The Best Repossessed Mobile Home Dealers Await

Achieve affordable homeownership! Find top repossessed mobile home dealers, learn pros, cons, and secure your dream home for less.

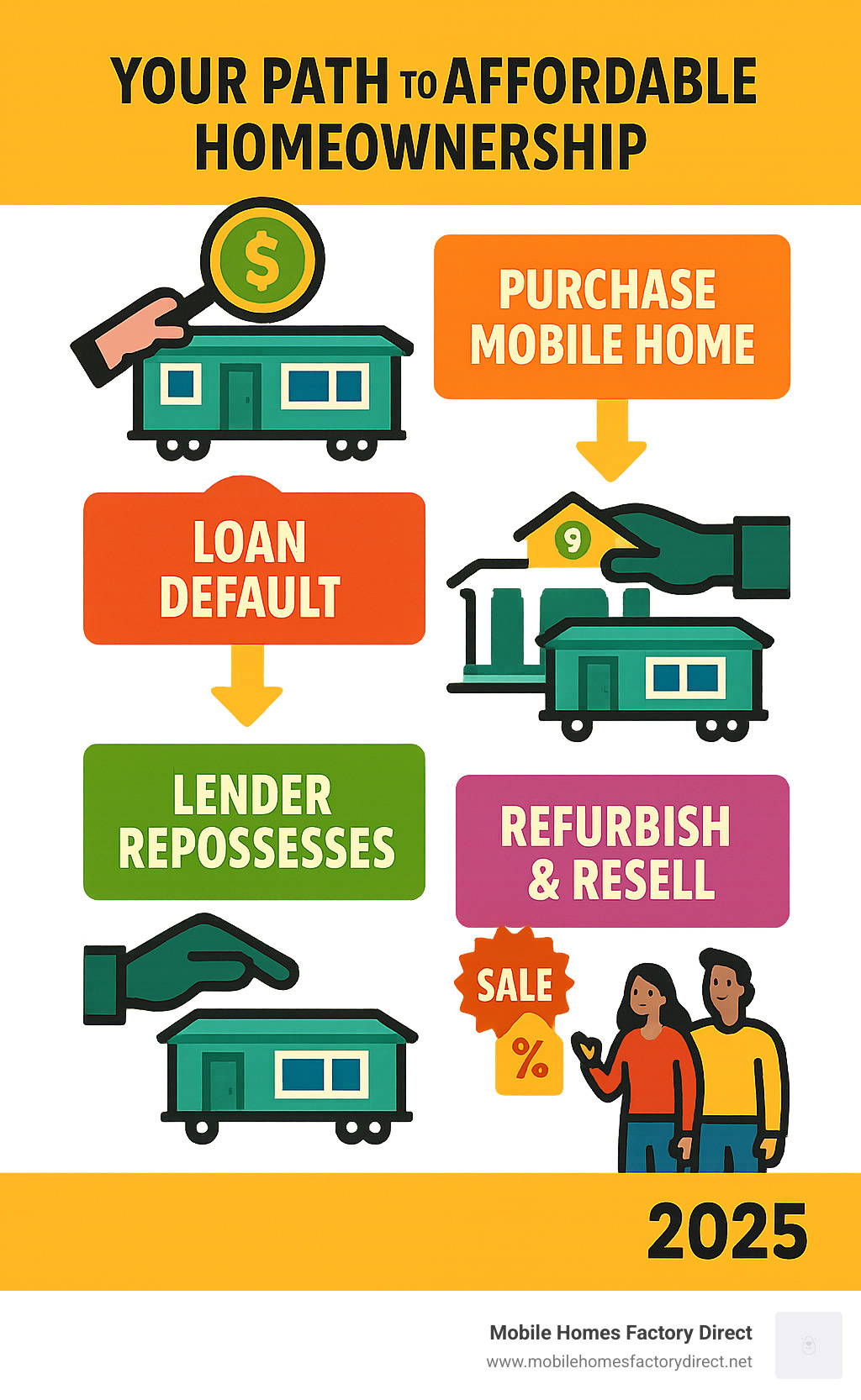

Your Path to Affordable Homeownership

Repossessed mobile home dealers offer a fantastic route to homeownership for buyers on a budget or with credit challenges. These dealers acquire homes from lenders after loan defaults and resell them at significant discounts.

Quick Answer: Top Places to Find Repossessed Mobile Home Dealers:

- Specialized repo dealers like Mobile Homes Factory Direct

- Bank and lender websites with foreclosure listings

- Local manufactured housing dealers with repo inventory

- Online marketplaces featuring bank-owned properties

- Auction sites selling repossessed inventory

The numbers tell the story: repossessed mobile homes can save you 30-50% compared to new manufactured homes. With roughly 100,000 repossessed manufactured homes sold annually in the US, there’s a substantial inventory for savvy buyers.

Buying from a repo dealer isn’t just about finding a cheap home; it’s about finding a path to homeownership when traditional routes seem blocked. As one Texas repo dealer puts it: “Times are tough, we understand that. Because of this, we want to offer you a chance at a home at a great price!”

The process requires due diligence, as these homes are typically sold “as-is” and may need repairs. However, for buyers willing to do their homework, repo mobile homes represent a genuine investment opportunity and a realistic way to achieve the homeownership dream.

Understanding the World of Repo Mobile Homes

A repossessed mobile home is a manufactured home that a lender took back when the previous owner couldn’t make their payments. These homes then enter a special resale market where their biggest selling point is a dramatically lower price.

Why Mobile Homes Get Repossessed

Life happens, and financial hardship is the most common reason for repossession. Job loss, medical emergencies, divorce, or economic downturns can make mortgage payments impossible. Other times, major life changes like a cross-country move or a park closure force owners to walk away from their homes. The lender’s role is simply to recover their losses when a loan defaults—it’s a business decision, not a personal one.

The Repossession Process Explained

The path from missed payments to the repo dealer’s lot is a legal process. It begins with a notice of default, which gives the homeowner a cure period to catch up on payments. If the default isn’t resolved, the process moves faster than a traditional home foreclosure. Mobile and manufactured homes that aren’t categorized as real estate can be seized or reclaimed by a secured creditor. The lender takes possession and begins the resale process. They want to sell the home quickly to recoup their money, which is where repossessed mobile home dealers step in to offer these homes to buyers at a discount.

Price Advantage: Repo vs. New Homes

Here’s where it gets exciting for your wallet. Repossessed homes typically sell for 30-50% less than comparable new homes, which can mean saving tens of thousands of dollars. Why the huge savings? A lender’s goal is to recoup their losses quickly, not make a profit. Every month a home sits unsold costs them money.

Repo homes are usually sold in “as-is” condition, meaning you’re responsible for any repairs. This “as-is” condition pricing is factored into the low price, creating an incredible opportunity for buyers willing to put in some sweat equity. Even after budgeting for repairs, you’ll often end up with a home that costs far less than buying new. For a detailed breakdown of what goes into mobile home pricing, check out our Mobile Home Pricing Guide.

The Pros and Cons of Buying from Repossessed Mobile Home Dealers

Buying from repossessed mobile home dealers has significant benefits and some genuine challenges. It’s important to understand both sides to make the best choice for your family.

The Upside: Major Advantages

The biggest advantage is the significant cost savings, often 30-50% off market value. This can be the difference between renting and owning. Buying below market value also means you can gain instant equity. Other benefits include faster move-in times compared to traditional home buying and a wide variety of models to choose from. For those who enjoy projects, these homes offer a great opportunity for renovation, allowing you to customize your space with the money you saved. Learn more in our guide: Why Should You Get a Repo Mobile Home?.

The Downside: Potential Risks to Consider

The main reality check is that repo homes are sold “as-is,” meaning they often need work. The potential for repairs can range from minor cosmetic fixes to major system overhauls. You’re also dealing with an unknown history, which makes a thorough inspection critical. There’s also a small risk of possible liens or back taxes that could become your problem.

| Pros | Cons |

|---|---|

| Cost: 30-50% savings over market value | Condition: Sold “as-is” with potential repair needs |

| Speed: Faster closing and move-in times | Hidden Costs: Unknown repair expenses and moving costs |

| Variety: Wide selection of models and sizes | Title Issues: Risk of liens or legal complications |

Many repo homes are sold “to be moved,” so you must budget for transportation and setup costs. The key is to have realistic expectations. You can save a lot of money, but you might need to put in some work. For many families, that trade-off is worth it to achieve homeownership.

How to Find and Evaluate Repo Homes

Finding the perfect repossessed mobile home is like a treasure hunt. You need to know where to look and what to check once you find a potential home.

Where to Find Listings

Your search should start with specialized dealers like Mobile Homes Factory Direct. We work directly with lenders and often get first access to inventory. Other places to look include:

- Bank and lender websites in their “foreclosure” or “REO” sections.

- Online marketplaces like MHVillage.com and Facebook Marketplace.

- Public auctions, which offer low prices but are high-risk, cash-only sales.

- Driving through mobile home parks and checking community bulletin boards.

For immediate options, check our current inventory: Find Repo Mobile Homes for Sale Near Me.

The Ultimate Inspection Checklist

Since repo homes are sold “as-is,” a thorough inspection is essential. What you don’t see can hurt your wallet later. Focus on these key areas:

- Structural Integrity: Check the foundation, blocking, and frame for levelness, cracks, or rust. Walk through every room, feeling for soft spots or uneven floors that signal subfloor damage.

- Roof and Water Damage: Look for missing shingles, sagging, or signs of past repairs. Inside, scan ceilings and walls for water stains. Check for signs of water damage everywhere.

- Exterior and Interior Systems: Inspect siding, windows, and doors. Test all plumbing, electrical outlets, and the HVAC system to ensure they work properly.

- HUD Labels: Locate the HUD data plate (usually inside a cabinet) and the red certification label on the exterior. These prove the home meets federal safety standards.

Understanding the Legal Side

Navigating the legal side is crucial to protect your investment. A title search with your state’s titling agency ensures the seller has the right to sell the home. Lien verification confirms there are no outstanding claims from other creditors. If you plan to move the home, you’ll need to research permit requirements and local zoning regulations. If placing the home in a park, review the park rules and lot rent fees beforehand. For Texas buyers, the Texas Department of Housing and Community Affairs is an excellent resource. Working with experienced dealers simplifies this process significantly.

Securing Financing and Finalizing Your Purchase

You’ve found the perfect repo home; now it’s time to make it yours. The financing and purchasing process is often smoother than you’d expect.

Financing Your Repo Mobile Home

Repossessed mobile home dealers like us work with lenders who understand this market. Several loan options are available:

- Chattel loans are the most common for home-only purchases, using the home as collateral.

- Land-home packages combine the home and land into a single mortgage, often with better rates.

- Government-backed loans like FHA Title I, VA, and USDA loans offer competitive terms for qualified buyers, sometimes with low or no down payment.

Your credit doesn’t have to be perfect. We work with lenders who approve loans for a wide range of credit scores, sometimes as low as 550. While a down payment can improve your terms, some lenders offer up to 100% financing. Our team can help you steer these options. Learn more on our Mobile Home Financing page.

What to Expect from Reputable Repossessed Mobile Home Dealers

Choosing a reputable dealer like Mobile Homes Factory Direct provides much more than just inventory. We offer:

- Inventory Access: Direct relationships with lenders give our customers first pick of the best deals.

- Refurbishment Services: We inspect and handle necessary repairs, so you can feel confident your home is in good, livable condition.

- Financing Assistance: Our team guides you through the application process to find the best rates and terms.

- Paperwork Handling: We manage title transfers, lien releases, and permits to save you headaches.

- Transportation and Support: We coordinate the move and provide ongoing customer support.

Explore our quality and variety on our Our Homes page.

Making an Offer and Closing the Deal

The closing process for repo homes is often faster than for traditional real estate. The key steps include:

- Negotiating the Price: Your offer should reflect the home’s condition and market value. There may be room to negotiate.

- Purchase Agreement: This legal document outlines all terms of the sale. Read it carefully.

- Earnest Money & Appraisal: You’ll provide a deposit, and your lender will order an appraisal to confirm the home’s value.

- Final Walk-Through: Before closing, you’ll inspect the home one last time to ensure it’s in the agreed-upon condition.

- Closing: You’ll sign the final paperwork, pay closing costs (which can often be rolled into the loan), and receive the title. Don’t forget to secure homeowner’s insurance beforehand.

The entire process typically takes four to eight weeks. We’re here to guide you every step of the way.

Frequently Asked Questions about Repo Mobile Homes

We get a lot of questions about repossessed mobile homes. Here are answers to some of the most common ones.

Are repossessed mobile homes a good investment?

Yes, absolutely! With proper due diligence, a repo home is a fantastic investment. You get significant savings upfront (30-50% off), which means you’re building instant equity. Instead of paying rent, you’re investing in your own future. Just be sure to budget for repairs, as these homes are sold “as-is.” Even after renovation costs, you’re typically far ahead financially, and the improvements add even more value.

Can I get a loan for a repo mobile home with bad credit?

Yes. We know that life happens and credit scores can take a hit. Many repossessed mobile home dealers, including us, work with specialized lenders who offer flexible financing options for all credit types. We’ve helped countless customers with bad credit, no credit, or ITINs become homeowners. While the interest rate might be slightly higher, you can still qualify and start rebuilding your credit by making timely payments. Learn more about Financing for Mobile Homes with Bad Credit.

Do repo mobile homes come with land?

It depends on the specific home. Some are sold as “real property,” meaning the home and land are sold together as a package. More often, they are “home-only” purchases, classified as personal property. This requires you to move the home to land you own or a spot in a mobile home park. This option gives you more flexibility on where you live. We sometimes have package deals available, so check our listings for Repo Mobile Homes with Land for Sale.

Conclusion: Take the Next Step with Confidence

Now that you’ve explored our guide to repossessed mobile home dealers, you can see this is more than just a way to get a great deal. The huge savings potential of 30-50% is incredible, but these homes represent something more valuable: an achievable path to homeownership.

Yes, it requires due diligence. You’ll need to inspect the home thoroughly and budget for potential repairs. But the reward is building equity in your own place instead of paying rent. The money you save upfront can be used to customize your home and make it truly yours.

We’ve walked through the entire journey, from understanding the process to securing financing. The challenges are manageable, especially when you have a trusted partner.

That’s where Mobile Homes Factory Direct comes in. We help families across Texas—from Von Ormy and Somerset to San Antonio and Castroville—find their perfect home. We offer flexible financing for all credit types and a straightforward process to take the stress out of buying.

Your dream of homeownership is within reach. That perfect repossessed mobile home could be waiting for you right now.

Ready to stop dreaming and start doing? Explore our available pre-owned homes today! Your future home is just a click away.