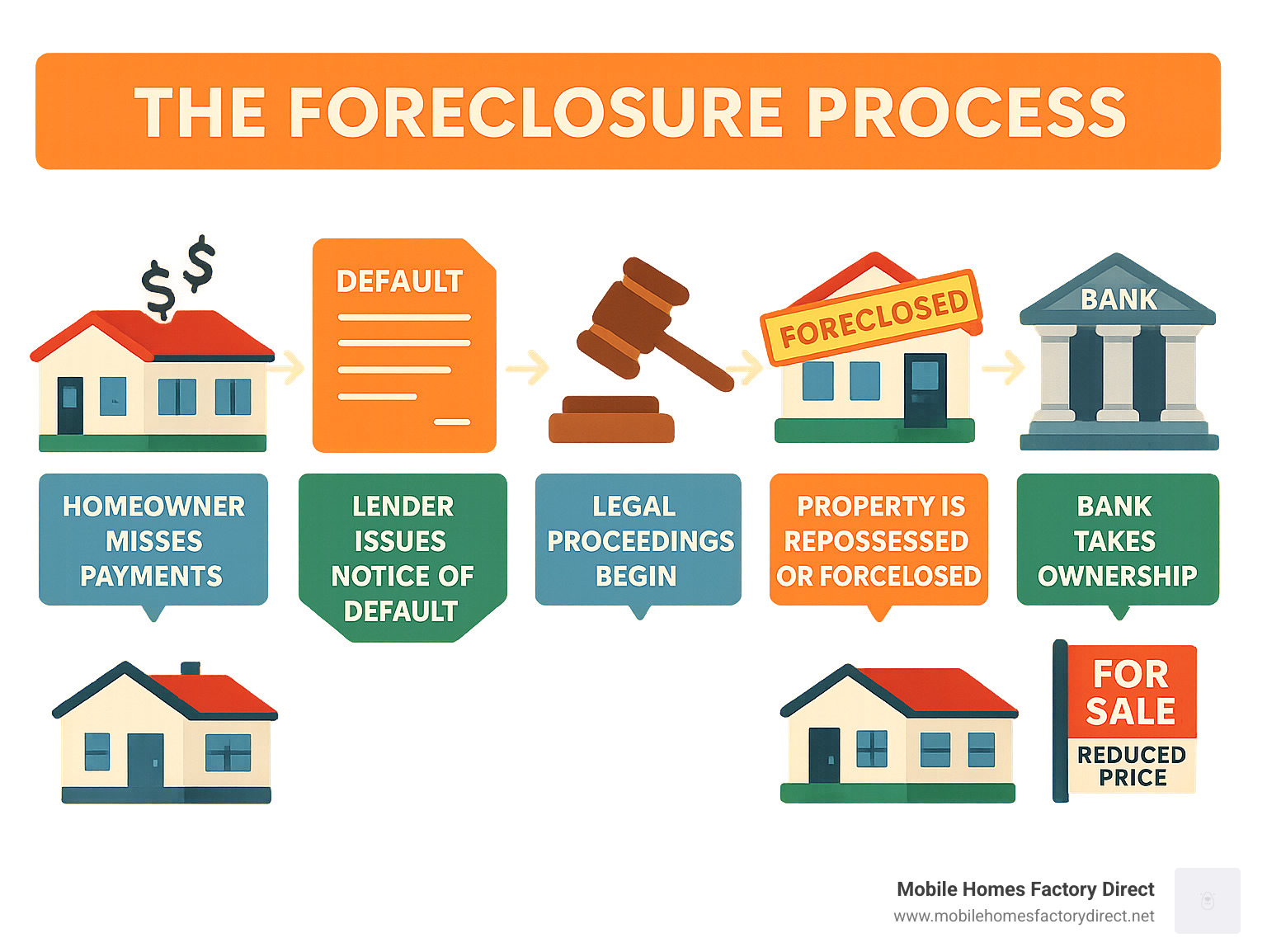

The foreclosure process begins when homeowners fall behind on payments. After missed payments and notices, the lender either repossesses the home (if it’s personal property) or forecloses (if it’s real property attached to land). The bank then sells these homes to recover their losses.

Why consider foreclosed manufactured homes? They provide an opportunity for buyers with budget constraints or credit challenges to achieve homeownership. While they require careful inspection and planning, these properties can offer significant savings and investment potential.

The key is understanding what you’re buying and being prepared for the process ahead.

Simple guide to foreclosed manufactured homes:

The Pros and Cons of Buying a Repo Mobile Home

When you’re considering a repossessed mobile home, it’s important to look at the complete picture. We believe in being upfront about both the exciting opportunities and the challenges you might face.

| Pros of Buying a Repossessed Mobile Home | Cons of Buying a Repossessed Mobile Home |

|---|---|

| Significantly lower purchase price | “As-is” condition, potential hidden costs |

| Opportunity for investment and equity | Limited financing options (sometimes) |

| Negotiation flexibility with lenders | Unknown history and potential neglect |

| Faster path to homeownership | May require extensive repairs and renovations |

| Environmentally friendly (repurposing) | Location may be fixed (if on land) |

The Upside: Major Advantages

The most exciting thing about foreclosed manufactured homes is the incredible savings you can achieve. We’re talking about homes priced 20-50% below market value – sometimes even more! This dramatic price reduction opens doors for buyers who thought homeownership was out of reach.

Think about it this way: you could buy a quality home for thousands less than its original price. That extra money stays in your pocket for renovations, furniture, or just peace of mind in your savings account. For first-time buyers, those with credit challenges, or anyone on a tight budget, this cost savings can be life-changing.

But the benefits go beyond just the initial purchase price. When you buy below market value, you’re building equity faster than traditional buyers. Many of our customers have turned these purchases into smart investment opportunities. With some strategic upgrades and a little elbow grease, you can significantly boost your home’s value.

The renovation opportunity aspect is particularly appealing if you enjoy DIY projects or have a vision for improvements. You’re starting with a solid foundation at a great price, giving you room to customize without breaking the bank.

Banks also tend to offer more negotiation flexibility than private sellers. They’re not emotionally attached to the property – they just want to recover their investment quickly. This business-focused approach often works in your favor during price discussions.

Want to learn more about the benefits? Check out Why Should You Get a Repo Mobile Home? for additional insights.

The Downside: Understanding the Risks of Foreclosed Manufactured Homes

Now let’s talk about the challenges you need to prepare for. The biggest consideration is that these homes are sold “as-is” – meaning what you see is what you get, repairs and all.

Hidden repair costs are probably the most significant risk. Previous owners facing financial difficulties may have skipped maintenance, and unfortunately, some people damage their homes before losing them. We’ve seen everything from minor cosmetic issues to serious problems with plumbing, electrical systems, or structural damage.

This potential for damage means you absolutely must budget for repairs beyond the purchase price. Sometimes these costs are minor, but occasionally they can be substantial. A thorough inspection isn’t optional – it’s essential for protecting your investment.

Limited financing options can also present challenges. While we at Mobile Homes Factory Direct offer flexible financing for all credit types, some traditional lenders have stricter requirements for repossessed homes. You might need to explore specialized lenders or consider alternative financing approaches.

There are also legal considerations to steer. You’ll want to ensure there are no outstanding liens, unpaid taxes, or other legal issues attached to the property. A proper title search protects you from inheriting someone else’s financial problems.

The key is going into this process with your eyes wide open. For comprehensive guidance on what to watch for, read our article on What to Know Before Buying a Foreclosed Manufactured Home.

Despite these challenges, many buyers find that the advantages far outweigh the risks when they’re properly prepared and realistic about the process ahead.

The Complete Guide to Buying Foreclosed Manufactured Homes

Buying a foreclosed manufactured home might seem overwhelming at first, but we’re here to walk you through every step. Think of it like following a recipe – once you know the ingredients and the process, you’ll be cooking up homeownership success in no time.

Step 1: Finding Your Opportunity

The treasure hunt begins with knowing where to look. Foreclosed manufactured homes don’t always show up in your typical real estate searches, so you’ll need to cast a wider net.

Online listings are your best friend here. Many websites let you filter specifically for foreclosures or “bank-owned” properties. These are often marked as REO (Real Estate Owned) properties, which is just fancy talk for “the bank owns it now and wants to sell it.”

Bank websites are goldmines that many people overlook. Large financial institutions often have entire sections dedicated to their repossessed inventory. It’s like shopping directly from the source – no middleman, no markup.

Working with real estate agents who specialize in foreclosures or manufactured homes can give you a serious advantage. These folks often get the inside scoop on properties before they hit the general market. Think of them as your personal treasure map.

Foreclosure auctions can be exciting (and a little nerve-wracking). Whether they’re in-person or online, these auctions can offer incredible deals. Just remember – you’ll need to make quick decisions and come prepared with your financing already sorted out.

For a head start on your search, check out our guide to Find Repo Mobile Homes for Sale Near Me.

Here are the top places to start your search:

- Online real estate marketplaces with foreclosure filters

- Bank and lender websites with REO sections

- Specialized foreclosure listing sites

- Government auction sites like GSA Auctions

- Local real estate agents who know the foreclosure market

- Social media groups focused on mobile home sales

Step 2: The All-Important Inspection

This is where the rubber meets the road – and where many buyers either save themselves from disaster or miss red flags that cost them dearly later. Since foreclosed manufactured homes are sold “as-is,” your inspection is your safety net.

Structural integrity should be your first concern. Walk around the home and look for sagging, cracks in walls, or anything that just doesn’t look right. The foundation is especially important – if it’s compromised, you could be looking at expensive repairs down the road.

Check the roof condition carefully. Water damage is the enemy of any home, but especially manufactured ones. Look for missing or damaged shingles, and don’t forget to peek inside for ceiling stains or signs of leaks.

Plumbing and electrical systems need your attention too. Turn on every faucet, flush every toilet, and test every outlet. These systems can be costly to repair or replace, so knowing their condition upfront helps you budget accurately.

Water damage is particularly sneaky. It might hide behind walls or under flooring. Trust your nose – musty smells often indicate moisture problems that aren’t immediately visible.

Don’t forget to check for pests. Rodents and insects can cause surprising amounts of damage, and getting rid of them can be both expensive and time-consuming.

We strongly recommend hiring a professional inspector who knows manufactured homes inside and out. They’ll catch things you might miss and give you a realistic picture of what you’re buying. Our guide on Inspecting the home for structural damage can help you understand what to look for.

If you’re considering a single-wide home, browse our Used Single Wide Mobile Homes for Sale to see examples of homes that have passed thorough inspections.

Step 3: Navigating Legal and Financial Problems

Now comes the paperwork part – not the most exciting step, but absolutely crucial for protecting your investment. Think of this as building the foundation for your future peace of mind.

A title search is non-negotiable when buying foreclosed manufactured homes. This process reveals any hidden surprises that could complicate your ownership later. You want to make sure the path to clean ownership is crystal clear. For detailed guidance, check out our resource on Performing a thorough title search.

Liens and encumbrances are like unwanted guests at a party – they can show up uninvited and cause problems. The title search will uncover any outstanding debts tied to the property, such as unpaid taxes or contractor liens. These need to be resolved before you take ownership, or they become your responsibility.

Local restrictions can vary dramatically depending on where the home is located. Some manufactured home communities have strict rules about everything from paint colors to pet ownership. Monthly community fees can also impact your budget significantly. Understanding these requirements upfront prevents unpleasant surprises later. Learn more about this on our page about Understanding Community Fees.

Step 4: Securing Financing and Closing the Deal

Financing a foreclosed manufactured home works a bit differently than traditional home loans, but don’t worry – plenty of options exist to help you seal the deal.

Chattel loans are common when the home isn’t permanently attached to land. These loans treat your home like a car loan – it’s personal property rather than real estate. They typically have shorter terms and higher interest rates, but they’re often easier to qualify for.

Personal loans might work for smaller purchase amounts, especially if you have good credit. They offer flexibility but usually come with higher interest rates than secured loans.

Specialized lenders understand the manufactured home market inside and out. At Mobile Homes Factory Direct, we work with buyers of all credit backgrounds – including those with bad credit or no credit history. We believe everyone deserves a shot at homeownership.

Down payment requirements vary widely based on your lender, credit score, and the home’s condition. Some situations might require substantial down payments, while others might offer financing up to 100% of the home’s value for primary residences.

The closing process depends on whether your home is considered personal property or real estate. Home-only purchases might close through a retailer with notarized documents, while land-and-home combinations typically involve title companies or attorneys. Expect four to six weeks for home-only loans and six to eight weeks for land-home combinations.

For those interested in larger homes, our Repossessed Double Wide Homes: Complete Guide offers additional insights into financing these properties.

Buying a foreclosed manufactured home is a marathon, not a sprint. Take your time with each step, ask plenty of questions, and don’t be afraid to walk away if something doesn’t feel right. The right home at the right price is out there waiting for you.

Budgeting and Post-Purchase Planning

Congratulations! You’ve found your foreclosed manufactured home and you’re ready to make the leap. But here’s the thing – buying the home is just the beginning of your journey. Smart budgeting and thoughtful planning for what comes next will help you turn that great deal into an even better investment.

Creating a Realistic Budget

Let’s be honest – that attractive purchase price you negotiated is just the starting point. While foreclosed manufactured homes offer incredible savings upfront, you’ll want to plan for several additional expenses to avoid any financial surprises down the road.

Your renovation costs deserve special attention since most foreclosed homes come “as-is.” We always tell our customers to budget generously here because, let’s face it, you never know what you’ll find once you start making improvements. That small water stain might reveal a bigger plumbing issue, or those “cosmetic” repairs might uncover structural needs.

Don’t forget about the ongoing expenses that come with homeownership. Property taxes apply whether your home is considered personal property or real estate, and the rates vary by location. Homeowners insurance is typically required by your lender and should cover your home’s current value plus any improvements you make.

If your home needs to be moved to a new location, moving expenses can add up quickly. Professional transport and setup aren’t cheap, but they’re essential for ensuring your home is properly positioned and leveled. Utility setup costs – connecting water, electricity, and sewage – might seem minor but can surprise first-time buyers with connection fees and deposits.

The key is being realistic about these costs from the start. We’ve seen too many buyers get caught off guard by expenses they didn’t anticipate.

Maximizing Your Investment

Here’s where the real magic happens. With some strategic thinking, you can transform your affordable purchase into a valuable asset that serves you well for years to come.

Smart upgrades are your best friend when it comes to building equity. Focus on improvements that give you the biggest bang for your buck. Kitchen updates, bathroom renovations, and quality flooring can dramatically increase both your home’s appeal and its value. Energy-efficient windows not only look great but can significantly reduce your utility bills too.

If you’re the hands-on type, DIY repairs can save you thousands in labor costs. Simple projects like painting, basic plumbing fixes, or installing new fixtures are well within most homeowners’ capabilities. Just remember – know your limits. Complex electrical work or major structural repairs are best left to the professionals.

Energy efficiency improvements deserve special mention because they keep paying you back month after month. Better insulation, weatherstripping around doors and windows, and modern appliances can slash your utility bills while making your home more comfortable year-round.

The secret to long-term value is staying on top of maintenance. Regular upkeep prevents small issues from becoming expensive problems. A well-maintained manufactured home can appreciate steadily over time, especially in desirable locations.

For buyers looking to start with an even more budget-friendly option and build sweat equity from the ground up, exploring a Cheap Trailer House for Sale might be worth considering.

Buying a foreclosed manufactured home isn’t just about finding affordable housing – it’s about creating a foundation for your financial future. With careful planning and smart improvements, you’ll be amazed at what you can accomplish.

Frequently Asked Questions about Foreclosed Homes

When people are considering foreclosed manufactured homes, they often have specific concerns and questions. We hear these same questions regularly at Mobile Homes Factory Direct, so let’s address the most common ones to help you feel confident about your decision.

Can I get financing for foreclosed manufactured homes with bad credit?

Absolutely, yes! This is one of the most frequent questions we get, and we’re happy to say that having less-than-perfect credit doesn’t have to be a roadblock to homeownership. At Mobile Homes Factory Direct, we specialize in helping people with all credit types achieve their homeownership dreams, including those with bad credit or even no credit history at all.

The key is working with the right lenders. We partner with specialized lenders who understand manufactured homes and are experienced in working with buyers who have credit challenges. These lenders know that a credit score doesn’t tell your whole story, and they’re willing to look at other factors like your income stability and down payment ability.

Now, let’s be honest – you might face higher interest rates than someone with excellent credit, and you may need a larger down payment. But here’s the thing: even with these adjustments, you’re often still getting a fantastic deal because foreclosed manufactured homes are already priced well below market value.

We focus on finding solutions that fit your specific situation and budget. Our goal isn’t just to get you approved – it’s to make sure you’re comfortable with the monthly payments and can truly enjoy your new home.

Are bank-owned manufactured homes a good investment?

In our experience, they can be an excellent investment opportunity! Bank-owned foreclosed manufactured homes offer something that’s pretty rare in today’s real estate market: the chance to buy below market value right from the start.

Think about it this way – you’re getting immediate equity the moment you close. That’s money in your pocket from day one. Many of our customers have used this built-in equity as a springboard for building wealth. Some make smart renovations and sell for a profit within a few years. Others keep the home as a rental property, generating steady rental income potential while the property appreciates.

We’ve seen people turn these investments into real success stories. The opportunity for sweat equity is huge – a weekend of painting, some new flooring, or updated fixtures can add thousands to the home’s value.

But here’s the important part: success requires thorough due diligence and budgeting for repairs. These homes are sold “as-is,” so you need to factor in renovation costs from the beginning. The smart investors we work with always get detailed inspections and budget generously for improvements.

When approached thoughtfully, bank-owned manufactured homes can be one of the best ways to enter the real estate investment market without needing a huge amount of capital.

What is the difference between a foreclosed and a repossessed mobile home?

This is such an important question because the answer affects everything from the buying process to your legal protections. Many people use these terms interchangeably, but they’re actually quite different.

Foreclosure applies to real property – this means the manufactured home is permanently attached to land that the homeowner owns. In these cases, the home’s title has usually been “retired” and converted to real estate, just like a traditional house. The legal process differs significantly here because it follows the same foreclosure laws as site-built homes, which typically involve court proceedings and provide substantial homeowner protections.

Repossession applies to personal property – this happens when the manufactured home is treated more like a car or other movable asset. This is common when the home sits on leased land (like in a mobile home park) or when the homeowner holds a separate title that hasn’t been converted to real estate.

Here’s why this matters to you as a buyer: repossession can be faster with fewer protections for the original homeowner, which sometimes means these properties become available more quickly. However, it also means the legal process is different, and you’ll need to understand what type of property you’re buying.

The bottom line? If it’s attached to land and treated like traditional real estate, it went through foreclosure. If it’s treated like a movable asset, it was repossessed. Understanding this distinction helps you know what to expect during the purchase process and what kind of financing you’ll need.

Your Path to Affordable Homeownership

We hope this comprehensive guide has shed light on the exciting opportunities that foreclosed manufactured homes present. They truly can be a fantastic way to achieve homeownership or make a savvy investment, offering significant cost savings and the potential for increased equity.

While the “as-is” nature and the need for thorough inspection are important considerations, the benefits often outweigh the challenges for informed buyers. We’ve seen countless families find their dream homes and build a secure future through these affordable options.

At Mobile Homes Factory Direct, we are committed to making homeownership a reality for everyone. Located in Von Ormy, TX, and serving communities like Somerset, Atascosa, Macdona, San Antonio, Jbsa Lackland, Lytle, Poteet, La Coste, Leming, Natalia, Elmendorf, Castroville, Jbsa Ft Sam Houston, Bigfoot, Devine, and across Texas, we offer the best homes at the best prices with a simple process and flexible financing for all credit types, including bad or no credit.

Your path to an affordable and quality home is closer than you think. With the right knowledge and a trusted partner, you can confidently steer foreclosed manufactured homes and open up incredible value.

Ready to find your next home? Explore our inventory of pre-owned homes today!