Score a Deal: How to Find Bank Repo Mobile Homes for Sale Near Me

Find bank repo mobile homes for sale near me & score incredible deals! Learn how to find, inspect, finance, and buy your dream home.

The Secret to Affordable Homeownership

Bank repo mobile homes for sale near me offer a proven path to homeownership at prices that can save you 30-50% compared to new manufactured homes. These repossessed properties become available when previous owners can’t make their mortgage payments, forcing lenders to recoup their losses through discounted sales.

Quick Answer: Where to Find Bank Repo Mobile Homes:

- Local specialized dealers – Contact repo mobile home dealers in your area

- Bank REO departments – Check lender websites for Real Estate Owned properties

- Online auction sites – Browse repossession auction platforms

- Mobile home communities – Drive through parks during ownership changes

- Real estate professionals – Work with agents experienced in foreclosures

The numbers tell the story. Research shows that repo mobile homes typically sell for much less than their original price because banks want to quickly eliminate the burden of property ownership. This creates genuine opportunities for buyers who understand the process.

But finding these deals requires knowing where to look and how to steer the buying process safely. From understanding what makes a home “repo” to securing financing and handling inspections, there are specific steps that separate successful buyers from those who miss out on the best opportunities.

What is a Bank Repo Mobile Home and Why Should You Consider One?

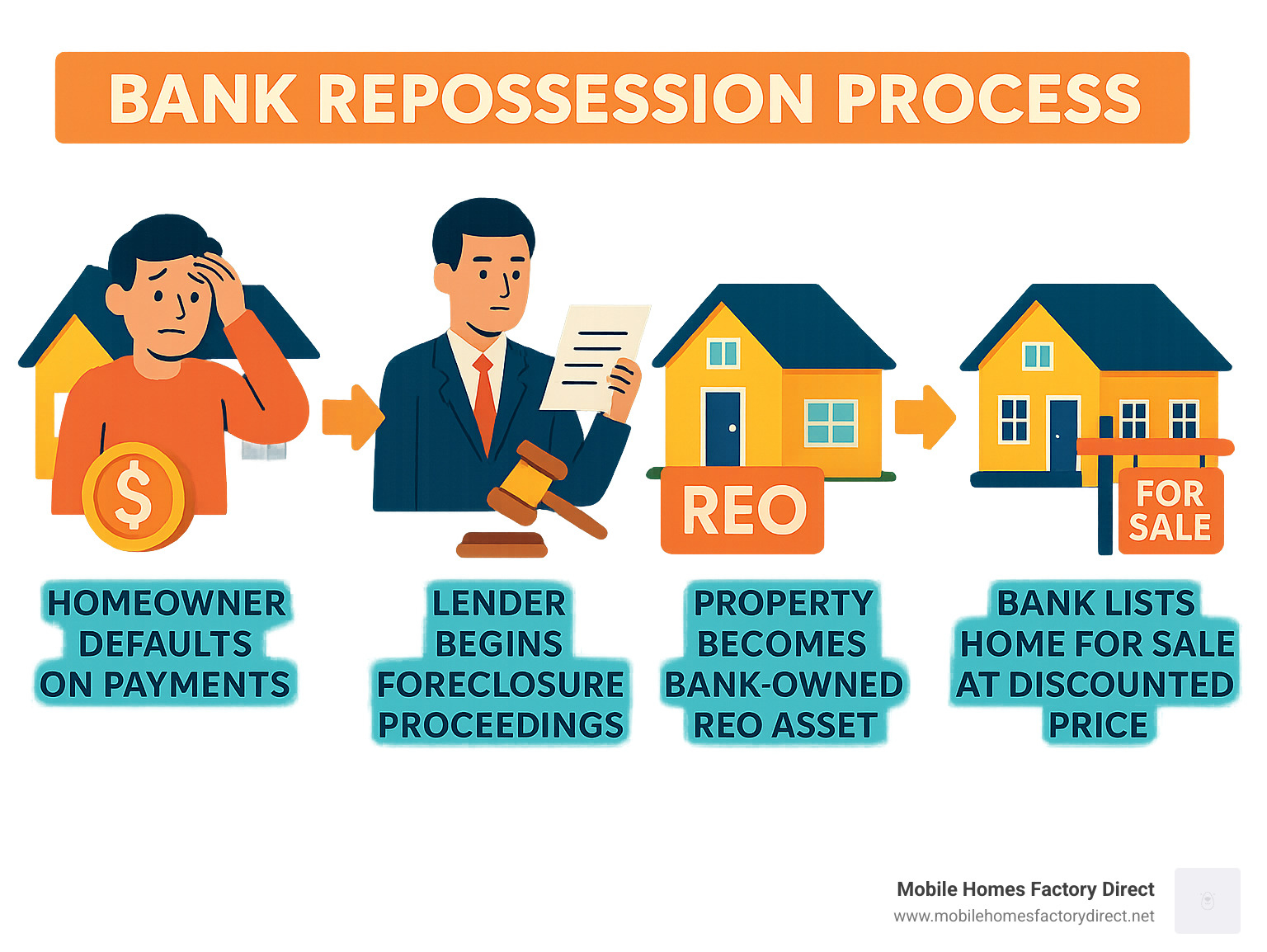

A bank repo mobile home is a manufactured home that a lender repossessed after the previous owner could no longer make their payments. When this happens, the bank takes ownership through foreclosure. Since banks are not in the property management business, they aim to sell these homes quickly to recover their losses from the original loan.

This creates a win-win situation: the bank offloads a property it doesn’t want, and you get access to a home at a price that’s often 30-50% less than a comparable new home. It’s a similar concept to buying a repossessed car, but with a home that can serve your family for decades at a fraction of the original cost.

The Pros: Unbeatable Value and Flexibility

The biggest advantage of buying a repo mobile home is the cost-effectiveness. The savings can be substantial, often amounting to tens of thousands of dollars. Homes originally priced at $80,000 to $120,000 might be available for $25,000 to $60,000, leaving significant money in your pocket.

These savings provide more value for your money. A lower purchase price might allow you to afford a larger, three-bedroom home instead of a two-bedroom, or get a home with upgraded features you thought were out of reach.

The customization potential is another huge plus. Saving thousands on the purchase price frees up your budget to make the home truly yours. You can update flooring, add a deck, or renovate the kitchen to match your style, giving you the flexibility to create the perfect home for your family.

There’s also the quicker equity benefit. By buying below market value and making smart improvements, you build equity from day one. A few key upgrades can significantly increase the home’s value, providing a solid return on your investment.

The Cons: Potential Risks and Required Homework

While the value is compelling, bank repo mobile homes for sale near me come with considerations you need to understand. The most important is that these homes are sold “as-is.” The bank will not make repairs or guarantee the home’s condition; they simply want to sell it and move on.

Potential repairs are common. The previous owners may have deferred maintenance due to financial hardship. It’s wise to budget an extra 5-10% of the purchase price for potential repairs, plus $1,000 to $5,000 for cosmetic updates.

Hidden damages are a risk with any “as-is” purchase, which is why a professional inspection is essential. Issues with plumbing, electrical systems, or the home’s structure may not be visible on the surface.

The paperwork can be more involved than a standard home purchase. You’ll need to verify titles, check for liens, and ensure all legal aspects are handled correctly.

Finally, there’s often higher competition for these homes. A great deal on a repo home can attract many buyers, so you need to be prepared to act quickly when you find a property that meets your needs.

| Feature | Bank Repo Mobile Home | New Manufactured Home |

|---|---|---|

| Initial Cost | Significantly lower (30-50% less) | Higher |

| Condition | “As-is,” may require repairs or updates | Brand new, typically no immediate repairs needed |

| Value | More value for money, potential for quicker equity | Full price, equity builds over time |

| Customization | High potential with saved money | Limited to initial factory options |

| Availability | Varies, can be competitive | Generally consistent |

| Paperwork | Can be more complex (liens, titles) | Standard, straightforward |

| Warranty | Typically none from seller (bank) | Manufacturer’s warranty |

| Financing | Available, but may require specialized lenders or terms | Standard manufactured home financing |

Despite these considerations, many families find that repo mobile homes offer an excellent path to homeownership. The key is going in with your eyes open, doing your homework, and working with experienced professionals who understand the process.

How to Find Bank Repo Mobile Homes for Sale Near Me

Finding bank repo mobile homes for sale near me requires a creative search approach, as they aren’t always marketed like regular listings. With the right strategy, you can uncover numerous opportunities.

Online Search Strategies

The internet is your most powerful tool for finding repo mobile homes.

Specialized listing sites are a great starting point. Many websites focus on manufactured homes and have sections for pre-owned and repo properties. You can filter by location to focus on areas like Von Ormy, Somerset, or San Antonio, looking for listings marked “repo,” “foreclosure,” or “bank-owned.”

Lender’s REO sections are another valuable resource. Banks that finance mobile homes often list repossessed properties directly on their websites in their Real Estate Owned (REO) departments. Check the bank’s property sales or asset recovery pages for these listings.

Auction websites list repossessed mobile homes, but be cautious. Auction terms can be strict, often requiring cash payment or pre-approved financing.

Don’t overlook social media marketplaces like Facebook Marketplace, where individual sellers, dealers, and sometimes banks post listings. The informal nature of these platforms can sometimes lead to better negotiation opportunities.

When searching online, use specific keywords. Try phrases like “repossessed mobile homes San Antonio TX,” “foreclosed mobile homes Atascosa County TX,” “bank owned manufactured homes,” “REO mobile homes,” or “cheap mobile homes for sale near me bank repo.”

Offline and Local Methods

While the internet is powerful, some of the best deals are found through local networking.

Contacting specialized repo dealers like us at Mobile Homes Factory Direct gives you a significant advantage. We often know about inventory before it hits the market and serve a wide area including Von Ormy, Somerset, Atascosa, Macdona, and San Antonio. Our experience with repo homes helps us guide you to the best opportunities while avoiding potential pitfalls.

Driving through mobile home communities is a surprisingly effective method. Look for “For Sale” signs on vacant homes that may not be listed online. Park managers are also great resources, as they often know about homes that are about to become available.

Local newspapers still carry classified ads for repossessed properties, especially in smaller towns, potentially uncovering deals not yet online.

Networking with real estate professionals who specialize in foreclosures can open doors. These agents often have insider knowledge of upcoming listings and can help you steer the unique aspects of a repo sale.

Success comes from combining multiple search methods. Using several strategies at once increases your chances of finding the perfect bank repo mobile home for sale near me at an unbeatable price.

Your Due Diligence Checklist: From Inspection to Paperwork

Once you’ve found a promising bank repo mobile home for sale near me, it’s time for due diligence. This is the most critical step. Never put money down on a used repo mobile home without a thorough inspection, as your financial well-being depends on it.

What to Look for When Inspecting Bank Repo Mobile Homes for Sale Near Me

A comprehensive inspection is vital because repo homes are sold “as-is.” What you don’t see could cost you thousands later. Here’s what to focus on.

Start with the foundation and frame. Crawl underneath (or hire a professional) to look for rust, cracks, or damage to the steel frame. Ensure the home is properly blocked and leveled. For homes that need to be moved, check the axles and wheels. Also, inspect the belly wrap (the protective material on the underside) to ensure it’s intact and protecting the home’s insulation and systems.

The roof and siding reveal a lot about the home’s maintenance. Walk the perimeter and check for missing shingles, soft spots indicating water damage, or leaks. Inspect the siding for cracks, holes, or loose sections. Any sign of moisture intrusion is a major red flag.

Inside, check the plumbing and electrical systems. Turn on all faucets and flush toilets, looking for leaks or pressure issues. Flip every light switch and test outlets. Exposed wiring, flickering lights, or an outdated electrical panel signal the need for professional repairs.

Test the HVAC system by running both the heat and air conditioning. Listen for strange noises and check for weak airflow. Replacing an HVAC system is expensive, so knowing its condition upfront is crucial.

Finally, locate and verify the HUD data plate, usually found in a cabinet, closet, or near the electrical panel. This plate contains the manufacturer, date, serial number, and essential Wind Zone and Snow Load ratings. In Texas, this information determines where the home can be legally placed.

Verifying the Legal Status and Documentation

Proper paperwork is just as important as the physical inspection. The most critical document is the title, which proves ownership. Ensure the title is clear and matches the home’s VIN (Vehicle Identification Number).

Next, conduct a lien search through a UCC (Uniform Commercial Code) filing search. This reveals if any creditors have a legal claim to the property, which you need to resolve before purchase.

Check with the local tax assessor’s office about any outstanding property taxes, as the new owner could become responsible for them.

In Texas, familiarize yourself with the Texas Department of Housing and Community Affairs. They are the resource for manufactured housing regulations, including zoning laws, placement permits, and utility connection requirements. TxDOT permits are required to move a manufactured home on Texas highways.

If the home is in a community, you’ll need approval from park management. Each community has rules about home age, appearance, and residents. Confirm the home meets these standards before committing.

This due diligence phase makes you a smart, informed buyer, allowing you to move forward confidently with your purchase of a bank repo mobile home for sale near me.

Sealing the Deal: Financing and Closing on Your Repo Home

You’ve found the perfect bank repo mobile home for sale near me and completed your inspection. Now it’s time to make it yours. The financing and closing process is more straightforward than many people think, and we’re here to help.

Financing Options for Bank Repo Mobile Homes for Sale Near Me

Financing a repo mobile home is very achievable. We work with flexible financing options for all credit types, including bad or no credit, because we believe everyone deserves a path to homeownership.

Chattel loans are the most common option for home-only purchases. Similar to a car loan, they are secured by the home itself and typically have terms of 15-20 years with interest rates from 5-15%. Down payments are usually between 5-20%.

For a land-home package, where the repo home includes property, you can often secure a traditional mortgage. These loans offer better interest rates and longer terms (up to 30 years) because the land provides extra security for the lender.

FHA Title I loans are government-backed options that are great for manufactured homes. They have more lenient credit and down payment requirements, making them ideal for first-time buyers.

For military families, VA loans offer excellent benefits, often with no down payment. USDA loans provide similar advantages for homes in designated rural areas. Many repo homes qualify for these programs if they meet foundation and safety standards.

Regarding credit scores, while a higher score secures better rates, we regularly work with scores as low as 550-600. Lenders look for stable income and a debt-to-income ratio below 43%.

The down payment varies by credit and loan type. Most closing costs can be rolled into the loan, with only the appraisal fee typically paid upfront.

The Purchase and Closing Process Explained

Once you’re ready, the process follows a clear sequence.

Making a written offer gets the process started. Your offer will include the price, conditions, and earnest money (usually $500-$2,000) to show you’re a serious buyer. This deposit is applied to your closing costs.

After the offer is accepted, the lender orders an appraisal to confirm the home’s value. Your loan then goes through underwriting, where all financial information is verified.

The timeline is typically 4-6 weeks for home-only purchases and 6-8 weeks if land is involved. We work to keep the process moving smoothly.

Closing costs, such as origination and title fees, are part of the transaction, but most can be financed into your loan.

Before closing, we’ll conduct a final walk-through to ensure the home is in the expected condition.

Closing day is when you sign the final paperwork, funds are transferred, and you receive the keys to your new home. It’s a rewarding moment we love to share with new homeowners.

Frequently Asked Questions about Buying Repo Mobile Homes

Buyers often have great questions about bank repo mobile homes for sale near me. Here are answers to some of the most common ones.

Are bank repo mobile homes sold with land?

Repo homes come in two distinct packages, and it’s crucial to know which you’re buying.

“Home-only” deals mean you are buying only the structure. You will need to secure a location, such as land you own, property you buy separately, or a lot in a manufactured home community. Budget for additional costs like transportation ($3-$7 per mile), site preparation, and professional setup.

“Land-home” packages include both the mobile home and the land it sits on. These are often more convenient because the home is already situated with utility connections, eliminating moving and setup costs.

Always verify exactly what is included in the sale price to avoid surprises.

What is the biggest mistake to avoid when buying a repo mobile home?

The single biggest mistake is skipping a thorough professional inspection. Repo homes are sold “as-is,” meaning the bank makes no warranties. Hidden problems with the frame, roof, plumbing, or electrical systems can turn a great deal into a financial burden.

A professional inspection costs a few hundred dollars but can save you thousands in unexpected repairs. It’s a small investment for peace of mind and is essential for protecting your purchase.

Can I use a government-backed loan for a repo mobile home?

Yes, many repo manufactured homes are eligible for government-backed financing like FHA, VA, or USDA loans. These programs often feature better terms, such as lower interest rates and smaller down payments (or even no down payment).

To qualify, the home must meet HUD standards (built after June 15, 1976) and, for some loans, be on a permanent foundation. VA loans are an excellent option for veterans and active-duty military, while USDA loans are designed for homes in rural areas.

Working with a lender experienced in these programs is key. We connect our customers with specialized lenders to make the process smoother and help more families achieve homeownership with a bank repo mobile home for sale near me.

Conclusion: Your Path to an Affordable Dream Home

Choosing a bank repo mobile home for sale near me is a smart step toward affordable homeownership that can improve your financial future. With potential savings of 30-50% and the opportunity to build equity quickly, it’s clear why this is an attractive option for many families.

The process—from searching for a home to inspection and financing—is manageable with the right guidance. Due diligence is your best friend. A thorough inspection protects you from costly mistakes, while proper legal verification secures your investment for years to come.

At Mobile Homes Factory Direct, our mission is to simplify this process. We understand that buying a home can feel overwhelming, which is why we offer flexible financing for all credit types, including bad or no credit. We believe everyone deserves a chance at homeownership.

Our team has helped countless families across Texas, in communities from Von Ormy and San Antonio to New Braunfels and Corpus Christi, find their perfect home. We’ve seen how the right repo mobile home provides not just shelter, but also pride of ownership and financial stability.

Your dream of owning a home is within reach. With the knowledge from this guide, you are equipped to make informed decisions and find a great deal on a bank repo mobile home for sale near me.

Ready to take the next step? We’re here to help you explore your options and find a home that fits both your budget and your dreams.