Is San Antonio Affordable? A Deep Dive into Local Home Prices

Discover if San Antonio home prices make it an affordable buyer's market. Get expert insights & find your dream home.

San Antonio’s Housing Market Reality: What You Need to Know

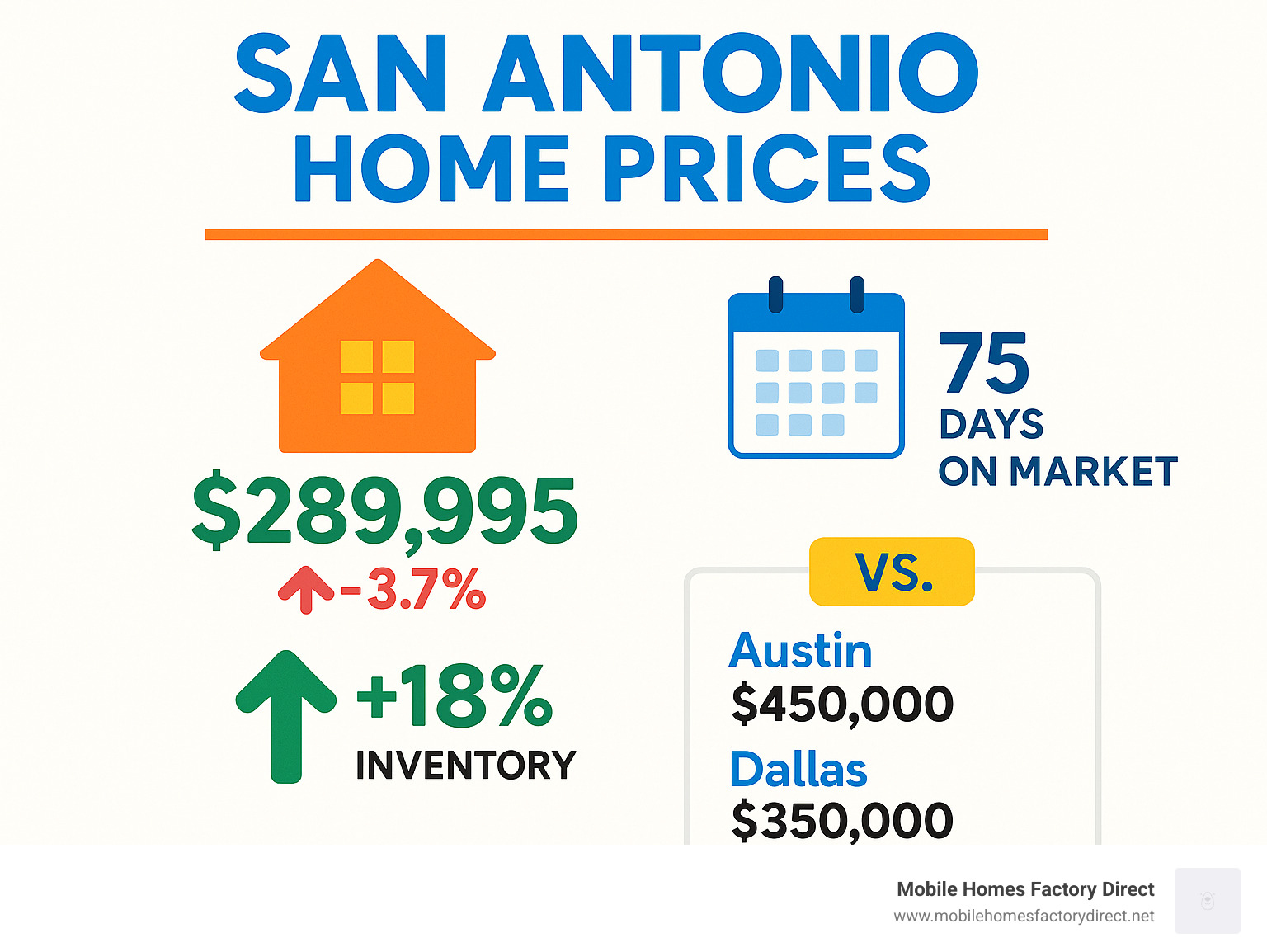

San Antonio home prices are experiencing a significant shift in 2025, creating new opportunities for buyers who’ve been priced out of other markets. With a median home price of $289,995 – down 3.7% from the previous year – the Alamo City stands out as one of the few major metros where home prices are actually dropping.

Current San Antonio Housing Market Snapshot:

- Median Home Price: $289,995 (down 3.7% year-over-year)

- Days on Market: 75 days (well above national average of 58 days)

- Market Type: Strong buyer’s market

- Inventory: 18% surge in active listings

- Affordability: 39% below national median home price

Here’s what’s driving this shift: mortgage rates hovering between 6.5% and 7% have cooled buyer demand, while new construction has surged with 4,080 homes started in Q4 2024 alone. This combination has created what many experts call a “golden opportunity” for buyers.

The contrast is stark when you compare San Antonio to other Texas cities. While Austin’s median sits at $450,000 and Dallas at $350,000, San Antonio remains remarkably affordable. Some market analysts note that many buyers, especially first-timers, are backing off due to recession fears, but this hesitation is creating opportunities for those who are well-informed.

For families seeking affordable homeownership, this market presents a rare window. The city that gained more residents than any other U.S. city in 2023 now offers homes at prices that make sense for middle-income buyers.

The Current State of the San Antonio Housing Market

The San Antonio home prices are signaling a major shift from the frantic bidding wars of recent years. We’re now in a genuine buyer’s market, creating real opportunities for families looking to make San Antonio their home.

Let’s talk numbers, because they tell quite a story. The median sale price has settled around $270,000 as of recent data, which represents a 3.5% decrease compared to last year. The average home value sits at approximately $265,322, showing a modest 0.4% dip over the past year. Meanwhile, the price per square foot holds steady at $166 – basically unchanged from last year’s figures.

But here’s where it gets really interesting for buyers: inventory has surged by 18% year-over-year. That means more choices, more time to think, and more negotiating power. The market is rated as “Somewhat Competitive” with a score of 43. If you remember the chaos of 2021 and 2022, this feels like a breath of fresh air.

The sale-to-list price ratio tells an even better story for buyers. Homes are selling for an average of 1.56% below asking price, with more recent data showing homes going for 97.1% of their list price. Even more telling? 41.3% of homes are experiencing price drops, and single-family homes were selling for 10.5% below asking price in recent months. Translation: sellers are ready to negotiate.

A Closer Look at San Antonio Home Prices

When we dig deeper into San Antonio home prices, the affordability story becomes even more compelling. That $270,000 median sale price we mentioned? It’s not just a number – it represents genuine opportunity in a city that’s growing faster than almost anywhere else in the country.

To understand where these values are heading, it helps to look at home value indices. These tools track monthly changes in property values across different neighborhoods and housing types. Right now, they show that San Antonio is in what experts call a “cooling period”—which means prices are stabilizing after years of rapid growth.

This cooling trend is creating space for different types of homeownership solutions. Whether you’re looking at traditional single-family homes or exploring more affordable alternatives, understanding how pricing works across different home types can help you make the smartest decision for your family. For detailed insights into how pricing varies across different housing options, you can find more info about our home pricing.

How Long Do Homes Stay on the Market?

Remember when homes in San Antonio would get snatched up in a weekend? Those days are behind us. The typical home now spends about 75 days on the market before finding its new owner – that’s 12 days longer than last year. Some recent data shows homes taking as long as 88 days to sell.

This might sound like bad news for sellers, but for buyers, it’s fantastic. You now have time to really think about your decision, get proper inspections done, and negotiate terms that work for your family. While the occasional “hot home” might still sell quickly – usually within 20 days and close to list price – most properties are receiving just two offers on average.

What does this mean for you as a buyer? Less pressure, more choices, and better deals. You can take your time touring neighborhoods and comparing options without feeling like you need to make snap decisions. It’s a complete turnaround from the stressful market conditions that pushed so many families to the sidelines.

This slower pace is helpful when exploring housing options or arranging financing. The days of cash-only, sight-unseen offers are largely gone, which is great news for families looking to buy.

Key Factors Influencing San Antonio Home Prices

Understanding what’s driving San Antonio home prices is straightforward. Several key ingredients are mixing together to create the market we see today.

The biggest factor is mortgage rates. When borrowing money gets more expensive, fewer people can afford to buy homes. At the same time, San Antonio keeps attracting new residents who need places to live. Add in a surge of new construction, and you’ve got the perfect recipe for a buyer’s market.

What makes San Antonio unique is how these forces are playing out differently than in other cities. While high mortgage rates are cooling demand everywhere, San Antonio’s steady stream of newcomers and booming construction industry are creating opportunities that simply don’t exist in pricier markets.

The Impact of Mortgage Rates and National Economic Trends

Mortgage rates between 6.5% and 7% are a shock compared to the recent past. For many buyers, this means monthly payments have jumped by hundreds of dollars compared to what they could have gotten just two years ago.

Here’s what’s happening: about 83% of current homeowners have mortgage rates below 6%. Most of these folks are staying put rather than trading their great rate for a much higher one. This “rate lock-in effect” is keeping some homes off the market in other cities, but San Antonio is different.

Instead of a shortage, we’re seeing more inventory hit the market. New construction is booming, and some sellers are still motivated to move. This creates a unique situation where buyers have more choices, even with fewer people actively shopping.

The Federal Reserve’s policies continue to shape these trends, and staying informed helps you make better decisions. You can Read the latest Federal Reserve economic updates to understand where rates might be headed.

If rates drop below 6% again, expect buyer demand to surge back quickly. But right now, the higher rates are actually working in buyers’ favor by reducing competition.

Population Growth and Migration

San Antonio gained more residents than any other U.S. city in 2023, a testament to its broad appeal. That means people are choosing the Alamo City over everywhere else in America.

The numbers tell an interesting story about who’s moving where. While 25% of San Antonio homebuyers looked to move out of the metro area between March and May 2024, 75% wanted to stay within the greater San Antonio area. Meanwhile, 0.88% of buyers from other cities searched to move here.

What’s drawing all these people? It’s a combination of affordability, job opportunities, and quality of life. The city’s strong military presence provides stable employment, while the growing tech sector and remote work flexibility make it attractive to professionals from expensive coastal markets.

The diverse economy built around military, healthcare, and tourism creates a steady foundation that doesn’t rely on any single industry. This stability is exactly what families look for when choosing where to plant roots.

All these new residents need homes, and that underlying demand helps explain why San Antonio home prices remain stable even in a cooling market. For newcomers looking to maximize their housing budget, exploring Affordable Housing Options in San Antonio can reveal possibilities they might not have considered.

The surge in new construction inventory – with 4,080 homes started in Q4 2024 alone – shows builders are responding to this population growth. This increased supply is what’s giving today’s buyers more negotiating power and better selection than they’ve had in years.

How San Antonio Compares: Affordability in Texas and the Nation

San Antonio’s key advantage is affordability. While housing costs stretch families in other cities, San Antonio home prices remain refreshingly reasonable. San Antonio offers genuine value without asking you to give up the amenities and opportunities of big-city living. Your paycheck simply goes further here, and that makes all the difference for families trying to build a future.

San Antonio vs. Other Texas Metros

When you compare San Antonio home prices to other major Texas cities, the difference is striking. San Antonio sits comfortably at around $289,995 to $297,000 for a median home price, with a cost of living that’s 9% lower than the national average.

Houston comes in higher at about $325,000, though it still maintains a cost of living 8% below national levels. Dallas pushes up to $350,000 with costs just 1% lower than the national average. Then there’s Austin – beautiful city, but with median prices hitting $450,000 and a cost of living that’s actually 3% higher than the national average.

What does this mean for your family? In Austin, you might be looking at a small condo for the same price as a spacious family home in San Antonio. In Dallas, that extra $50,000 to $60,000 in home costs could cover years of your child’s college fund or a complete home renovation.

San Antonio has become a genuine haven for middle-income families who’ve been squeezed out of other Texas markets. You get the job opportunities, cultural attractions, and urban conveniences without the financial stress that comes with sky-high housing costs.

San Antonio vs. The National Average

The national comparison is even more impressive. San Antonio home prices are 39% lower than the national median—a life-changing difference. Combined with a 9% lower cost of living, San Antonio is a rare major city where homeownership still makes financial sense.

Think about what that 39% difference means in real terms. If the national median is around $400,000, you’re looking at savings of over $100,000 just on the purchase price. That’s money that stays in your pocket for emergencies, improvements, or simply enjoying life without house-poor stress.

For first-time buyers especially, this affordability gap opens doors that remain firmly shut in pricier markets. Young professionals can actually afford to buy instead of renting forever. Growing families can find homes with yards and good schools without breaking the bank.

The best part? You don’t have to go it alone. Programs exist to help make homeownership even more accessible. You can Explore down payment assistance programs through the Texas State Affordable Housing Corporation to see what support might be available for your situation.

This combination of reasonable prices and financial assistance programs makes San Antonio a place where the American dream of homeownership is still very much alive and achievable.

Finding Your Home: A Guide to San Antonio’s Neighborhoods and Housing Options

San Antonio is a city of diverse neighborhoods, each with its own personality and price tag. From historic homes with character to family-friendly suburbs, this sprawling city has something for everyone. But with that variety comes the need to understand what makes each area special. From school ratings to transportation scores, knowing these details helps you find not just a house, but the perfect spot to build your life.

Most and Least Expensive Neighborhoods

Here’s where San Antonio home prices get really interesting – the range is absolutely incredible. On the luxury end, you’ll find neighborhoods like Olmos Park where homes list around $979,884, and Hill Country Village at about $1.2 million. These areas offer prestige, beautiful properties, and all the amenities you’d expect from premium locations.

Alamo Heights sits around $726,027 and has long been considered one of San Antonio’s most desirable addresses. Terrell Hills comes in at about $858,923, while Shavano Park averages $935,820. For those wanting newer developments, Stone Oak offers family-friendly living around $500,000 – it’s popular for good reason, with great schools and modern amenities.

On the flip side, San Antonio’s affordability really shines in neighborhoods like Prospect Hill where you’ll find homes around $104,572. Los Jardines and Loma Vista both hover around $111,000, making homeownership accessible for many families. Areas like Las Palmas at $113,644 and Memorial Heights at $121,714 offer incredible value.

Don’t overlook neighborhoods like University Park at $149,133 or Harvard Place – Eastlawn at $192,500. These areas provide that sweet spot between affordability and amenities. Harlandale remains one of the most budget-friendly options, while Vance Jackson at $347,500 and Denver Heights at $249,500 offer great balance between location and value.

Alamo Ranch deserves special mention as an emerging area that’s gaining serious traction. It’s become a go-to spot for families wanting new construction and growing communities without breaking the bank.

Environmental Risks and Other Considerations

Let’s talk about the practical stuff – because knowing what you’re getting into helps you make the best decision for your family. San Antonio, like any city, has some environmental factors worth considering.

Flooding affects about 18% of properties in San Antonio, with moderate risk over the next 30 years. Wildfire risk touches about 33% of properties, while severe wind events (mainly from hurricanes) could affect 52% of homes. The biggest concern? Heat – with 99% of homes facing severe heat risk and a projected 214% increase in days over 108°F in the coming decades.

While these risks exist, San Antonio has dealt with them for generations. Proper insurance, smart home choices, and understanding local risks are key to preparation.

Transportation in San Antonio is pretty car-dependent, with a Walk Score of 37 out of 100. The Transit Score sits at 31 (some transit available), and the Bike Score is 45 (somewhat bikeable). Most folks find having a car essential for getting around comfortably.

For families, San Antonio’s school situation is actually quite promising. The city boasts 585 public schools rated good or higher by GreatSchools. That’s a lot of quality options to choose from. You can Learn more about school ratings to find schools that match what you want for your children.

Exploring Affordable Housing: A Smart Alternative

For budget-conscious buyers, even with San Antonio’s affordable prices, traditional site-built homes in desirable neighborhoods can still be a stretch.

That’s where modern manufactured and modular homes become a game-changer. We’re not talking about your grandfather’s mobile home here – today’s manufactured homes are built to rigorous federal standards and offer incredible quality, energy efficiency, and customization options at a fraction of traditional housing costs.

These homes provide all the comfort and space of site-built homes, often with gorgeous layouts, modern designs, and high-end finishes. The benefits are impressive: faster construction times, lower per-square-foot costs, and flexibility to place them on your own land or in a welcoming community.

Right here in Von Ormy, just outside San Antonio, we help families throughout the area – including Somerset, Atascosa, Macdona, and many other local communities – find how manufactured homes can make homeownership a reality. We offer flexible financing for all credit types, even if your credit isn’t perfect or you’re just starting to build credit history.

The process is straightforward, and the results speak for themselves. Many families find they can get more space, better features, and lower monthly payments compared to traditional housing options. It’s about opening doors to homeownership without compromising on quality or comfort. To get the full picture of what this means for you, consider reading about The Pros and Cons of Owning a Mobile Home.

Frequently Asked Questions about San Antonio Home Prices

We get questions about the San Antonio housing market every day from families trying to figure out if now’s their moment to make a move. Let’s tackle the big ones that keep coming up.

Is now a good time to buy a house in San Antonio?

If you’ve been waiting for the right time, this might be it. The market has flipped into a buyer’s paradise—something we haven’t seen in years.

Here’s what’s working in your favor right now. Inventory is up 18%, which means you’re not fighting tooth and nail with five other families for the same house. You actually have time to think, compare, and choose what’s right for you.

The negotiation game has completely changed too. Homes are sitting on the market for about 75 days on average, and sellers are getting realistic about pricing. In fact, single-family homes were selling for 10.5% below asking price as recently as March 2025. When’s the last time you heard that in any major city?

San Antonio home prices are already a steal compared to Austin or Dallas, but now you’re getting even more bang for your buck. Plus, you’re buying into a city that’s growing like crazy – San Antonio added more residents than any other U.S. city in 2023. That kind of growth doesn’t happen by accident.

The bottom line? This buyer-friendly window won’t last forever, especially once mortgage rates start dropping again.

Are home prices in San Antonio expected to drop more?

While some forecasts predict a 4% price decline through 2025, most experts anticipate stabilization rather than a major crash.

Here’s why prices probably won’t keep falling dramatically. San Antonio keeps growing – all those new residents need somewhere to live. The city’s economy is rock-solid with healthcare, military, and tech jobs providing stability. And if mortgage rates drop even a little bit below their current 6.5-7% range, you’ll see buyers flood back into the market.

Think of it this way: the market got a little overheated, and now it’s finding its natural rhythm. That’s actually healthy for everyone involved.

How much income do you need to afford a house in San Antonio?

Using the 28% rule (where housing costs shouldn’t exceed 28% of your income), we can calculate what you might need.

Say you’re buying a home at the current median price of around $310,000. If you put down 20% (that’s $62,000), you’d be financing $248,000. With today’s interest rates around 6.89%, your monthly payment for principal and interest would be roughly $1,630.

To keep that within the 28% rule, you’d need to make at least $70,000 a year. That’s significantly less than what you’d need in most major cities across the country.

Down payment assistance programs can help reduce what you need upfront. Exploring manufactured or modular homes can also bring that required income down even further while still getting a beautiful, modern home.

The math in San Antonio just works better for regular families. It’s one of the few places left where middle-income buyers can still make homeownership happen without stretching themselves too thin.

Conclusion: Your Path to an Affordable San Antonio Home

The San Antonio home prices landscape tells a story of opportunity. With a median price around $290,000 (down 3.7% year-over-year), homes on the market for 75 days, and sellers willing to negotiate, the market is rolling out the red carpet for buyers.

What makes San Antonio truly special isn’t just the affordability – though being 39% below the national median certainly doesn’t hurt your wallet. It’s the complete package you’re getting. You have a thriving city with diverse job opportunities, world-class attractions, and that famous Texas hospitality, all without the sticker shock of Austin or Dallas.

San Antonio is a rare major metro with declining home prices alongside the nation’s fastest population growth. You can still find quality homes at prices that make sense for real families with real budgets.

This buyer’s market won’t last forever. Markets are cyclical, and when mortgage rates eventually drop or when the surge of new residents catches up with inventory, we’ll likely see prices stabilize and potentially rise again. Right now, though, you have negotiating power, time to make thoughtful decisions, and access to homes that might have been out of reach just a few years ago.

Find Your Dream Home Today

Here at Mobile Homes Factory Direct, we’ve been watching this market closely from our location in Von Ormy, and we’re excited about what it means for families throughout the San Antonio area. Whether you’re looking in Somerset, Castroville, or any of the communities we serve, this is your moment to make homeownership a reality.

We know that even with San Antonio home prices being more affordable than most places, traditional site-built homes might still stretch your budget. That’s exactly why we specialize in modern manufactured and modular homes that deliver the quality and comfort you want at prices that actually work with your family’s finances.

Our homes are both affordable and smart. Built to rigorous federal standards, they are energy-efficient, customizable, and offer everything you want in a home without the premium price. Plus, our flexible financing for all credit types can help you, even with imperfect credit.

The best part? You don’t have to steer this alone. Our team understands the local market and can guide you through every step, from choosing the right home to securing financing that fits your situation.

Don’t let this buyer-friendly market pass you by. Explore our wide selection of affordable, high-quality homes and find how simple the path to homeownership can be when you have the right partner by your side.