The Secret to Affordable Living: Discovering Bank Repo Homes

Unlock huge savings! Our guide helps you find, inspect, and finance bank repo manufactured homes. Discover your affordable dream home today.

Why Bank Repo Manufactured Homes Are Your Key to Affordable Homeownership

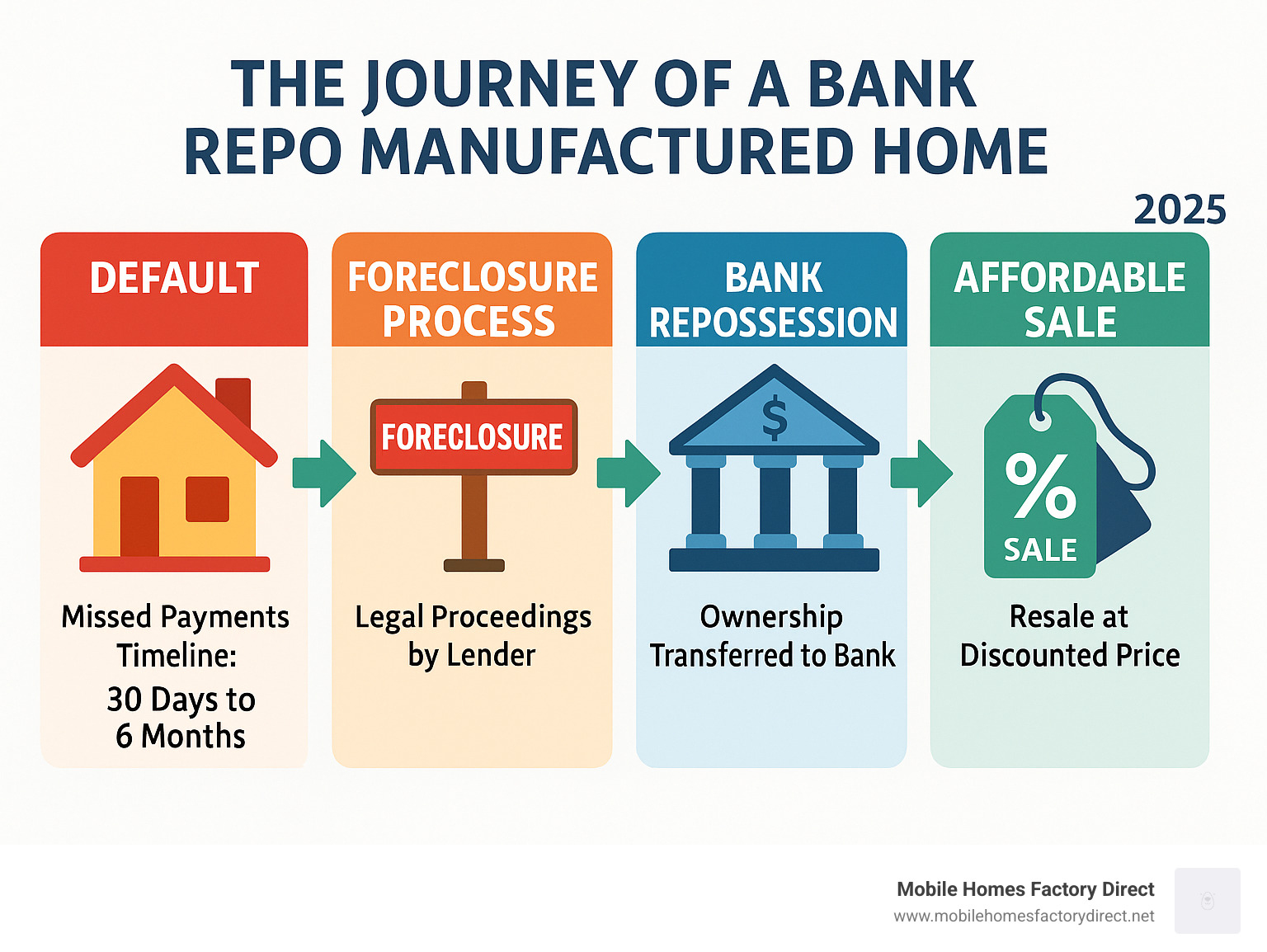

Bank repo manufactured homes offer one of the smartest pathways to affordable homeownership, with savings that can reach up to 50% below market value. These properties become available when banks repossess manufactured homes due to loan defaults and need to sell them quickly to recover their losses.

What Are Bank Repo Manufactured Homes?

- Repossessed Properties: Homes taken back by lenders when owners can’t make payments

- REO Properties: Real Estate Owned properties that banks want to sell quickly

- Significant Discounts: Typically priced 20-50% below comparable market value

- As-Is Condition: Sold without warranties, requiring careful inspection

- Immediate Equity: Potential to build equity from day one of ownership

The appeal is undeniable. As one industry expert noted, “Times are tough, we understand that. Because of this, we want to offer you a chance at a home at a great price!”

But repo homes aren’t just about the lower sticker price. They represent a unique opportunity for buyers who might otherwise struggle to enter the housing market. Whether you’re a first-time buyer facing credit challenges or simply looking to maximize your housing budget, repo manufactured homes can provide the flexibility and affordability you need.

However, buying a repo home requires careful planning and thorough research. The “as-is” nature of these sales means what you don’t see can hurt your wallet later. Understanding the process, knowing what to inspect, and securing proper financing are crucial steps to making this affordable housing option work for you.

The Allure and The Risk: Weighing the Pros and Cons

Picture this: you’re scrolling through home listings and find a beautiful manufactured home that would normally cost $80,000 – but it’s priced at just $45,000. Your heart skips a beat. Could this really be your ticket to affordable homeownership?

That’s the magic of bank repo manufactured homes. When someone can’t keep up with their mortgage payments, the bank takes back the home and becomes eager to sell it quickly. They’re not trying to make a profit – they just want to recover what they’re owed and move on. This urgency creates incredible opportunities for buyers like you.

The savings can be absolutely stunning. We’ve seen homes discounted by as much as 50% below market value, though 20-40% savings are more typical. But it’s not just about the lower price tag. You’re getting immediate equity from day one, which is like having money in the bank.

Banks are also surprisingly flexible when it comes to negotiations. Since their main goal is getting these homes off their books, they’re often willing to work with you on terms that might not fly in a traditional sale. This gives you real leverage in the buying process.

For investors and handy homeowners, repo homes offer fantastic customization potential. Many come as blank canvases, ready for you to add your personal touch while still saving thousands compared to buying new.

But let’s be honest – it’s not all smooth sailing.

The biggest challenge? That dreaded phrase “as-is condition.” When banks sell repo homes, they’re basically saying, “What you see is what you get – no warranties, no guarantees, no take-backs.” This means you could find expensive surprises after closing, from signs of water damage to electrical issues that weren’t obvious during your walkthrough.

Hidden repair costs can quickly eat into your savings. Smart buyers budget an extra 5-15% of the purchase price for immediate fixes and updates. Sometimes it’s just cosmetic touch-ups, but other times you might face serious structural or system repairs.

The intense competition can also be stressful. When word gets out about a great repo deal, buyers and investors come running. You might find yourself in a bidding war or pressured to make quick decisions without as much time to think things through as you’d like.

Financing can get tricky too. While options exist for all credit types, some traditional lenders get nervous about repo properties. You might need to explore specialized financing or work with dealers like us who understand the repo market inside and out.

There are also legal complexities to steer. You’ll need to ensure the title is clear and that the repossession process was handled properly. Nobody wants legal headaches down the road.

The Pros and Cons of Investing in Bank Repo Manufactured Homes

Despite these challenges, we believe repo homes offer incredible value for the right buyer. The lower purchase prices create excellent investment opportunities with high potential returns. The negotiation flexibility gives you power that’s rare in today’s housing market.

On the flip side, those hidden costs and financing challenges can catch unprepared buyers off guard. Limited warranties mean you’re on your own if problems arise, and the legal complexities require careful attention to detail.

The key is working with experienced professionals who understand the repo market. At Mobile Homes Factory Direct, we’ve helped countless families steer these waters successfully. We know which Used Repo Mobile Homes offer the best value and can guide you through the process from start to finish.

Why consider a repo manufactured home from a trusted dealer? Because with the right guidance and preparation, the potential rewards far outweigh the risks. We’re here to help you find that perfect home at an unbeatable price – and avoid the pitfalls that trip up inexperienced buyers.

The Ultimate Guide to Buying Bank Repo Manufactured Homes

Ready to take the plunge into bank repo manufactured homes? Great choice! Think of this as your roadmap to finding an incredible deal. We’ve helped countless families steer this process, and we’re here to guide you every step of the way.

Finding Your Perfect Repo Home

The hunt begins with knowing where to look. Our company website is always a great starting point – we regularly feature quality pre-owned homes that might be exactly what you’re seeking. Specialized dealers like us often have the inside track on repo inventory before it hits the general market.

Don’t limit yourself to just one source though. Online marketplaces, foreclosure websites, and even your local bank offices can be goldmines for repo listings. Some real estate agents specialize in repossessed properties and can be valuable allies in your search.

The Art of Due Diligence

Once you’ve spotted a potential home, it’s time to put on your detective hat. This is where many buyers either save thousands or end up with expensive surprises later. A professional inspection isn’t just recommended – it’s absolutely essential for bank repo manufactured homes.

Your inspector should examine the structural integrity thoroughly, checking the foundation, walls, roof, and floors for any signs of sagging, cracks, or damage. Pay special attention to the chassis and frame – look for rust, bends, or cracks that could spell trouble down the road.

Water damage is one of the biggest concerns with repo homes. Have your inspector check for leaks, mold, or discoloration around windows, doors, and plumbing fixtures. Signs of water damage can lead to costly repairs that eat into your savings.

Don’t forget about the systems check – test all plumbing for water pressure and leaks, verify electrical outlets and switches work properly, and make sure the HVAC system heats and cools effectively. If appliances are included, give them a test run too.

Legal Considerations Matter

Here’s where things get a bit more technical, but it’s crucial stuff. You need to ensure the home has a clear title with no hidden liens or legal claims hanging over it. A thorough title search will reveal any potential issues before they become your problems.

Always verify that the VIN on the title matches the VIN on the actual home – it sounds simple, but this step prevents major headaches later. You’ll also want to understand local permit requirements and zoning regulations for manufactured homes in your area.

For those in Texas, the Texas Manufactured Housing Division website provides helpful information about state regulations and requirements.

Your Step-by-Step Purchase Plan

Buying a repo home doesn’t have to feel overwhelming. We’ve broken it down into manageable steps that hundreds of our customers have successfully followed. Here’s your game plan for securing an amazing deal on Repossessed Mobile Homes:

Step 1: Research and Locate your ideal home by exploring multiple sources. Start with our inventory since we often have exclusive access to quality repo homes. Keep your eyes peeled for “for sale” signs in manufactured home communities and check local classifieds regularly. The best deals move fast, so being proactive in your search to Find Repo Mobile Homes For Sale Near Me gives you a real advantage.

Step 2: Thorough Inspection is your safety net. Hire a professional inspector who specializes in manufactured homes – they know exactly what to look for. Based on their findings, budget about 5-15% of the purchase price for potential repairs. This might seem like extra expense upfront, but it can save you thousands later.

Step 3: Secure Financing before you fall in love with a specific home. Getting pre-approved shows sellers you’re serious and gives you a clear budget to work with. We work with various lenders and offer flexible financing programs for all credit types, so don’t let credit concerns hold you back.

Step 4: Making an Offer requires some strategy. Research comparable homes in the area to make sure your offer is competitive but still gets you a great deal. Present a written offer with your proposed price, terms, and any contingencies like satisfactory inspection results. Banks want to sell quickly, which often works in your favor during negotiations.

Step 5: Closing the Deal brings everything together. This involves a title search to confirm no liens exist, securing homeowner’s insurance, and signing loan documents. If the home needs to be moved to your lot, arrange for delivery and setup. Make sure all crucial documentation is in order – a clear title and necessary permits are non-negotiable.

Following these steps puts you on the path to owning a quality, affordable manufactured home without the stress and confusion that often comes with repo purchases.

Securing Your Investment: Financing and Comparisons

Let’s be honest – financing a bank repo manufactured home isn’t always as straightforward as walking into your local bank and asking for a traditional mortgage. These unique properties come with their own set of challenges that can make some lenders a bit nervous.

The main hurdle? That “as-is” condition we keep talking about. Lenders worry about financing homes that might need significant repairs. Plus, there’s the whole personal property versus real property question that can make your head spin. If your manufactured home isn’t permanently attached to land, it’s considered personal property – kind of like financing a really expensive car. This means you’ll likely need a chattel loan, which typically comes with shorter terms and higher interest rates than traditional mortgages.

But here’s the good news – we’ve been helping folks steer these waters for years, and we know exactly where to find the right financing solutions. Specialized lenders understand the manufactured home market inside and out. They know that a repo home at a great price can be an excellent investment, even if it needs some TLC.

Your credit score will definitely play a role in determining your interest rates and terms, but don’t let a less-than-perfect score discourage you. We’ve helped countless customers with all types of credit situations find their path to homeownership. That’s what we’re here for – to make the seemingly impossible, possible.

Financing Options for Bank Repo Manufactured Homes

When it comes to financing your repo home, you’ve got more options than you might think. We work with a network of lenders who specialize in manufactured home financing, and we also offer our own flexible financing programs designed specifically for situations like yours.

Specialized lenders are your best friends in this process. These companies focus exclusively on manufactured homes and understand that repo properties can be fantastic deals. They’re comfortable with the unique aspects of these homes and often have no age restrictions on the properties they’ll finance.

If your home will be considered personal property, a chattel loan might be your go-to option. Yes, the terms are typically shorter – usually 15 to 20 years – and interest rates can range from 5% to 15%. But here’s the thing: you can often get approved quickly with down payments as low as 5% to 20%.

For those lucky enough to be buying land with their home or placing it on land they already own, a land-home package loan opens up much better interest rates and longer terms. It’s like getting the best of both worlds.

Don’t overlook government-backed loans either. FHA loans are incredibly popular because they allow down payments as low as 3.5% and accept credit scores starting at 580. If you’re a veteran, VA loans can be a game-changer with 100% financing and competitive rates. And for those looking at rural areas, USDA loans offer 100% financing with excellent rates.

Sometimes, especially for lower-priced homes, a personal loan might make sense, though these typically come with higher rates and shorter repayment periods.

The key is understanding what lenders are looking for: typically a debt-to-income ratio below 43% and minimum credit scores around 550, though 600 or higher gets you better terms. That’s where our expertise in Mobile Home Financing really shines – we help you understand these requirements and find the best fit for your situation.

Repo vs. New: What’s the Best Choice for You?

This is probably the question we get asked most often, and honestly, there’s no one-size-fits-all answer. It really comes down to what matters most to you – immediate savings or long-term predictability.

Let’s look at this realistically. Bank repo manufactured homes offer incredible cost savings – we’re talking 20% to 50% below market value. That’s money that stays in your pocket from day one. But they come “as-is,” which means you might be looking at some repair costs down the road.

New manufactured homes, on the other hand, give you that fresh-start feeling. Everything’s pristine, you’ve got full manufacturer warranties, and there are no surprises waiting in the walls or under the floors. But you’ll pay full price for that peace of mind.

Here’s how they stack up:

| Feature | Bank Repo Home | New Home |

|---|---|---|

| Cost | 20-50% below market value | Full retail price |

| Condition | As-is; potential repairs needed | Move-in ready |

| Warranty | Typically none | Full manufacturer warranty |

| Customization | Great renovation opportunity | Built-to-order options |

| Financing | May need specialized lenders | Standard financing available |

| Timeline | Often available immediately | May require manufacturing wait |

For a deeper dive into this comparison, check out our guide on New vs Used Mobile Homes For Sale.

When thinking about long-term value, manufactured homes typically depreciate when they’re considered personal property, much like cars do. However, when they’re permanently affixed to land and titled as real property, they can actually appreciate in value over time.

Here’s where repo homes get really interesting: buying at a deep discount helps offset that initial depreciation. Plus, any improvements you make can add significant value. That immediate equity you gain by purchasing below market value can be a powerful financial advantage.

The bottom line? If you’re comfortable with a little uncertainty and want maximum savings, a repo home could be your perfect match. If you prefer predictability and don’t mind paying for it, a new home might be better. Either way, we’re here to help you make the choice that’s right for your family and your budget.

Frequently Asked Questions about Bank Repo Homes

We love getting questions about bank repo manufactured homes – it shows you’re being smart and doing your research before making such an important decision. Over the years, we’ve helped countless families find their perfect home, and these are the questions that come up time and time again.

What is the biggest risk when buying a repossessed manufactured home?

The biggest risk is the unknown condition of the home. When banks repossess manufactured homes, they’re not home experts – they’re financial institutions that want to recover their money as quickly as possible. This means repo homes are sold “as-is,” with no guarantees about what’s working or what might be broken.

Think of it like buying a used car without being able to pop the hood. You might get a fantastic deal, or you might find that the engine needs major work. With repo homes, you could face unexpected and costly repairs for issues like structural damage, plumbing problems, or electrical system failures that weren’t obvious during your initial walkthrough.

We’ve seen buyers get surprised by everything from hidden water damage to outdated electrical systems that need complete replacement. That’s why we always tell our customers: never skip the professional inspection. What you don’t see during that first visit really can hurt your wallet later.

How much cheaper are bank repo manufactured homes?

Here’s where bank repo manufactured homes really shine – the savings are genuinely impressive. These homes typically sell for 20-50% below the market value of comparable homes, and we’ve even seen discounts reach up to 50% in some cases.

Why such deep discounts? It’s simple economics. Banks aren’t in the home business – they’re in the lending business. When they repossess a manufactured home, their goal isn’t to make a profit on the sale. They want to recover the outstanding loan balance and move on. Every month they hold onto that property costs them money in maintenance, insurance, and storage.

This urgency to sell translates directly into significant cost savings for you. We’ve helped families save tens of thousands of dollars compared to buying new or even traditionally-sold used homes. It’s one of the most affordable paths to homeownership we know of.

Can I get a loan for a repo mobile home if I have bad credit?

Absolutely, yes! We understand that life throws curveballs, and not everyone has perfect credit. That’s exactly why we’ve built relationships with specialized lenders who understand manufactured homes and work with all kinds of credit situations.

While it might be more challenging than if you had excellent credit, you definitely have options. Government-backed loans like FHA loans can be particularly helpful – some programs accept credit scores as low as 580. These loans are designed to help people achieve homeownership even when traditional banks might say no.

We also offer our own flexible financing programs specifically designed for people with bad credit or no credit history at all. We believe everyone deserves a chance at homeownership, and we’ll work with you to explore every available option. Some of our happiest customers are folks who thought they’d never qualify for a home loan.

The key is being honest about your situation and working with people who understand both manufactured homes and creative financing solutions. That’s where we come in – we’ve helped people with all kinds of credit challenges find their way to homeownership.

Your Path to an Affordable Dream Home

What started as a search for an affordable home can become your gateway to financial freedom. Bank repo manufactured homes aren’t just about saving money upfront – they’re about opening doors that might otherwise stay locked. When you buy a repo home at 20-50% below market value, you’re not just getting a place to live. You’re getting immediate equity, lower monthly payments, and the freedom to invest your savings in other dreams.

The journey isn’t always simple, though. That “as-is” condition we’ve talked about means you’ll need to roll up your sleeves and do your homework. A thorough inspection isn’t optional – it’s your insurance policy against costly surprises. Setting aside 5-15% of your purchase price for potential repairs is smart planning, not pessimism.

But here’s the thing: you don’t have to steer this alone. We’ve been helping families in Von Ormy, Somerset, San Antonio, and throughout South Texas find their perfect homes for years. We know the ins and outs of repo home purchases, from spotting the best deals to securing financing even when your credit isn’t perfect.

Due diligence becomes your best friend in this process. We’ll help you understand what to look for during inspections, how to budget for improvements, and which repairs are worth tackling versus which ones to avoid. Our expert guidance can mean the difference between finding a diamond in the rough and getting stuck with a money pit.

At Mobile Homes Factory Direct, we believe homeownership should be within everyone’s reach. Whether you’re a first-time buyer with limited credit history or someone looking to downsize without breaking the bank, we have the experience and flexible financing options to help make it happen.

Ready to turn your housing dreams into reality? Your affordable dream home might be just a phone call away. Browse through Our Homes to see what’s currently available, or take a closer look at our selection of quality pre-owned options.

The path to affordable homeownership starts with taking that first step. Let’s walk it together.