The Definitive Guide to Mobile Home Financing

Get expert insights on mobile home financing. Compare FHA, VA, and chattel loans to find your path to affordable homeownership today.

Why Mobile Home Financing Opens Doors to Affordable Homeownership

Mobile home financing offers a pathway to homeownership for many who find traditional housing costs prohibitive. With traditional home prices exceeding $416,900 and the average manufactured double-wide costing around $145,200, manufactured housing is one of the most affordable options on the market.

Quick Answer: Mobile Home Financing Options

Here are your primary financing paths for a manufactured home:

- FHA Loans: Government-backed loans with down payments as low as 3.5% and flexible credit requirements.

- VA Loans: A zero-down-payment option for eligible veterans and service members.

- Conventional Loans: Programs requiring 3-5% down for buyers with credit scores of 620+.

- Chattel Loans: Personal property loans for homes on leased land, typically with 15-20 year terms.

- Personal Loans: Unsecured financing for older homes or unique situations.

However, financing a manufactured home differs from a traditional mortgage. The key distinction is whether the home is classified as personal property (like a vehicle) or real property (like a site-built house). This affects your interest rate, loan term, and available lenders.

While lenders were once cautious due to depreciation concerns, recent data from the Urban Institute shows manufactured homes on owned land appreciate at nearly the same rate as site-built homes. This is changing the industry, and more financing options exist today than ever before.

This guide will break down everything you need to know to steer the process and secure the best terms for your new home.

Foundations of Financing: Home Types, Land, and Associated Costs

Before applying for a loan, it’s crucial to understand the basics of your home type, its legal classification, and where it will be located. Getting this prep work right can save you time, money, and headaches.

Understanding Your Home: Mobile vs. Manufactured vs. Modular

The terms are often used interchangeably, but they mean different things to lenders:

- Mobile Homes: Factory-built homes produced before June 15, 1976. They were built to varied standards, and financing them can be challenging, often limited to personal property loans.

- Manufactured Homes: Homes built after June 15, 1976, under federal standards from the U.S. Department of Housing and Urban Development (the HUD Code). This code ensures consistent quality and safety. These homes are built on a permanent steel chassis for transport. Learn more in our What is Manufactured Housing guide.

- Modular Homes: Also factory-built, but constructed to meet local and state building codes—the same as traditional site-built homes. They are assembled on a permanent foundation and qualify for standard mortgages.

Your home type directly impacts your financing options, with newer manufactured homes on permanent foundations opening the most doors.

The Critical Distinction: Real Property vs. Personal Property

This is the most important concept in mobile home financing. It determines your interest rate, loan term, and lender options.

- Personal Property: The home is treated legally like a car, with a vehicle title. This is common for homes on leased land in mobile home parks. Loans for these are called chattel loans, which have higher interest rates (often 7-10%+) and shorter terms (15-20 years) because lenders see them as higher risk.

- Real Property: This occurs when the home is permanently affixed to land you own and the vehicle title is converted to a real estate deed. The home is then legally treated like a site-built house. This makes you eligible for traditional mortgage options like FHA, VA, and conventional loans, which offer lower interest rates and longer terms (up to 30 years), saving you thousands over the life of the loan.

Properly installing your home on a permanent foundation is a smart financial move. Our mobile home foundation types guide explains the requirements.

Land Ownership: Leased Lot vs. Owned Land

Where your home sits is as important as the home itself.

- Financing on Leased Land: Common in mobile home communities, you own the home but rent the lot. This typically limits you to chattel loans. You’ll pay monthly lot rent (around $300-$800 in Texas) on top of your loan payment. For FHA Title I loans, the lease must have an initial term of at least three years to offer you protection.

- Financing on Owned Land: When you own the land, you can qualify for better loan terms (FHA Title II, VA, conventional) by having the home permanently installed and titled as real property. If you already own land, you may be able to use its equity as your down payment through land-in-lieu financing. This is a game-changer for many buyers, as it can cover the down payment and even site improvement costs. See how it works in our guide on financing a mobile home with land.

Budgeting for Long-Term Ownership Costs

Your monthly payment is just one piece of the puzzle. Be sure to budget for all ongoing expenses:

- Property Taxes: If your home is real property, expect to pay 1.5% to 2.5% of its assessed value annually in Texas.

- Homeowners Insurance: Manufactured home insurance can range from $300 to $1,000 per year. Your lender will require it.

- Utilities: Standard costs for electricity, water, gas, and internet.

- Maintenance and Repairs: A good rule is to set aside 1-2% of your home’s value each year for upkeep.

- Lot Rent/HOA Fees: If on leased land, factor in monthly lot rent ($300-$800) and any community HOA dues ($50-$200).

Understanding these costs upfront ensures you can comfortably afford homeownership long-term. For a full cost breakdown, see our mobile home prices guide.

Exploring Your Loan Options for Mobile Homes

Understanding your mobile home financing options helps you find the best path forward. The good news is that whether you’re a veteran, a first-time buyer, or someone who already owns land, there’s likely a solution for you. The landscape includes government-backed programs (FHA, VA) designed for accessibility and private loans for more flexibility.

Here’s what the financing landscape looks like at a glance:

| Loan Type | Minimum Credit Score | Down Payment | Loan Term (Typical) | Best For |

|---|---|---|---|---|

| FHA Title I | 500 (10% down), 580+ | 3.5% or 10% | Up to 20 years | Homes on leased land, home-only, or older homes |

| FHA Title II | 580+ | 3.5% | Up to 30 years | Homes on owned land, permanently affixed |

| VA Loans | 580+ (no formal min) | 0% | Up to 30 years | Eligible veterans/service members with home on owned land |

| Conventional | 620+ | 3-5% | Up to 30 years | Newer homes on owned land (MH Advantage/CHOICEHome) |

| Chattel Loans | 575+ (varies) | 0-35% | Up to 20 years | Homes on leased land, personal property |

| Personal Loans | 580+ | 0% | Up to 7 years | Older homes, smaller loans, quick funding, higher interest tolerance |

For a comprehensive look at how these options compare, explore our Loan options for mobile homes overview.

FHA Loans: Flexible Government-Backed Financing

Backed by the Federal Housing Administration, FHA loans reduce lender risk and offer favorable terms. The FHA provides two distinct programs for mobile home financing.

-

FHA Title I loans are for homes classified as personal property. They can be used for a home on leased land, a home-only purchase, or even a lot. Loan limits are up to $105,532 for a single-wide home and $193,719 for a multi-width home. Terms extend up to 20 years. A credit score of 580+ typically requires a 3.5% down payment, while scores from 500-579 may require 10% down. These loans are accessible but have limits and require FHA mortgage insurance. For details, see HUD’s Title I program info and our FHA mobile home financing details guide.

-

FHA Title II loans are traditional FHA mortgages for manufactured homes classified as real property (permanently attached to owned land). The home must be built after June 15, 1976, be at least 400 sq. ft., and sit on an FHA-approved permanent foundation. In return, you get mortgage terms up to 30 years with a 3.5% down payment (for scores 580+). This option offers lower rates and longer terms but has strict property requirements.

VA Loans: An Option for Service Members

For eligible veterans and active-duty service members, VA loans are often the best financing option available. Key benefits include zero down payment and no private mortgage insurance (PMI), which saves hundreds per month. To qualify, the manufactured home must be classified as real property and permanently affixed to land you own. While the VA has no minimum credit score, most lenders look for 580-620+. A one-time VA funding fee applies but can be rolled into the loan. The advantages are significant, but the program is limited to eligible service members and requires the home to be real property. Review the official VA loan requirements for manufactured homes.

Conventional Loans (Fannie Mae & Freddie Mac)

Fannie Mae’s MH Advantage® and Freddie Mac’s CHOICEHome® programs are designed for high-quality manufactured homes that resemble site-built houses (e.g., pitched roofs, permanent foundations). The home must be real property on owned land. These loans offer down payments as low as 3-5%, competitive interest rates, and terms up to 30 years. Lenders typically require a minimum credit score of 620. These programs are great for newer, high-end manufactured homes but have stricter credit and property standards than FHA or VA loans. See Fannie Mae’s MH requirements for specifics.

Chattel Loans: The Go-To for Personal Property Mobile Home Financing

A chattel loan is your primary option when a home is on leased land or not permanently attached to owned land. It treats the home as personal property, using the home itself as collateral. Because the land isn’t included, these loans are seen as higher risk, resulting in higher interest rates (8-14%) and shorter terms (15-20 years). You’ll need to work with specialized lenders, as most traditional banks don’t offer them. Chattel loans are accessible and have a faster closing process, but the trade-off is higher overall borrowing costs.

Personal Loans

As a last resort, an unsecured personal loan can finance a mobile home. Lenders approve you based on your credit and income, not collateral. Funding is fast, and you can use the money for homes that don’t qualify for other loans (e.g., pre-1976 models). However, the costs are very high. Interest rates can reach 36%, loan amounts are typically lower ($25k-$100k), and terms are short (up to 7 years). This combination leads to very high monthly payments. We recommend exploring all other options first.

Your Step-by-Step Guide to Securing Mobile Home Financing

Securing mobile home financing is a manageable process with clear steps. We’ve guided hundreds of Texas families through it, and we’re here to help you too.

Step 1: Financial Preparation

Before you start shopping, get your finances in order.

- Check Your Credit: Pull your free credit reports from

[annualcreditreport.com](http://www.annualcreditreport.com/)and dispute any errors. We work with lenders who offer solutions for all credit types, so a low score doesn’t have to be a deal-breaker. - Create a Budget: Determine how much you can comfortably afford for a monthly payment, including taxes, insurance, and potential lot rent.

- Calculate Your Debt-to-Income (DTI) Ratio: Divide your total monthly debt payments by your gross monthly income. Most lenders prefer a DTI of 43% or less, but some programs are more flexible.

Step 2: Determine Your Needs

Decide what you’re looking for, as this will guide your financing path.

- Home Type: Are you interested in a new manufactured home or an older model? Our

[New vs. used mobile homes guide](https://mobilehomesfactorydirect.net/used-mobile-homes-guide/)can help you weigh the pros and cons. - Land Ownership: Will you place the home on a leased lot or on land you own? This is the key factor in determining whether you’ll need a chattel loan (personal property) or can qualify for a mortgage (real property). If you own land, ask about land-in-lieu financing.

Step 3: Research and Compare Lenders

Not all lenders handle mobile home financing. It’s essential to find one who understands the market.

- Seek Specialized Lenders: Look for lenders, credit unions, and regional banks that specifically advertise manufactured home loans. They understand the nuances of HUD codes and property classifications.

- Compare Offers: Look beyond the interest rate. Compare loan terms, fees, and down payment requirements. We partner with a network of trusted lenders to help our customers find the best fit. For more tips, see our guide on

[Finding manufactured home financing companies](https://mobilehomesfactorydirect.net/manufactured-home-financing-companies/).

Step 4: The Application and Pre-Approval Process

Getting pre-approved shows sellers you’re a serious buyer and gives you a firm budget.

- Gather Documents: You’ll typically need recent pay stubs, W-2s, tax returns, and bank statements. If you own land, have the deed ready.

- Get Pre-Approved: A pre-approval is a lender’s conditional commitment to lend you a specific amount. It’s a powerful tool that strengthens your position when making an offer. Our

[Pre-approval process explained](https://mobilehomesfactorydirect.net/mobile-home-financing-2/pre-approval-process/)guide walks you through what to expect.

Step 5: Closing the Loan

The final stage makes your homeownership official.

- Appraisal and Title Search: An independent appraiser will confirm the home’s value, and a title company will ensure the property has a clear title with no liens.

- Sign the Paperwork: You’ll review and sign the loan documents. Don’t hesitate to ask your lender to clarify anything you don’t understand.

- Timeline: Expect the process to take 4-6 weeks for a home-only purchase and 6-8 weeks if land is involved. We stay involved throughout to ensure a smooth closing.

Frequently Asked Questions about Mobile Home Loans

What credit score is needed for a mobile home loan?

The required credit score for mobile home financing varies by loan type:

- FHA Loans: Typically 580+ for a 3.5% down payment. Some lenders go down to 500 with 10% down.

- VA Loans: No official minimum, but most lenders prefer 580-620+.

- Conventional Loans: Usually require a minimum of 620.

- Chattel Loans: Varies by lender, but some approve scores as low as 575.

- Personal Loans: Often start around 580, but with much higher interest rates.

A lower credit score doesn’t automatically disqualify you. At Mobile Homes Factory Direct, we specialize in flexible financing for all credit types, including bad or no credit. Explore our guide on [Financing for mobile homes with bad credit](https://mobilehomesfactorydirect.net/financing-for-mobile-homes-with-bad-credit/) for more strategies.

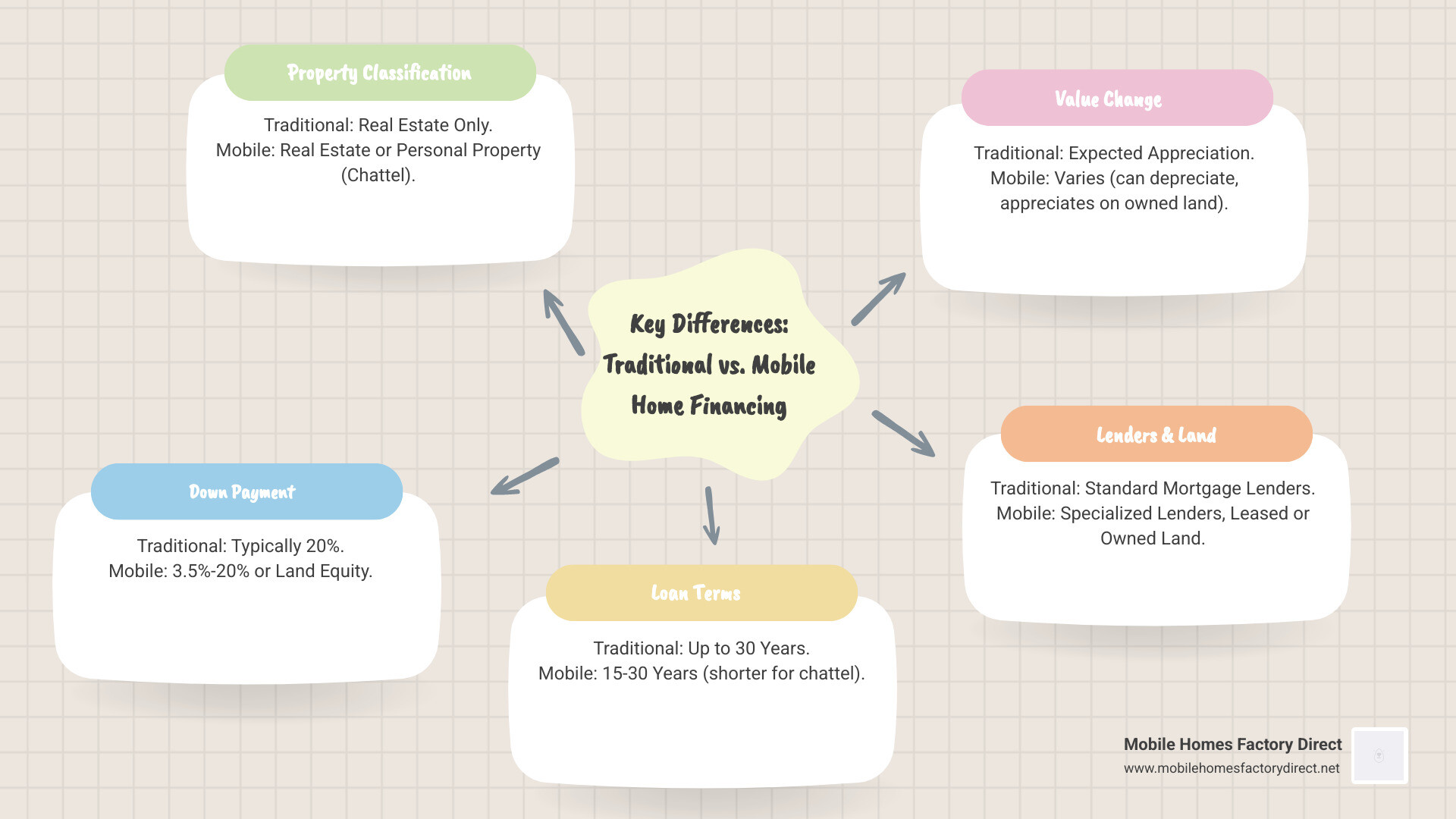

How is financing a mobile home different from a traditional mortgage?

The primary differences in mobile home financing stem from a few key factors:

- Property Classification: A manufactured home can be either personal property (like a car) or real property (like a house). This is the biggest difference and dictates the loan type. Personal property usually requires a chattel loan with higher rates and shorter terms (15-20 years).

- Lender Type: Many traditional banks don’t finance manufactured homes, so you’ll often work with specialized lenders who understand the market.

- Property Requirements: To qualify for the best mortgage rates, a manufactured home must be built after June 15, 1976, be on a permanent foundation, and be on land you own.

- Appreciation: While once viewed as depreciating assets, a study by the Urban Institute found that manufactured homes on owned land appreciate similarly to site-built homes. The lending industry is slowly adapting to this reality.

Our [Manufactured home mortgage guide](https://mobilehomesfactorydirect.net/manufactured-home-mortgage/) explains these distinctions in greater detail.

Can I get financing for an older mobile home?

Yes, but your options become more limited with age. The critical date is June 15, 1976, when the federal HUD Code for construction standards was implemented.

- Homes built before 1976 (true “mobile homes”) are very difficult to finance through traditional mortgage programs like FHA Title II or conventional loans. Lenders view them as higher risk due to outdated construction standards.

- Your best options for older homes are typically chattel loans from specialized lenders, who are more flexible on age and condition. You will face higher interest rates and shorter terms.

- Personal loans are another possibility, especially for smaller purchase amounts, but they come with the highest interest rates and shortest repayment periods.

We have experience helping families finance homes of all ages. Our [Used mobile homes guide](https://mobilehomesfactorydirect.net/used-mobile-homes-guide/) provides more information on navigating the purchase of an older unit.

Conclusion: Your Path to Affordable Homeownership

You now know that mobile home financing is not one-size-fits-all. From FHA and VA loans to conventional and chattel loans, there is a path for nearly every buyer. The key is matching the right loan to your credit, your land situation, and your home’s property classification.

The manufactured housing industry is evolving. With modern homes appreciating like site-built homes, financing is more accessible than ever. Your path to affordable homeownership begins with taking action: check your credit, set a budget, and get pre-approved.

At Mobile Homes Factory Direct, we’ve helped hundreds of families in Von Ormy, Somerset, Atascosa, Macdona, San Antonio, and across Texas find their way home. We work with all credit levels—good, bad, or none at all—because we believe everyone deserves a chance at homeownership. Our team knows the financing landscape and partners with specialized lenders to find a solution that works for you.

Don’t let financing questions hold you back. The home you’re dreaming of is within reach. [Start your mobile home financing journey today](https://mobilehomesfactorydirect.net/mobile-home-financing-2/) by reaching out to our team. We’re ready to help you take the next step.