Everything’s Bigger in Texas: Including Deals on Repo Mobile Homes

Discover huge savings on bank repo mobile homes in Texas. Get your affordable dream home with our guide to finding deals & financing.

Your Gateway to Affordable Texas Homeownership

Bank repo mobile homes in texas offer a practical path to homeownership, saving you thousands and getting you into your new home faster than traditional methods.

Quick Answer for Texas Repo Home Buyers:

- Where to Find Them: Specialized dealers, bank websites, online marketplaces, and repo auction sites

- Typical Savings: 20-40% below market value compared to non-repo homes

- Price Range: Usually $25,000-$60,000 for most repo mobile homes

- Financing Options: Chattel loans, FHA Title I, VA loans, and bad credit programs available

- Best Locations: San Antonio, Houston, Dallas, Austin, and surrounding areas

- Key Requirements: Professional inspection, clear title verification, and pre-approved financing

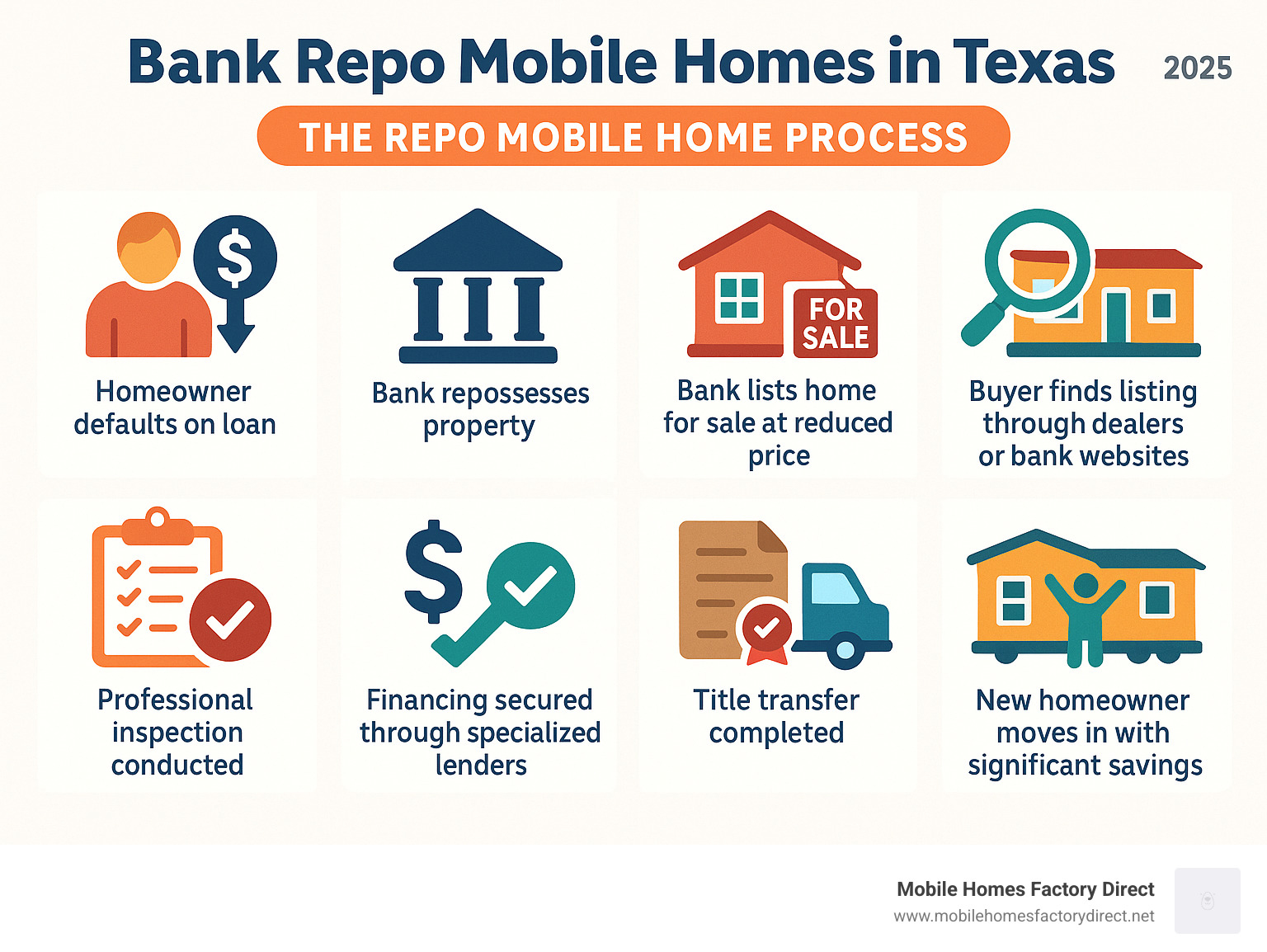

A bank repo mobile home is a manufactured home repossessed by a lender after the previous owner defaulted on payments. Banks sell these homes at significantly reduced prices to quickly recover their losses, as they are not in the housing business.

The Texas repo market is robust, with thousands of quality manufactured homes available annually. Many are just a few years old and in excellent condition, making them an attractive option for first-time buyers, families on a budget, or anyone looking to build equity.

As one Texas repo dealer puts it: “Times are tough, we understand that. Because of this, we want to offer you a chance at a home at a great price!”

The process is straightforward when you know the steps. From finding listings to securing financing, buying a repo mobile home in Texas can be one of the smartest financial decisions you’ll make.

The Good, The Bad, and The Bargain: Weighing the Pros and Cons

Considering bank repo mobile homes in Texas is like shopping at an outlet store: you can find amazing deals if you know what to look for. The main difference is the history. A regular mobile home is a standard sale, while a bank repo mobile home was repossessed after the owner defaulted. The bank wants to sell it quickly, and this urgency benefits you.

Banks are motivated sellers who often price these homes to move fast, creating a unique opportunity for buyers.

Here’s how the two options stack up:

| Feature | New Mobile Home | Bank Repo Mobile Home |

|---|---|---|

| Cost | Full market price, higher upfront investment | Significantly discounted (20-40% below market value) |

| Condition | Brand new, customizable, warranty | “As-is,” condition varies, potential for repairs |

| Availability | Built to order, wide selection of models | Limited to current repossessed inventory, fast turnover |

| Process | Standard purchase, direct from dealer | Bank-driven sale, potentially faster closing |

| Financing | Standard manufactured home loans | Specialized loans, some lenders offer flexible options for varied credit |

The beauty of repo homes is immediate equity. Buying below market value means you can have equity from day one. However, there are challenges. Homes are sold “as-is,” meaning their condition varies. Some are in great shape, while others need repairs. Competition for good repos is also a factor, so you must be ready to act fast.

Having the right guidance makes all the difference. We’ve helped hundreds of families steer the repo market successfully. For a deeper dive into why repos might be perfect for your situation, check out our guide on Why Should You Get a Repo Mobile Home.

The Major Advantages of Buying Repo

The cost savings on bank repo mobile homes in Texas are impressive. Families can save $20,000, $30,000, or more compared to a similar home at market price. These savings typically fall in the 20-40% discount range. That’s thousands of dollars that stay in your pocket for improvements or other needs.

This discount creates immediate equity. You could own more than you owe from the start—a financial head start that usually takes years to build. The faster path to homeownership is another key advantage. Banks streamline the process for quicker closings, so you get your keys sooner.

Repos also have investment potential, with possible annual returns of 8-12%, especially with land. They are compelling opportunities for rental income or personal investment. Many of the homes in our Used Repo Mobile Homes inventory are only a few years old, offering modern features at a fraction of the new cost.

Potential Risks and How to Mitigate Them

It’s important to discuss the potential downsides of bank repo mobile homes in Texas so you can make an informed decision.

The biggest risk is hidden damage. The previous owner’s maintenance habits are unknown, and issues can range from minor cosmetic fixes to serious plumbing, electrical, or structural problems. Repair costs can add up, eating into your savings if you haven’t planned for them.

Title liens are another potential issue. Repossessed properties can carry outstanding debts that could become your problem if not cleared. The intense competition for good repos is also real. Well-priced homes in good condition can sell in days, so you must be prepared to act quickly.

The good news is that these risks can be managed:

Professional inspections are your best defense. We always recommend a thorough inspection from a specialist in manufactured homes. It costs a few hundred dollars but can save you thousands by uncovering issues with the foundation, roof, plumbing, electrical, and HVAC systems.

A title search reveals any liens or ownership issues, ensuring you get a clean title. This small investment provides huge peace of mind.

Budgeting for repairs from the start keeps you prepared. We recommend setting aside 5-10% of the purchase price for immediate repairs and at least $1,000 for first-year maintenance. This way, you’re ready for any unexpected costs.

With these precautions, you can confidently pursue repo homes. The key is working with experienced professionals who understand the Texas repo market.

The Ultimate Guide to Buying Bank Repo Mobile Homes in Texas

Ready to buy a bank repo mobile home in Texas? It’s a smart path to homeownership and more straightforward than you might think. The key is knowing where to look, what to inspect, and how to make a winning offer.

Buying a repo home is like a treasure hunt for a great deal. We can guide you through the process, whether you’re looking near San Antonio and Austin or in smaller communities like Von Ormy, Somerset, or Devine. The journey involves four main steps: finding listings, inspecting the home, making an offer, and closing the deal. We’ll walk you through each step.

To get started on your search, check out our comprehensive guide on how to Find Repo Mobile Homes For Sale Near Me.

Where to Find Listings for Bank Repo Mobile Homes in Texas

Bank repo mobile homes in Texas often aren’t on major real estate websites. They move through different channels, so knowing where to look is crucial.

- Specialized dealers like us are your best starting point. We work directly with banks, often getting access to homes before they’re on the general market. We also handle the complex details like delivery and setup.

- Bank and lender websites are another source. Many lenders list repossessed properties online. However, you’ll have to manage more of the process yourself.

- Online marketplaces for manufactured homes can also be a source. You can often filter your search for repo homes in specific Texas areas, giving you a broader view of available inventory.

- Public auctions can offer low prices but are risky for beginners. Homes are sold strictly “as-is” with limited inspection opportunities, making them better suited for experienced investors.

- Driving through manufactured home communities in areas like Atascosa County or checking local ads can uncover unadvertised properties.

We offer exclusive access to bank repo mobile homes in Texas through our network of banking relationships. Many of our best deals never make it to the general market. Explore our current selection of Bank Repos and see what’s available right now.

The Non-Negotiable Home Inspection

When buying a bank repo mobile home in Texas, a professional inspection is essential. Skipping it to save a few hundred dollars can lead to thousands in unexpected repairs. Repo homes are sold “as-is.” The bank makes no repairs. An inspection is your financial safety net, revealing what you’re truly buying.

A comprehensive inspection covers the foundation and structural integrity, roof, plumbing and electrical systems, and the HVAC system. It should also check the siding, windows, doors, the vapor barrier underneath the home, and any signs of water damage.

Hire an inspector who specializes in manufactured homes. They understand the unique construction and potential issues a regular inspector might miss. Understanding Mobile Home Foundation Types is also important, especially for a home already on a property.

Making an Offer and Negotiating with the Bank

Making an offer on a bank repo mobile home in Texas can be exciting. Banks are often easier to negotiate with than private sellers because they aren’t emotionally attached; they simply want to recover their money.

Research is your secret weapon. Look up recent sales of similar homes in the area to create a solid foundation for your offer. Your inspection report is a powerful negotiation tool. Factor in repair costs to justify a lower offer. Banks understand you’ll need to cover these expenses.

Make a fair but firm offer. Banks reject extremely low offers but are open to reasonable proposals reflecting the home’s condition. Start below your maximum budget to leave room for negotiation.

Speed matters. Desirable homes sell fast. Pre-approved financing puts you ahead of other buyers and appeals to banks, who prefer quick, simple transactions. Banks want to minimize losses, not maximize profits, so they are often more flexible on price, especially for a well-researched offer backed by an inspection report.

Financing and Legalities in the Lone Star State

Buying a bank repo mobile home in Texas involves financing and legal steps that don’t have to be overwhelming. Texas has specific regulations for manufactured housing, and we’ll guide you through each step. Financing options have expanded, and there are paths to homeownership even with imperfect credit. We work with lenders who understand that a few credit bumps shouldn’t stop you from owning a home.

The Texas Department of Housing & Community Affairs (TDHCA) oversees these regulations, and we ensure every home we sell meets their requirements. For a comprehensive look at all your options, check out our detailed guide on Mobile Home Financing.

How to Finance Your Repo Home Purchase

A common question is, “How do I pay for a repo home?” More financing options exist than most people realize, and we specialize in finding the right fit for you.

- Chattel loans are the most common method for financing a mobile home without land. The home itself is the collateral, with terms of 15-20 years. We’ve helped many customers with varying credit scores secure these loans.

- FHA Title I loans, backed by the government, help moderate-income buyers. They offer flexible credit requirements and competitive rates.

- Conventional mortgages are an option if you’re buying the home and land together. These are like traditional home loans with 30-year terms and lower rates, though credit requirements are stricter.

- VA loans are an unbeatable deal for veterans and active military. They offer no down payment and competitive rates.

- USDA loans offer 100% financing for homes in qualifying rural areas. Many areas near major Texas cities qualify.

Lining up financing early puts you in a strong position. We can help you understand your qualifying range and find the best loan programs, even if you have credit challenges. We have experience with lenders specializing in Mobile Home Loan Bad Credit situations. Our goal is to ensure financing isn’t a barrier.

Legal Steps for Buying Bank Repo Mobile Homes in Texas

The legal side of buying a bank repo mobile home in Texas has unique considerations. We handle the complex paperwork, but understanding the process will help you feel more confident.

The biggest legal difference is classification. Manufactured homes can be either personal property (like a vehicle) or real property (like a house) if permanently attached to land you own.

Most mobile homes have a Certificate of Title from the TDHCA, which proves ownership. We ensure this is transferred to your name smoothly. A thorough title search is essential before closing. It reveals any outstanding liens. We ensure all previous liens are released and you receive a clear title, protecting you from future claims.

If you own the land, filing an Affidavit of Affixation with the county converts the home to real estate. This can improve financing options and resale value. We also verify with the county tax office that all property taxes are current through the sale date.

The paperwork can seem intimidating, but we’ve guided thousands of families through it. Our experience with Repossessed Mobile Homes means we know what to do. You can focus on your new home while we handle the legal details.

Frequently Asked Questions about Texas Repo Homes

We get many questions about bank repo mobile homes in Texas. They represent a great opportunity for affordable homeownership. Here are answers to the most common questions.

How much cheaper are bank repo mobile homes?

The savings on bank repo mobile homes in Texas are impressive, typically 20-40% below market value compared to non-repo homes. Quality repo homes often sell for $25,000 to $60,000, compared to a normal price of $40,000 to $85,000. This means significant savings.

However, the sticker price isn’t the whole story. Since homes are sold “as-is,” you must factor in potential repair costs to calculate your true savings. The final price depends on the home’s condition, age, location, and the bank’s motivation to sell.

Can I buy a repo mobile home with land in Texas?

Yes, and these are often great deals. Bank repo mobile homes in Texas with land offer incredible value, as you get two assets for one discounted price and avoid lot rent. When you own both, you build equity in the home and the appreciating land.

We recommend a property survey to confirm property lines and any restrictions. Also, verify utility connections and local zoning. Financing can also be better. A home-and-land package may qualify for a traditional mortgage with a longer term and lower interest rates than a chattel loan.

Check out our current inventory of Repo Mobile Homes With Land For Sale – we update these listings regularly.

What is the difference between a repo and a foreclosure?

These terms are often used interchangeably, but there’s a key difference when shopping for bank repo mobile homes in Texas.

Foreclosure is the legal process a lender uses to take back a property. A “repo” (repossession) or “REO” (Real Estate Owned) is the property itself after the foreclosure process is complete and the bank officially owns it.

This matters because when you buy a repo, the complex legal process is over. The bank owns the home and is ready to sell, making for a simpler transaction. The bank has a clear title and is motivated to sell, resulting in a straightforward process that gets you into a home faster.

Your Path to an Affordable Texas Dream Home

We’ve covered the journey of buying bank repo mobile homes in Texas, from inspections to financing. This is more than just buying a house; it’s about achieving a dream that may have seemed out of reach.

Saving 20-40% isn’t just a deal; it’s a head start on building wealth. That’s money in your pocket for improvements, savings, or your family’s future.

Repo homes have challenges, like the “as-is” condition and competition. But with our experience helping countless Texas families, we know these are manageable parts of the process, not roadblocks.

At Mobile Homes Factory Direct, we believe everyone deserves a shot at homeownership, regardless of credit history or budget. We’ve helped families in places like Von Ormy and San Antonio transform their lives with these homes.

What sets us apart is our process. We walk alongside you, helping you find the right home, secure financing that works for you, and handle every detail. A “repo” might sound intimidating, but for thousands of Texas families, it’s the key to stability, pride, and an affordable place to call home.

Your affordable Texas dream home is out there, and we’re here to help you find it. View our available pre-owned and repo homes today! – your future self will thank you for taking this step.