Bad Credit, Big State: How to Buy a Home in Texas

Facing bad credit in Texas? Discover how to buy Bad credit homes Texas with flexible financing & state aid. Your dream is possible!

Why Bad Credit Doesn’t Have to Stop You from Owning a Home in Texas

Bad credit homes Texas are more accessible than most people think. If you’re looking to buy a home in the Lone Star State but worried about your credit score, you have real options—especially when it comes to mobile and manufactured homes.

Quick Answer: Your Main Options for Bad Credit Homes in Texas

- Chattel Loans – Financing for mobile/manufactured homes (often easier to qualify with bad credit)

- In-House Financing – Direct financing from sellers with flexible terms

- FHA Loans – Government-backed loans accepting scores as low as 500 (with 10% down) or 580 (with 3.5% down)

- Texas State Programs – TSAHC programs offering down payment assistance and special terms

- Co-Signer Options – Boost your approval chances with a creditworthy co-signer

Here’s the reality: 21% of mortgage applications in the U.S. were rejected in 2024, with bad credit being the top reason. A credit score below 580 is considered poor by most lenders, and this creates real barriers to traditional home financing.

But Texas is a big state with big opportunities.

Many Texans with credit challenges are finding their path to homeownership through manufactured and mobile homes. These homes offer lower purchase prices, more flexible financing options, and faster approval processes compared to traditional stick-built houses.

You don’t need perfect credit to own a home in Texas. You need the right information, the right approach, and the right type of home financing. This guide will show you exactly how to steer the process—from understanding what bad credit means to Texas lenders, to finding flexible financing options, to building a strong application that gets approved.

Understanding the Landscape: What “Bad Credit” Means for Texas Homebuyers

When you’re trying to buy a home in Texas, “bad credit” generally refers to a FICO credit score below 580. This isn’t a personal judgment; it’s how lenders measure financial risk based on your credit history. A lower score, which might result from late payments, high debt, or collections accounts, signals a higher risk to lenders. This perception has real consequences for bad credit homes Texas buyers.

Higher interest rates are the first hurdle. Lenders charge more to offset the perceived risk, which can mean paying thousands more over the life of your loan.

Larger down payments are also common. For an FHA loan, a score below 580 (but above 500) typically requires a 10% down payment, compared to just 3.5% for a score of 580 or higher.

You’ll also likely face Private Mortgage Insurance (PMI) for conventional loans or Mortgage Insurance Premiums (MIP) for government-backed loans. This is an extra monthly cost added to your payment if you put down less than 20%.

Understanding how lenders see your credit is empowering. Once you know the challenges, you can make smarter choices about which financing options to pursue. In Texas, especially with manufactured and mobile homes, you have more options than you might think.

Your Path to Homeownership: Mobile & Manufactured Home Loan Options for Bad Credit in Texas

If traditional banks have turned you down, manufactured and mobile homes offer a more accessible path to homeownership in Texas. These homes have financing options designed for real-world credit challenges. At Mobile Homes Factory Direct, our Bad Credit Home Loans program is built on the idea that your credit score shouldn’t be a barrier to owning a home. We specialize in helping families with less-than-perfect credit secure financing.

Chattel Loans for Bad Credit Homes Texas

A chattel loan is a key option for financing a manufactured home. Unlike a traditional mortgage, it treats the home as personal property, securing the loan with the home itself, not the land. This distinction is crucial for buyers with bad credit.

Chattel loans are often easier to qualify for because the lenders who offer them specialize in this market and are more flexible than traditional banks. This is the primary financing route if you plan to place your home on leased land or in a mobile home park. Both “mobile homes” (built before June 1976) and “manufactured homes” (built after) qualify, opening up many affordable options for bad credit homes Texas buyers.

While owning your land can open up other loan types, for many with credit challenges, chattel loans are the clearest path forward. We’ve helped many Texans with scores in the 500s secure chattel financing. With a score over 500 and a modest down payment, we can likely find you a reasonable rate. Learn more in our guide on Financing for Mobile Homes with Bad Credit.

In-House and Flexible Financing Options

Mobile Homes Factory Direct also offers in-house and flexible financing solutions that can bypass traditional bank obstacles. In-house financing means we work directly with you or through our network of specialized lenders who look beyond just your credit score.

They consider your whole financial picture—income, job stability, and down payment—to find a solution. A 550 score might be an automatic rejection from a bank, but we’ll work to find what’s possible. Our flexible options allow for adjustments to terms and down payments that rigid bank policies don’t. We are always transparent about contract details, ensuring you understand the interest rate and payment schedule.

If you have no credit history, our No Credit Mobile Homes Ultimate Guide can help. We are committed to making homeownership a reality for families across Texas.

Texas-Specific Help and Alternative Routes

Texas offers state programs and alternative financing routes to help buyers with credit challenges. These resources can help you find bad credit homes Texas by looking beyond just your credit score. Let’s break down what’s available.

Tapping into Texas State Programs for Manufactured Homes

The Texas State Affordable Housing Corporation (TSAHC) is a key resource, and its programs apply to manufactured homes that are permanently affixed to real property.

- Homes for Texas Heroes Program: Assists teachers, firefighters, EMS workers, police, correctional officers, and veterans with mortgages and down payment assistance.

- Home Sweet Texas Home Loan Program: Offers similar benefits to other Texans who meet income requirements.

- Down Payment Assistance (DPA): Provides grants or deferred second liens to cover down payment and closing costs, a huge help for those with challenged credit.

- Mortgage Credit Certificate (MCC): Gives you an annual federal tax credit, which can lower your debt-to-income ratio and make qualifying easier.

Income and purchase price limits apply and vary by county, with expanded limits in certain targeted areas. Be aware that many TSAHC programs require a minimum credit score around 620-640. However, don’t be discouraged, as other paths exist.

Exploring Flexible Financing Options for Bad Credit

When state programs aren’t the right fit, alternative financing can open doors for bad credit homes Texas.

- Owner financing: The seller acts as your lender, allowing for flexible terms based on your overall financial situation, not just your credit score. We offer owner financing on many of our homes.

- Rent-to-own programs: These lease-purchase agreements let you rent your future home while a portion of your rent builds equity for a down payment. This gives you time to improve your credit and save.

- Specialized Lenders: We partner with lenders who specialize in manufactured homes and understand buyers with credit challenges, offering more flexible criteria than big banks.

These options may come with higher interest rates, so it’s crucial to review all contract terms. However, they provide a valuable path to homeownership and equity building. Our No Credit Mobile Homes Ultimate Guide provides more detail on these strategies.

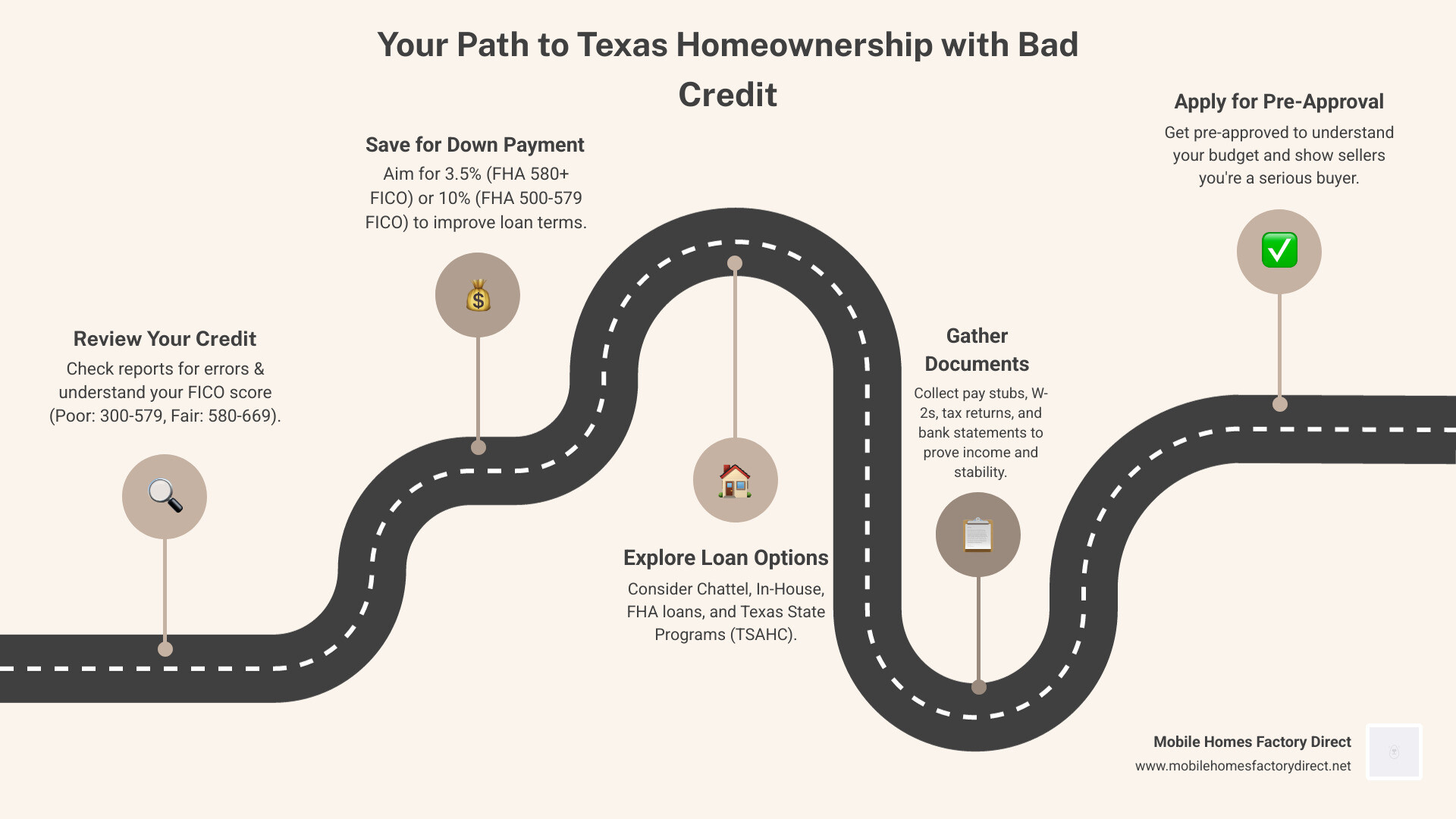

Building a Strong Application: How to Get Approved

Getting approved for a home loan with bad credit is achievable. The key is building a strong application that shows lenders you’re a reliable borrower, despite your credit score. Here’s how to strengthen your profile for bad credit homes Texas.

Strengthening Your Financial Profile for Bad Credit Homes Texas

Lenders look beyond your credit score. Strengthen your financial profile to boost your approval chances.

- Lower Your Debt-to-Income (DTI) Ratio: Your DTI compares your monthly debt payments to your gross monthly income. Lenders prefer a DTI below 43%. Pay down existing debt before applying to lower your ratio.

- Show Stable Employment: A consistent two-year employment history with the same employer demonstrates a reliable income. If you’ve changed jobs, be ready to explain why, especially if it was a career advancement.

- Save for a Down Payment: A larger down payment reduces the lender’s risk and is one of the most powerful ways to improve your chances. For an FHA loan, a score of 580+ requires 3.5% down, while a score of 500-579 requires 10%. A down payment is crucial for securing manufactured home financing.

- Organize Your Documents: Have your paperwork ready to show you’re an organized and serious applicant. You will need:

- Recent pay stubs (last 30 days)

- W-2s from the past two years

- Tax returns

- Bank statements (past 60-90 days)

- Other proof of income

Actionable Steps to Boost Your Credit Score

While we can help you find financing with bad credit, improving your score will secure better loan terms.

- Check and Dispute Errors: Get your free annual credit reports from Equifax, Experian, and TransUnion. Review them carefully for errors and dispute any inaccuracies immediately. Fixing mistakes can significantly boost your score.

- Make On-Time Payments: Your payment history is the biggest factor in your FICO score (35%). Pay every bill on time, every time. Use automatic payments to stay on track.

- Reduce Credit Utilization: Keep your credit card balances below 30% of your total limit (ideally below 10%). Paying down high balances can quickly improve your score.

- Use Our FICO Score Improvement Program: Our FICO Score Improvement Program is designed to help you raise your score for manufactured home financing. Every dollar you invest in the program is applied toward your down payment on a home from us.

Maintaining these good credit habits is key to your long-term financial health.

The Role of a Co-Signer and Handling Past Issues

If your score is still a barrier, consider these strategies:

- Find a Co-Signer: A co-signer with good credit agrees to share responsibility for the loan, which can significantly improve your approval odds and interest rate. Ensure your co-signer understands this serious commitment.

- Address Past Issues:

- Bankruptcy: It’s not a permanent disqualifier. Waiting periods apply after discharge (e.g., 2 years for FHA after Chapter 7; 1 year of on-time payments for FHA after Chapter 13).

- Foreclosure: Waiting periods also apply (e.g., 3 years for FHA/VA loans, 7 for conventional). Use this time to rebuild credit and save.

- Tax Liens: You may still qualify if you pay the lien or have an established repayment plan with the IRS.

- Explain Your History: Be prepared to honestly explain past financial difficulties. Lenders appreciate transparency and want to see that you are now on a stable financial path. We can help you steer these conversations.

Frequently Asked Questions about Buying a Home with Bad Credit in Texas

We know you have questions, and we’re here to provide clear, straightforward answers. Let’s tackle some of the most common concerns about purchasing bad credit homes Texas.

Can I really buy a home in Texas with a credit score of 500?

Yes, it’s possible to buy a home with a 500 credit score, but you’ll need to meet specific criteria.

- FHA Loans: You may qualify with a score between 500-579, but you will typically need a 10% down payment (vs. 3.5% for scores 580+).

- Manufactured Homes: These offer more flexible financing, like chattel loans and in-house options from dealers like us, which are more accessible for lower credit scores.

- Compensating Factors: A low debt-to-income ratio, cash reserves, stable employment, or a strong co-signer can help your application get approved.

Our guide on How to Get a Mobile Home with Bad Credit has more details.

Are interest rates for bad credit loans in Texas much higher?

Yes, interest rates are typically higher for bad credit loans. Lenders do this to offset the higher perceived risk of default.

- Higher Costs: This results in higher monthly payments and more total interest paid over the loan’s life.

- Improving Your Score Saves Money: Even a small increase in your score can qualify you for a lower rate, saving you thousands of dollars.

- Current Climate: In a high-rate environment, the impact on bad credit borrowers is even greater, making flexible financing and credit improvement programs essential to mitigate costs.

What’s the difference between buying a traditional home and a mobile home with bad credit?

The difference is significant, and manufactured homes often provide a more accessible path to homeownership for those with bad credit homes Texas.

- Affordability: Manufactured homes typically have a lower purchase price, meaning you borrow less, which is more appealing to lenders.

- Flexible Financing: This is the key difference. You have access to chattel loans (often easier to qualify for), in-house financing from dealers like us, and other specialized options that are more forgiving of bad credit.

- Faster Process: The financing and approval process for manufactured homes is often quicker than for traditional mortgages.

- Land Options: You can finance the home separately from the land (e.g., by placing it in a park), which simplifies the loan process, especially with a chattel loan.

Our Manufactured Home Loan Complete Guide offers a full breakdown. With a score over 500 and a down payment, we can likely find you financing.

Conclusion

If you’ve made it this far, you know that bad credit homes Texas aren’t just a pipe dream—they’re within your reach. Yes, the road to homeownership with credit challenges comes with its bumps: you’ll likely face higher interest rates, need to save for a larger down payment, and spend extra time finding the right lender who’s willing to work with your situation. But here’s the truth we want you to hold onto: none of these obstacles are impossible.

Throughout this guide, we’ve walked through what bad credit actually means to Texas lenders and why it doesn’t have to be the final word on your homeownership journey. We’ve shown you the powerful alternatives available—chattel loans that focus on the home rather than your credit history, in-house financing options that look at your whole financial picture, and Texas state programs through TSAHC that offer down payment assistance and mortgage credit certificates to qualifying buyers.

You’ve also learned how to build the strongest application possible. Improving your debt-to-income ratio, saving for a meaningful down payment, and taking concrete steps to boost your credit score can transform your options. And when you need extra support, strategies like bringing in a co-signer or honestly addressing past financial setbacks can make all the difference.

The reality is this: manufactured and mobile homes have opened doors for thousands of Texans who thought homeownership was out of reach. These homes are affordable, the financing is more flexible, and the approval process moves faster than traditional mortgages. That’s not just theory—it’s what we see every day working with families across Von Ormy, Somerset, Atascosa, Macdona, San Antonio, Jbsa Lackland, and throughout Texas.

At Mobile Homes Factory Direct, we’re not just selling homes. We’re helping people write new chapters in their lives. Our flexible financing works with all credit types, including bad or no credit, because we believe your past doesn’t have to define your future. We’ve simplified the entire process, from finding the perfect home to securing the financing that fits your budget.

Your credit score is just a number. Your determination, your willingness to take the right steps, and your dream of having a place to truly call your own—those matter so much more.

Ready to take that first step? Explore our available mobile homes today! Let’s turn your homeownership dream into your everyday reality.